Tristar Risk Management: 21,719 Audit Complaints Filed

It’s a dubious distinction, but Tristar Risk Management’s non-compliance rate is practically 100%.

We have encountered consistent failures to abide by California workers’ comp payment laws and regulations before, even at high rates. But Tristar, a Third-Party Administrator (TPA), is singular in its obstinance and refusal to meet regulatory obligations.

Insurers and self-insured employers should take note.

This week, daisyBill submitted an additional 21,719 Audit Complaints to the Division of Workers’ Compensation (DWC) reporting Tristar’s non-compliance. Data from this most recent Audit Complaint show that Tristar has maintained a statistical non-compliance rate of 100% in 12 of the last 15 months.

Since July 2023, daisyBill has submitted four Audit Complaints to the DWC detailing 29,459 instances of Tristar’s non-compliance.

This is beyond a technical glitch or casual oversight. This is a TPA refusing to comply with long-established regulatory requirements.

Worse, California’s DWC evidently couldn’t care less.

Tristar’s Shameful Compliance Numbers

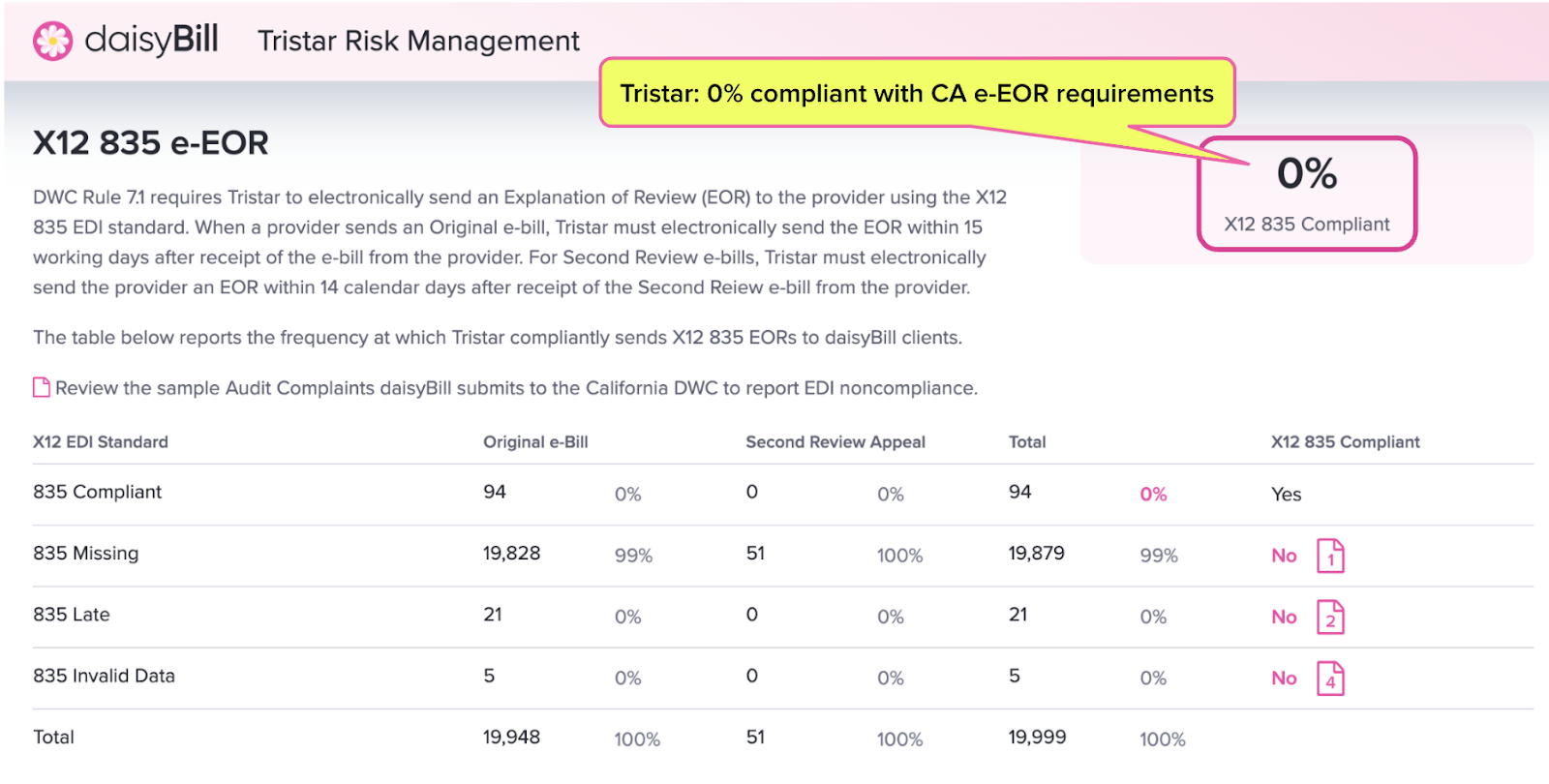

Statistically as of this writing, Tristar’s Claims Administrator Directory page reveals a number we don’t (and shouldn’t) see often: 0%.

As the data show, the rare instances in which Tristar actually complies with California e-EOR requirements are not even sufficient to warrant rounding up to a single percent.

As we must continue to explain, e-EORs are non-negotiable, critical facets of e-billing. Without them, providers must waste incalculable time and administrative resources manually entering payment information from paper EORs—undermining the greatest advantages of e-billing.

California legislators and regulators understand this; returning e-EORs in response to e-bills has been a requirement since 2012.

