Provider Alert: MTI Discount "Contract"

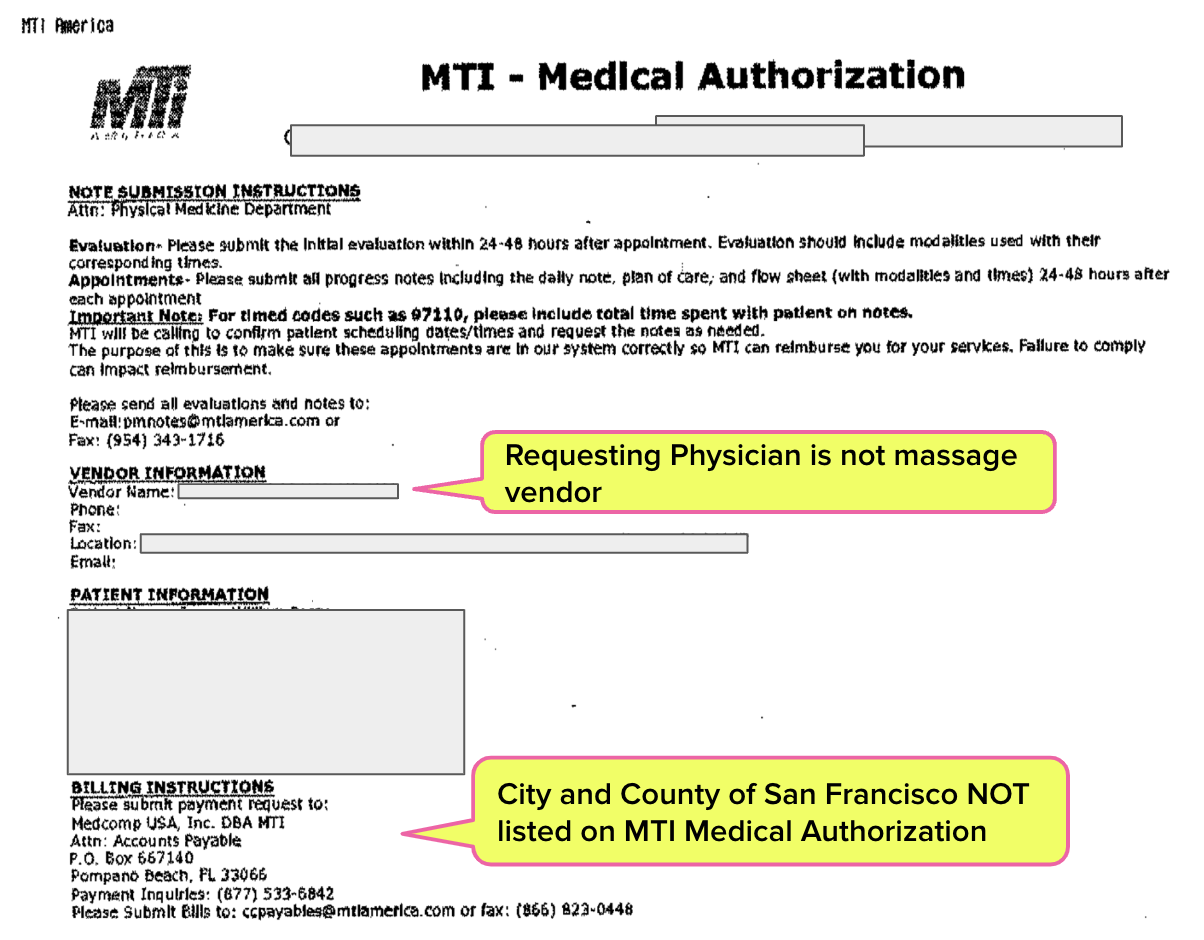

A daisyBill provider client received a disturbing document purporting to authorize treatment for an injured employee of City and County of San Francisco (CCSF). MTI America, a self-described “integrated network health solutions” company, sent the document, which:

- Failed to list the claims administrator responsible for the treatment authorization (CCSF), and

- Imposed discounted reimbursement rates for authorized services, and

- Asserted that any bills received later than 45 days after treatment would be denied

