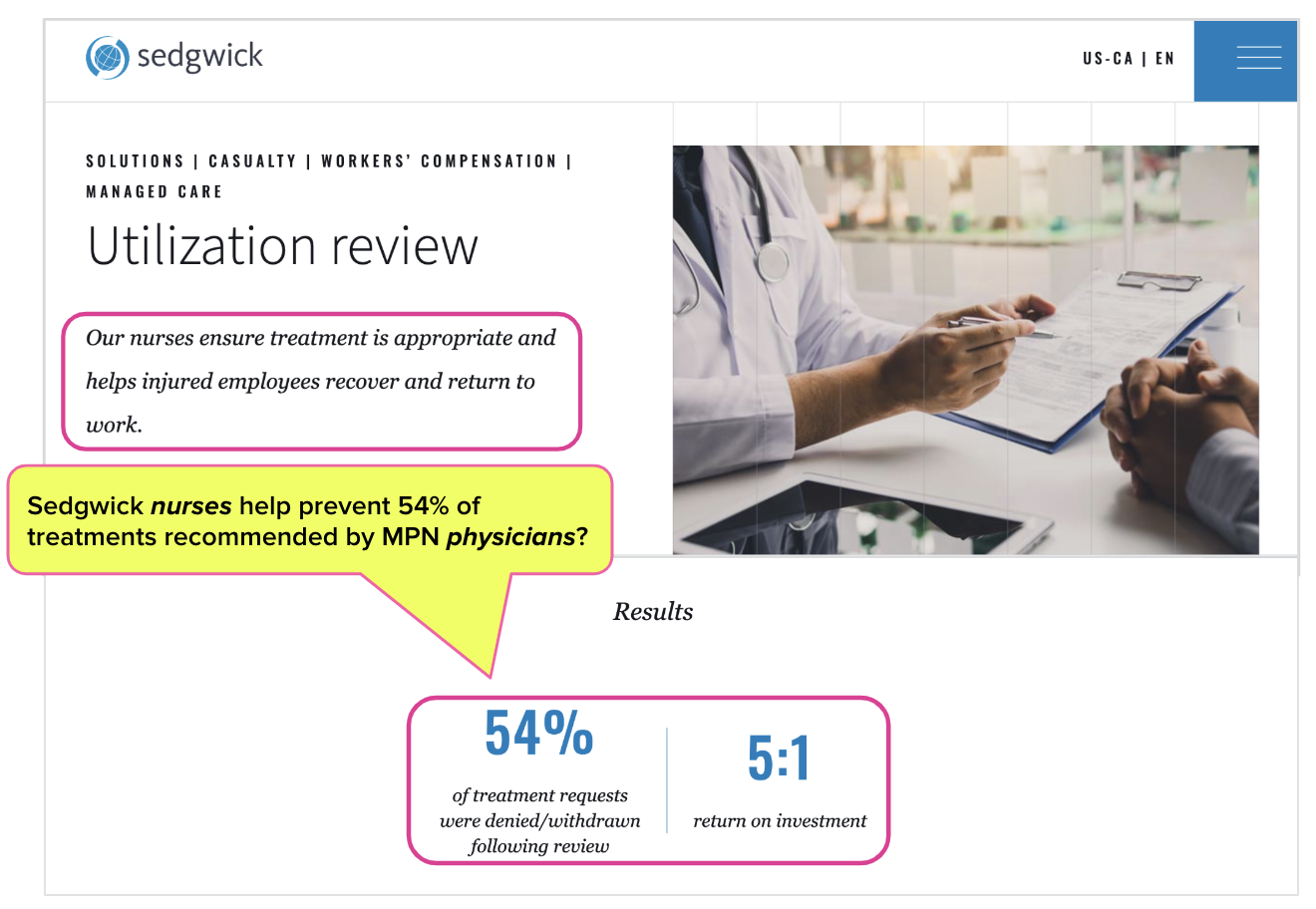

Sedgwick Boasts 54% Denial Rate for Injured Worker Treatment

Editor’s note: As predicted below, Sedgwick removed the 54% statistic from its marketing website, shortly after the publication of this article. Who could’ve guessed?

You have to respect, if grudgingly, one thing about Sedgwick Claims Management Services, Inc.—the Third-Party Administrator (TPA) appears to fear no judgment, legal or moral.

Sedgwick’s marketing website, aimed at employers looking for a vendor to manage their injured employees’ claims, boasts—seriously, boasts—of a 54% denial rate for treatments recommended by injured workers’ physicians.

Right alongside that statistic, placed front and center for all to behold, is another: a purported 5 to 1 “return on investment” resulting from Sedgwick’s unparalleled achievements in denying injured workers medical care.

