Sedgwick’s Shell Game: From Coventry to CareWorks, the Chicanery Continues

Sedgwick Claims Management Services, Inc., a Third-Party Administrator (TPA), appears to be throwing any available spaghetti at the wall to continue funneling employer dollars into its private-equity owners’ bank accounts.

As daisyNews reported, Sedgwick admitted that it improperly discounted reimbursements owed to an orthopedic group for treating injured workers. Sedgwick acknowledged applying invalid Coventry and Multiplan Preferred Provider Organization (PPO) reductions to bills the practice sent to Sedgwick.

However, instead of paying the practice the over $570,000 owed and correcting its course, the TPA is using a different PPO contract to shortchange the orthopedists. Sedgwick now cites a CareWorks discount to stiff these providers.

Spoiler alert: the CareWorks discount doesn’t hold up, either.

Unless something changes, the status quo will remain in California's workers’ comp system. And California employer dollars will fund private equity profits rather than injured workers’ care.

Sedgwick’s CareWorks PPO Reduction

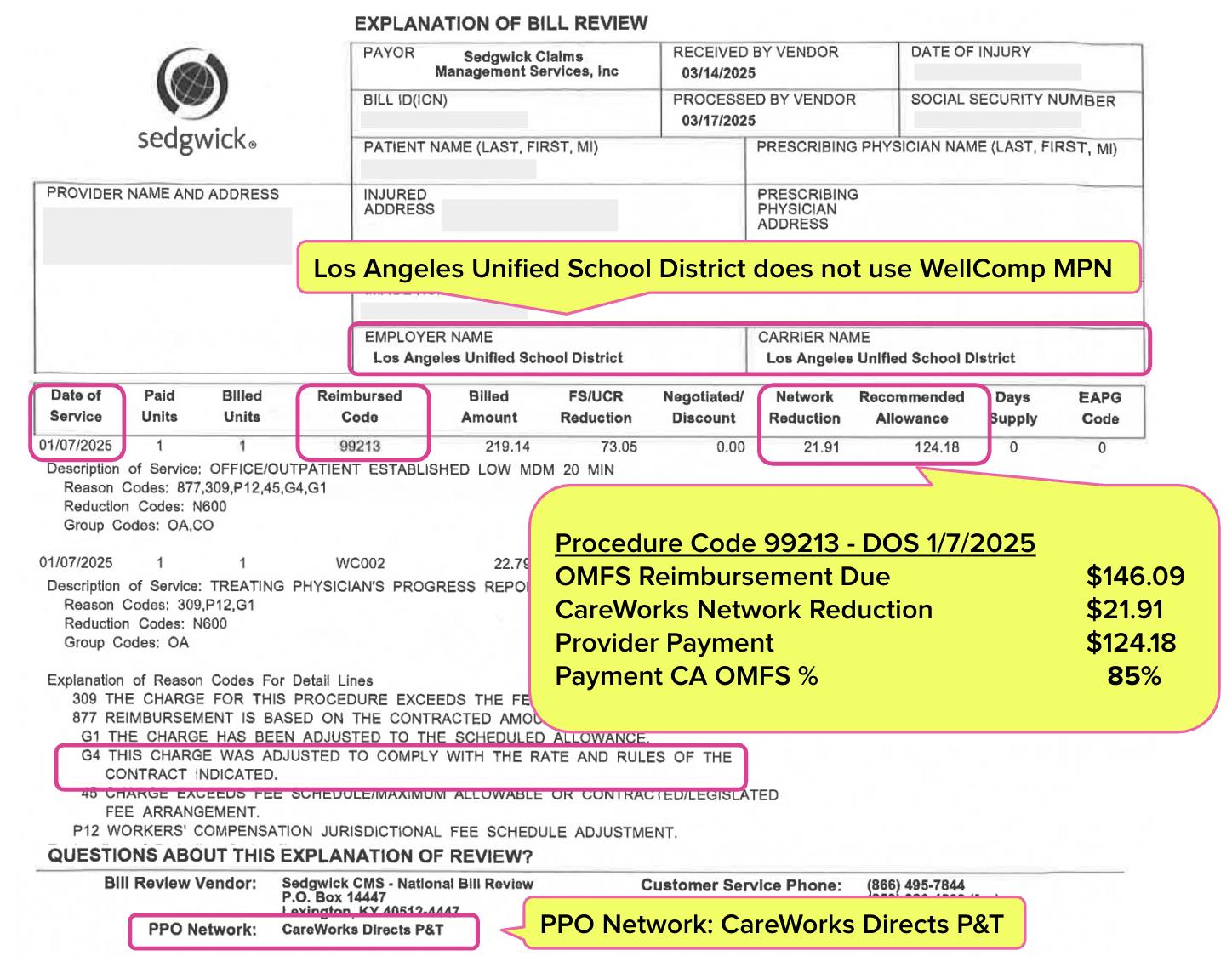

After racking up a half-million-dollar debt (which remains mostly unpaid), Sedgwick’s next move was to slash the practice’s reimbursement to just 85% of the Official Medical Fee Schedule (OMFS), citing a contract based on a CareWorks PPO agreement.

See an example Explanation of Review (below) Sedgwick sent on behalf of the Los Angeles Unified School District, which cites a CareWorks PPO discount to reduce the reimbursement owed to the doctor to just 85% of the OMFS rate.

Sedgwick Sent a WellComp Contract (From 2005)

Once again, the California Orthopaedic Association (COA) stepped in on the practice’s behalf. COA exerted its influence to demand documentation—a signed contract between the orthopedic practice and CareWorks that would legally authorize Sedgwick to apply a 15% discount to the fees owed to the orthopedic practice.

Predictably, Sedgwick did not produce a CareWorks contract.

