CA DWC Fails, Vendors Thrive, Employers Pay More

Fact: In California workers’ comp, the claims administrator is legally responsible for compliance with state laws and regulations, regardless of any outside vendor or agent the claims administrator hires.

The claims administrator (sometimes referred to as the “payer” or “carrier”) is the entity responsible for managing a worker’s injury claim. The claims administrator can be:

- An employer’s workers’ comp insurer⠀

- A self-administering employer⠀

- A Third-Party Administrator (TPA) handling claims on behalf of an insurer or employer⠀

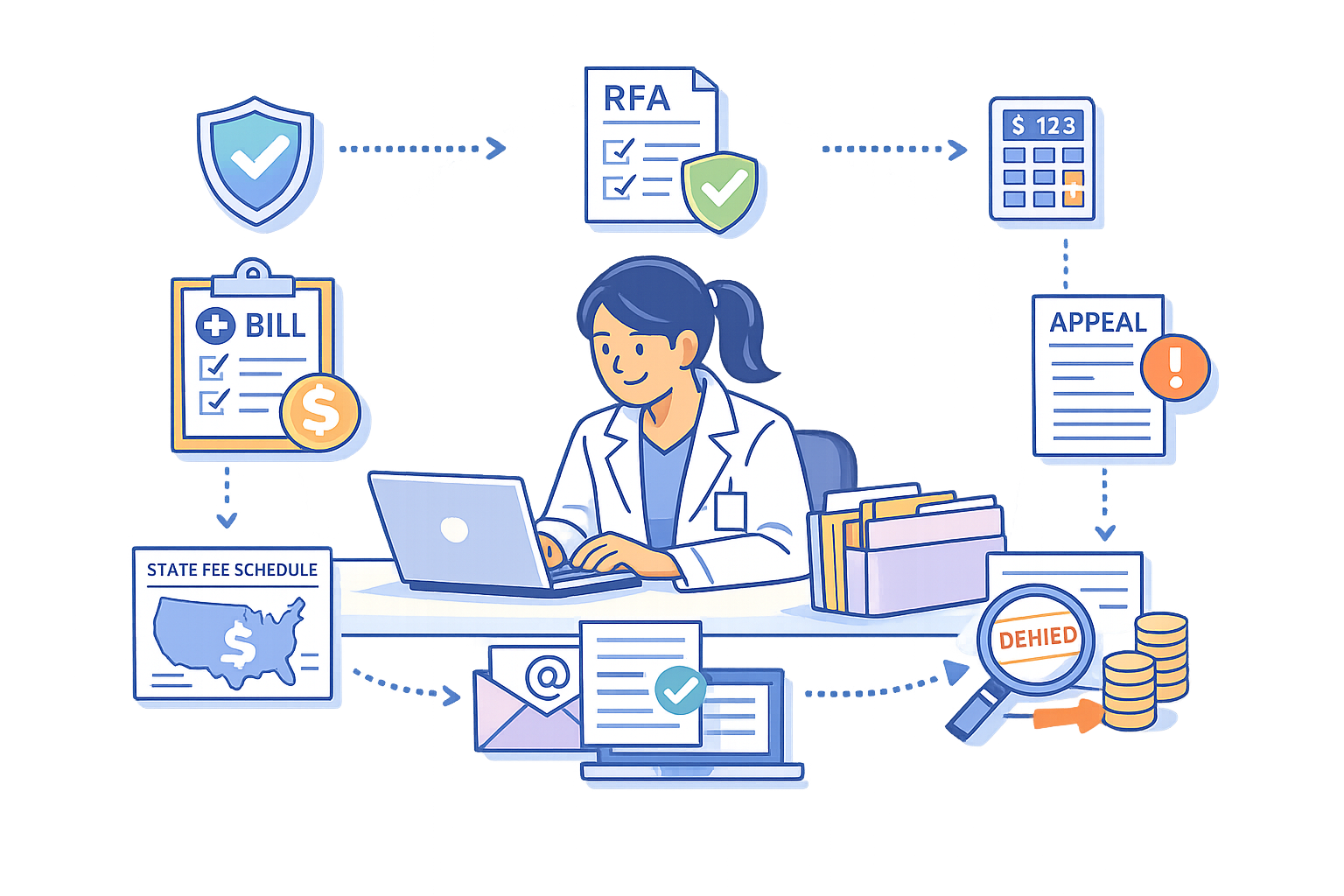

Claims administrators frequently outsource functions like bill review, accepting and responding to electronic bills (e-bills), care coordination, and more to vendors.

