Liberty Mutual, Gallagher Bassett, Chubb Scoff at CA IBR Rules

It’s still happening: claims administrators including Liberty Mutual, Gallagher Bassett, and Chubb are ignoring the rules regarding Independent Bill Review (IBR), brazenly refusing to timely remit what they owe.

When providers take a workers’ comp billing dispute to the state, they aren’t guaranteed to win. But when they do, providers should be able to expect the claims administrator to abide by the state’s decision. Somehow, certain claims administrators feel comfortable declining to comply — withholding the disputed amounts, the IBR filing fee the provider paid, or both.

Lack of IBR Decision Enforcement

As we decried in a recent blog post, some claims administrators are in no hurry to comply with the decisions of Maximus, the company tasked by California’s Division of Workers’ Compensation (DWC) with resolving workers’ comp billing and payment disputes.

As claims administrators continue to play scofflaw, we can only expect this noncompliance to continue.

Following a failed second review appeal, providers must escalate a payment dispute to IBR, enlisting the state (as represented by Maximus) to either uphold or overturn the claims administrator’s Explanation of Review (EOR). When providers request IBR, they must remit a $195 IBR filing fee, to be refunded by the claims administrator if the provider prevails.

When Maximus finds in favor of the provider, California Labor Code 4603.2.(2)(A) requires the claims administrator to remit both the disputed amount and the $195 IBR filing fee within 45 days of the decision.

Despite this, we find ourselves repeatedly having to chase down claims administrators on behalf of our provider clients. For example:

Liberty Mutual

On May 31 of this year, Maximus overturned a Liberty Mutual EOR, ordering Liberty Mutual to remit an additional $177.98, as well as the $195 IBR filing fee, by July 15. Liberty Mutual reimbursed the provider for only the IBR filing fee.

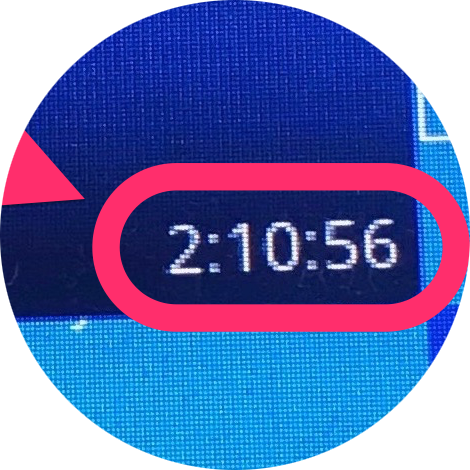

After leaving four voicemails with Liberty Mutual, our Compliance Team finally got a response: a voicemail instructing DaisyBill to contact Liberty Mutual Bill Review. We did so, which resulted in a galling waste of our Compliance Team’s time — a two hour, ten minute hold.

Liberty Mutual Bill Review’s representative could only assure us that the payment is being processed. But as of this writing, no such payment has materialized.

Gallagher Bassett

On June 26 of this year, Maximus overturned a Gallagher Bassett EOR, ordering GB to remit an additional $156.56, as well as the $195 IBR filing fee, by August 10. The due date came and went, with no payment sent to the provider.

Once again, our Compliance Team got on the phone. The Gallagher Bassett claims call center provided a stunning example of the kind of inefficiency and incompetence that makes workers’ comp so difficult for providers and their agents — refusing at first to provide contact information for the adjuster, despite the adjuster being the only person capable of resolving the issue.

When informed that the adjuster’s contact information was necessary to resolve an IBR issue, the call center representative’s reply said it all: “What is IBR?”

Following further pointless, frustrating wrangling with the hopelessly uninformed representative (and several minutes on hold), our Compliance Team obtained the adjuster’s contact information from the representative’s supervisor. Having experienced further stonewalling by this particular adjuster in a previous dispute, we decided to contact the adjuster’s supervisor directly.

The provider finally received reimbursement on August 22 — a full 12 days after it was due, and only after an absurd degree of administrative hoop-jumping.

Chubb

On July 12 of this year, Maximus overturned a Chubb EOR, ordering Chubb to remit an additional $331.80, as well as the $195 IBR filing fee, by August 26. On August 27, our Compliance Team left what we can only dare to hope is the only voicemail necessary to prod Chubb into compliance.

As of this writing, the provider has received no payment.

We are more than happy to make whatever demands are necessary — as many times as necessary — to ensure our providers obtain correct reimbursement. But not all providers have billing agents. More to the point, no provider should have to rely on a billing agent, their own staff, or anyone else to put so much time and effort into simply recovering just compensation.

The behavior of these claims administrators isn’t just an affront to providers and an inconvenience to billing agents; increasingly, this non-compliance by claims administrators seems like a dare to state authorities to enforce its own decisions.

For everyone’s sake, we hope California accepts.

Workers’ comp can work for providers. daisyBill software, data, and expertise makes billing easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.