We can’t decide what’s more alarming: that a claims administrator would celebrate its propensity for denying treatment at mind-boggling rates or that employers believe, contrary to available data, that such an approach saves money rather than exacerbating injuries and costs more in the long run.

Wake up, California employers. When claims administrators aspire to high treatment denial rates, it doesn’t save you money. Instead, private equity profits increase each day an injured worker remains injured. The more complicated, less efficient, and obstacle-laden workers’ compensation is, the more employer dollars enter private equity’s pockets.

Sedgwick’s 54% treatment denial rate simply feeds the Utilization Review (UR) industry, with all its beneficiaries, while your employees’ injuries are extended, compounded, and ultimately made more expensive.

Sedgwick Touts High Denial Rates, Promises ROI

According to data reported by the Workers’ Compensation Insurance Rating Bureau (WCIRB), it costs 49¢ to deliver $1 worth of workers’ comp benefits to a California injured worker, compared with the national median of 26¢.

That 49¢ does not pay for treatment to heal the injured worker; instead, it represents administrative profit for claims administrators, side-kick vendors, and private equity.

In California, two primary drivers of these employer administrative costs are—paradoxically—Medical Provider Networks (MPN) and Utilization Review (UR) of the treatment recommended by MPN physicians. Claims administrators have convinced California employers to pay for:

- Medical Provider Networks (MPNs) that restrict injured workers to specific physicians chosen by the MPN

- Utilization Review (UR) to deny the care recommended by the MPN physicians who are allowed to treat the employer’s injured workers

In other words, employers pay to restrict their injured workers’ care to only the most supposedly trustworthy, cost-effective doctors—then pay again to have those doctors overruled by UR vendors.

On its UR marketing website (shown below), Sedgwick boasts that 54% of treatments, presumably recommended by Sedgwick MPN treating physicians, were “denied/withdrawn” following review by Sedgwick’s nurses.

The Claim Extending, Money-Wasting UR Game

Further, as shown above, Sedgwick’s UR page boasts that its 54% treatment denial has a “return on investment” of 5:1.

Presumably, this ratio means the administrative costs employers pay for Sedgwick’s nurses to deny/withdraw 54% of treatments recommended by MPN physicians are offset by the “savings” of not having to pay for the treatments, by a multiple of 5—an excellent return on investment (ROI) by anyone’s standards.

However, excessive denials can actually increase employers’ costs.

The state of California is a perfect example; according to Workers’ Compensation Insurance Rating Bureau (WCIRB) data, closing a California worker’s claim takes seven years, more than twice the national median—with the aforementioned 49¢ spent on administration for every dollar of benefits along the (long, long) way.

Sedgwick’s UR page reminds employers that “Unnecessary and inappropriate medical care can have detrimental effects on patients, including delayed recovery, additional health issues, stress and anxiety.” Seven years to close an injured worker’s claim proves that refusing appropriate medical care can also be bad for an injured worker’s health (while increasing employers’ administrative costs).

California workers’ comp can be viewed as a brilliant, albeit stunningly cynical, business model. Deny care→ the injured worker cannot return to work→ the injured worker’s claim stays open.

The longer the claim remains open, the more profitable it is for business entities that feed on employer administrative costs. The more physician visits, treatment, and UR an injured worker “requires,” the more revenue claims administrators, side-kick vendors, and private equity can potentially reap.

Once again, data affirms the facts. Private equity firm Carlyle invested $6.7 billion in Sedgwick, and the TPA is now valued at $13.2 billion. Carlyle also presides over nebulous webs of bill review entities and network discounting companies, all siphoning their share of the 49¢ spent to deliver every dollar’s worth of benefits.

Over/Under: How Long Will Sedgwick Leave This Page Online?

We ask our readers to forward this article to other workers’ comp stakeholders, from employers to providers to labor representatives. Great marketing doesn’t work without exposure, and we want Sedgwick’s self-proclaimed treatment denial rates to reach as large an audience as possible.

Given enough exposure, we predict Sedgwick will take down this UR web page. The only question is how long it will take. Two weeks? Six months? Choose an over/under, and place your bets with your colleagues.

By saying the quiet part out loud and brazenly admitting their policy of denying treatment like the titular rodents in a game of whack-a-mole, Sedgwick has acknowledged what providers already endure: UR creates profitable friction that generates revenue at the expense of injured workers’ health.

And don’t worry—even if (when) this page comes down, daisyBill has all the screenshots.

We can’t fix UR, but we can make authorization easier for providers. Submit RFAs in 30 seconds and automatically track UR decisions with daisyAuth.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

I will be glad to share this with my 24,500 current and former work comp professional students. When a company boasts that 54% of requested medical treatment is not provided then something appears to be very wrong. Such percentages far exceed the industry average of denied or withdrawn requests.