Sedgwick Stiffs AME for IBR Filing Fee

In California, when Independent Bill Review (IBR) overturns a Sedgwick erroneous reimbursement denial, Sedgwick owes the provider $180 (the cost of the filing fee the provider paid to request IBR) in addition to the denied reimbursement amount.

However, state regulators fail to enforce this $180 IBR reimbursement requirement, and subsequently, Sedgwick routinely fails to reimburse providers who prevail at IBR. The lack of regulatory protection forces providers to hound claims administrators for the $180 filing fee.

As of this writing, Sedgwick is over a year late in returning the IBR filing fee to an Agreed Medical Evaluator (AME) who successfully disputed a nonsense payment denial in 2022.

Is Sedgwick going for a record? Is this a test of the state’s infamous permissiveness towards claims administrators? Or is Sedgwick so accustomed to consequence-free non-compliance that it hasn’t crossed their collective mind to pay what they owe?

Insurers and self-insured employers using Sedgwick as their third-party administrator should be concerned. Sedgwick's payment abuse of providers should raise red flags about Sedgwick’s treatment of injured workers.

Sedgwick Overturned at IBR

In November 2022, on behalf of an Agreed Medical Evaluator (AME), daisyCollect sent Sedgwick a bill for a missed Medical-Legal appointment for a State Farm Fire and Casualty Company injured employee.

Sedgwick improperly denied payment for the entire bill.

daisyCollect submitted a compliant Second Review appeal, which Sedgwick denied by incorrectly stating the appeal was a “duplicate” of the original bill-–a mistake Sedgwick makes with remarkable consistency (daisyBill has filed 22,155 Audit Complaints reporting this (profitable) Sedgwick duplicate “error”).

