Applied Underwriters: Appalling Treatment Denial

California’s authorization and Utilization Review (UR) system for workers’ comp treatment is profoundly broken—and injured workers are suffering as a result.

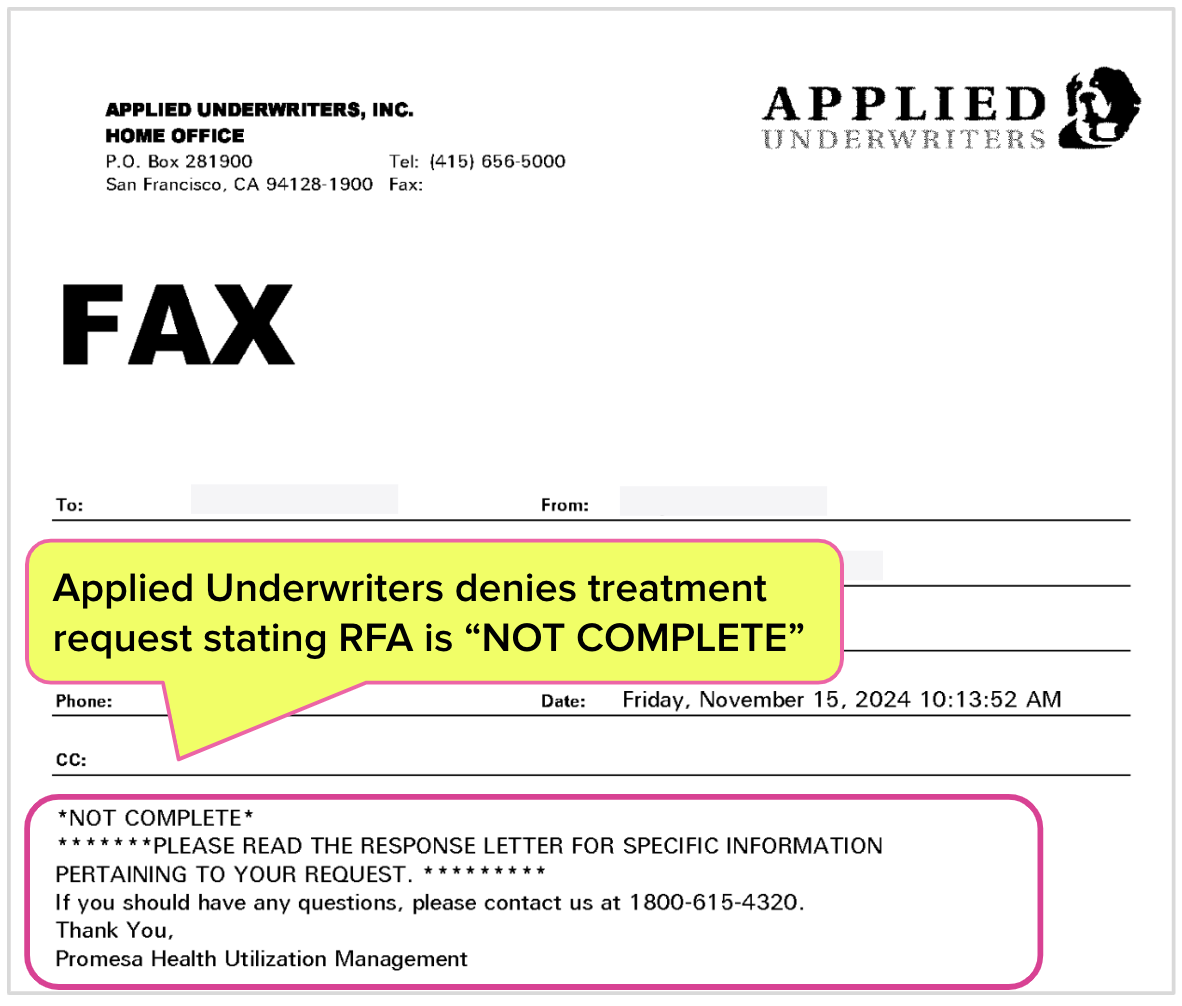

For the latest example, see Applied Underwriters’ denial of a Request for Authorization (RFA) requesting psychotherapy services for a worker who had fallen from a roof, sustaining a traumatic brain injury that left them comatose for days.

Applied did not deny treatment on medical grounds. Instead, the insurer rejected the RFA as “NOT COMPLETE” based on a string of nonsensical and erroneous reasons improperly preventing care for a severely debilitated individual.

Applied’s appalling behavior is the inevitable result of the California Division of Workers’ Compensation (CA DWC)’s complete abdication of its responsibility to monitor how claims administrators process RFAs and conduct (or refuse to conduct) UR.

Insurers incur no consequences for failing to respond compliantly to RFAs. Insurers can render dubious denials without regulatory oversight to protect injured workers with impunity. Each improper denial ultimately increases insurers’ profits, with no risk of legal repercussions.

As the CA DWC fails to act, insurers act in their financial self-interest.

Now, a seriously injured worker in need of care will have to wait for treatment that is at least delayed, if not completely off the table, thanks to a broken system left ungoverned by a state agency that lets insurers run roughshod over the rights—and medical needs—of injured workers.

A Horrific Injury

According to the initial evaluation report, the injured worker was on a roof when a misstep caused them to fall. Unsurprisingly, the resulting injuries were serious, with five days of unconsciousness followed by severe pain, confusion, and loss of mobility. Walking, showering, and using the bathroom without assistance were impossible.

