Liberty Mutual: 23-Month Wait for Surgery in CA

.gif)

If you need proof of how dysfunctional California workers’ comp is—and that absurdly long claim durations have become the appalling standard—see the 23-month ordeal an injured worker endured on the long road to receiving medically necessary care.

Initially injured in June of 2022, this Saroyan Lumber Company Inc. employee did not receive surgery to address a shoulder injury until May 2024. A treating physician first recommended the surgery in November 2023.

Sadly enough, after more than two years, this claim isn’t even halfway through the typical seven-year duration of a workers’ comp claim in California (compared to a US median of three years). Delays and denials of treatment are nothing but good news for entities that profit from a Utilization Review (UR) system so dysfunctional that it keeps injured workers injured, rather than returning them to work.

Below, see the surreal obstacles the treating physician overcame to obtain authorization to deliver medically necessary care. Any human with a conscience scrolling through the exchange below will have only one question: How can this be?

Despite countless examples like this, injured workers and their treating physicians have no reason for hope—the California Division of Workers’ Compensation (DWC) is apparently committed to keeping the UR system broken.

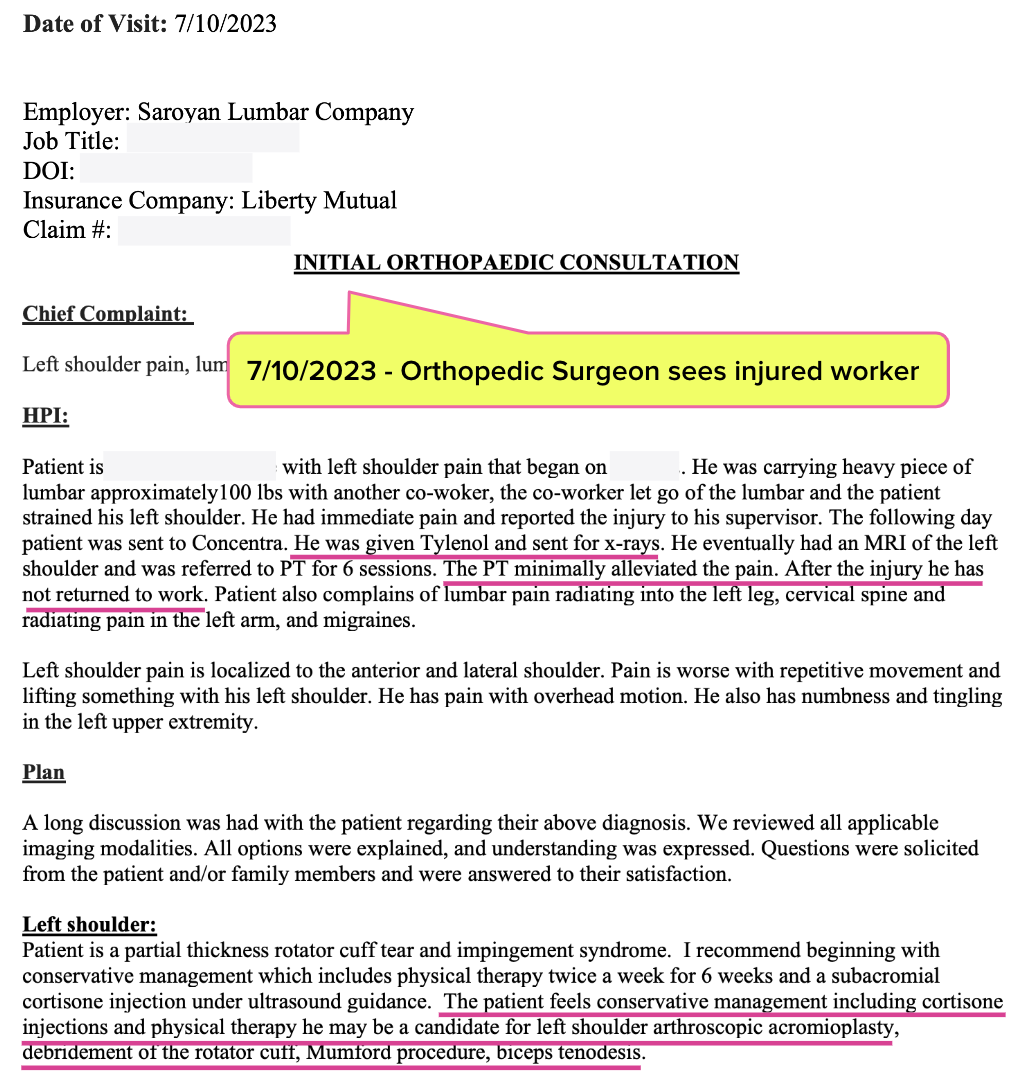

July 2023: Liberty Mutual Approves Ortho Consult

In June of 2023 (over a year after the initial injury, following an apparent dispute requiring a Medical Legal evaluation), Liberty Mutual approved an orthopedic surgery consultation for the lumber worker who had been out of work since June 2022 with a shoulder injury.

In July 2023, thirteen months after the injury, the orthopedist examined the worker and noted that conservative treatments, including Tylenol and physical therapy, had yet to resolve the injury.

As shown in the report below, the orthopedist recommended continuing conservative treatment—while acknowledging that the worker “may be a candidate for left shoulder arthroscopic acromioplasty, debridement of the rotator cuff, Mumford procedure, biceps tenodesis.”

