Broken CA Workers' Comp Takes 7 Years to Close Claims

In California, closing an injured worker’s claim takes over twice as long as the national median.

According to a report from the Workers’ Compensation Insurance Rating Bureau (WCIRB), it takes 7 years to close 90% of claims in California, compared with the national median of 3 years. This may be the most straightforward, dramatic evidence of the deep dysfunction at the core of California workers’ comp as currently mismanaged by the Division of Workers’ Compensation (DWC).

The worst part, however, is not how long it takes to close claims—it’s the deeply disturbing fact that the longer a claim remains open, the more profitable the claim is for business entities that feed on the system. The more physician visits and treatment an injured worker “requires,” the more revenue these entities can potentially reap from employers.

For those who profit, seven-year claim durations are cause for celebration.

Even with an exceedingly wide margin of error to account for the WCIRB’s low-quality, questionable data, this report makes one conclusion inescapable: California workers’ comp is a minefield for employers, providers, and injured workers, but unconscionably profitable for claims administrators, side-kick vendors, and their private equity owners—all with the tacit blessing of the do-nothing DWC.

For years, it has been apparent that the DWC is not interested in acting as a governing body. Instead, the agency lets claims administrators, vendors, and private equity firms profit from extended claim durations.

California not only fails injured workers but turns them into annuities that funnel profit to these entities.

CA: 7 Years to Close Claims

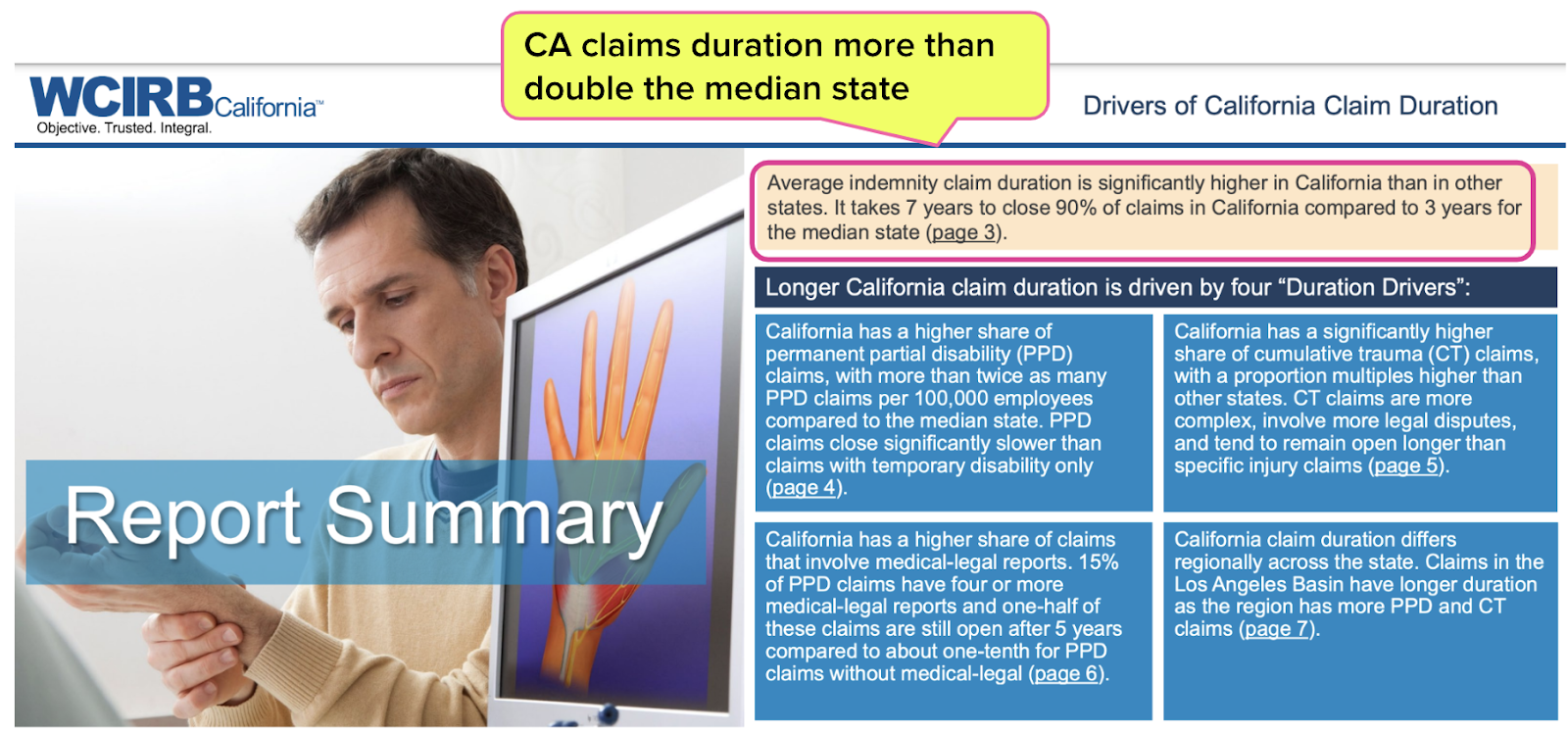

The WCIRB’s 2022 report on Drivers of California Claim Duration paints a stark picture of just how behind California is compared to the rest of the country. According to the report (emphasis ours):

“Average indemnity claim duration is significantly higher in California than in other states. It takes 7 years to close 90% of claims in California compared to 3 years for the median state.”

The WCIRB claims this is the result of four specific “duration drivers” that are uniquely out of hand in California:

- A higher proportion of Permanent Partial Disability (PPD) claims

- A higher proportion of Cumulative Trauma (CT) claims

- A higher proportion of Medical-Legal disputes

- Regional variations in claim duration

We would also argue that one more item should be added to the list of “duration drivers:” the dysfunctional and opaque UR system, which can delay or prevent medically necessary and appropriate care based on questionable (or downright spurious) grounds—a perfect way to extend claim durations.

Seven years to close injured workers’ claims is a boon for anyone invested in businesses whose profits increase the longer an injured worker stays injured—to say nothing of the private equity firms that own those entities. These include:

- Bill review entities

- Preferred Provider Organizations (PPOs) and other network discount contracting entities

- Medical Provider Networks (MPNs) and “entities providing physician network services”

- Utilization Review Organizations (UROs)

- Credit card companies that enjoy fees for treatments paid with Virtual Credit Cards (VCCs)

- Pharmacy benefit managers (PBMs)

In California, injured workers have a Sisyphean uphill battle to get the care they need, while providers face similar obstacles to receiving appropriate payment for that care. A significant percentage of this friction results from claims administrators (like the insurers that make up the WCIRB) dragging the process out, creating needless disputes, and otherwise gumming up the works.

Each day an injured worker’s claim remains open is another profitable day for claims administrators, side-kick vendors, and private equity.

No wonder it takes twice as long to resolve a work-related injury.

In a rational world, the DWC would seek and execute solutions to this apparent, system-wide malfunction. But in the real world, the DWC is a non-factor and, at worst, a willing lackey of more powerful interests.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

%20(1).gif)

Excellent take on an impaired system

You cannot when you omit two biggest delay drivers: Applicant Attorneys and the Medical Providers (your customers) who stand to profit more than any other party from delays.