Sedgwick Stiffs Doctors With Outdated Fee Schedule Rates

The California Division of Workers’ Compensation (DWC) increased reimbursements for physician services for dates of service on or after April 1, 2024. Yet Third-Party Administrator (TPA) Sedgwick Claims Management Services, Inc. has failed to pay correct reimbursement rates that reflect the increase.

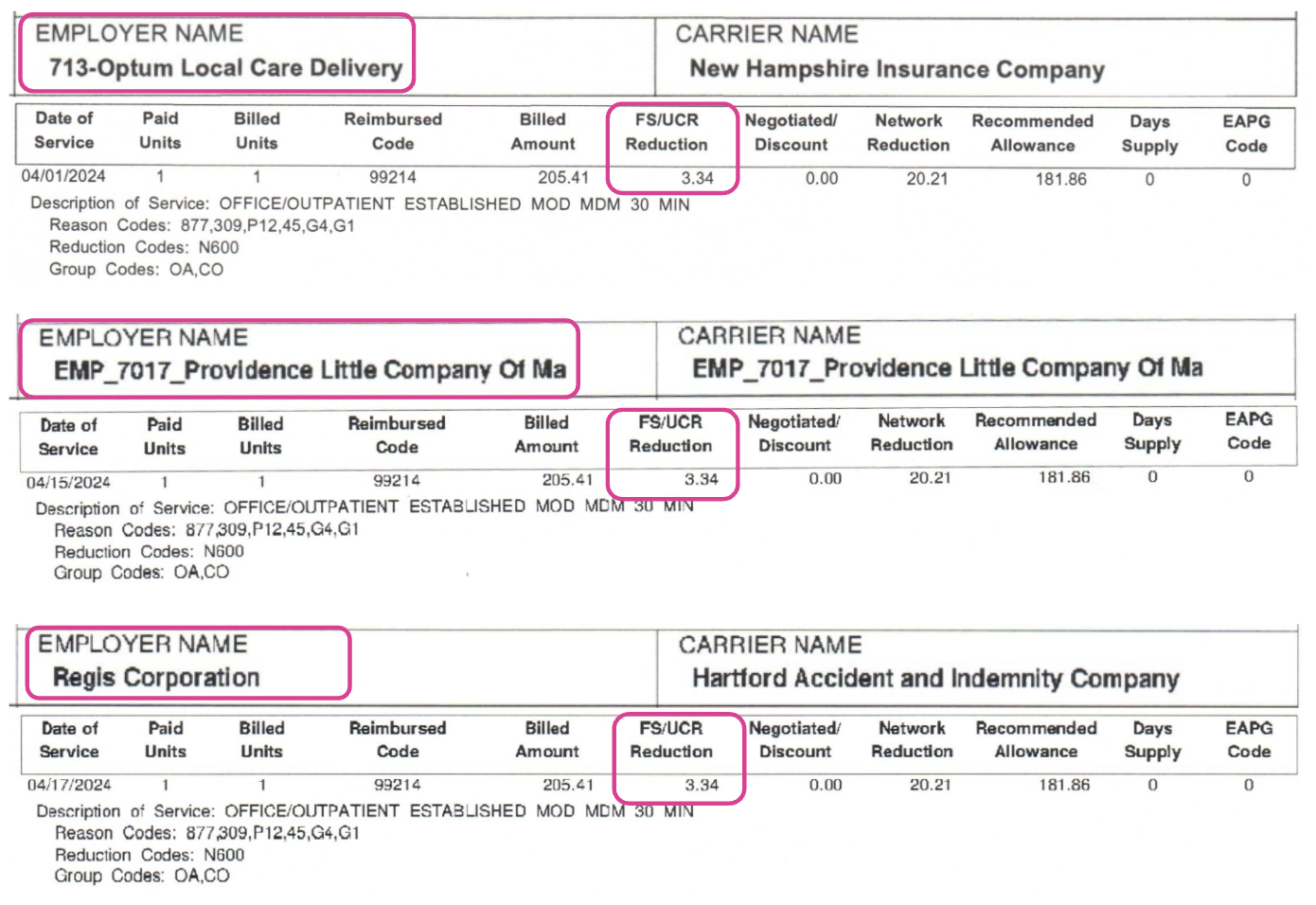

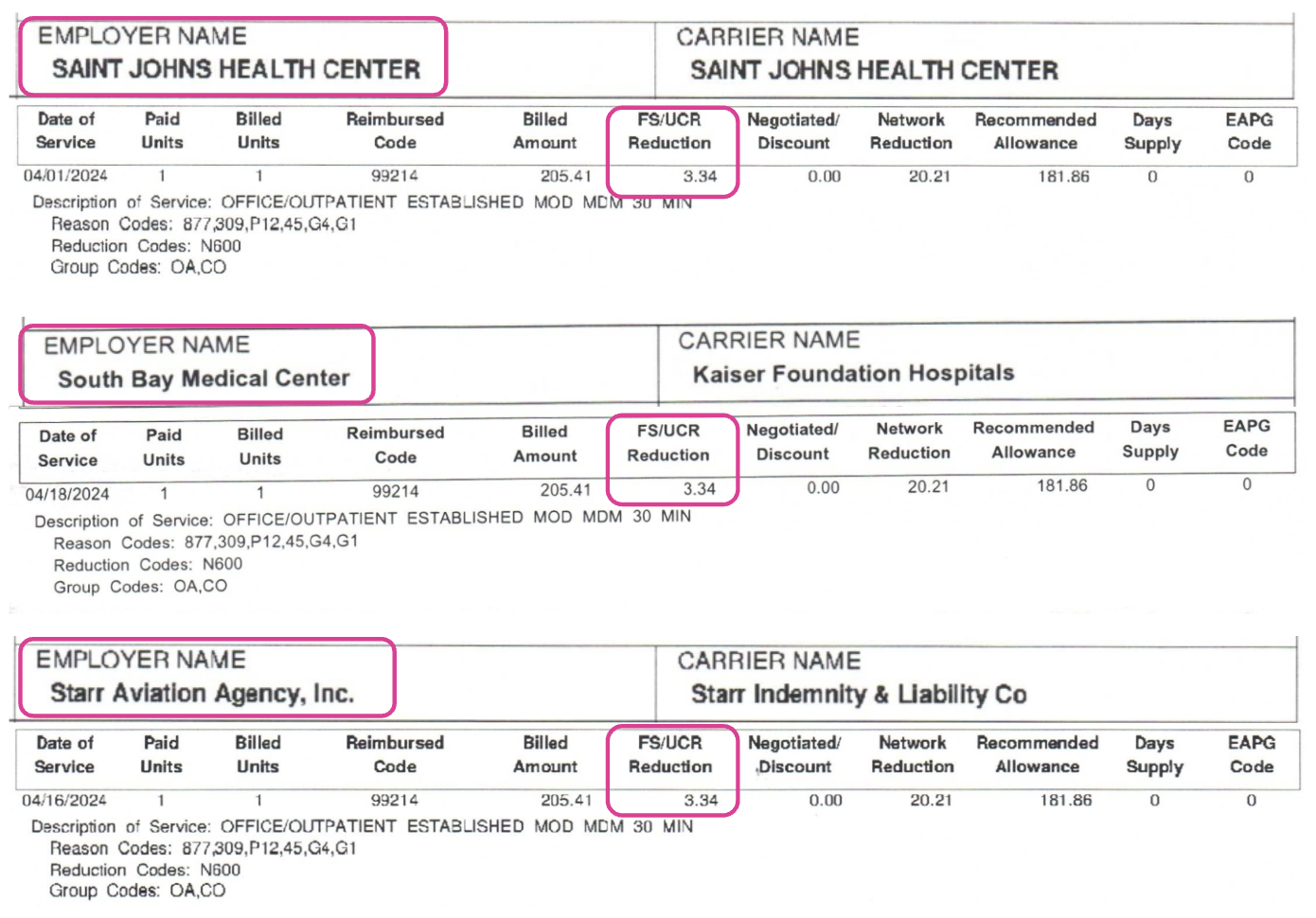

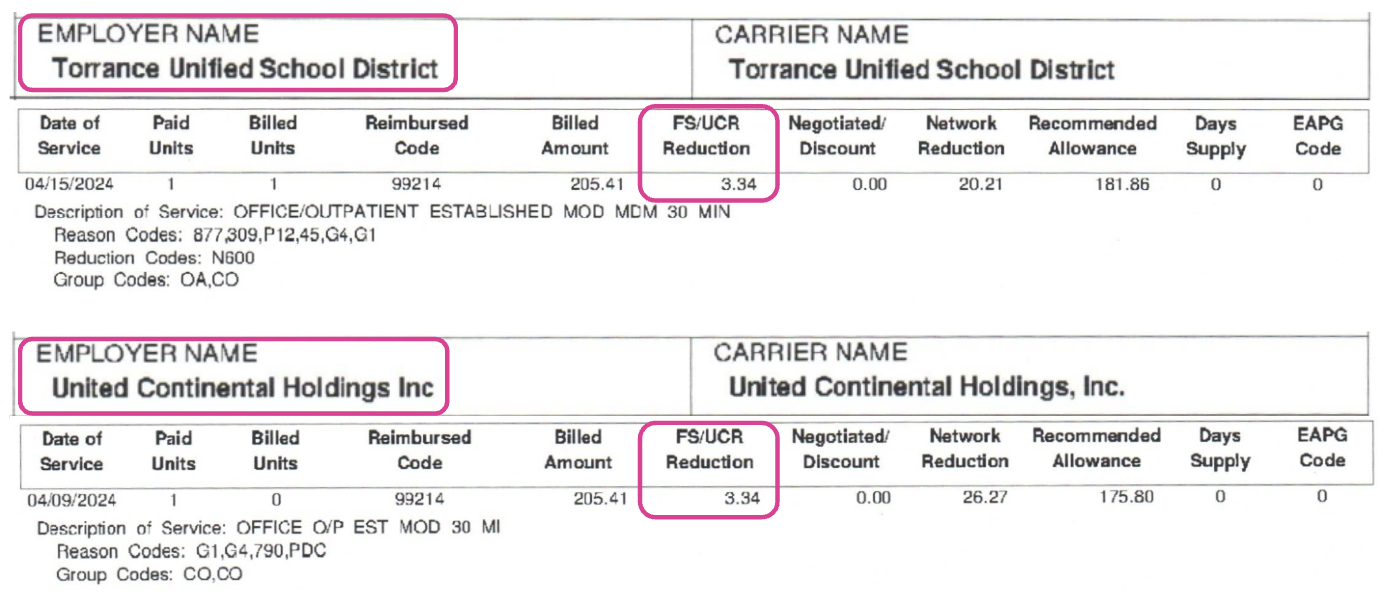

Below are 20 payments Sedgwick made to a single provider for common Evaluation and Management billing code CPT 99214. In each instance, Sedgwick shorted the provider $3.34 by applying the wrong rate for the date of service.

As discussed many (many) times in this space, there are no consequences when a claims administrator incorrectly reimburses providers. In effect, California law incentivizes these payment errors. California allows Sedgwick to retain the balance due if the provider fails to submit timely and compliant Second Review appeals to dispute each incorrect reimbursement.

Not only are Second Review appeals a significant administrative burden (absent technology to make it easy), but Sedgwick has a particular penchant for improperly denying Second Review appeals as “duplicates” of the original bill—without regulatory consequences.

The 20 examples below reflect only a single provider and CPT code, and a relatively small amount of revenue. But as the largest claims administrator in the state, Sedgwick’s failure has a massive financial impact when extrapolated across thousands of providers and hundreds of thousands of billing codes.