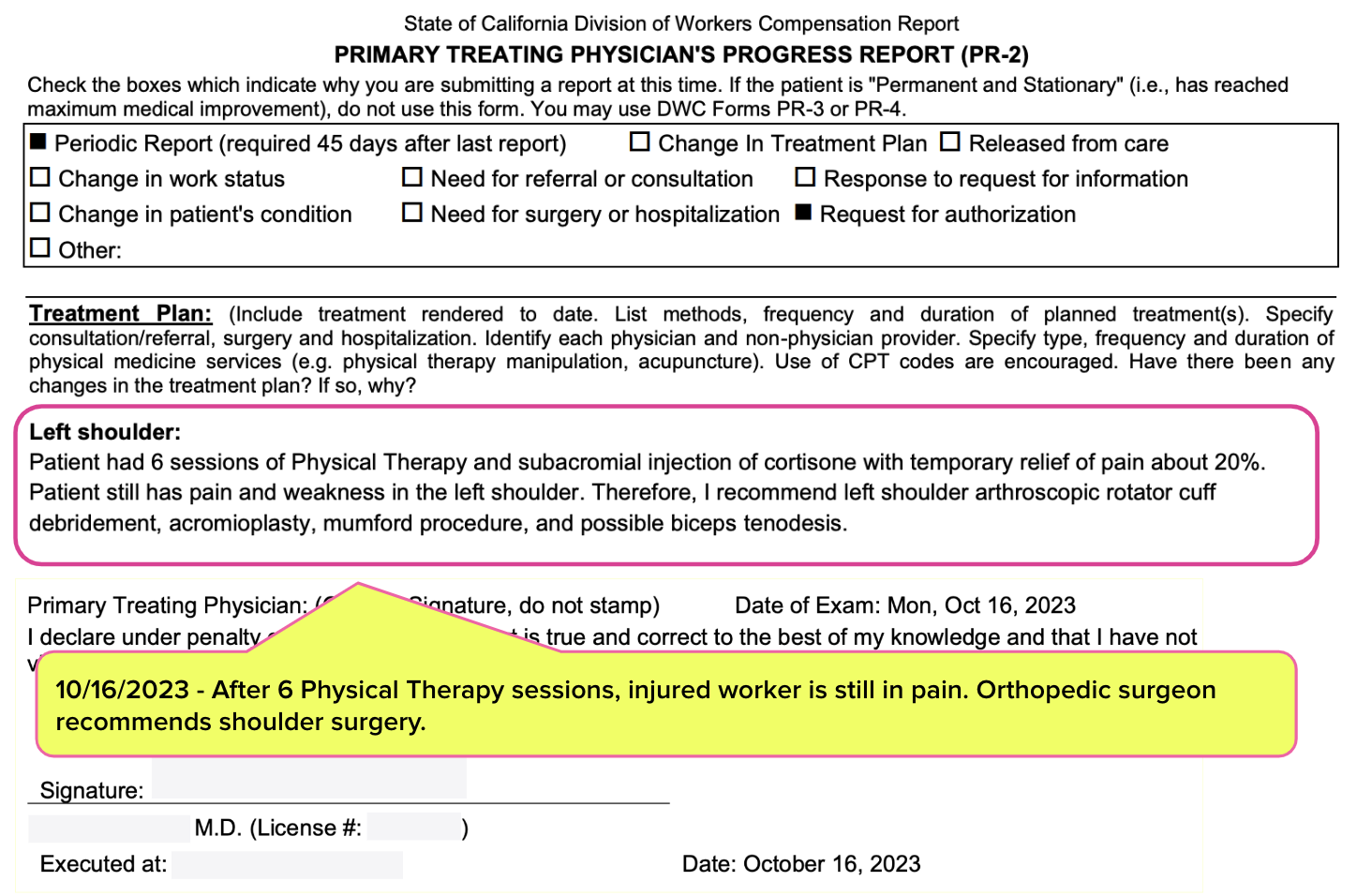

November 2023: Orthopedist Requests Liberty Mutual Approve Surgery

By October 2023, it was clear that conservative treatment was not sufficient. As shown in the PR-2 report below, the injured worker and orthopedist determined physical therapy and injections resulted only in minor, temporary relief. The injured worker agreed to surgical intervention.