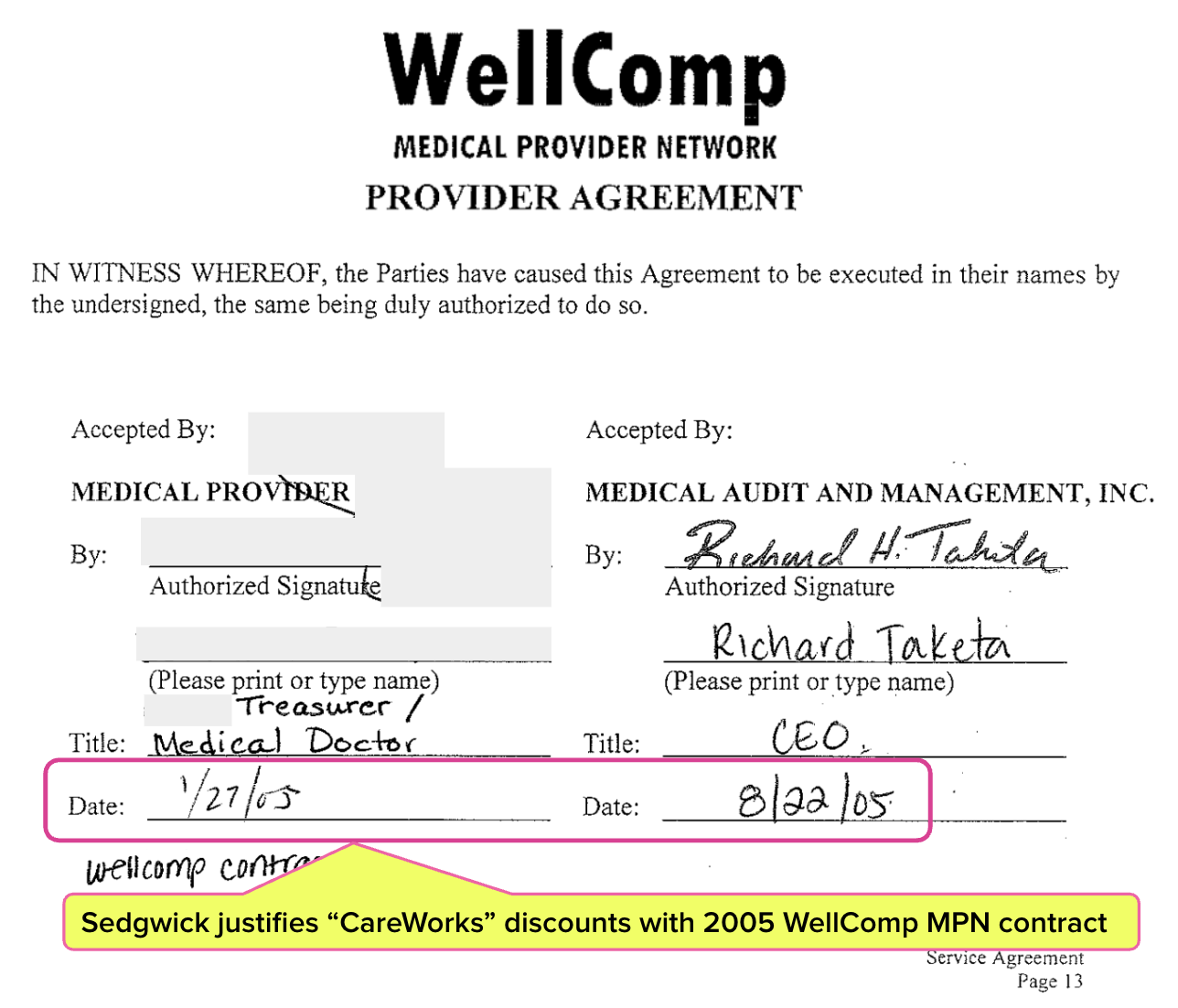

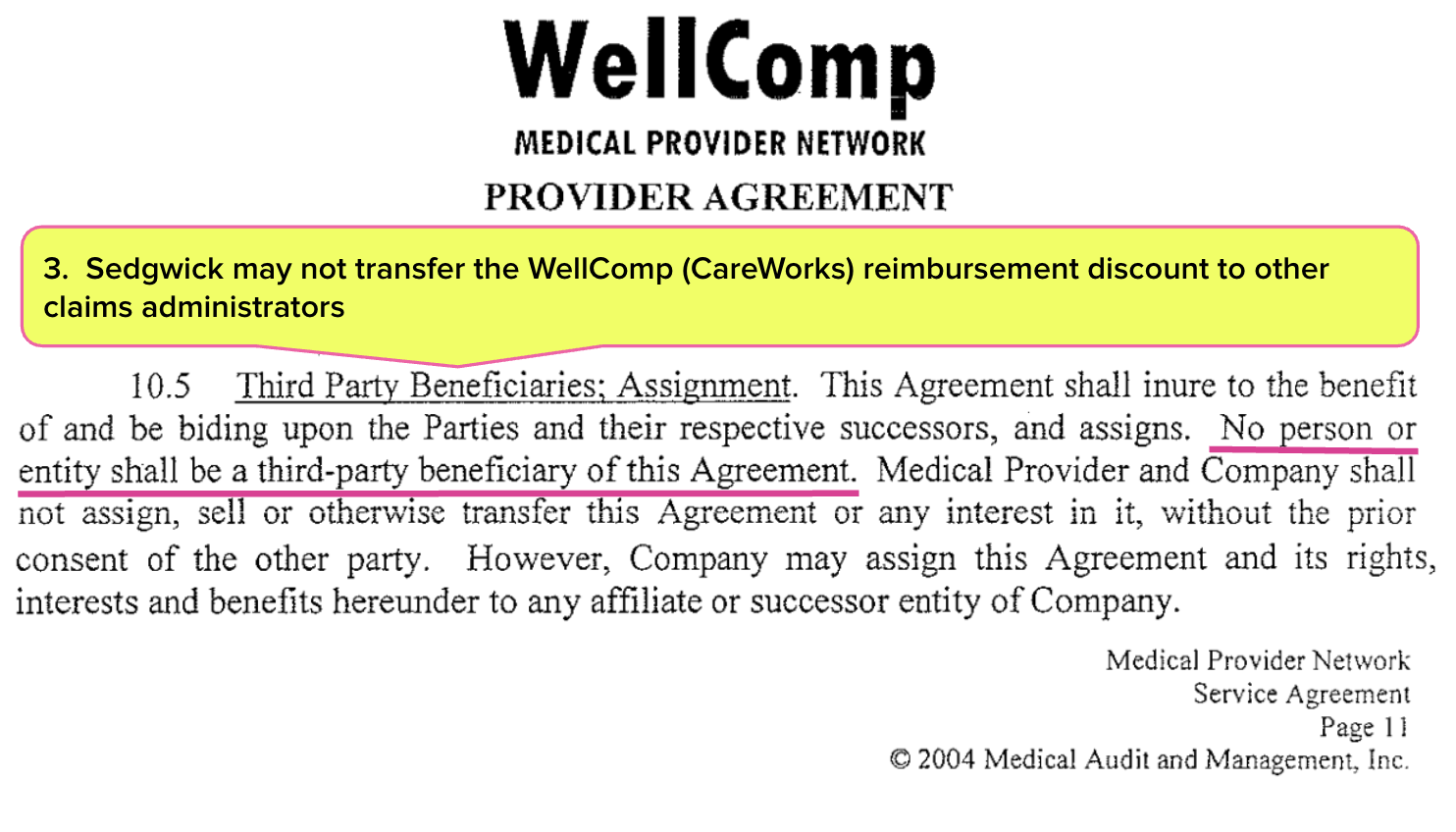

Instead of delivering a valid CareWorks PPO agreement, Sedgwick sent the practice a WellComp MPN contract signed in 2005. The contract (below) is two decades old and predates multiple WellComp corporate acquisitions.

WellComp formerly operated as a York Risk Services Group subsidiary, offering MPN services. In 2019, Sedgwick acquired York, including legacy WellComp contracts signed under its prior ownership (e.g., contracts with providers from 2005, when WellComp was still independent or operating under other entities).

We’ll spare readers the trip down the rabbit hole necessary to explain that this 2005 contract fails to adhere to California Labor Code Section 4609—because there are even bigger problems with Sedgwick’s absurd claim that the contract justifies its reimbursement reductions.