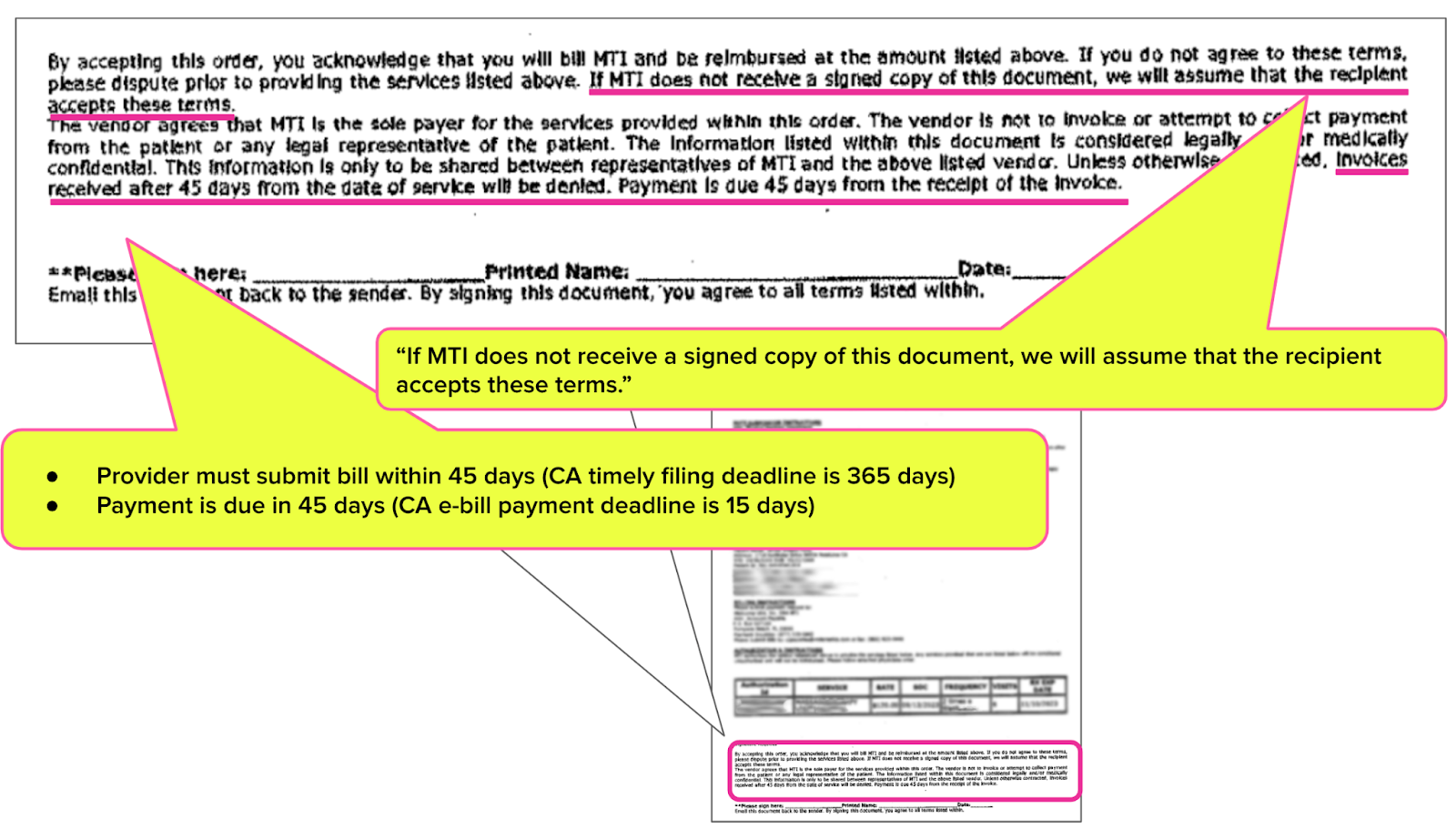

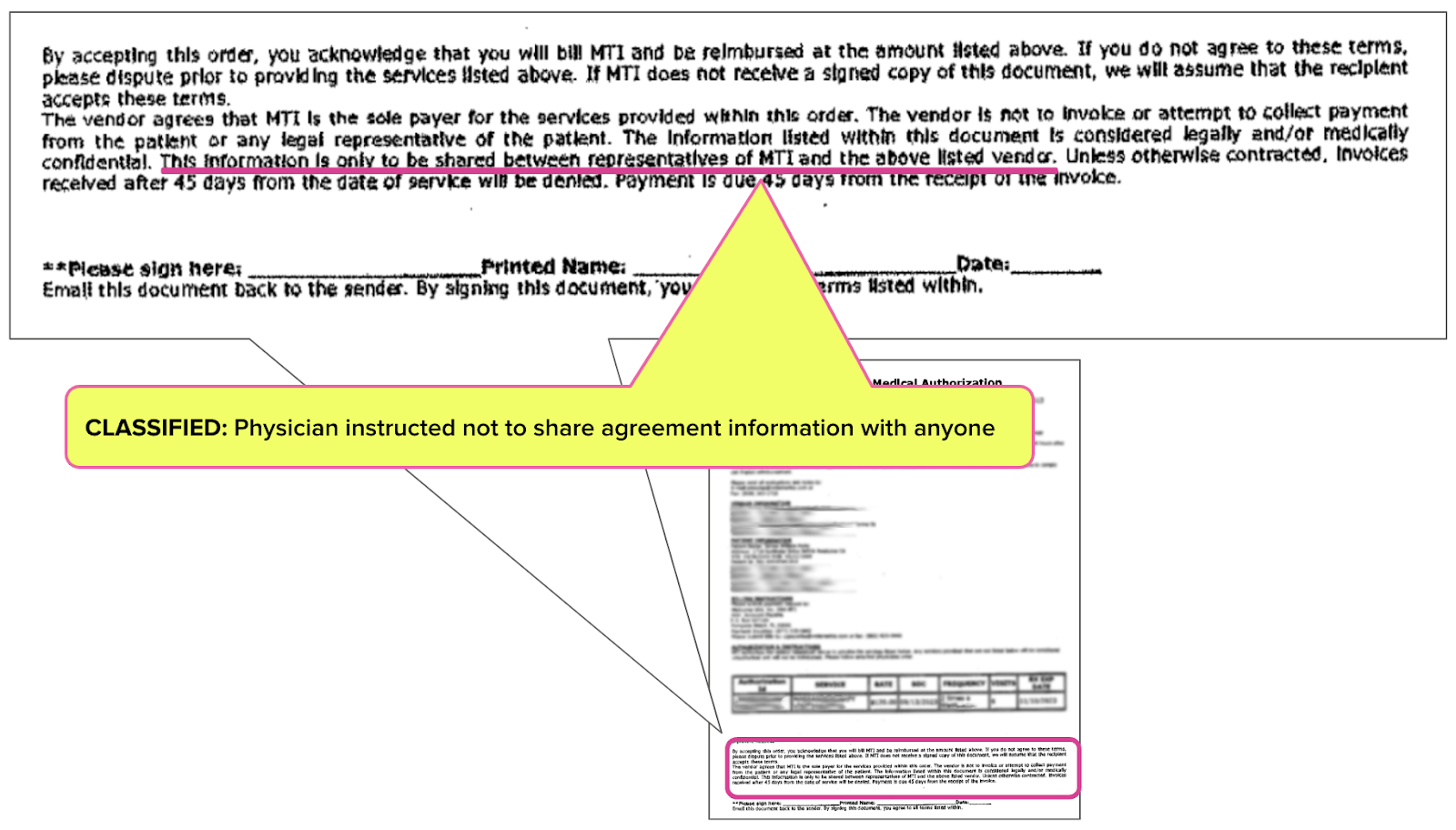

Worse, the document included a statement declaring that the provider is locked into MTI’s payment terms whether or not the provider signs the agreement.

You read that right — MTI asserts that the provider agrees to its payment terms by simply receiving the faxed authorization document and rendering the services listed.

In many states, no provider can treat an injured worker in the workers’ compensation system until obtaining prior authorization for the proposed treatment. MTI’s document arguably contorts this prior authorization process by implying that authorization depends on the provider accepting onerous payment terms — a potentially dark new twist in prior authorization and injured workers’ access to treatment.

We do not know whether CCSF is aware that MTI is sending these questionable, conditional authorization documents on CCSF’s behalf. However, all physicians should carefully review the following information and be on high alert for similar documents.

Spoiler: In this case, the requesting physician ignored the faxed agreement, forwarded the authorization to a provider who rendered the services, and sent the bills to CCSF — which paid for the services at fee schedule rates.

MTI’s Mysterious “Authorization”

Typically, CCSF is an excellent example of a claims administrator that adheres to its state’s workers’ comp laws and regulations. Our physician clients consistently report that CCSF is fair and reasonable, which has also been daisyBill’s experience with this public employer in California.