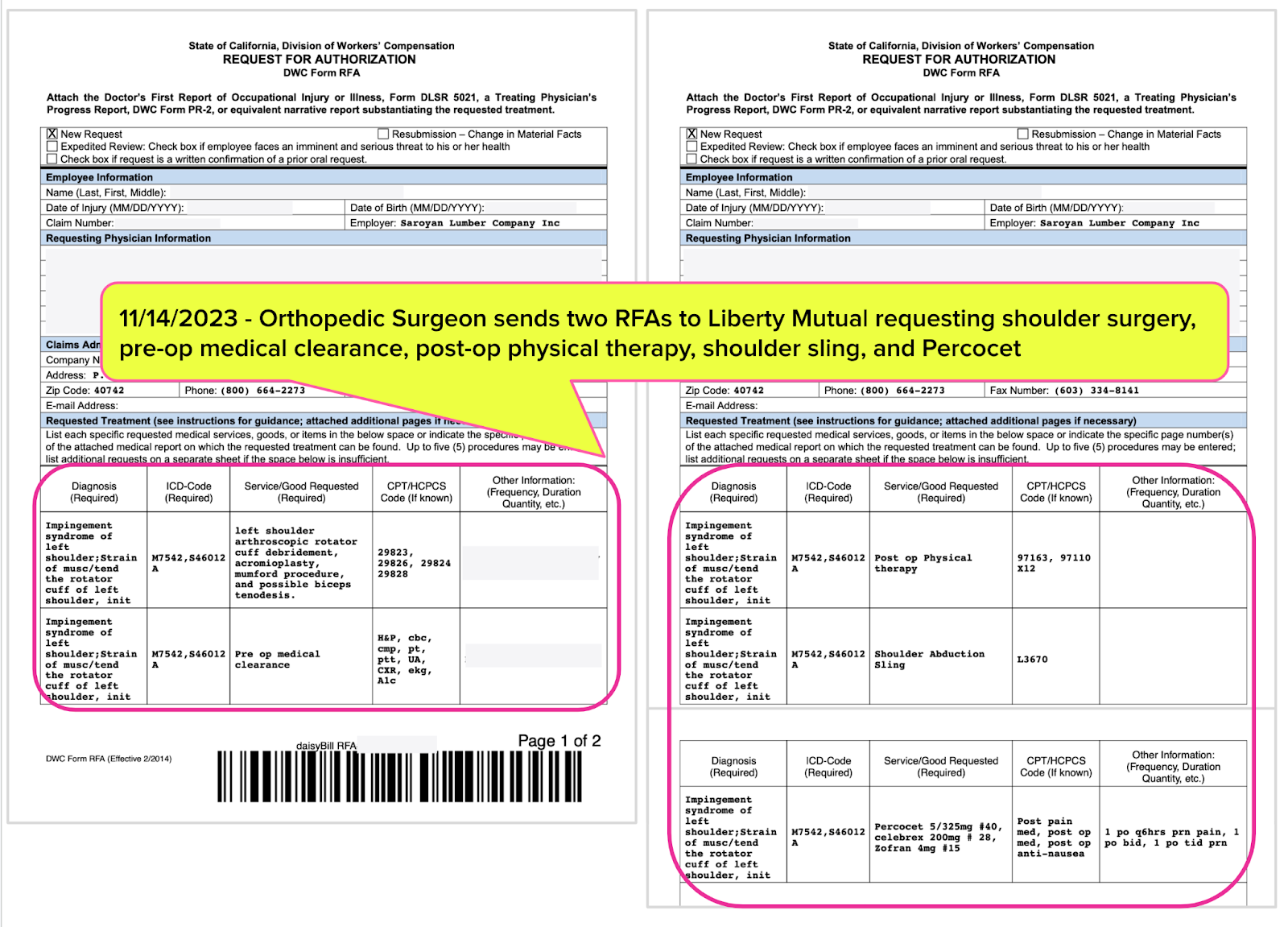

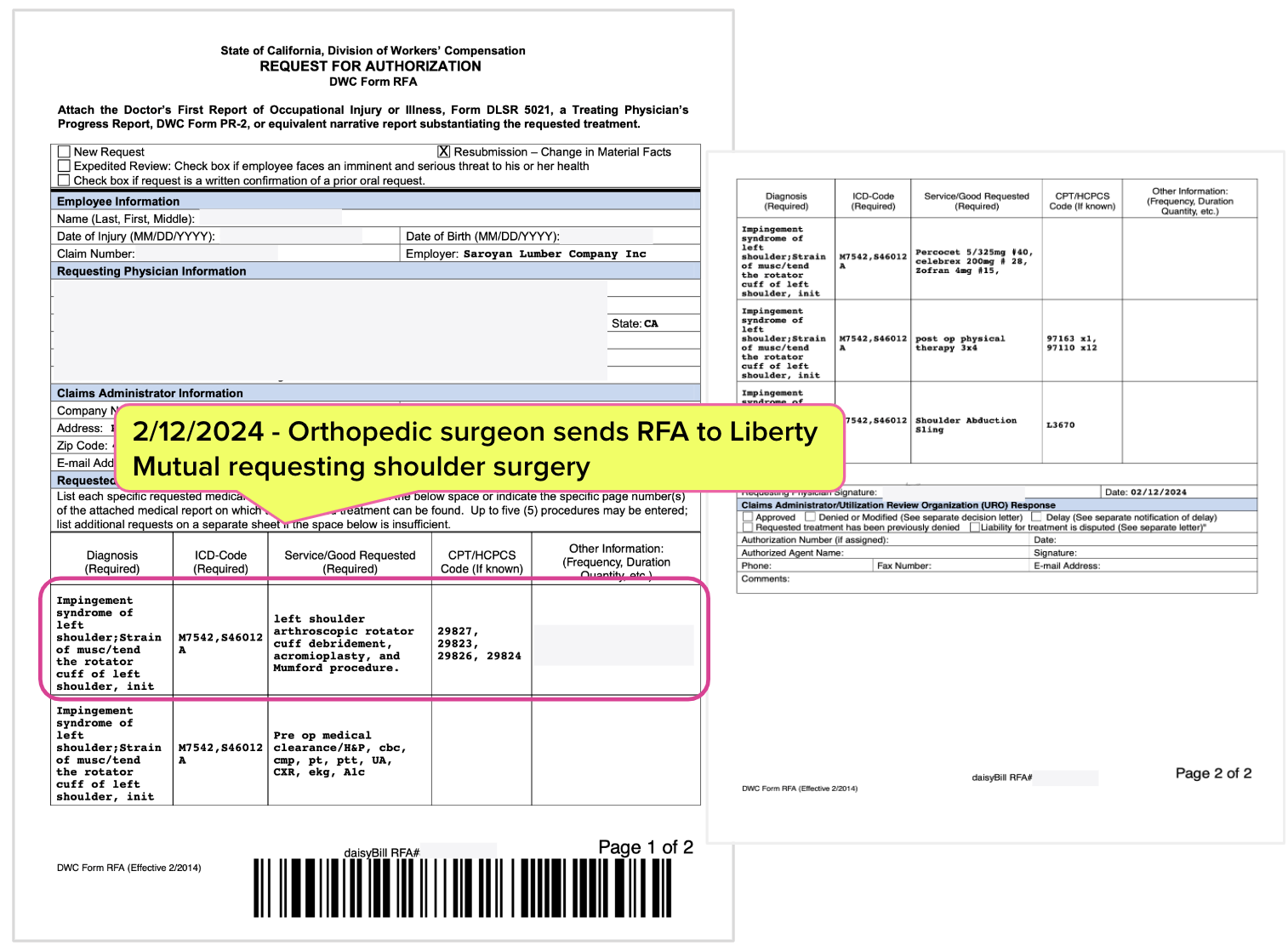

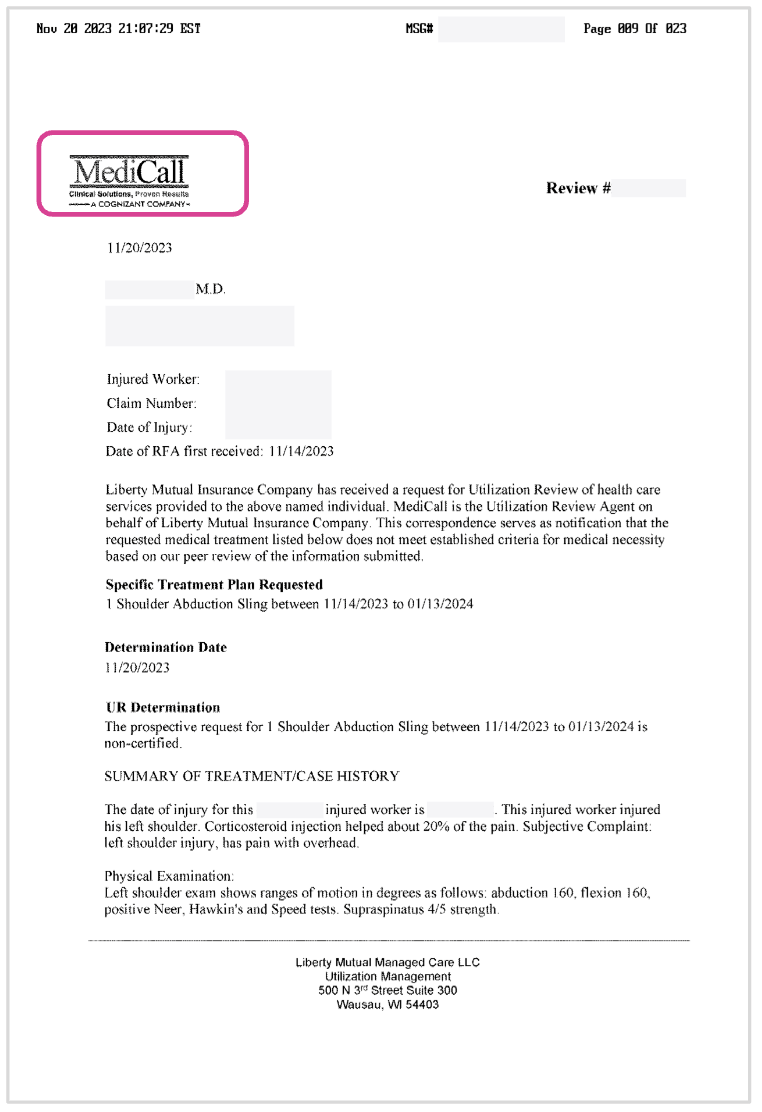

