Athens Pays Interpreter More Than Physician For Evaluation

.gif)

Once again, a claims administrator — with the help of a Preferred Provider Organization (PPO) — offers a perfect example of what makes treating injured workers financially unsustainable for California providers.

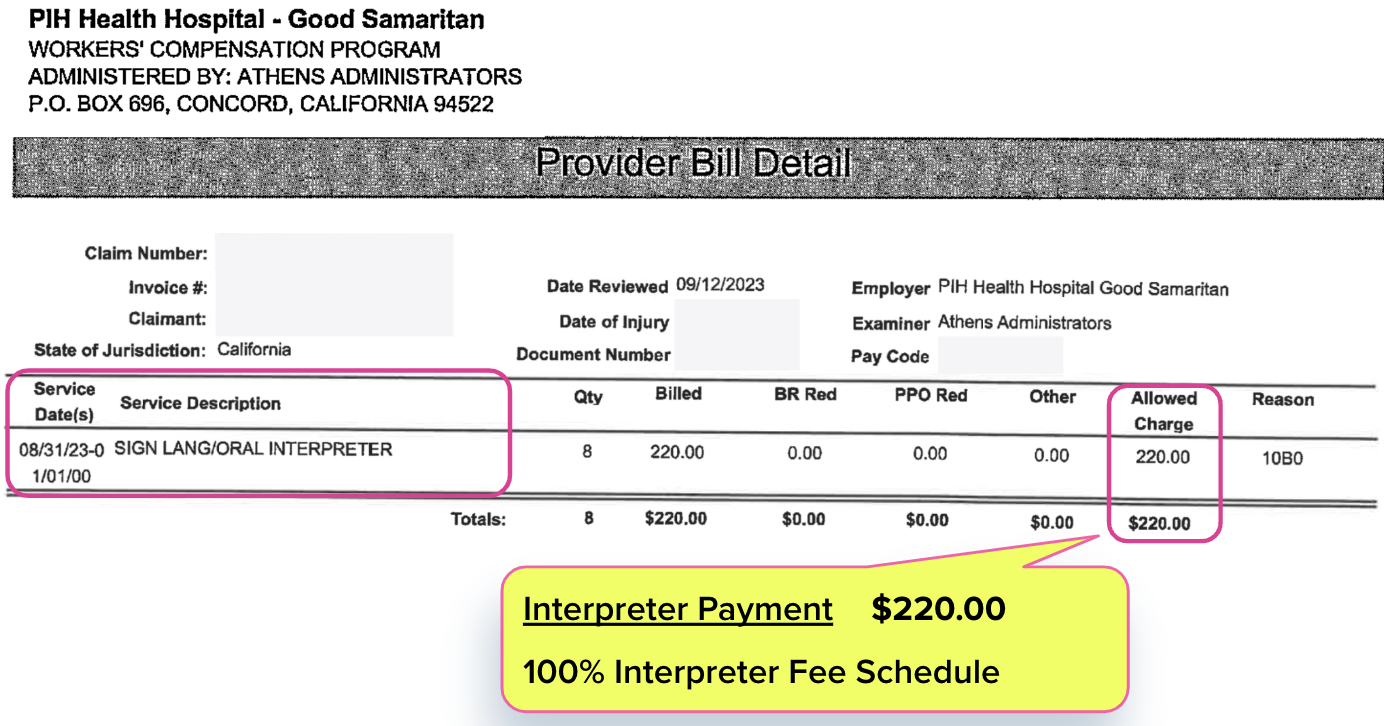

For a standard Evaluation and Management (E/M) visit, Third-Party Administrator (TPA) Athens Administrators paid a physician only $157.03 for their medical services. Meanwhile, Athens paid the interpreter who translated during the medical evaluation $220.00.

Undoubtedly, the interpreter’s vital services were worth every dime of the fee schedule rate they received. That acknowledged, here are two cold, hard monetary facts that should concern California physicians:

- Physicians are routinely paid significantly less than the interpreters in the room.

- In this case, Athens used a PPO discount contract to pay the physician 29% less than the interpreter.

Even without PPO discount carnage, California workers’ compensation fee schedules guarantee that physicians often receive lower reimbursements for conducting medical services than the interpreters who facilitate those services.

