Sedgwick's Sloppy EDI Tech Goes Haywire

Sedgwick Claims Management, Inc. is daisyBill’s largest workers’ comp claims administrator, as measured by the volume of bills our clients send to the Third-Party Administrator (TPA).

It’s also among the least compliant and most technologically inept—making treating injured workers difficult for providers.

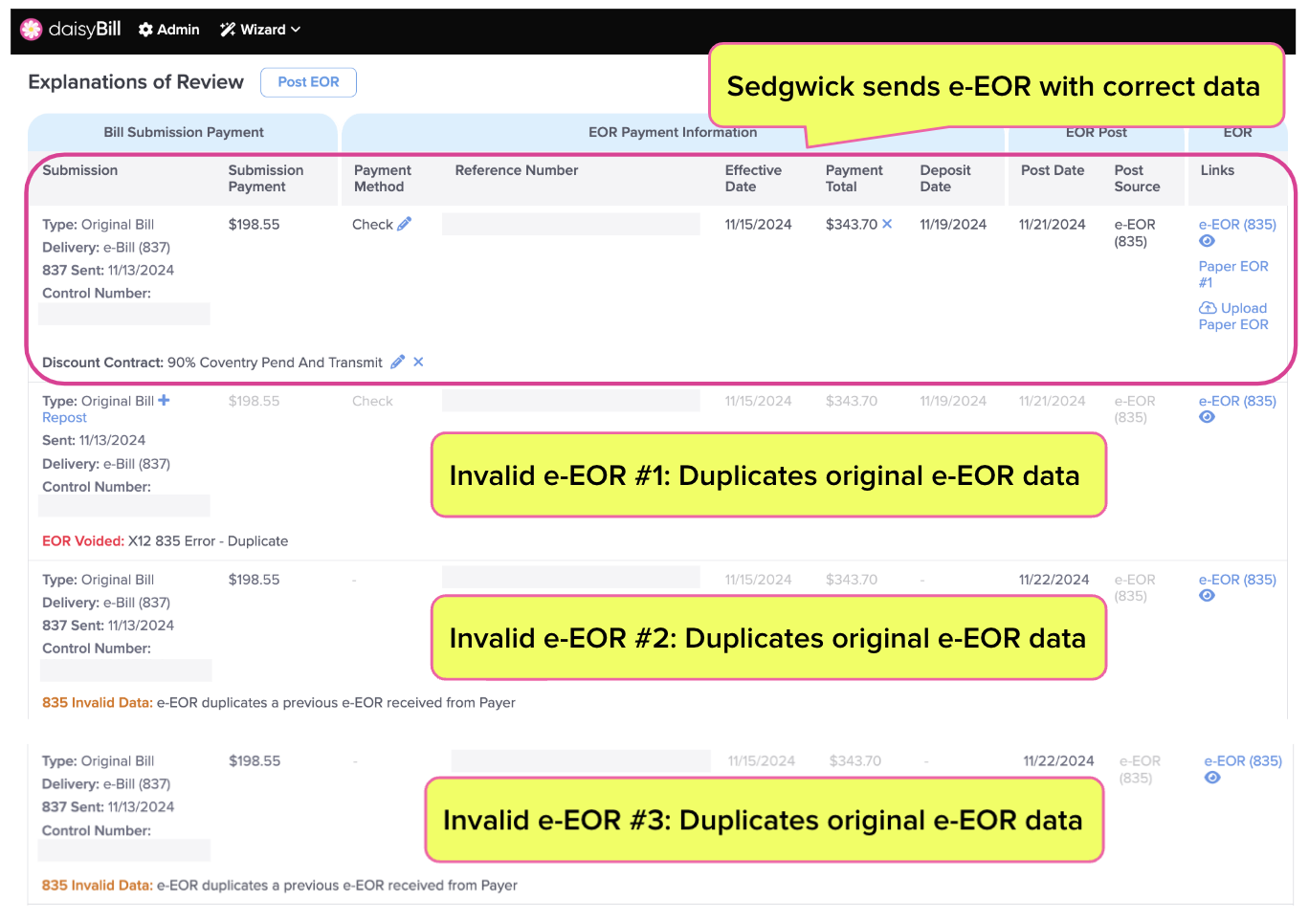

See the example below for a glimpse at how Sedgwick fails to manage bills providers send electronically (e-bills). Instead of simply returning a (single) electronic Explanation of Review (e-EOR) in response to an e-bill—as required by California regulations—Sedgwick sent a dozen e-EORs with contradictory payment information.

