CA Employers: Paying More for Comp Coverage as Insurers Make Bank

Yet another industry report confirms that workers’ compensation is stupendously profitable for insurers, outperforming the rest of the insurance industry even as rates decrease in most of the nation.

…so why are California employers paying 8.7% more for workers’ comp coverage as of September 2025?

National insurers are hauling in cash as comp contributes more profit than any other major line of insurance. Yet California Insurance Commissioner Ricardo Lara instituted a rate hike for CA employers at the behest of the insurer-funded Workers’ Compensation Insurance Rating Bureau (WCIRB).

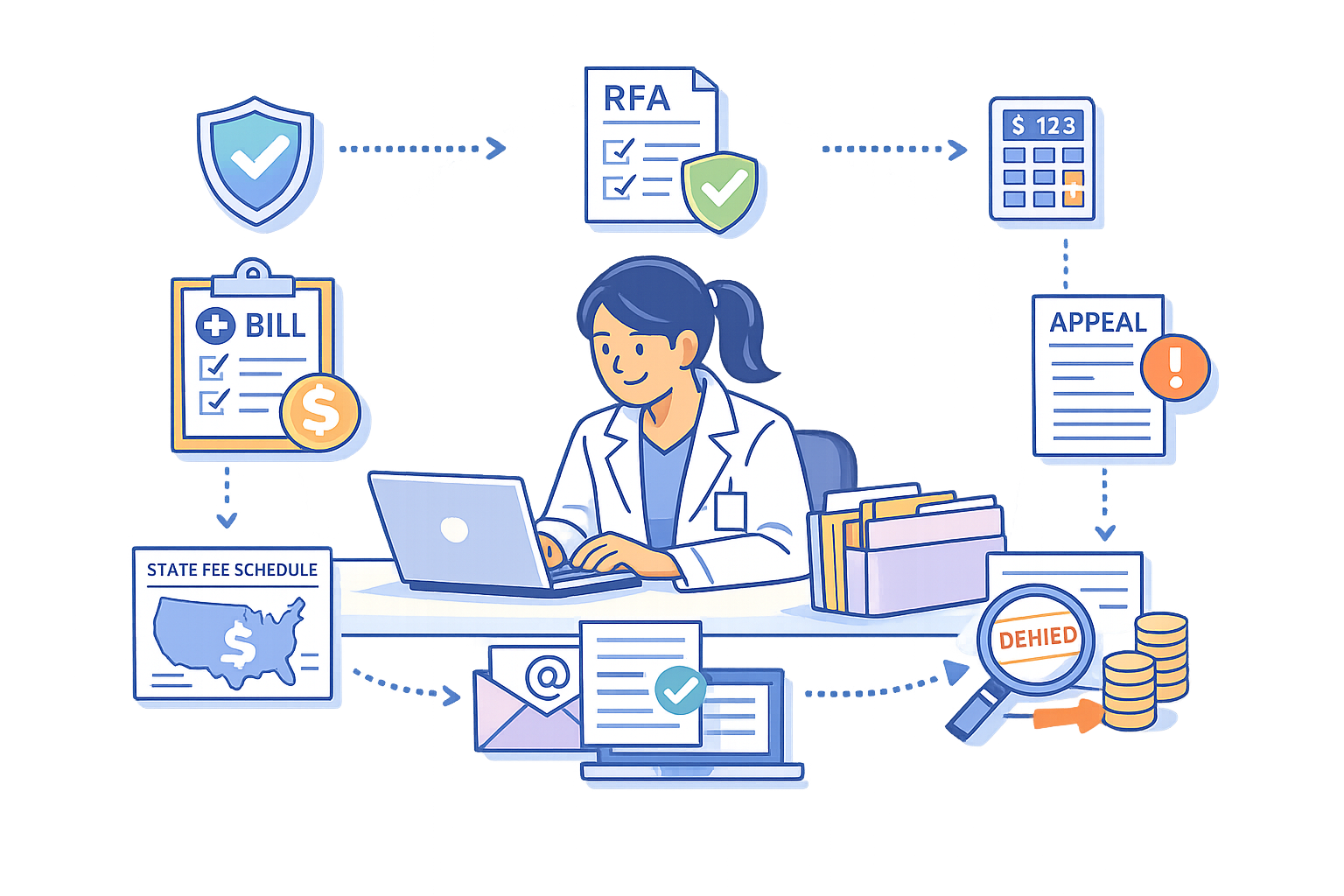

Meanwhile, California’s state workers’ comp fee schedule pays providers some of the lowest reimbursement rates in the nation.

California employers, something isn’t adding up. Workers’ comp insurers are using employers (and the doctors who treat injured workers) to generate exorbitant profits.

It’s time for employers to stop letting insurers write the narrative. Instead, employers must demand data transparency and insist that Commissioner Lara stop basing comp rates on insurer-led WCIRB fiction.

Workers’ Comp: A Gold Mine for Insurers

AM Best’s Market Segment Report touting workers’ comp’s “Strong Profits, Despite Pricing Cuts” comes on the heels of a 2025 State of the Line report from the National Council on Compensation Insurance (NCCI) reporting wild profit and billions in excess reserves for workers’ comp insurers.

Risk & Insurance Magazine quotes AM Best senior analyst Christopher Graham summing it up (emphases ours):

“Workers’ compensation is the key line of business driving the profitability of the whole property/casualty industry…”

Both Risk & Insurance and Business Insurance cite insurers’ deep reserves and improved workplace safety as reasons for comp’s sustained profitability, with AM Best pegging the line’s “combined ratio” at 88.8% (any combined ratio under 100% represents profit; the lower the combined ratio, the more money insurers make).

Industry analysts agree that workers’ comp’s profitability comes despite downward pressure on rates nationwide, with Risk & Insurance noting (emphases ours):

“This stability comes despite quarterly pricing decreases for workers’ compensation coverage that have accelerated to their steepest levels in five years, with first quarter 2025 showing the largest cuts.”

You read that right: workers’ comp coverage is historically cheap…unless you’re a California employer.

California: Rate Hikes Defy National Trend

As rate cuts typify the trend in comp coverage nationwide, the WCIRB and Commissioner Lara pushed California into a 8.7% increase.

Why?

California workers' comp is uniquely expensive, inefficient, and plagued by costly administrative friction. However, that friction is mainly due to factors under insurers’ control, including:

- Medical Provider Networks (MPNs), by which insurers restrict workers to physicians who are willing to accept reimbursement discounts

- Utilization Review (UR), by which insurers expend vast resources to delay and deny care, despite already restricting injured workers to approved MPN physicians

- Preferred Provider Organizations (PPOs), which providers must join as a condition of MPN membership, resulting in PPO reimbursement discounts

- Bill review

- Attorney fees

- Medical-Legal disputes

As for the medical costs of actually treating injured workers, a Workers’ Compensation Research Institute report found California’s fee schedule rates near the bottom nationally.

In other words, the bloat appears to be more on the insurer's administrative side than on the treatment side.

Insurers, their Third-Party Administrators, assorted vendors, and the private equity firms funding the whole mess are largely responsible for making every claim needlessly, wastefully expensive, to the detriment of workers’ actual medical care. Then, insurers cry poor and demand that employers make up the in-state shortfall while profits pour in from workers’ comp nationally.

If you’re running a business in California, your premiums are fueling the dysfunction as your employees struggle to access treatment.

It’s time to start asking hard questions and demanding satisfactory answers (and data).

daisyBill makes workers’ comp billing easy, so your practice can say “yes” to treating injured workers. Click below for a closer look:

SEE THE DAISY DIFFERENCE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)