Speech and physical therapy were rendered before the worker was transferred to a rehab facility, from which they were discharged while still reporting pain and remaining wheelchair-bound. Since the worker lived up three flights of stairs, they took up residence with a relative, where they stayed in bed for weeks and reported continuing to need assistance with daily activities.

This injured worker needs treatment, likely for a long time to come. But instead of treatment, they received an introduction to the California bureaucratic hellscape where regulators protect insurer profits at the expense of injured workers and the providers who treat them.

Baffling Denial Reasoning

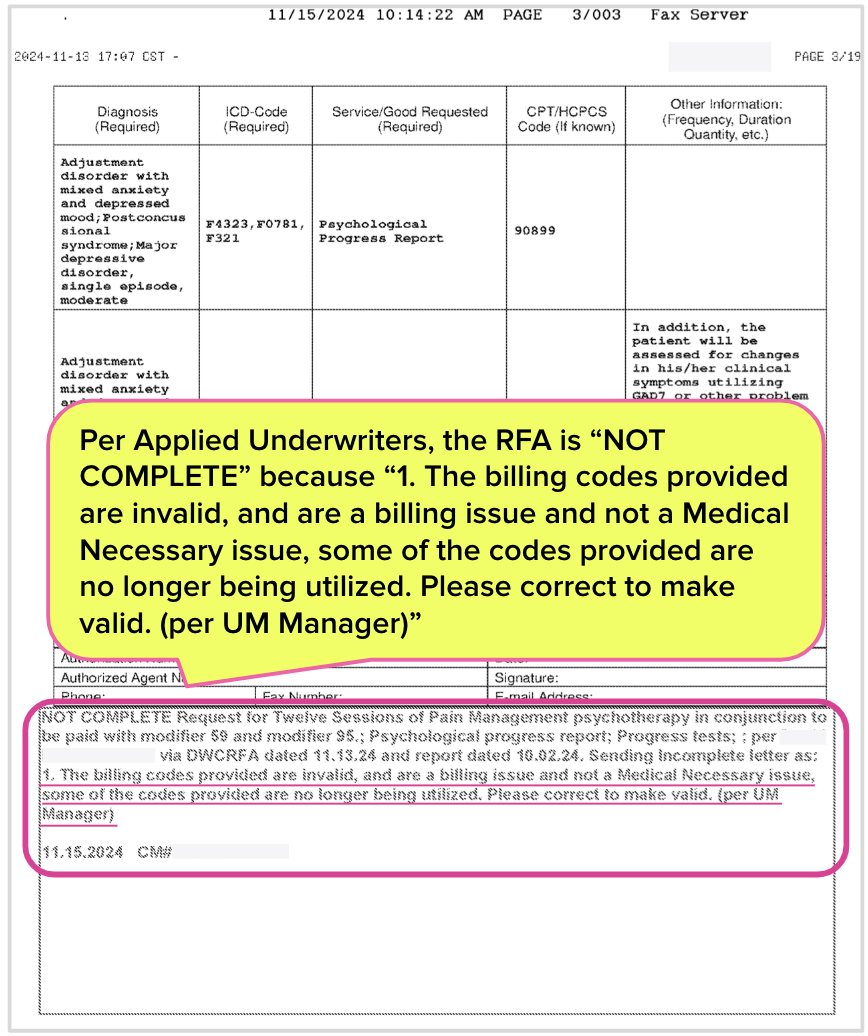

The requesting psychologist submitted an RFA to Applied Underwriters requesting psychotherapy and related services. The RFA was complete and compliant with California’s strict requirements. It included the specific procedure codes to identify the treatments requested and met every regulatory standard the CA DWC imposes on providers.

Yet Applied Underwriters rejected the RFA, claiming it was “NOT COMPLETE”—without indicating any missing information. Additionally, Applied incorrectly cited the following absurd reasons for not authorizing the requested treatment:

-

The billing codes are “invalid.” This is a false statement. The provider's procedure codes listed in the RFA are valid Current Procedural Terminology (CPT) codes.

-

The billing codes “are a billing issue and not a medical issue.” This is gibberish and cannot possibly be parsed in a way that makes any rational sense.

- The “codes provided are no longer being utilized.” This is also simply untrue–CPT codes 90837, 90899, 96136, and 96137 are currently used by providers throughout the United States.

Applied Underwriters Contorts CA “Utilization Management”

By incorrectly declaring this RFA is “NOT COMPLETE,” Applied Underwriters skirted California UR regulations, which allow only a physician to deny requested treatment.

The denial fails to cite the name of the individual responsible for the decision. However, the Applied representative who faxed the denial is listed on LinkedIn's professional networking site. This Applied employee’s only healthcare-related experience is as a nursing assistant.

This is the state of treatment authorization in California: A doctor thinks the treatments requested in the RFA are necessary to heal the patient. Yet Applied apparently grants a nursing assistant the authority to forestall the doctor’s recommended course of action—with no rational basis.

The provider cannot make this RFA more valid or compliant; it already was. Further, in declaring the RFA “NOT COMPLETE,” Applied did not issue an actual UR decision or provide an Independent Medical Review (IMR) form, which would have allowed the injured worker to dispute the denial (though likely unsuccessfully).

Accordingly, how is this catastrophically injured worker supposed to receive treatment?

daisyNews can (and has) produced many stories like this that illustrate the problems with UR. However, the CA DWC willfully defies state law requiring the agency to collect UR data for the purpose of spotting abuse, negligence, or non-compliance.

The CA DWC’s refusal to monitor UR or enforce UR regulations and laws allows workers’ comp insurers to pursue their most financially beneficial option: reflexively deny treatment requests, even on specious grounds. In the absence of any real consequences, why do otherwise?

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)