CA DWC Defies Law, Botches WCIS

Without reliable data, no government can understand—let alone solve—the problems of any major system. Yet California’s Division of Workers’ Compensation (DWC) has openly defied California legislators and failed to gather vital workers’ comp data, in unabashed violation of state law.

-

The DWC is required by California law to electronically collect data from all claims administrators for the purpose of monitoring, studying, and improving California’s workers’ comp system.

- The DWC is also required by law to assess monetary penalties against any claims administrator that fails to submit the required data.

Further, the DWC’s own regulations (promulgated by the agency itself) establish how the DWC must comply with this law by requiring claims administrators to report their data to the Workers’ Compensation Information System (WCIS).

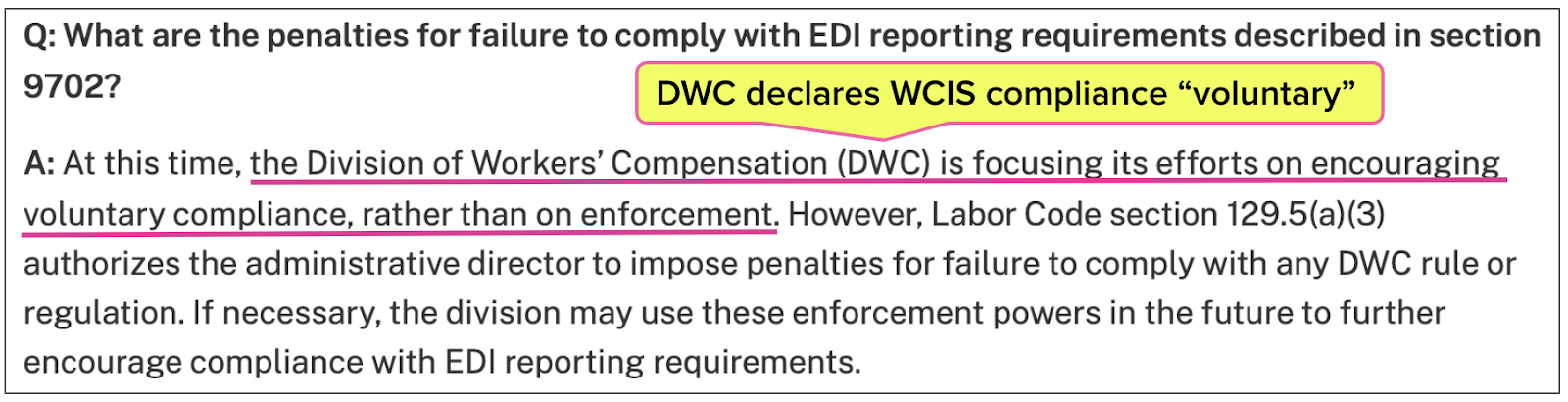

Yet despite paying lip service to the law by promulgating these regulations, the DWC publicly declines to enforce WCIS reporting requirements. On its WCIS FAQ page, the DWC declares that WCIS reporting is “voluntary” for claims administrators, in direct contravention of the law passed by legislators and the regulations created by the DWC itself.

Once again, the DWC demonstrates that it is empowered to choose which California laws it will adhere to or enforce. This selective enforcement creates profit for claims administrators, their sidekick vendors, and their private equity owners while injured workers grapple with a broken system.

CA Law: DWC Must Gather Data

California Labor Code Section 138.6, in effect since 2017, requires the DWC to establish an electronic data reporting system, through which claims administrators submit mandatory data about every injured worker’s claim, §138.6 states:

“The administrative director [of the DWC], in consultation with the Insurance Commissioner and the Workers’ Compensation Insurance Rating Bureau, shall develop a cost-efficient workers’ compensation information system, which shall be administered by the division [of workers’ compensation].”

For now, we’ll put aside the fact that the insurer-controlled and unreliable Workers’ Compensation Insurance Rating Bureau (WCIRB) has its hand in this directive. The purpose of this legally mandated data-gathering is to:

- Assist the DWC in managing workers’ comp “in an effective and efficient manner.”

- Facilitate the “evaluation of the efficiency and effectiveness of the delivery system.”

- Help measure “how adequately the system indemnifies injured workers and their dependents.”

- Collect “statistical data for research into specific aspects of the workers’ compensation program.”

Just as crucially, §138.6(d)(1) mandates that the DWC enforce claims administrator data reporting, and apply penalties if necessary (emphases ours):

“The administrative director shall assess an administrative penalty against a claims administrator for a violation of data reporting requirements adopted pursuant to this section. The administrative director shall promulgate a schedule of penalties providing for an assessment of no more than ten thousand dollars ($10,000) against a claims administrator in any single year…”

Further, §138.6(d)(5) requires the DWC to publicize the compliance rates of all claims administrators on the DWC website:

The administrative director shall publish an annual report disclosing the compliance rates of claims administrators and post the report and a list of claims administrators who are in violation of the data reporting requirements on the Internet Web site of the Division of Workers’ Compensation.

But rather than comply with this California law, which would provide essential data about how the workers’ comp system functions (and how it could potentially be improved), the DWC has taken a shocking laissez faire approach to WCIS reporting requirements—leaving stakeholders groping in the dark, dependent on unverified, self-reported insurer data from the WCRIB.

DWC: Treating CA Law as Optional

Elected officials wisely determined that data was necessary to create a better workers’ comp system. Unfortunately, the DWC apparently decided it knew better than legislators.

Despite the clear law outlined above, the DWC has declared, in full view of legislators, stakeholders, and the public, that it does not enforce WCIS reporting requirements. The DWC WCIS FAQ page (below), displays this abdication of legal duty:

Claims administrators, rejoice—there will be no administrative penalties in your future, whether you submit the required data to WCIS or not. Under the DWC, compliance with laws and regulations is “voluntary.” And presumably, the frequency of your violations will not be made public on the DWC website.

As a result, we have no idea which claims administrators actually “voluntarily” comply with the requirements for WCIS reporting. WCIS data are therefore as unreliable as WCIRB data. The accurate realities of workers’ comp, demonstrable only with complete, hard data, remain shrouded.

Worse, the DWC requires providers to submit some of the same information that claims administrators are gently asked to submit to the WCIS (using the soon-to-be-replaced Doctor’s First Report of Occupational Injury or Illness, aka Form 5021). To our knowledge, California doctors are offered no options for “voluntary” compliance.

Given the DWC’s non-enforcement of WCIS reporting requirements, is it rational to assume that WCIS data are complete, accurate, or valuable? Which claims administrators report to WCIS, and how consistently? Who, if anyone, even knows?

In the seven years since it came into effect, a law that would potentially benefit injured workers and improve the system as a whole has gone unenforced. As in so many aspects of workers’ comp, the DWC has settled into its role of actively dismissing California workers’ comp laws while passively allowing payers to do whatever they please.

Protect your practice. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Reach out to learn how we can help.

CONTACT US

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

%20(1).gif)