Fortunately, daisyBill software monitors and automatically invalidates duplicate e-EORs, sparing providers the revenue management complications that would arise from receiving multiple incorrect e-EORs.

But who monitors (and untangles) this accounting mess for Sedgwick’s employer and insurer clients?

Sedgwick clients should carefully examine the example below and ask if the TPA accurately reports the medical expenditures made on a client’s behalf. In this instance, what accounting did Sedgwick report to the carrier, and what did the carrier report to the insured employer?

We’d say that Sedgwick should do better. But history suggests the TPA won’t bother trying. Why should it?

Sedgwick Sloppies: Provider Sent Bizarre Series of e-EORs

In the background, loads of technological complexity go into e-billing and payment. Normally, that’s for e-billing vendors and claims administrators (as well as their clearinghouses) to worry about.

But weirdness ensues when a claims administrator doesn’t have its technological act together (and seemingly has zero incentive to comply with e-billing laws and regulations). Sedgwick is the proverbial poster child for that weirdness, which can create serious friction (unless the provider’s e-billing software can compensate).

This should raise alarms for Sedgwick’s clients.

Recently, a provider sent Sedgwick a perfectly compliant, clean e-bill. Sedgwick’s clearinghouse vendor, Data Dimensions, acknowledged receipt and accepted the e-bill for processing. Sedgwick sent the provider an e-EOR in a timely manner. But then…things went sideways.

- After sending the initial e-EOR, Sedgwick sent the provider three additional e-EORs, each reporting an extra payment of $198.55.

- Then, Sedgwick sent the provider eight more e-EORs, each denying payment.

In total, Sedgwick sent the provider 12 e-EORs, as shown below.

daisyBill technology was able to manage Sedgwick’s failures on the provider end. However, the employer (JetSuite, Inc.) and the carrier (listed on the e-EOR as Starr Specialty Insurance Company) should be highly concerned by Sedgwick’s performance—and correspondingly vigilant about how Sedgwick accounts for this slopiness.

To put it bluntly, this is a mess. It’s also a sad display from a TPA (somehow) trusted by insurers and employers nationwide to handle workers’ comp claims.

daisyBill Tech Cleans Up Sedgwick’s Mess

For providers, e-billing should be relatively straightforward:

- The provider sends an e-bill with PDFs of supporting medical and authorization documents.

- The claims administrator sends the provider a ‘277 Acknowledgement’ indicating receipt of the e-bill.

- After processing the bill, the claims administrator sends the provider one electronic Explanation of Review/Benefit (EOR/EOB) that automatically posts payment information to the e-bill.

daisyBill software monitors every e-EOR sent to our clients. If the claims administrator sends e-EORs for a bill with an e-EOR already posted (and the check amount, reference number, and check date match the original e-EOR) daisyBill automatically invalidates the additional e-EOR.

In this case, since the “payment” amount on the fourth e-EOR was $0, this denial was “posted” in addition to the original e-EOR’s payment of $198.55. Since daisyBill software knows the provider received a check for $198.55, the invalid e-EORs’ $0 “payments” do not affect the provider’s analytics or revenue management.

In other words, our system doesn’t allow Sedgwick’s erroneous e-EORs to waste the provider’s time.

The question is: what technology protects Sedgwick’s clients from its ineptitude? Exactly what expenditures did Sedgwick report to JetSuite and Starr Industry Insurers in this case?

Alert to Sedgwick clients: this is not an isolated incident.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.