And There Are (Much) Bigger Problems

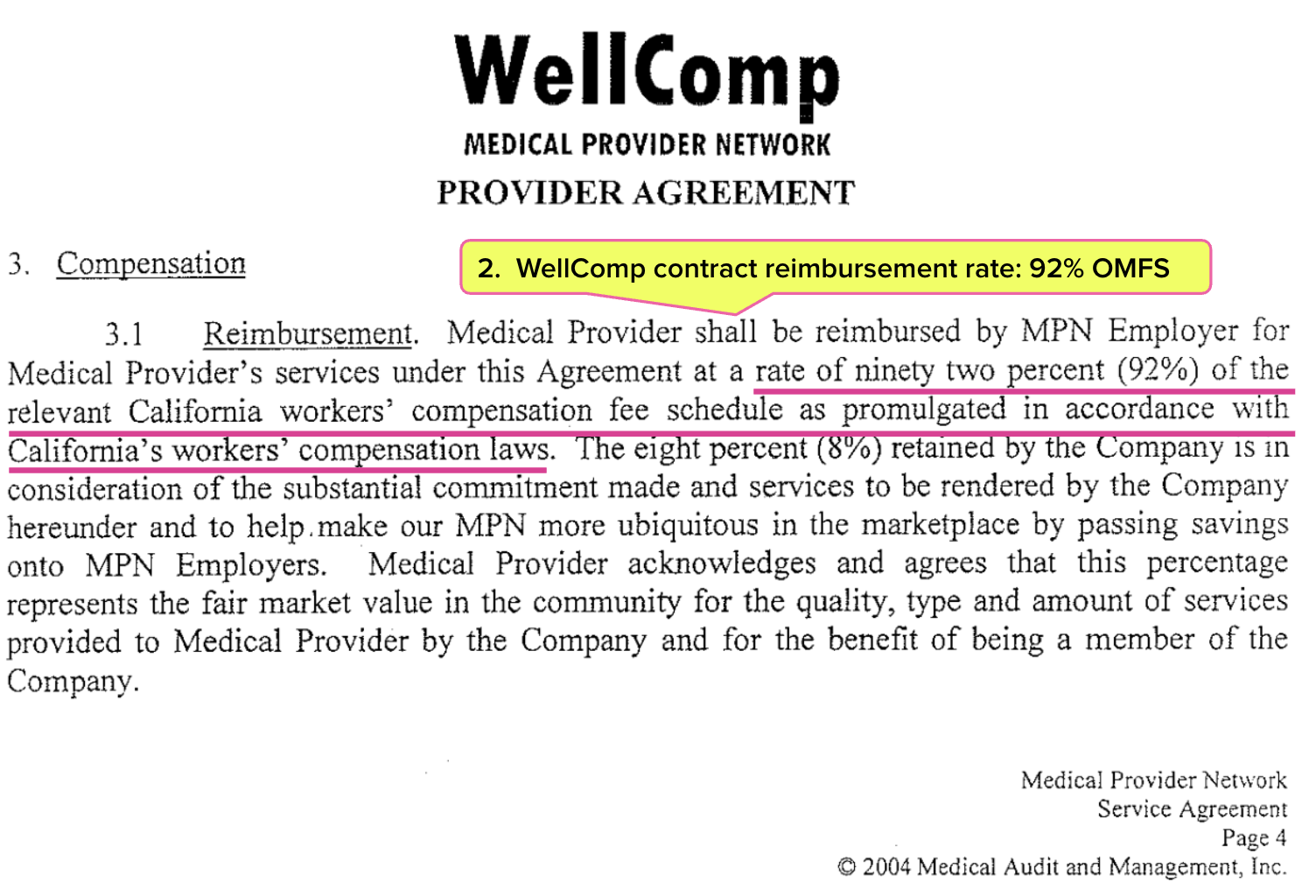

Even if the 2005 WellComp MPN contract were valid—and that’s a generous “if”—Sedgwick would still be violating its terms and incorrectly reducing the orthopedists’ reimbursements.

-

Sedgwick took a 15% discount from the orthopedic surgeons, citing the supposed CareWorks contract. As the contract shows below, the WellComp agreement permits only an 8% discount.