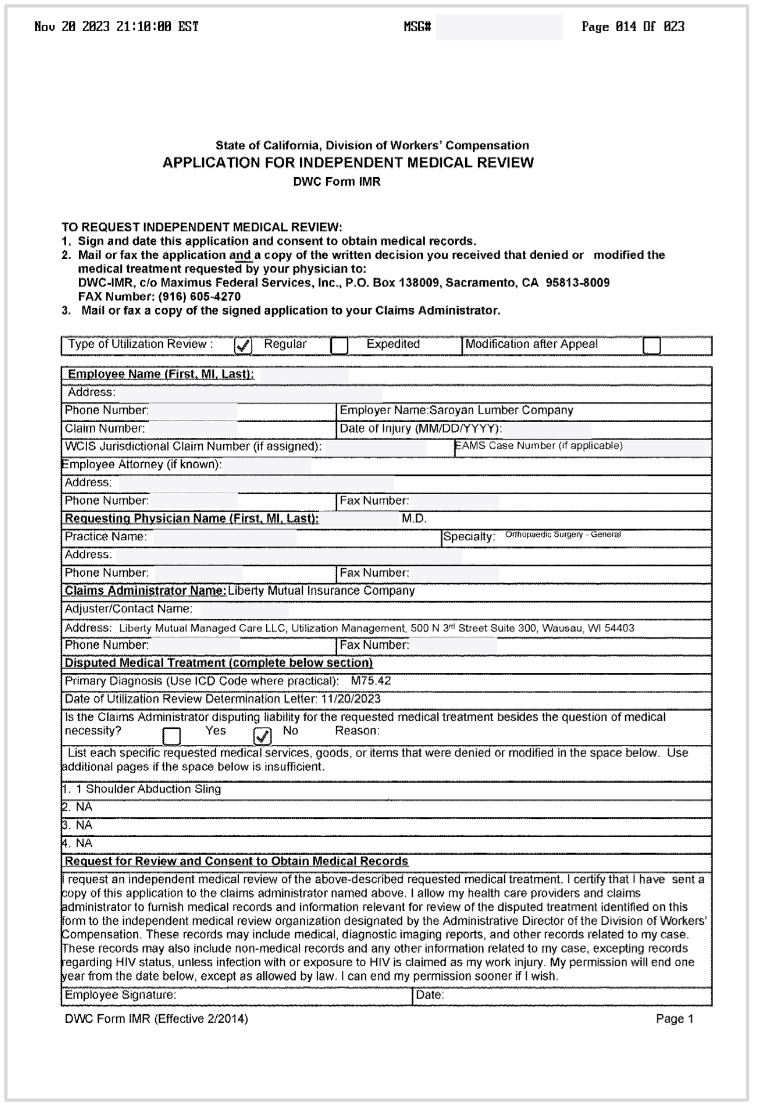

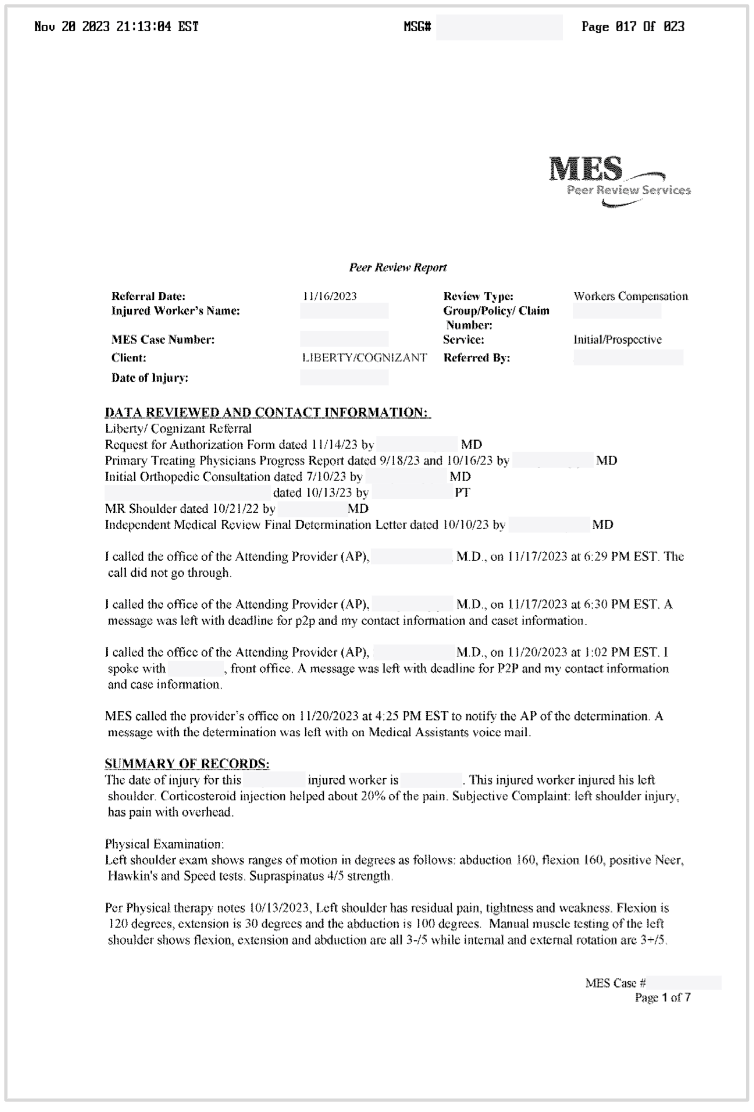

On November 14, 2023, the orthopedist submitted Requests for Authorization (RFAs) to Liberty Mutual seeking approval to conduct the surgery as well as pre-and-post operative care.