Each instance below represents a few dollars in underpayment—but by failing to apply fee schedule updates, Sedgwick enjoys significant savings.

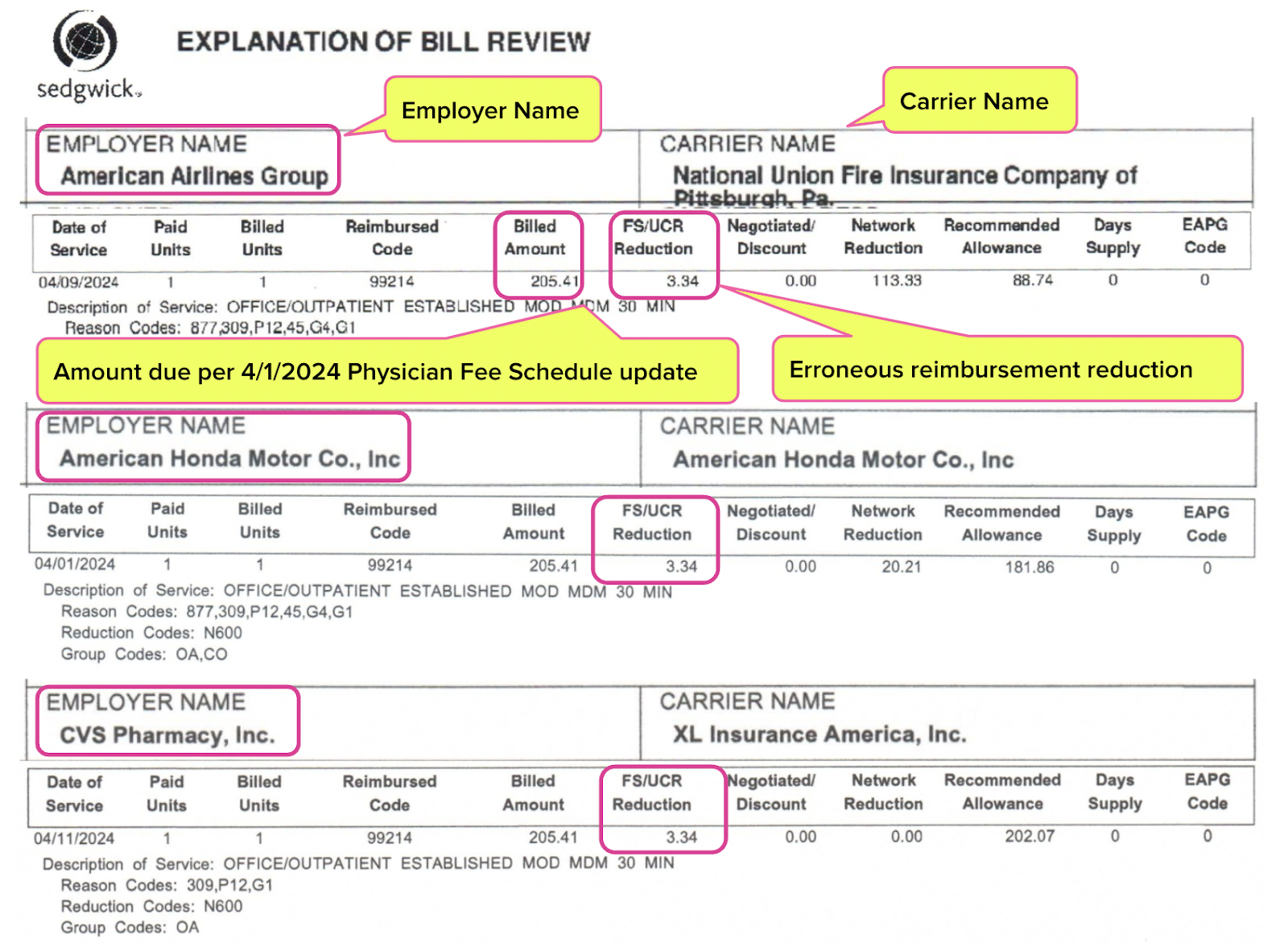

Sedgwick Fails to Apply Fee Schedule Increase

In March 2024, the DWC issued an update order increasing reimbursements under the Physician Fee Schedule, effective for dates of service on or after April 1, 2024. However, Sedgwick continued to pay the previous, lower rates for services rendered after April 1st.

