Sedgwick Still Reimbursing at 2018 Rates for California

Since the beginning of 2019, Sedgwick CMS has incorrectly used the 2018 Physician Fee Schedule to reimburse providers. Our data indicates that Sedgwick is consistently and incorrectly reimbursing providers for 2019 dates of service.

While the California Physician Fee Schedule is infinitely more complex in 2019, many claims administrators are correctly reimbursing providers. But some are not. On a regular basis, this blog will bring to light the claims administrators that repeatedly and non-compliantly reimburse providers the wrong amount for services rendered in 2019. Today, we commence with Sedgwick.

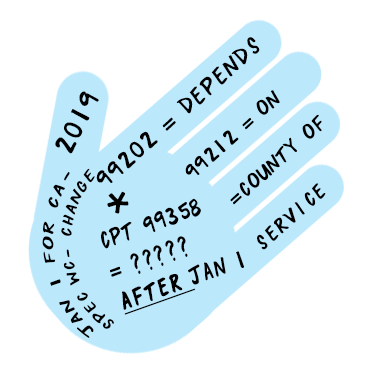

2019 Physician Fee Schedule Changes

The California Division of Workers’ Compensation (DWC) modified the Physician Fee Schedule, effective for dates of service as of January 1, 2019. Changes to this fee schedule include the adoption of Medicare Geographic Practice Cost Indices (GPCIs), in 8 CCR § 9789.12.2(e)(2), to calculate reimbursement for physician and non-physician services. Starting in 2019, the OMFS reimbursement amount for this fee schedule is based upon the location where the services were provided.

With the adoption of location-based reimbursement, effective for all dates of service on or after 1/1/2019, California no longer reimburses providers using a single state-wide geographic adjustment factor (GAF). Instead, the reimbursement calculation now uses the location-based three GPCIs (PW, PE, MP) assigned by Medicare to the place of service. The 2019 OMFS Reimbursement Analysis below shows the impact on OMFS reimbursements for providers throughout the state of California for CPT 99214.

However, the adoption of GPCIs does not impact the reimbursement for California-specific codes. Annually, the California Division of Workers’ Comp establishes a single new statewide reimbursement for each of the services covered by these ‘WC’ codes.

Sedgwick’s Bungled Payments

The following three examples are representative of the many, many, bungled Sedgwick payments we found during our data analysis. In the first two examples, Sedgwick underpaid the provider and in the last example, Sedgwick overpaid the provider for one code while underpaying the second ‘WC’ code.

In these examples, the mistakes in CPT payments are a bit complicated, but the mistakes in WC002 payments are dead easy to understand. This California-specific code reimbursement is a statewide $12.65 for dates of service in 2019. There is absolutely NO excuse for incorrectly paying the WC002 in 2019.

In this first example, for a date of service 1/18/2019:

- The Sedgwick explanation of review (EOR) shows that Sedgwick incorrectly reduced the billed charges using the 2018 reimbursement rates. Sedgwick incorrectly reduced CPT 99214 by $50.67 and incorrectly reduced WC002 by $7.54.

- The correct 2019 reimbursement reduction is $35.44 for CPT 99214 and $7.35 for WC002.

- The Sedgwick incorrect reimbursements resulted in this provider receiving an underpayment for services in the amount of $15.42. This error reduced the provider’s reimbursement by approximately 10%.

In the second example, for a date of service of 1/16/2019:

- The Sedgwick EOR again shows that Sedgwick incorrectly reduced the billed charge using the 2018 reimbursement rate. Sedgwick erroneously reduced CPT 90837 by $225.12.

- The correct 2019 reimbursement reduction is $208.09.

- The Sedgwick incorrect reimbursement resulted in this provider receiving an underpayment for services in the amount of $17.03. This error reduced the providers’ reimbursement by approximately 10%.

In some instances, the Sedgwick misstep results in some providers receiving too much (not exactly confidence inspiring, especially during a TPA contract renewal).

In this last example, for a date of service 1/02/2019:

- Again, the Sedgwick EOR shows that Sedgwick incorrectly adjusted the billed charges using the 2018 reimbursement rates. Sedgwick incorrectly reduced CPT 99215 by $28.82 and incorrectly reduced WC002 by $4.59.

- However, for this bill, the correct 2019 reimbursement reduction for CPT 99215 is $33.21 and $2.53 for WC002.

- So Sedgwick’s incorrect reimbursement resulted in this provider receiving a 3% overpayment in the amount of $4.39 for CPT 99215, and a 16% underpayment of $2.06 for WC002. The EOR offers no reason for the grossly incorrect WC002 payment other than “Workers’ Compensation Jurisdictional Fee Schedule Adjustment.”

Sedgwick Needs to Take Responsibility for Issuing Corrected Payments

It seems counterintuitive to rely on an old fee schedule, especially when it means having to reprocess a large chunk of erroneous payments -- unless Sedgwick is assuming employers will not notice the overpayments and providers will not notice the underpayments.