November 2023: Liberty Mutual Denies Surgery

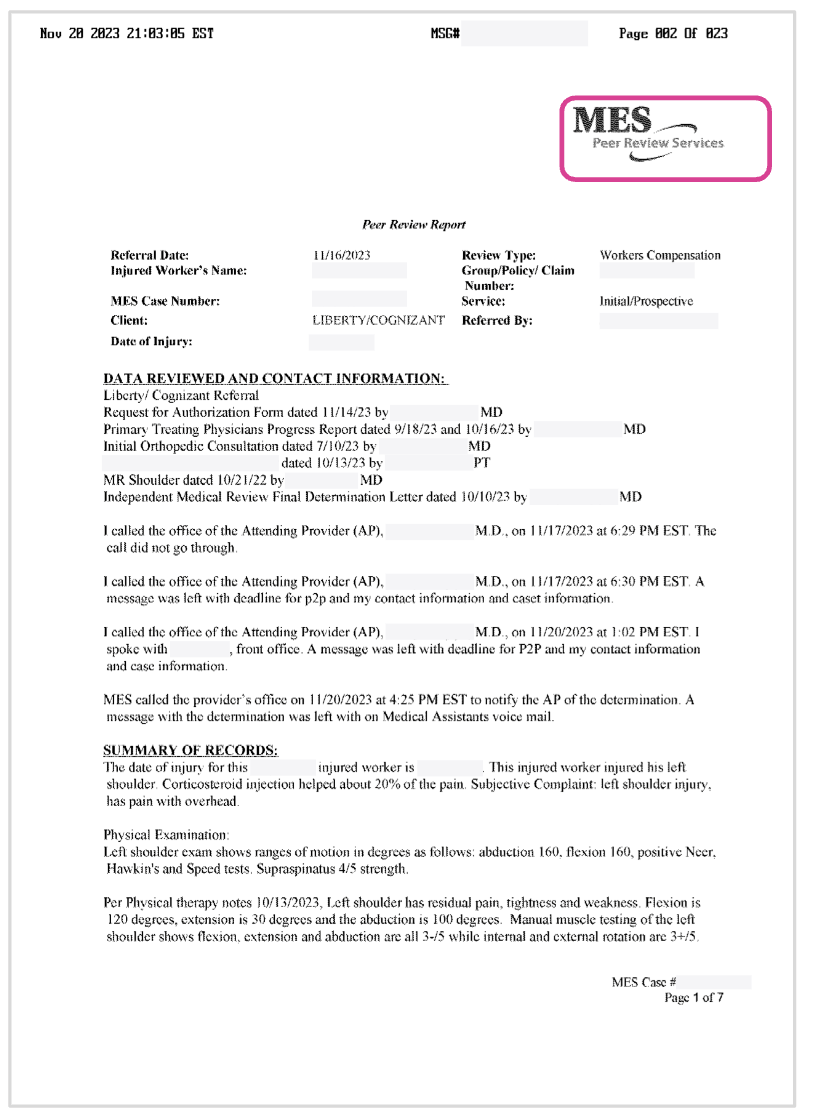

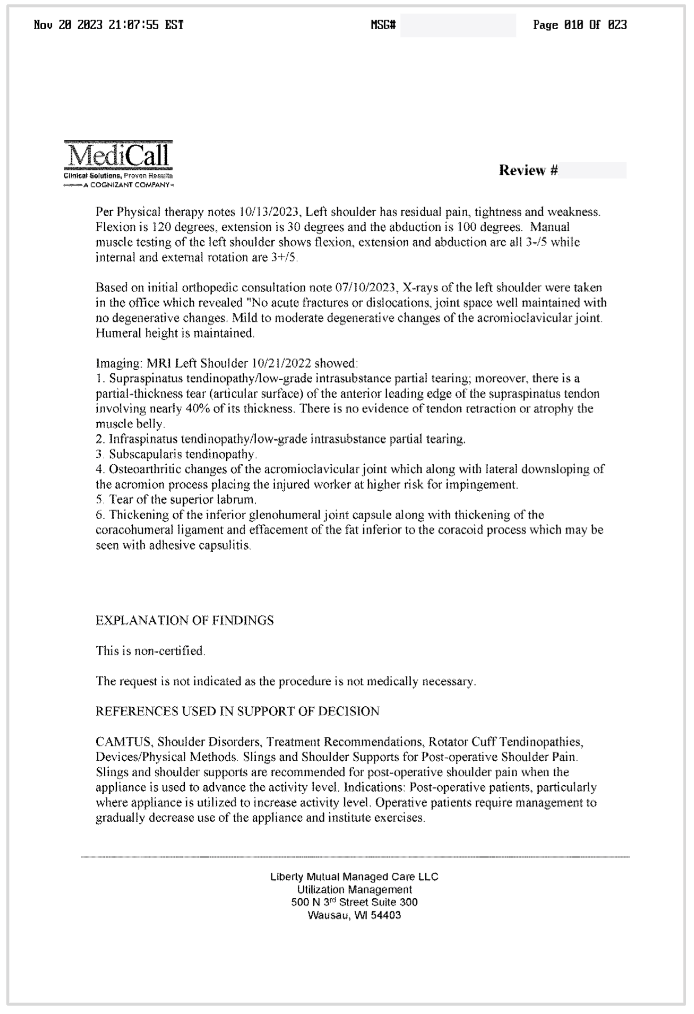

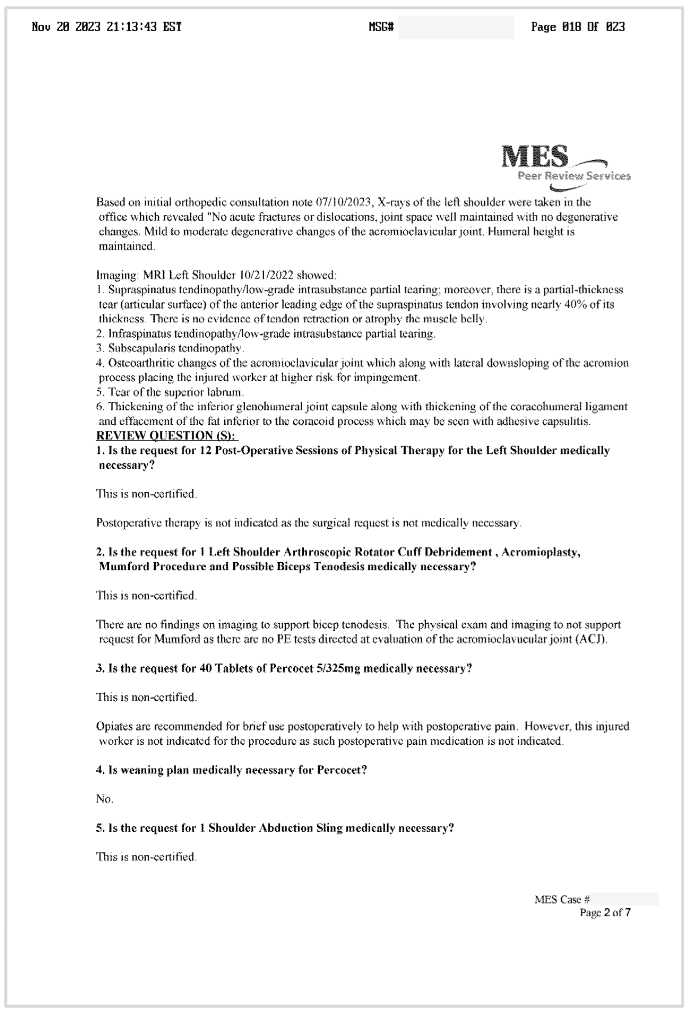

Liberty Mutual responded to the RFA with a 23-page UR decision denying the surgery, which we have published in its entirety at the bottom of this article. We invite readers to review this bloated document and attempt to make any sense of the word-sewage employed to deny treatment to this worker.

A UR physician employed by MES Peer Review Services, an outside UR vendor, rendered the denial decision on behalf of Liberty Mutual. This MES UR physician making decisions about a California worker’s care is licensed in Georgia, Massachusetts, and Washington, but not California—a practice that California law may soon ban. A second UR vendor, MediCall, also weighed in.