-

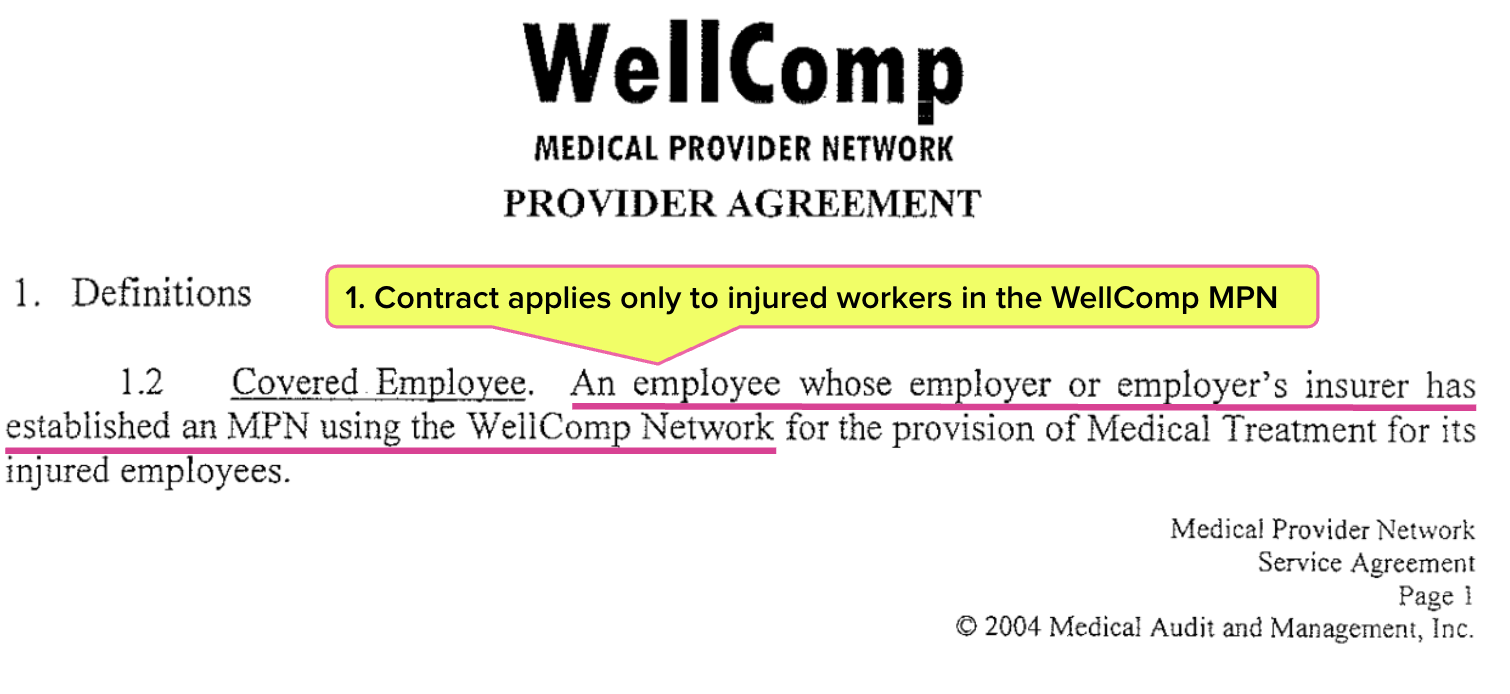

Sedgwick discounts reimbursements for injured workers even when they are not restricted to the WellComp MPN. As the contract shows below, the WellComp agreement permits reimbursement reductions only when the injured worker is treated through the WellComp MPN.

- Sedgwick has allowed many other claims administrators to cite CareWorks as justification for reducing providers’ reimbursements. The contract forbids Sedgwick from assigning, selling, or transferring this agreement to a non-affiliate or non-successor entity.

At the end of this faulty reimbursement discount funnel sit private equity firms The Carlyle Group and Altas Partners, which are invested heavily in Sedgwick—and ultimately benefit from every employer dollar not paid to a provider.

Same Invalid Discounts, New Label

There’s a clear pattern here: When Sedgwick is called out for inappropriately applying a PPO discount contract, it simply pivots to another—regardless of legality, applicability, or basic transparency.

- First it was Coventry.

- Then Multiplan.

- Now it’s CareWorks (backed by a decades-old WellComp MPN contract).

The alleged agreements change, but the whack-a-mole playbook stays the same: Sedgwick misapplies PPO and MPN discounts to avoid paying providers in full, depriving medical practices of lawfully earned revenue.

Who Really Pays the Price?

While Sedgwick and its private equity investors benefit, the real victims of this contract chicanery are California employers and injured workers.

-

Employers pay premiums and claims costs, expecting those dollars to fund treatment. Instead, some of that money is diverted through unjustified reimbursement cuts—reductions that don’t lower employer costs but inflate private equity profits.

- Injured workers suffer the consequences when providers—exhausted by interminable billing disputes—stop accepting workers’ comp patients altogether. And who can blame them? Giving up is a reasonable reaction when providers can’t compel correct payment and have no feasible legal recourse.