However, laws and regulations are meaningless in the absence of enforcement—and absence of enforcement defines the performance of the DWC, a papier-mâché regulatory agency that seems content to let any type or frequency of non-compliance slide.

This regulatory free-for-all has inevitably produced behavior like that of Tristar, which simply declines to follow the rules and suffers zero consequences. As the table below shows, every month from July of 2023 to September of 2024, Tristar has sent either literally zero e-EORs or inexcusably close to zero e-EORs.

Month |

% of Tristar e-Bills Missing e-EOR |

2023-07 |

100% |

2023-08 |

100% |

2023-09 |

100% |

2023-10 |

100% |

2023-11 |

99% |

2023-12 |

97% |

2024-01 |

98% |

2024-02 |

100% |

2024-03 |

100% |

2024-04 |

100% |

2024-05 |

100% |

2024-06 |

100% |

2024-07 |

100% |

2024-08 |

100% |

2024-09 |

100% |

The DWC is not unaware of this pattern. Below are the exact numbers of Tristar violations daisyBill has reported since July 2023.

Audit Complaint Submitted to DWC |

Count of Tristar Violations Reported |

daisyBill e-Bill Submission Date Range |

7/12/2023 |

3,678 |

3/30/2023 - 6/14/2023 |

8/29/2023 |

2,315 |

6/15/2023 - 7/31/2023 |

9/28/2023 |

1,831 |

8/1/2023 - 8/31/2023 |

10/30/2024 |

21,719 |

9/1/2023 - 9/30/2024 |

Total |

29,543 |

Below is the most recent Audit Complaint filed with the DWC, reproduced with redactions to protect privacy.

Despite being one of the few (only?) entities monitoring and reporting payer non-compliance, daisyBill is not a regulatory agency; that responsibility falls to the DWC.

On behalf of providers and injured workers, we implore the DWC to take action—you couldn’t ask for a more blatant, well-evidenced pattern of misbehavior than Tristar.

Audit Complaint Filed: 21,719 Violations Reported

To: [Redacted]@dir.ca.gov

Subject: Tristar EDI Non-compliance: X12 835 Missing - Count 21,719

Hello [Redacted],

Per correspondence with [redacted] exchanged on January 23, 2024, the Audit Unit has no authority over X12 835 EDI non-compliance. [Redacted] advised that the DWC Legal Unit handles these matters.

For bills submitted electronically between 9/1/2023 and 9/30/2024, below is an Audit Complaint reporting credible data that Tristar Risk Management failed to adhere to California EDI regulations requiring claims administrators to respond to providers' e-bills with electronic EORs (X12 835).

In the past, daisyBill has submitted 7,824 Audit Complaints to the DWC to report Tristar Risk Management’s failure to send providers electronic EORs.

Today, daisyBill is submitting an additional 21,719 Audit Complaints to report that Tristar refuses to comply with DWC EDI regulations.

Date Audit Complaint Submitted to DWC |

Count of Tristar Audit Complaints |

daisyBill e-Bill Submission Date Range |

7/12/2023 |

3,678 |

3/30/2023 - 6/14/2023 |

8/29/2023 |

2,315 |

6/15/2023 - 7/31/2023 |

9/28/2023 |

1,831 |

8/1/2023 - 8/31/2023 |

10/30/2024 |

21,719 |

9/1/2023 - 9/30/2024 |

Total |

29,543 |

The table below lists the e-Bill and electronic EORs (X12 835) data gathered for Tristar. It shows that Tristar's electronic EOR non-compliance has persisted through 2024 after daisyBill initially reported this problem to the DWC in July 2023.

Month daisyBill providers sent e-Bills to Tristar |

Electronic EORs (X12 835) Missing % |

2023-07 |

100% |

2023-08 |

100% |

2023-09 |

100% |

2023-10 |

100% |

2023-11 |

99% |

2023-12 |

97% |

2024-01 |

98% |

2024-02 |

100% |

2024-03 |

100% |

2024-04 |

100% |

2024-05 |

100% |

2024-06 |

100% |

2024-07 |

100% |

2024-08 |

100% |

2024-09 |

100% |

daisyBill has emailed Tristar’s designated EDI clearinghouse, Jopari, about this problem. Rather than assisting daisyBill, Jopari instructed daisyBill to “reach out to Tristar directly regarding remediation of the 835 requests.”

A provider's receipt of an electronic EOR (X12 835) is a critical component of electronic billing for the following three reasons:

- The electronic EOR closes the payment loop for a workers’ comp e-bill and

- Automatically posts to the respective e-bill, thereby significantly reducing a provider's administrative burden of manually recording payment information to the respective e-bill and

- Allows the gathering of essential payment data about the claims administrator hidden in the paper EORs mailed to individual providers.

For e-bills submitted electronically between 9/1/2023 and 9/30/2024, I’ve attached a CSV list containing a total of 21,719 e-bills providers submitted to Tristar demonstrating the following:

Tristar Electronic EOR (X12 835) Missing - 21,719

For September 1, 2023 through September 30, 2024, this CSV lists 21,719 e-bills daisyBill providers submitted where Tristar failed to return a mandated electronic EOR to the provider in response to the e-bill. The attached CSV list includes the following columns:

- Column L: [Bill] Transmission Date

- Column W: EOR (835) Compliance Due Date

- Column X: EOR (835) Receipt Date - This column is BLANK because Tristar failed to send the provider an electronic EOR (835).

- Column AO: Patient Name

- Column AP: Claim Number

Protect your practice. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Reach out to learn how we can help.

CONTACT US

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.