For each employer listed in the table below, Sedgwick failed to apply the fee schedule update and underpaid the provider for treating the employer’s injured worker. Explanations of Review (EORs) documenting the underpayments are shown at the bottom of this article.

Employer |

Workers’ Comp Insurance Carrier |

Carrier Type (Insurer or Self-Insured Employer) |

American Airlines Group |

National Union Fire Insurance Company of Pittsburgh, Pa. |

Insurer |

American Honda Motor Co., Inc |

American Honda Motor Co., Inc |

Self-Insured Employer |

CVS Pharmacy, Inc. |

XL Insurance America, Inc. |

Insurer |

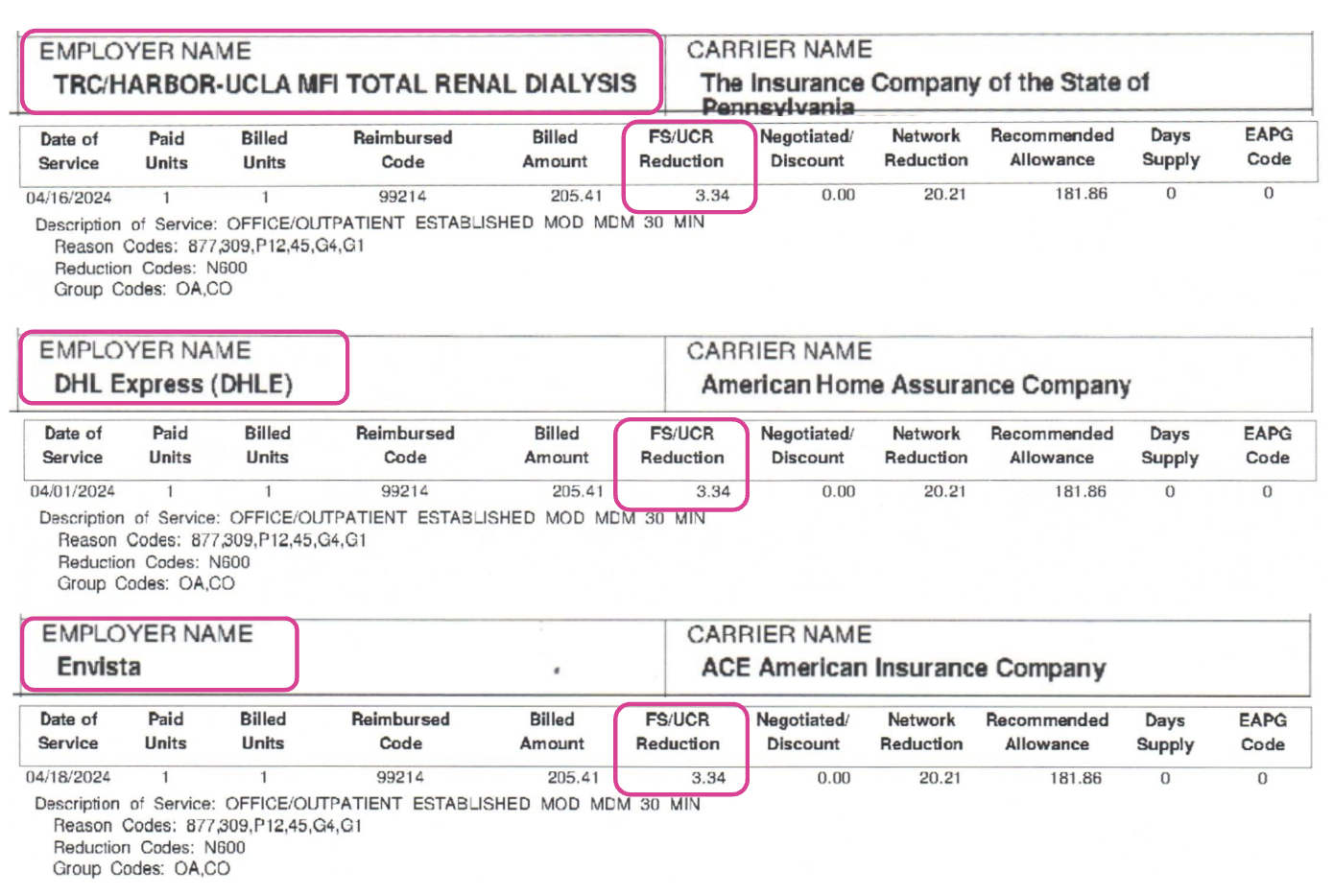

TRC/Harbor-UCLA MFI Total Renal Dialysis (DaVita) |

The Insurance Company of the State of Pennsylvania |

Insurer |

DHL Express |

American Home Assurance Company |

Insurer |

Envista |

ACE American Insurance Company |

Insurer |

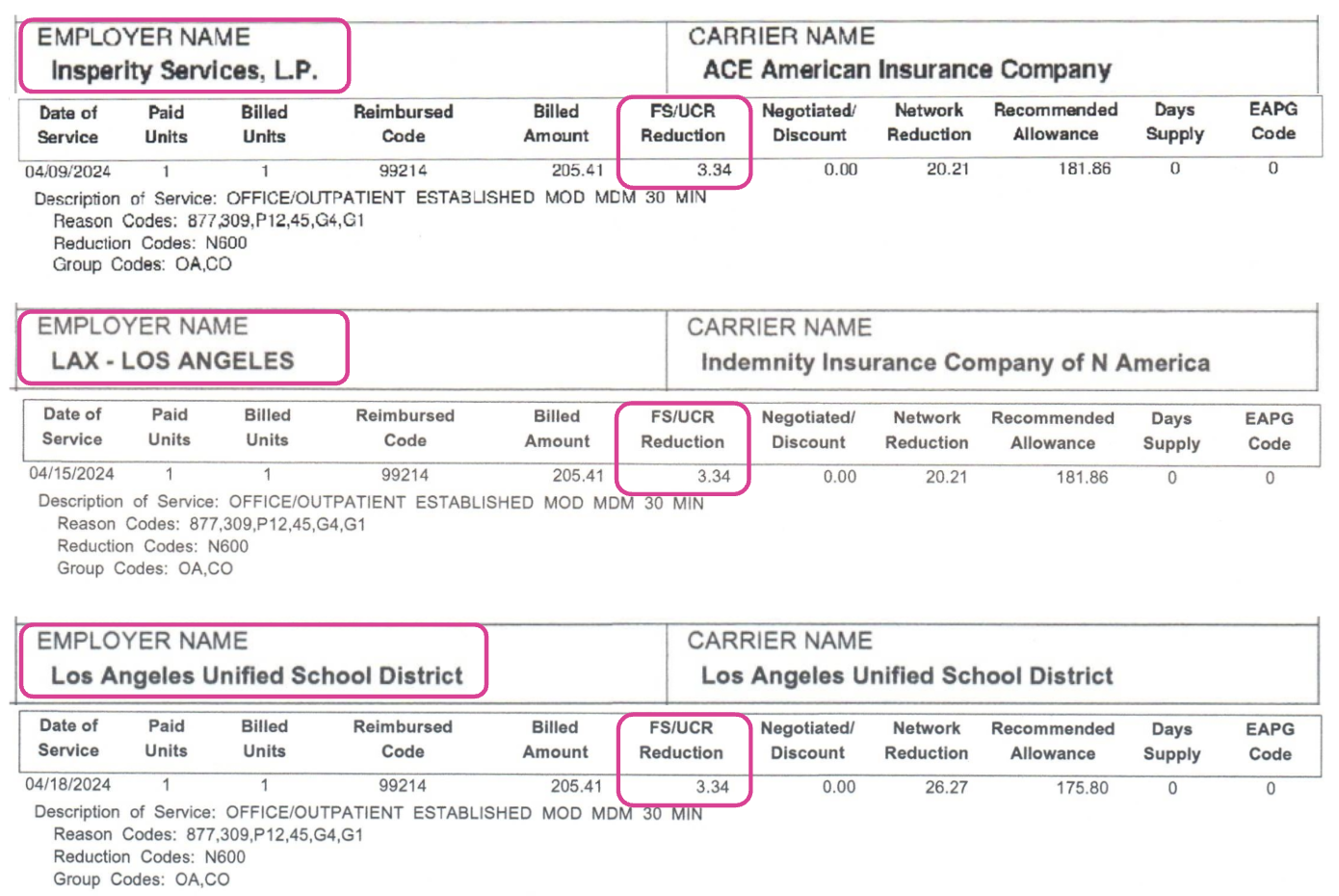

Insperity Services, L.P. |