The UR decision offers a summary of the reasons for denying some (but not all) of the surgical procedures on page 3.

As a reminder, at this point the injured worker had been out of work for seventeen months after repeated attempts at recovery through conservative treatment.

February 2024: Liberty Mutual Approves Surgery Request

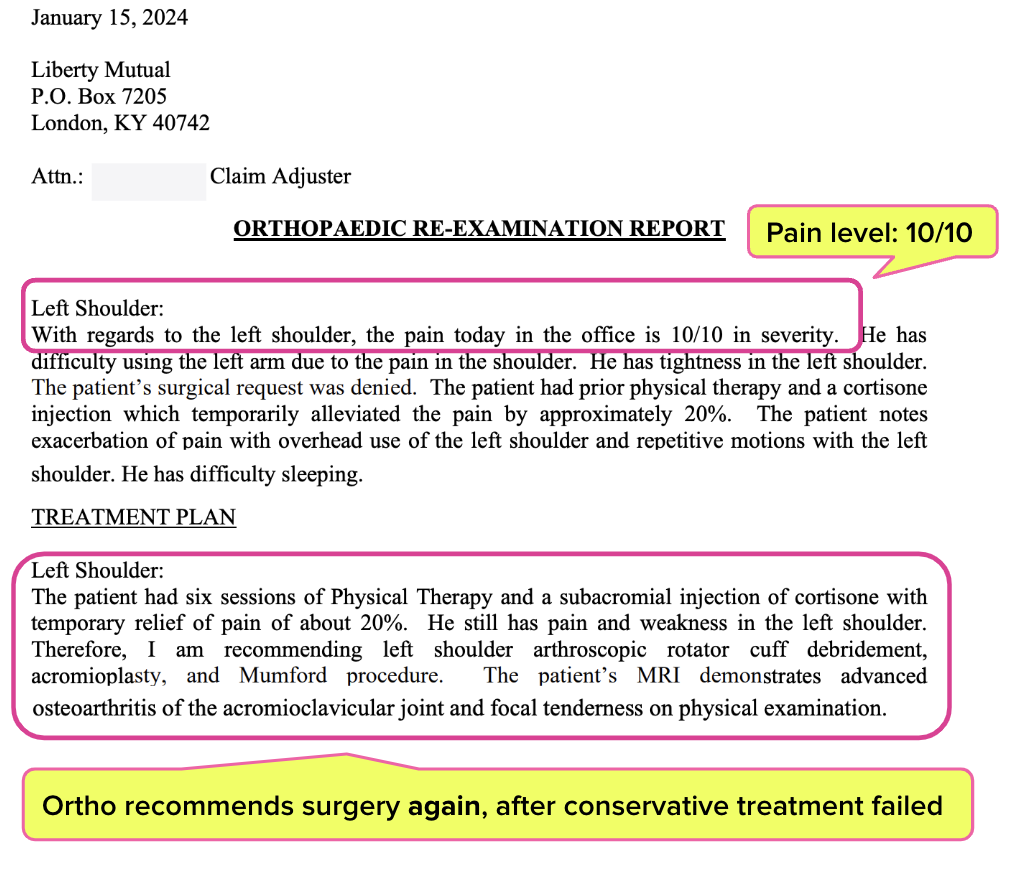

In January 2024, the orthopedist reexamined the injured worker, who rated his pain as a 10 out of 10 and continued to struggle.

The orthopedist again determined that surgery was medically necessary and appropriate. In the RFA below, the orthopedist requested the procedures initially outlined in the first RFA.

