Enlyte’s MPI: A Smokescreen to Protect Private Equity Profits

.gif)

Last week, Enlyte—the parent company of Coventry, Mitchell, and Genex, all backed by private equity firm Stone Point Capital—released its latest report on its “Medical Price Index” (MPI), which claims to track medical cost trends in workers’ compensation.

But Enlyte doesn’t track what matters.

“We analyzed our medical bill review professional services charge data for trends…”

— Enlyte MPI, Q1 2025 (emphasis added)

The key word here is “charge”—not reimbursement or cost to the employer. Charges are meaningless in any study of workers’ comp payment trends. This might be laughable if it stayed in Enlyte’s marketing department—but it didn’t. Industry outlets uncritically echo Enlyte’s distorted metrics:

“Texas and California saw the biggest year over year increases in the workers compensation component of the overall index.”

— Workers’ Comp Advisor, parroting Enlyte’s report

But that “increase” is in charges—not the actual costs for payers, and definitely not the pitiful amounts providers receive. Enlyte’s MPI is not a cost analysis—it’s a diversion designed to keep stakeholders from asking the real question:

How much profit is Enlyte—and its private equity owners—siphoning from the workers’ comp system?

What Enlyte Leaves Out

Enlyte operates bill review systems, among many other payer services. It knows precisely how much claims administrators reimburse providers, so why not publish that data?

One possible reason is that if Enlyte reported actual reimbursements paid to providers, Enlyte would expose the brutal reality of their business model:

- PPO discounts slash reimbursements to rates below fee schedule

- Providers are underpaid—often below Medicare rates

- Private equity is profiting off the difference

In other words, Enlyte carefully constructs its MPI to keep employers and policymakers focused on “charges” while its private equity owners quietly extract profit from every discounted payment.

This isn’t analysis. It’s a distortion of reality.