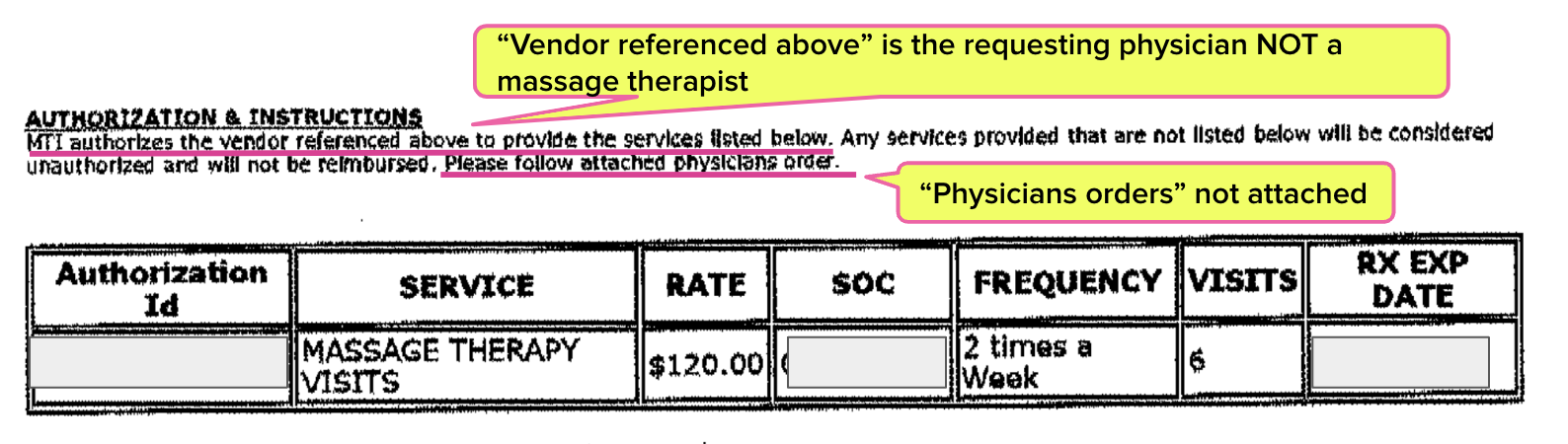

For an injured CCSF worker, the physician received a one-page “MTI - Medical Authorization” document approving six massage therapy sessions at a flat rate below the amount allowed by the California Official Medical Fee Schedule (OMFS).

The MTI authorization failed to list CCSF as the claims administrator, so there is no way to determine if this claims administrator knows about MTI’s shenanigans. In fact, we wonder whether MTI is empowered to authorize or deny treatment for CCSF employees.

MTI’s “Damned If You Do” Contract

MTI’s authorization demands that someone (we are unclear who exactly) sign the authorization document. However, the authorization also asserts that if no one signs the document and the services are provided to the injured worker, MTI discounted, onerous payment terms apply.

In a mind-bending disclaimer, MTI states the following [emphasis added]:

“If you do not agree to these terms, please dispute prior to providing the services listed above. If MTI does not receive a signed copy of this document, we will assume that the recipient accepts these terms.”

In addition to discounted reimbursement rates, the MTI authorization stipulates:

- “Invoices received after 45 days from the date of service will be denied” — even though, in this instance, California Labor Code Section 4603.2 gives providers a whole year to submit bills for injured worker treatment.

- MTI is allowed 45 days to pay the bill – even though California Labor Code Section 4603.4 demands payment in 15 working days if a provider chooses to send an e-bill

Finally, MTI also insists that the document and its terms be hush-hush, instructing that only MTI representatives and the “above listed vendor” be privy to this strange, secretive agreement.

Usually, we’d look at a contract like this and ask ourselves why any provider would sign it.

But in this case, it’s much worse. MTI converts prior authorization into a payment trap by including contractual ambush language declaring the payment terms take effect with the receipt of an unsolicited, faxed document.

Providers, be careful. There’s no limit to the creative thinking that discount vendors apply to draining revenue from practices that treat injured workers.

Edited July 10, 2024 for clarity.

daisyBill makes workers’ comp billing easier, faster, and less costly. Get in touch with us below to see your options and schedule a free demo.

LET’S TALK

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.