- In the case of this evaluation, the California Physician Fee Schedule sets the reimbursement rate at $196.29 for the doctor conducting the evaluation.

- The California Interpreter Fee Schedule sets the reimbursement rate at $220.00 for the translation services provided during this medical evaluation.

- California workers’ comp fee schedules reimburse interpreters approximately 11% more for translation than physicians are reimbursed for medical evaluations.

While interpreters should be well-compensated commensurate with their important role, physicians certainly deserve no less. Many physicians already understand this (along with other cold, hard monetary facts) and have stopped treating injured workers.

How long until the remaining physicians also revolt? Doctors have plenty of options, and treating injured workers seems increasingly like the least favorable.

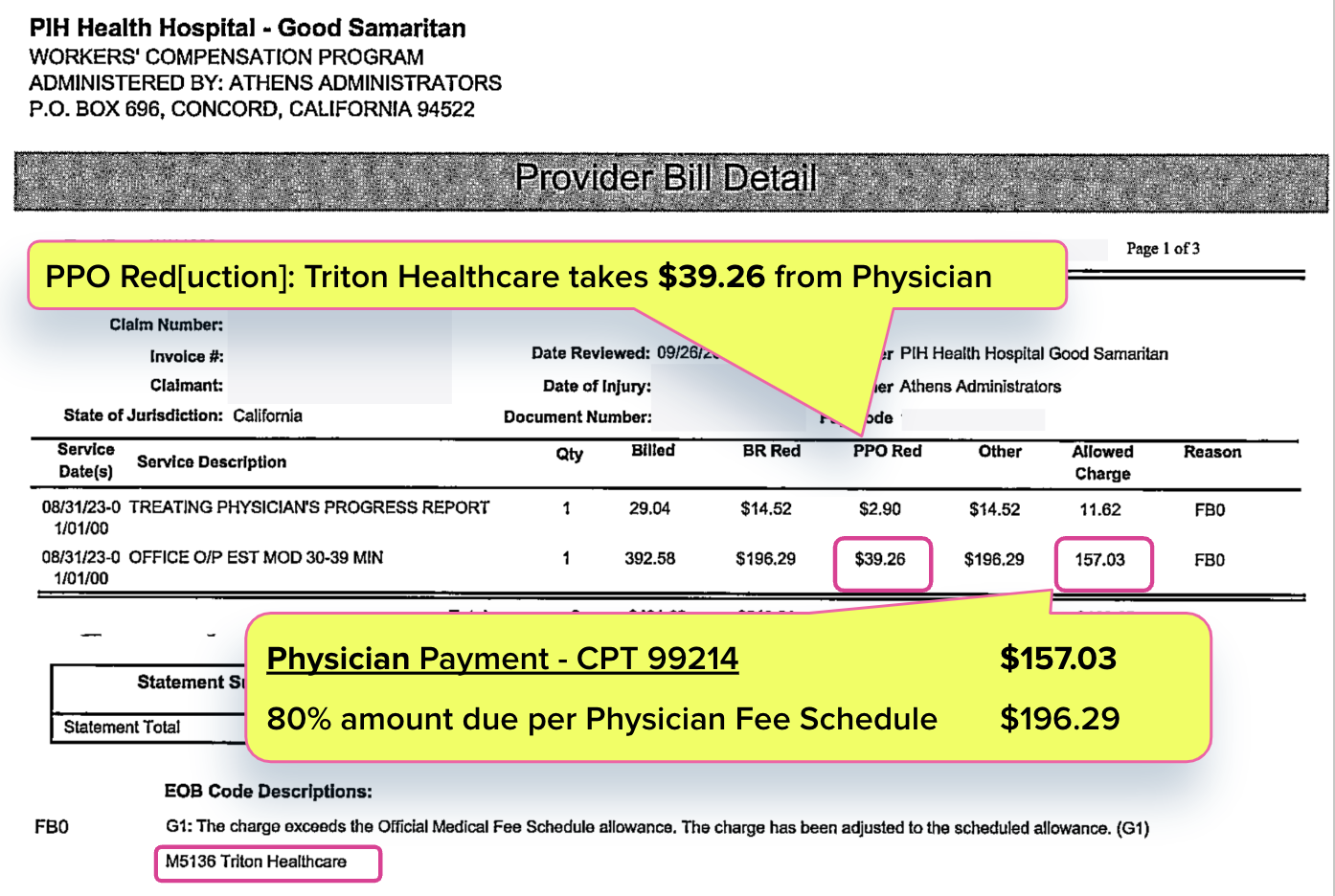

Physician Takes Triton PPO Hit

The physician evaluated the injured worker and prepared the mandatory Treating Physician’s Progress Report (for the record, this was after completing undergraduate studies, graduate studies, and medical school, which required an obscene cost in both time and money).