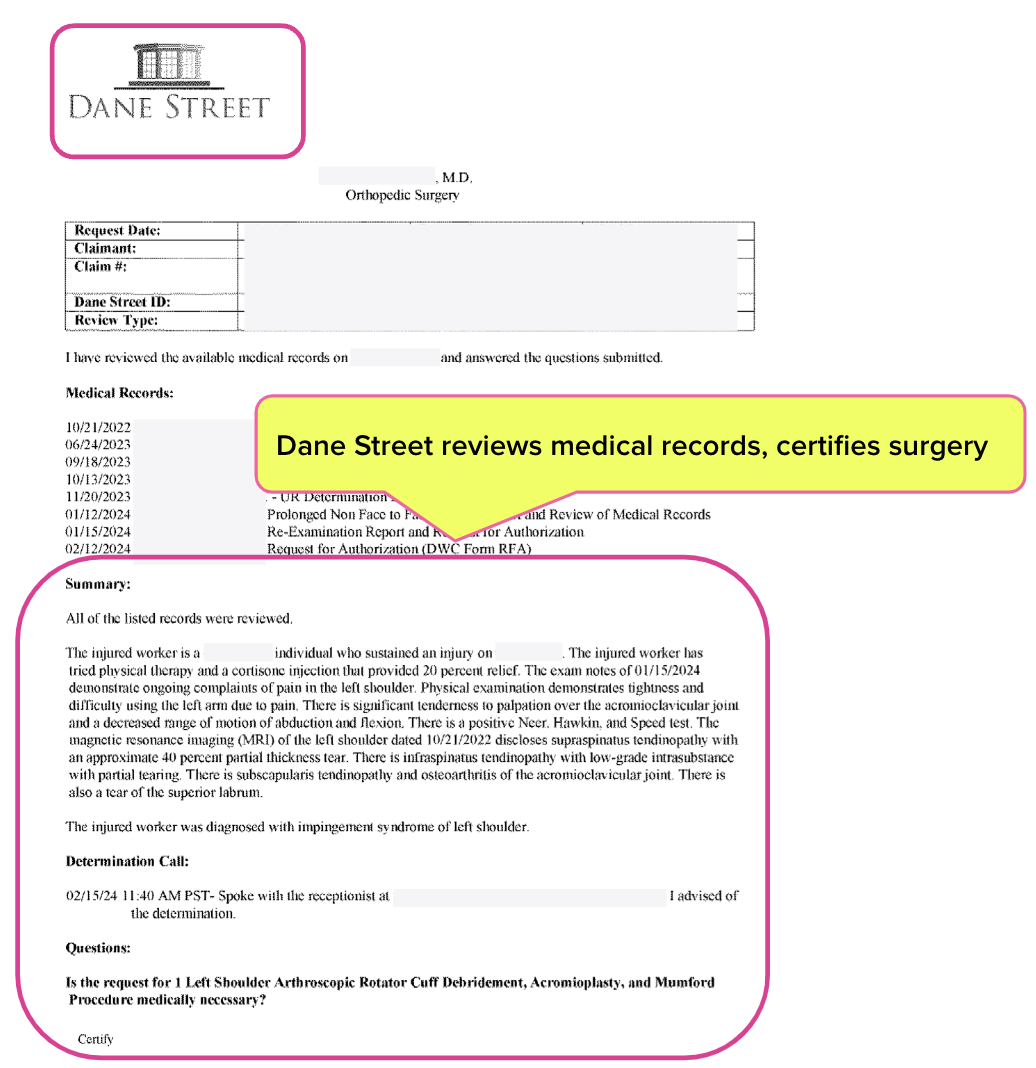

This time, Liberty Mutual farmed out the UR to a different outfit, Dane Street.

A Dane Street UR physician (licensed in California) finally mercifully authorized the surgery, which took place in May of 2024.

To review:

- A lumber worker with a work-related shoulder injury didn’t even see an orthopedic specialist until a year after the Date of Injury—and only after a Medical-Legal dispute.

- Subsequently, it took several months of pain and inability to work, as well as three separate RFAs reviewed by three separate UR vendors, before Liberty Mutual would authorize the necessary surgery.

- The total time between the Date of Injury and the surgery was almost two years.

This is the labyrinth of nonsense injured workers and providers must navigate to obtain care. Unfortunately, it’s the logical result of a UR system the DWC chooses to leave effectively unmonitored, ungoverned, and opaque—a perfect recipe for inefficiency (at best) and profit-leeching (at worst).

Just as unacceptably, this story has a twist ending worthy of M. Night Shyamalan: Liberty Mutual now refuses to pay the orthopedist for the authorized surgery. We’ll detail that travesty in an upcoming article—stay tuned.

Read If You Dare: Bloated, Baffling 23-Page UR Decision Denying Surgery

This UR decision denying the recommended surgery exemplifies why daisyBill consistently pleads for the DWC to mandate a standardized UR response form.

California providers must submit Requests for Authorization (RFAs) on the prescribed DWC Form RFA, subject to strict requirements. Meanwhile, claims administrators may respond to RFAs in any form or format of their choosing—hence UR decisions like the one below.

Lengthy, illegible, even nonsensical UR decisions are a standard feature of workers’ comp, thanks to this double standard.

Submit RFAs in 30 seconds and automatically track UR decisions with daisyAuth. Request a demo below!

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)