ACE American Insurance Company |

Insurer |

LAX - Los Angeles |

Indemnity Insurance Company of N America |

Insurer |

Los Angeles Unified School District |

Los Angeles Unified School District |

Self-Insured Employer |

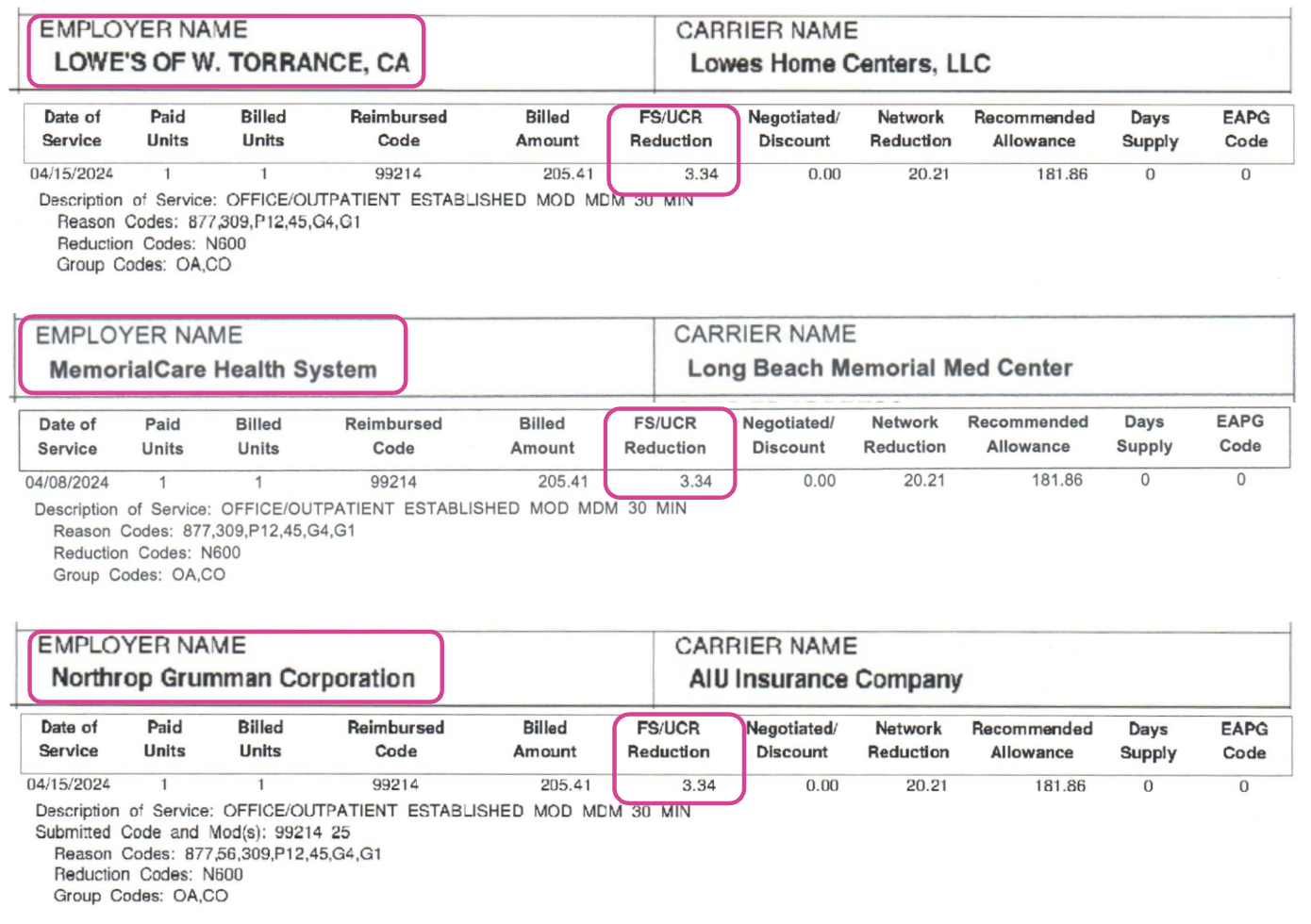

Lowe’s of W Torrance CA |

Lowes Home Centers, LLC |

Self-Insured Employer |

MemorialCare Health System |

Long Beach Memorial Med Center |

Self-Insured Employer |

Northrup Gruman Corporation |

AIU Insurance Company |

Insurer |

Optum Local Care Delivery |

New Hampshire Insurance Company |

Insurer |

Providence Little Company of Mary |

Providence Little Company of Mary |

Self-Insured Employer |

Regis Corporation |

Hartford Accident and Indemnity Company |

Insurer |

Saint Johns Health Center |

Saint Johns Health Center |

Self-Insured Employer |

South Bay Medical Center |

Kaiser Foundation Hospitals |

Self-Insured Employer |

Starr Aviation Agency, Inc. |

Starr Indemnity & Liability Co |

Insurer |