Example: Coventry/Enlyte Slashes Reimbursement to 60% of Medicare

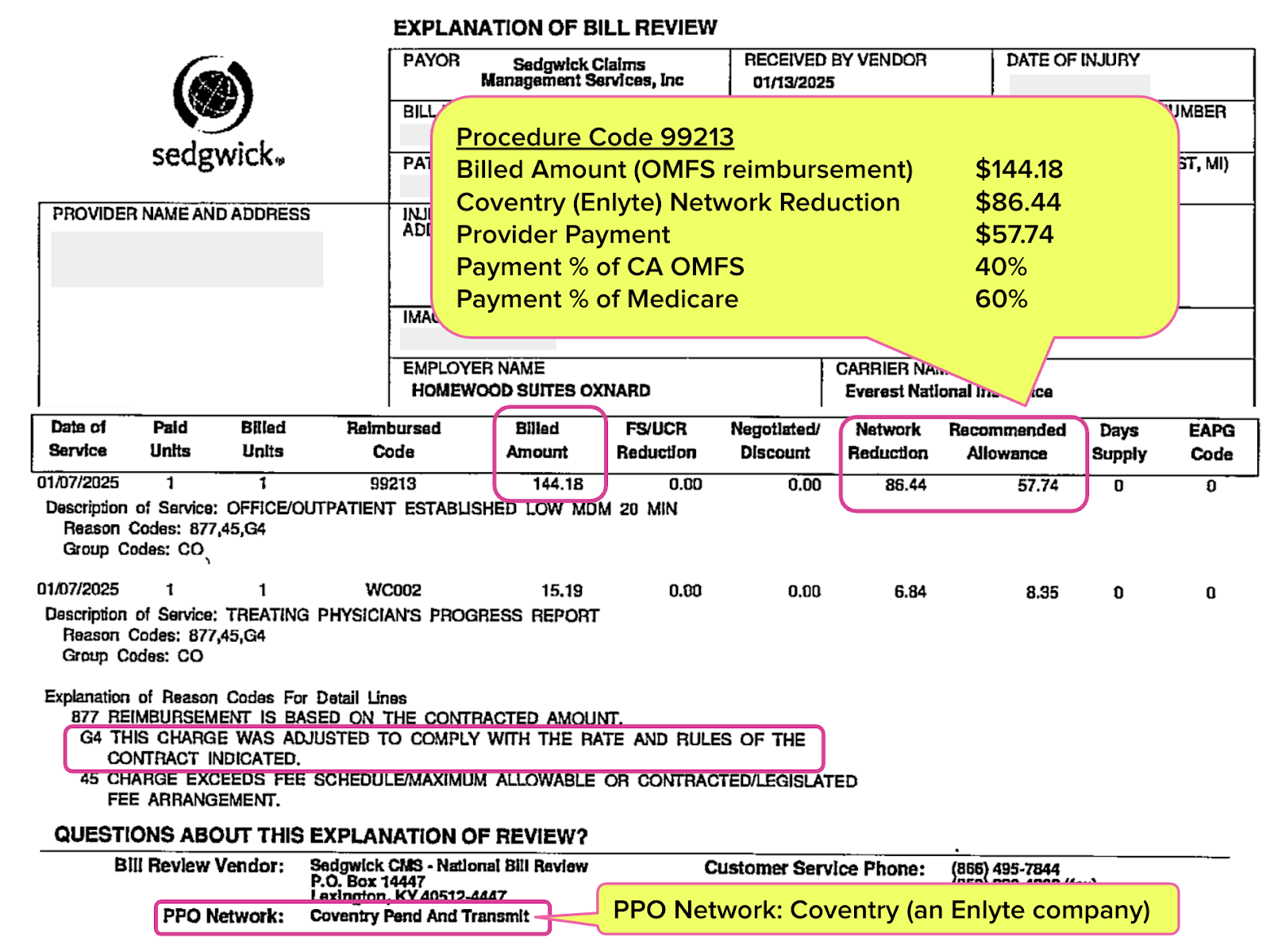

Here’s a real-world example from California. Below is a Sedgwick Explanation of Review (EOR) where the provider charged the amount allowed under the state’s Official Medical Fee Schedule (OMFS):

- “Billed Amount” (aka the charge amount): $144.18

- Coventry PPO “Network Reduction”: –$86.44

- Amount paid to provider: $57.74

Thanks to a Coventry PPO discount, Sedgwick paid this provider only 40% of the OMFS rate, equal to just 60% of the Medicare rate.

The Enlyte/Coventry cut ($86.44) was 50% higher than the amount the doctor received ($57.74)—and Coventry did not provide a second of patient care. Yet, presumably, Enlyte will plug the original charge of $144.18 into its MPI trend line—as if that number reflects what providers are earning. It doesn’t, but it does make a great distraction from the ugly truth.

Enlyte’s MPI: Propaganda Disguised as Data

The Enlyte MPI isn’t analysis—it’s PR. It paints a misleading picture of rising medical costs to justify “cost containment” practices that enrich private equity while gutting reimbursement for doctors who treat injured workers.

So who loses?

- Providers who are forced to accept deep discounts

- Injured workers who struggle to find doctors willing to treat them

- Employers that pay high premiums while private equity firms profit from reduced provider reimbursement

If you want to understand the fundamental economics of workers’ comp, follow the money—straight into private equity pockets.

Get a clear picture of how PPO and other network discounts are draining your revenue with daisyBill. Take a closer look by clicking below.

CHECK OUT DAISYBILL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)

Anyone working in or associated with, the delivery of medical care in California's work comp system is all too familiar with how the system actually works. Today, Daisybill hits one nail squarely on its head. There is however another "nail" or component of this "medical delivery system" that remains hidden and yet is more insidious and outright illegal. Requests for care from injured workers often include providing them with a "panel" or choice of providers based on location, especially when it comes to "ancillary:" services such as MRIs and physical therapy. These panels are supposed to be presented based solely upon convenient access for the injured worker. However, the named providers are often, if not always, based on the provider's discounted reimbursement rate when a group of providers are within relatively the same access standard. As DB describes in its comment, the spread between billed charge/fee schedule and the actual payment goes directly into the pocket of the network (in this case owned by Enlyte). Thus, Enlyte often directly benefits by paneling providers with the lowest net payment....thus making referrals for money, which is illegal in California and perhaps other jurisdictions in which it provides claims services.

Thank you Daisybill for keeping us abreast of the truth and reality of what these networks, ie, MPI's are doing to the Doctors that serve employers and their injured workers. If it weren't for Daisybill, a lot of this information would be difficult to research and track and go after the reimbursements due.