Either way, the California DWC should REQUIRE Sedgwick to reprocess the tens of thousand incorrect payments (as of 1/30 DaisyBillers had submitted 5,219 bills to Sedgwick with dates of service on or after 1/1/2019). Providers should not be expected to wade through the Sedgwick pile of reimbursement chaos and expend resources to appeal for correct 2019 reimbursement.

2019 Reimbursement Analysis - CPT 99214

For CPT 99214, this table compares the 2019 reimbursement to the previous 2018 reimbursement. Depending on the location where services are provided to the injured worker, the adoption of location-based reimbursement will result in a reduced 2019 reimbursement for some providers while increasing the reimbursement for other providers.

- For localities above the 2018 reimbursement line, Sedgwick is overpaying providers by the indicated percent change. For example, for providers located in the first county on the list, Chico, the Sedgwick mistake of paying 2018 rates results in the provider receiving a 3.25% overpayment. Remember, past court rulings forbid claims administrators from recouping these overpayments. (EXCEPT, the examples above show Sedgwick is incorrectly underpaying these providers for the California specific ‘WC’ codes).

- For localities below the 2018 reimbursement line, Sedgwick is underpaying providers by the indicated percent change. So for the last county on the list, Santa Clara, the Sedgwick mistake means a provider is receiving 10.53% less payment than required by the OMFS. These providers will need to reach for the ibuprofen to stave off the monumental headache of appealing a month (and still counting) of Sedgwick incorrect reimbursements.

Place of Service County |

CPT 99214 |

2019 vs 2018 OMFS Reimbursement |

2019 vs 2018 |

CHICO |

$144.62 |

OMFS Reduction |

-3.25% |

FRESNO |

$144.62 |

OMFS Reduction |

-3.25% |

MADERA |

$144.62 |

OMFS Reduction |

-3.25% |

MERCED |

$144.62 |

OMFS Reduction |

-3.25% |

MODESTO |

$144.62 |

OMFS Reduction |

-3.25% |

REDDING |

$144.62 |

OMFS Reduction |

-3.25% |

STOCKTON-LODI |

$144.62 |

OMFS Reduction |

-3.25% |

VISALIA-PORTERVILLE |

$144.62 |

OMFS Reduction |

-3.25% |

YUBA CITY |

$144.62 |

OMFS Reduction |

-3.25% |

REST OF STATE* |

$144.62 |

OMFS Reduction |

-3.25% |

EL CENTRO |

$144.66 |

OMFS Reduction |

-3.22% |

HANFORD-CORCORAN |

$144.69 |

OMFS Reduction |

-3.20% |

BAKERSFIELD |

$144.88 |

OMFS Reduction |

-3.06% |

SAN LUIS OBISPO-PASO ROBLES-ARROYO GRANDE |

$145.29 |

OMFS Reduction |

-2.77% |

RIVERSIDE-SAN BERNARDINO-ONTARIO |

$145.57 |

OMFS Reduction |

-2.58% |

SACRAMENTO--ROSEVILLE--ARDEN-ARCADE |

$146.31 |

OMFS Reduction |

-2.06% |

SALINAS |

$146.84 |

OMFS Reduction |

-1.69% |

SAN DIEGO-CARLSBAD |

$147.68 |

OMFS Reduction |

-1.11% |

SANTA ROSA |

$148.64 |

OMFS Increase |

-0.46% |

SANTA MARIA-SANTA BARBARA |

$148.93 |

OMFS Increase |

-0.26% |

2018 REIMBURSEMENT |

$149.32 |

||

SANTA CRUZ-WATSONVILLE |

$151.13 |

OMFS Increase |

1.20% |

OXNARD-THOUSAND OAKS-VENTURA |

$152.23 |

OMFS Increase |

1.91% |

LOS ANGELES-LONG BEACH-ANAHEIM (ORANGE CNTY) |

$153.91 |

OMFS Increase |

2.98% |

LOS ANGELES-LONG BEACH-ANAHEIM (LOS ANGELES CNTY) |

$153.91 |

OMFS Increase |

2.98% |

SAN JOSE-SUNNYVALE-SANTA CLARA (SAN BENITO CNTY) |

$156.19 |

OMFS Increase |

4.40% |

NAPA |

$158.74 |

OMFS Increase |

5.93% |

VALLEJO-FAIRFIELD |

$158.74 |

OMFS Increase |

5.93% |

SAN FRANCISCO-OAKLAND-HAYWARD (MARIN CNTY) |

$161.77 |

OMFS Increase |

7.70% |

OAKLAND/BERKLEY |

$164.56 |

OMFS Increase |

9.26% |

SAN FRANCISCO |

$164.56 |

OMFS Increase |

9.26% |

SAN MATEO |

$164.56 |

OMFS Increase |

9.26% |

SANTA CLARA |

$166.90 |

OMFS Increase |

10.53% |

One of the great things about electronic billing is how quickly these payment trends can be spotted. With a mere nine-day bill turnaround, DaisyBill quickly identified the Sedgwick pattern of payment mistakes. Most importantly, DaisyBill clients can easily submit compliant appeals in seconds with our intuitive software. DaisyBill makes receiving the correct reimbursement simple and keeps intraoffice NSAID use to a minimum.

SIGN UP FOR A DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.