Meanwhile, California’s Division of Workers’ Compensation (CA DWC), which (in theory) regulates this system, remains silent. The state takes no meaningful action to stop TPAs from engaging in these tactics, protect employers' workers’ comp dollars, or injured workers’ access to care.

Accountability Starts at the Top

Until regulators act—or until Governor Gavin Newsom decides to hold TPAs accountable—Sedgwick and other claims administrators will continue to shift justifications, fail to remit full payment, and funnel employer dollars from frontline care into financial markets.

In this case, the orthopedic practice is just one of many victims. This isn’t just a failure of Sedgwick or the CA DWC—it’s a systemic failure of leadership.

Under the Newsom administration, California’s workers’ compensation system has allowed TPAs to operate with impunity. Providers cannot enforce correct payment, injured workers lose access to care, and employers unknowingly foot the bill for a system that siphons treatment dollars to private equity.

Governor Newsom has the power to fix this.

He appoints the leaders and oversees the agencies responsible for regulating California’s workers’ compensation system. But instead of protecting the system, this administration has allowed private equity profiteering to flourish—at the expense of injured workers, doctors, and the employers who fund the entire system.

How much is your practice losing to dubious discounts? daisyBill keeps track of payments so you’re never in the dark. See how it works by clicking below.

BILL BETTER

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)

.gif)

Very true. Careworks does the same and tries to use an old Orchid tpa contract to pay us vs. the one we have with better rates through Careworks directly

...and good luck trying to cancel the contracts. I have been trying to cancel a 25% PPO reduction Multiplan contract with no success. Very frustrating.