Prime Health PPO: 2024 Medicare Cuts May Decrease Workers' Comp Reimbursement

The Centers for Medicare and Medicaid Services (CMS) announced it will cut reimbursement rates for physician services in 2024 by 3.4%.

This Medicare reimbursement reduction is terrible news for many workers’ comp doctors throughout the United States — largely thanks to Preferred Provider Organizations (PPOs) like Prime Health Services (PHS).

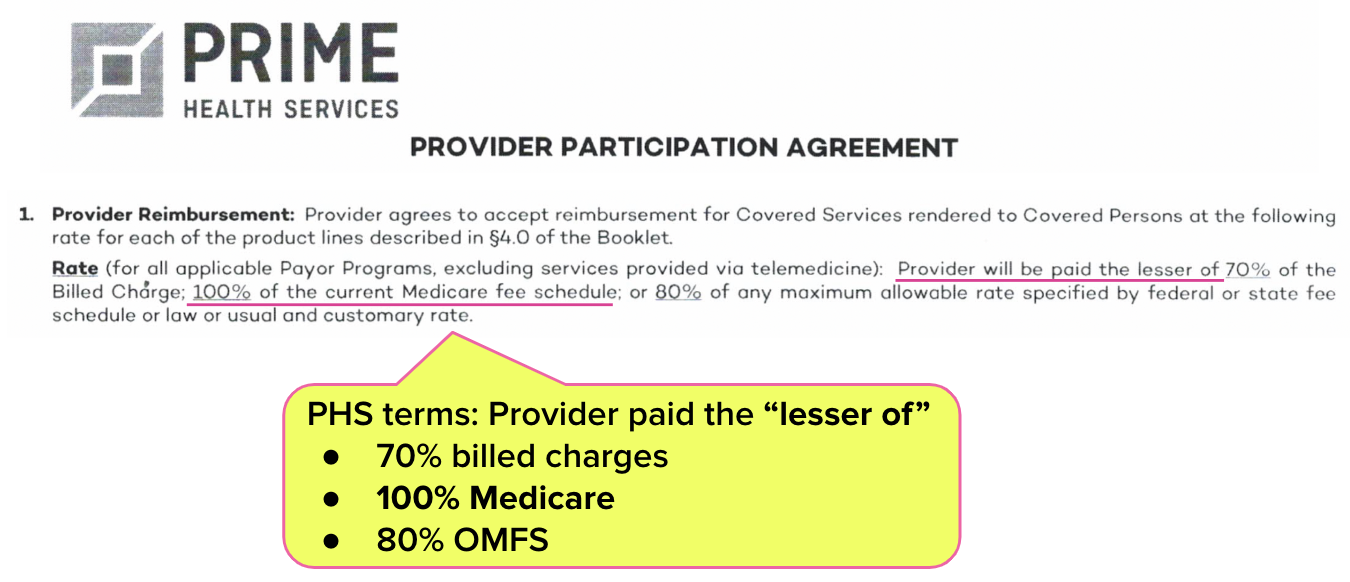

As shown below, PHS discount contract terms can include “lesser of” language that reduces reimbursement for treating injured workers to Medicare rates — regardless of state workers’ comp fee schedule rates.

Effective January 1, 2024, physicians working under such contracts will be paid the new, lower Medicare amounts.

Read on to learn how this Medicare cut may affect your workers’ comp reimbursements — and why state regulators are powerless to help.

PHS Discount Contracts: The Dreaded “Lesser Of” Language

Providers nationwide sign PPO discount contracts because they believe it will result in more injured workers visiting the practice.

In California for example, providers often sign these contracts under threat of exclusion from Medical Provider Networks (MPNs); if the provider refuses a contract, they’re booted from the associated MPN and rendered ineligible to treat injured workers restricted to that MPN.

As we’ve explored extensively, many providers and their administrative staff do not understand the machinations of these agreements, or the potential effects on reimbursement.

Often physicians are shocked to learn that PPO contracts reduce reimbursements for treating injured workers to Medicare rates. For example, the PHS contract shown below lists the reimbursement terms using “lesser of” language — as in, the provider agrees to accept the “lesser of” several reimbursement options:

- 70% of the provider’s billed charges

- 100% of Medicare rates

- 80% of OMFS rates

The terms of this PHS contract mean that even if state regulators drastically increase reimbursement under state fee schedules, the provider would still receive only Medicare rates for treating injured workers. Increasing workers’ comp fee schedule rates would only serve to ensure that Medicare rates remain the “lesser of” the three.

Once the Medicare reimbursement reduction takes effect on January 1, 2024, workers’ comp providers who signed a PHS contract with terms like those above will be paid 3.4% less in 2024 than in 2023.

Workers’ Comp Reimbursement Carnage

Since California’s adoption of Medicare RBRVS reimbursement for physician services in 2014, annually, the California Division of Workers’ Compensation (DWC) has set the reimbursement for treating injured workers to rates that exceed the reimbursements allowed by Medicare.

For example, in 2023, the DWC set physician fee reimbursement at approximately 139% of Medicare reimbursement.

To sustain a robust community of providers willing to treat injured workers, state law requires higher fee schedule reimbursement rates to offset the higher administrative costs and physician work. These higher rates represent state legislators’ and regulators’ recognition that treating an injured worker is far more costly for practices than treating a Medicare patient.

However, PPOs like PHS can siphon as much as 39% of a provider’s reimbursements — even though PPO entities themselves do not treat injured workers.

For providers who have signed PPO agreements like the PHS contract above, no increase in state fee schedule rates can stop reimbursement for treating injured workers from declining effective January 1, 2024. All the more reason to cancel or renegotiate PPO or other discount contracts.

The terms of these contracts, which undermine and effectively negate state workers’ comp fee schedules, have the most significant impact on practice revenue for treating injured workers — no matter what state regulators do.

With services ranging from fee schedule calculators to fully managed workers’ comp billing, daisyBill can help protect and empower your practice. Reach out to learn more.

LET’S CHAT

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

Wow! I just ended our contract with PHS within the last month. Grateful I did!

This is an incredibly misleading article. While the majority of states use Medicare for fee schedules, including California, it is on the basis of the annual Medicare RVU updates. These RVUs are calculated with a state-specific conversion factor to determine rates for physician services. California is one such state that uses Medicare RVUs and it's own unique conversion factor to calculate provider reimbursement rates, NOT the Medicare conversion factor. The reason for the nationwide 3.4% rate decrease is because of the decrease in the Medicare conversion factor, NOT state conversion factors which normally are not correlated with Medicare. The Medicare RVUs for most physician fee services have actually increased. Thus, the California workers' compensation fee schedule is not going to be impacted by the reduction Medicare conversion factor. Get your facts straight before you publish inaccurate information.