As noted above, California’s Physician Fee Schedule reimburses $196.29 for an evaluation like this, as billed with Current Procedural Terminology (CPT) code 99214.

But as Athens’ Explanation of Review (EOR) below shows, Triton Healthcare PPO took a $39.26 bite of the physician’s reimbursement, leaving the physician with $157.03 — equivalent to just 80% of the California Physician Fee Schedule rate.

As Triton Healthcare’s website shows, the only “service” Triton provides is a “data processing platform” for “claims repricing.” In other words, unlike physicians, Triton does nothing to help injured workers recover. Yet California allows Triton to “reprice” this physician’s bill and reduce payment to 20% below the amount allowed by the Physician Fee Schedule.

The interpreter (quite rightfully) received the full fee schedule reimbursement of $220.00, as shown in the EOR below. Of course, the interpreter’s critical services were worth that amount. But it is no less accurate to state that the physician who performed the evaluation should also be compensated per fee schedule rates — at the very least.

California workers’ comp fee schedules pays physicians less than interpreters for their respective roles during the same service. PPO discounts widen that indefensible pay gap even further, ensuring that physicians receive rates significantly below interpreters’ reimbursement.

California allows these “data processing platforms” to gut physician revenue, enriching PPOs off the backs of those who actually treat injured workers. As physicians flee the workers’ comp system, no one can blame them for exercising their options.

Know (and get) exactly what you’re owed for treating injured workers. Get instant, accurate fee schedule calculations with our OMFS Calculator.

TRY THE CALCULATOR

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

Not surprising. But I don't begrudge interpreters. They get paid maybe once for every 3 or 4 patients they help. There are several insurance companies who flat out never pay interpreters. He who holds the gold, makes the rules.

We wholeheartedly agree. As mentioned elsewhere in this comments section, interpreters should always submit Second Review appeals when denied full payment. In 2023 over a hundred thousand bills were submitted via daisyBill for interpreter services, the vast majority of which were paid at fee schedule rates.

PPO contracts are not a one-way street. Doctors agree to a reduction in their fees in return for a steady stream of patients. If they are getting the patients, why shouldn't they hold up their end of the agreement and reduce their fee? As far as I know, PPO agreements are optional. If they are so unfair, why are the doctors agreeing to these arrangements?

Unlike in group health, PPOs never direct injured workers to physicians. Instead, MPNs direct injured workers to physicians.

To be in MPNs, physicians must agree to sacrifice revenue to PPOs. We call this MPN/PPO strategy "Pay-to-Treat" (see our article 'PPOs Force Doctors to "Pay-to-Play"')

You are 100% correct – doctors should refuse to sign these agreements. And that is precisely what is happening, as more doctors refuse to treat injured workers. Throughout California, it is challenging for injured workers to find a specialist who will treat them, and it will become even more difficult in 2024 as more physicians abandon this PPO payment abuse.

"Interpreters Get Paid More Than Physicians" is something heard from some claims examiners as a justification when denying or reducing payment for interpreting services. Articles such as this might be unintendedly encouraging this sentiment.

Thank you for your thoughts.

Interpreters should be paid at the rates established by the California fee schedule and should never accept a claims examiner's false justification for reducing the amount owed.

If a claims administrator fails to adequately reimburse an interpreter's bill, the interpreter should immediately file a Second Review to dispute reduced reimbursement (see our article 'CA Interpreters, Submit Those Second Bill Reviews!')

daisyBill payment data indicates that our interpreter clients' 100,000+ bills submitted last year were rarely reduced and more accurately paid than physician bills.

We are big supporters of our interpreter clients. If there were a whiff of false payment reductions, we would know and take the appropriate actions to expose the claims administrators to the public and to the state regulators.

Again, thank you for reaching out.