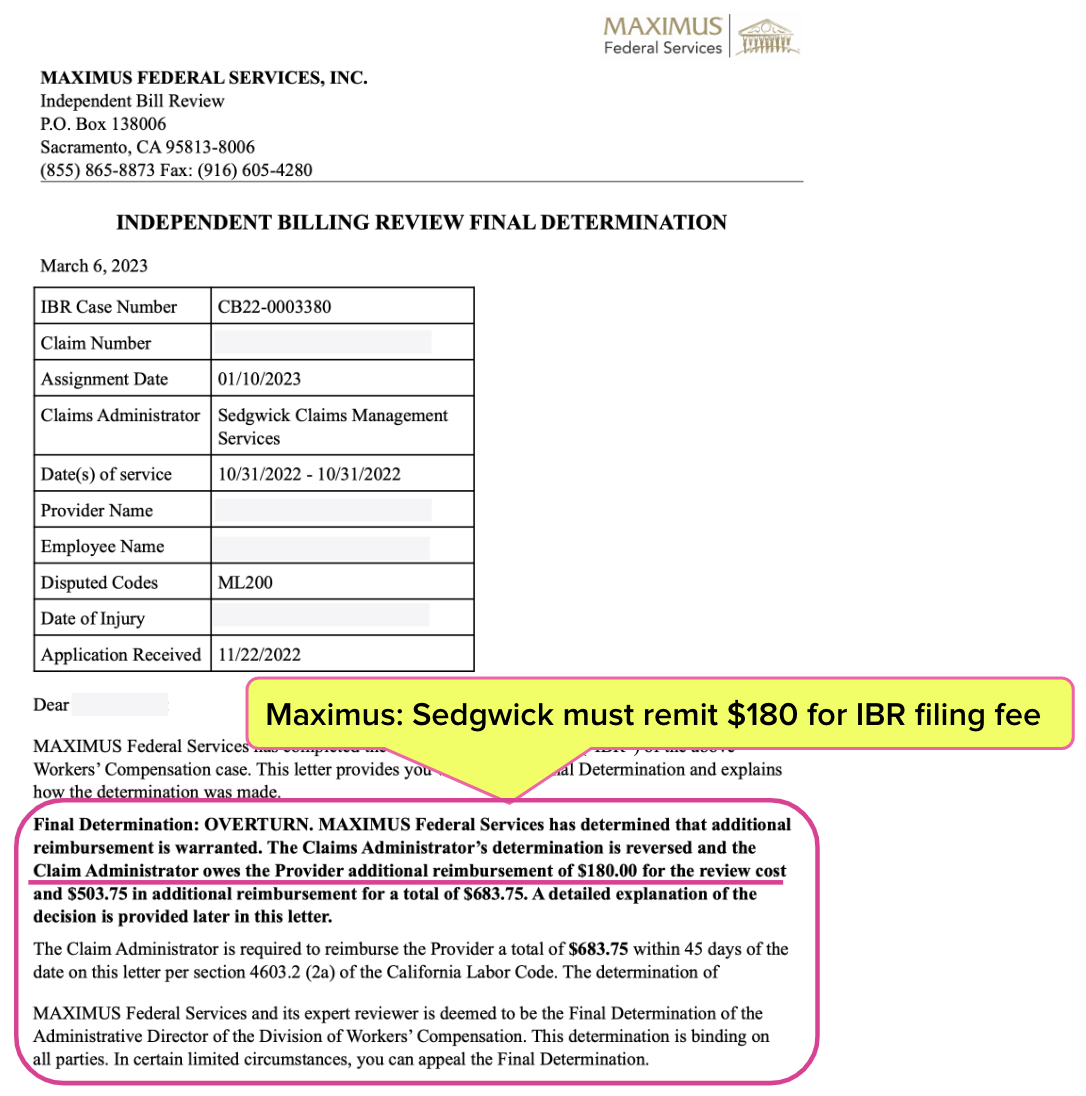

Maximus (the entity that conducts IBR in California) overturned Sedgwick’s improper denial and ordered Sedgwick to pay the provider both the amount owed for the missed appointment and the $180 IBR filing fee. Maximus’ March 6, 2023 Final Determination letter is shown below.

Given the history of California regulatory agency inaction when TPAs stiff physicians who treat California’s injured workers, it’s no surprise that Sedgwick paid the provider the Overturn billed amount but failed to pay the provider the $180 IBR filing fee as required by California law and ordered by Maximus.

CA Law Ignored Again

As is their well-established practice, Sedgwick simply ignores California workers’ comp laws and regulations.

California Code of Regulations Section 9792.5.14 mandates (emphasis ours):

“If the independent bill reviewer finds any additional amount of money is owed to the provider, the determination shall also order the claims administrator to reimburse the provider the amount of the filing fee in addition to any additional payments for services found owing.”

Per California Labor Code Section 4603.2, Sedgwick had 45 days from the date of the Final Determination letter to remit all of the money owed.

daisyCollect obtained the claims adjuster’s email address via Sedgwick’s Live Chat and emailed the adjuster seven times about the missing $180 IBR reimbursement. The adjuster ignored all seven emails—then daisyCollect looped in the adjuster’s supervisor.

On June 20, 2024, a Sedgwick supervisor responded to an email promising to issue the physician the $180 it owes.

Below is a table of the payment torture Sedgwick inflicted on a provider attempting to recover what is owed per California workers’ comp law and regulations.

Date |

Actions Taken To Recover $180 IBR Fee From Sedgwick |

4/3/2024 |

daisyCollect contacts Sedgwick via Live Chat to obtain adjuster’s email |

4/3/2024 |

daisyCollect sends email to Sedgwick adjuster requesting IBR filing fee |

4/15/2024 |

daisyCollect sends second email to Sedgwick adjuster requesting IBR filing fee |

4/29/2024 |

daisyCollect sends third email to Sedgwick adjuster requesting IBR filing fee |

5/8/2024 |

daisyCollect sends fourth email to Sedgwick adjuster requesting IBR filing fee |

5/23/2024 |

daisyCollect sends fifth email to Sedgwick adjuster requesting IBR filing fee |

6/6/2024 |

daisyCollect sends sixth email to Sedgwick adjuster requesting IBR filing fee |

6/13/2024 |

daisyCollect sends seventh email to Sedgwick adjuster requesting IBR filing fee |

6/19/2024 |

daisyCollect contacts Sedgwick via Live Chat to obtain adjuster’s supervisor’s email |

6/19/2024 |

daisyCollect sends email to Sedgwick adjuster’s supervisor requesting IBR filing fee |

6/19/2024 |

Sedgwick supervisor replies to the email cc’ing the adjuster to review the inquiry |

6/19/2024 |

Sedgwick adjuster replies that the IBR payment was already sent |

6/19/2024 |

daisyCollect advises that's correct, but Sedgwick has not paid the $180 IBR Filing Fee yet |

6/19/2024 |

Sedgwick supervisor replies that they will review and get back to daisyCollect |

6/20/2024 |

Sedgwick replies that a $180 IBR Filing Fee check will be issued |

As of today, July 2, 2024, the physician has not received the check. It has been 484 days since Maximus ordered Sedgwick to pay the bill and IBR filing fee and 439 days since the deadline for Sedgwick to remit those funds.

This is a Sedgwick tale on infinite repeat. State Farm Fire and Casualty Company should take note and choose its TPA vendors more wisely.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

Rather than continuing to beg for action, the provider should file a petition to enforce the administrative directors IBR determination, costs and sanctions. That is the remedy provided by California law. Feel free to reach out should you want to learn more.

We were having that problem with Sedgwick in particular denials of med/legal claims. Initial claim denied for silly reason, SBR denied as duplicate. We began filing petitions for cost and sanctions. After Sedgwick had to pay a few penalties and attorney cost, those denials stopped.