However, claims administrators cannot outsource accountability for legal and regulatory compliance. Likewise, insurers and employers are responsible for violations by the TPAs to which they outsource claims administration.

Despite the legal reality, claims administrators often give vendors free rein, with disastrous results for injured workers, their medical providers, and their employers.

For example, take PhysNet, a network middleperson entity. As we reported yesterday, PhysNet sent a provider a contract that suggested that if the provider signed on, PhysNet would assume responsibility for coordinating an injured worker’s care in place of the designated claims administrator, TPA Broadspire.

Even if (and it’s a big “if”) it was somehow legal for PhysNet to usurp Broadspire’s duties as claims administrator, PhysNet cannot shield Broadspire from the consequences of non-compliance.

Unfortunately, the California Division of Workers’ Compensation (CA DWC) has largely abdicated its role as the regulatory agency in charge of workers’ compensation, consistently failing to take action when vendors and TPAs flout state law and regulations.

With the CA DWC inert, claims administrators effectively have a free pass to let vendors run wild. The fallout for stakeholders is real:

- Injured workers suffer treatment delays, disruptions, and denials.

- Employers pay inflated rates for comp coverage, driven by administrative friction and rampant non-compliance.

- Providers spend time and practice resources navigating a labyrinth of vendor-related complications when seeking authorization or payment for treatment.

While the CA DWC seemingly ignores its responsibilities, stakeholders suffer as the profits of claims administrators, vendors, and private equity investors soar.

Insurers and Employers: Responsible for TPA Non-Compliance

In the context of administrative penalties for claims administrators that “knowingly” cause unreasonable delays or denials of compensation (including medical benefits) to an injured worker, CCR Section 10112.1 defines "knowingly" as:

“…acting with knowledge of the facts of the conduct at issue…An employer or insurer has knowledge of information contained in the records of its third-party administrator and of the actions of the employees of the third-party administrator performed in the scope and course of employment.”

In other words, when a TPA is the claims administrator and violates an injured workers’ rights, the TPA’s client (i.e, the insurer or employer) has also committed the violation.

Moreover, under CCR Section 10112, when a TPA is the subject of an audit resulting in administrative penalties, the TPA’s insurer or employer client is just as liable for those penalties as the TPA itself (emphases and line break ours):

“The audit subject is liable for all penalty assessments, except that if the audit subject is acting as a third-party administrator, the client of that third-party administrator which secures the payment of compensation is jointly and severally liable with the administrator…”

…a third-party administrator and its client may agree how to allocate the audit penalty expense between them.”

The bottom line is that insurers and employers have no way to escape accountability for the actions of their TPAs.

Claims Admins: Responsible for Vendors’ Billing Non-Compliance

California Code of Regulations (CCR) Section 9792.5.1 incorporates the California Division of Workers’ Compensation (CA DWC)’s Electronic Medical Billing and Payment Companion Guide, which states (emphasis ours):

“Billing agents, electronic billing agents, third party administrators, bill review companies, software vendors, data collection agents, and clearinghouses are examples of companies that may have a role in electronic billing. Entities or persons using agents are responsible for the acts or omissions of those agents executed in the performance of services for the entity or person.”

The claims administrator is responsible if a bill review vendor imposes an improper payment denial or a clearinghouse fails to accept a valid e-bill or deliver an electronic Explanation of Review.

This also means the claims administrator is responsible for any administrative penalties under Labor Code (LAB) Section 129.5 for failure to pay “the reasonable cost of medical treatment of an injured worker” or to “comply with any rule or regulation” of the CA DWC.

CA DWC Inaction Fosters Rampant Non-Compliance

The laws and regulations are clear, as is the responsibility for compliance. Unfortunately, the CA DWC’s enforcement is effectively nonexistent.

By refusing to exercise its authority in the face of vendor overreach and claims administrator violations, the CA DWC has created an environment so permissive as to arguably undermine state laws and regulations, which claims administrators and vendors disregard with near-impunity.

This is the result when a regulatory agency refuses to regulate.

Until the CA DWC steps up and enforces the law and the regulations it promulgates, claims administrators and their vendors will continue breaking the rules, dodging accountability, and letting injured workers’ care fall by the wayside (even as employers pay higher and higher rates for workers’ comp coverage).

It’s time California legislators stepped in and demanded the CA DWC do its job.

daisyBill makes workers’ comp billing fast and easy, saving time, resources, and revenue. Click below for a closer look:

BILL BETTER: DAISYBILL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)