Torrance Unified School District |

Torrance Unified School District |

Self-Insured Employer |

United Continental Holdings Inc |

United Continental Holdings Inc |

Self-Insured Employer |

Warning: Sedgwick Denies Second Review Appeals

To dispute each payment error, California law requires this provider to submit a compliant Second Review appeal within 90 days of receiving the EOR. If the provider fails to submit the appeal timely, Sedgwick is off the hook and owes the provider $0.

Certainly, in these instances, the administrative cost of submitting Second Review appeals exceeds the $3.34 Sedgwick owes. Moreover, Sedgwick routinely denies Second Review appeals by incorrectly claiming the appeals are “duplicates” of the original bill—yet another payment error from which Sedgwick profits.

Even if this provider appeals all 20 underpayments, the disputes will likely require the additional (and costly) step of requesting Independent Bill Review to resolve. In the absence of any real enforcement of payment laws, these are the burdens California imposes on providers who treat injured workers.

Sedgwick EOR Examples

In the EORs below for CPT 99214, the provider’s “Billed Amount” represents the correct, applicable fee schedule amount owed of $205.41.

Sedgwick incorrectly adjusted the billed charges by applying a $3.34 “FS/UCR” (Fee Schedule/Usual and Customary Rate) reduction to lower reimbursement to pre-April 1 rates.

Submit Second Review appeals in seconds with daisyBill. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

I have a question for you......please don't laugh if you can help it....I couldn't help but lol....Can the insurance/bill review company use reduction code CBR = Complex Bill Review and BR = Bill Review to reduce our payment? I guess I will have to do an SBR-1. The first claim payment only had one reduction CBR now the next payment has an additional BR reducing it even more that the last payment.