Obituary: Major CA Practice Quits Workers' Comp Treatment

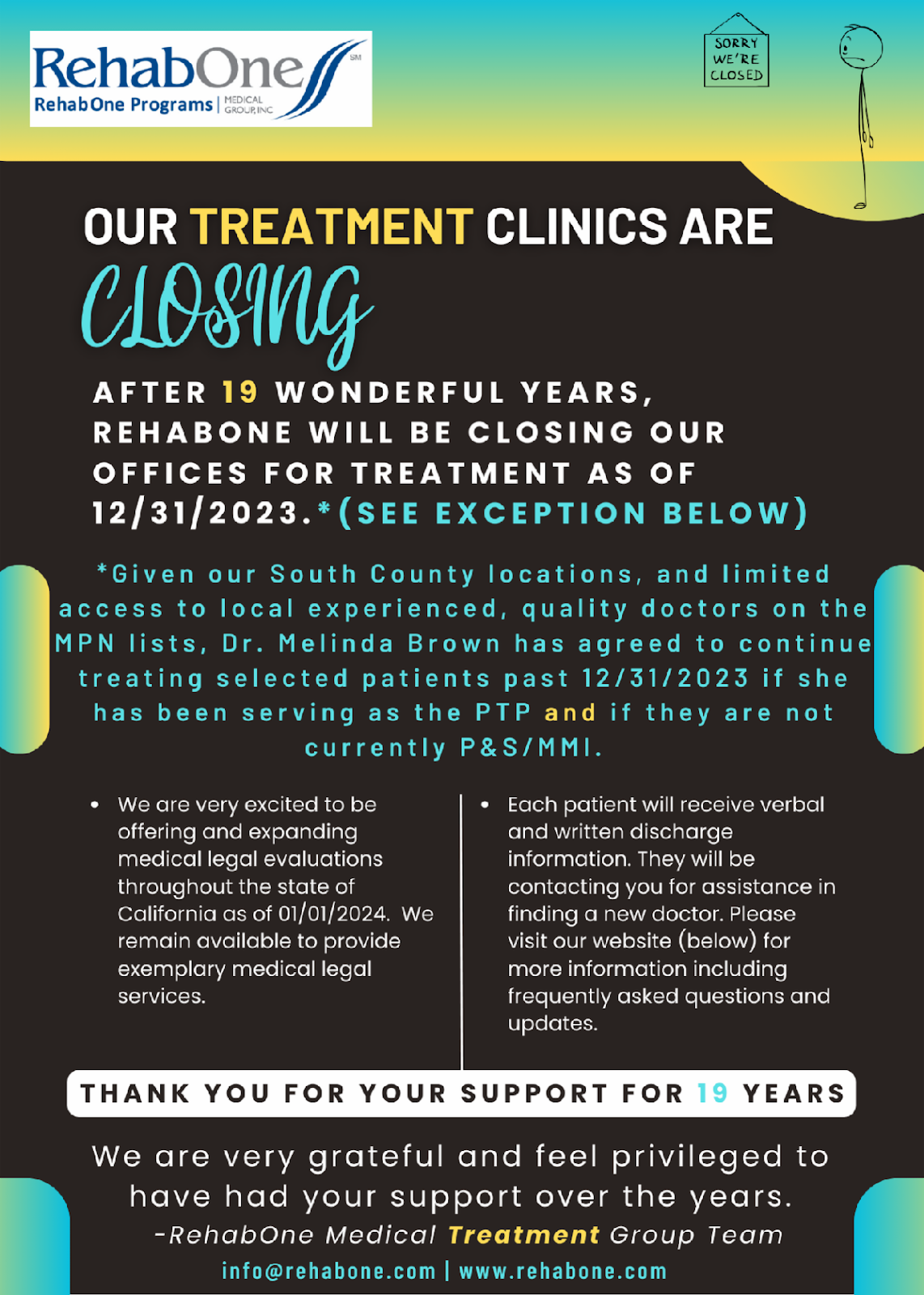

RIP RehabOne Medical Group, 2004-2023

California workers’ comp will lose a pillar of the provider community, effective at the close of this year. RehabOne will have provided quality treatment for work-related injuries for almost 20 years before permanently closing its doors to injured workers.

The exact cause of RehabOne’s demise remains unconfirmed.

However, it’s easy to list many reasons that a group of dedicated providers would decide to treat injured workers no longer:

- The ungoverned, unnavigable Medical Provider Network (MPN) system

- Preferred Provider Organizations (PPOs), which reduce reimbursement rates to unsustainable levels

- The seemingly arbitrary Utilization Review (UR) system, by which payers can deny treatment for even the most nonsensical reasons

- Lax enforcement of payment laws and regulations designed to protect practices from abuse, non-compliance, and incompetence by claims administrators

Regardless of which factor or combination of factors is responsible for the loss of RehabOne, thousands of injured workers are now deprived of the excellent standard of care for which RehabOne is deservedly known.

daisyBill can only guess at the precise reason(s) for RehabOne’s exit from workers’ compensation treatment. However, we have written extensively about how California allows claims administrators, MPNs, PPOs, and other entities to contort workers’ compensation into a financial noose that chokes providers with contractual discounts, dubious downcoding, surprise removal from networks, and endless, costly bureaucratic struggles to obtain authorization and correct reimbursement.

California lets third-party entities (MPNs, UROs, PPOs) treat practices as profit centers and thrive at providers’ expense while offering arguably nothing of value to injured workers. We will miss RehabOne as a client, but we completely understand why this practice has concluded that enough is enough.

RehabOne entered the scene 19 years ago, establishing locations from Silicon Valley to Monterey Bay. The practice treats thousands of injured workers as of this writing (but only for a little while).

We don’t know the exact reasons for RehabOne’s closure, but below are the most likely.

The MPN Problem

The harsh reality of a for-profit healthcare system is simple: when providers lose revenue on patients, eventually, they can no longer afford to treat them.

From retroactive denials of payment for MPN non-membership to the imposition of network discounts as a condition of MPN membership, to surprise physician removals from MPNs to the general disdain in which MPNs and unregulated discount contracting entities hold providers, practices are more likely than ever to conclude that workers’ comp is no longer sustainable.

For example, insurers like State Compensation Insurance Fund (SCIF) and The Zenith use MPNs to pay less than Medicare rates for standard Physician Services, according to data from hundreds of daisyBill providers. The MPN reimbursement slashing is even worse for ancillary services like physical therapy and acupuncture.

By allowing the MPN system to rope providers into discount contracts, California has ensured that workers’ comp providers struggle to treat injured workers and simultaneously keep the lights on.

Add to this the fact that there is no reliable way for providers to confirm whether an MPN applies to a given injured worker or whether the provider is a member of the applicable MPN. The MPN system is pure chaos.

The PPO Problem

Of course, providers believe they need to maintain MPN membership to remain eligible to treat injured workers. That’s where PPOs come in; acceptance of PPO or other discount contracts is often a condition of MPN membership. No discount, no membership.

Of course, PPO reimbursement rates can be drastically, tragically low. We keep tabs on the real-world reimbursement rates paid to our provider clients, using data from the millions of e-bills sent through daisyBill. The numbers are disheartening, to say the least, and it’s almost entirely due to PPO reductions.

That’s California’s “pay-to-treat” system — and fewer and fewer providers are willing (or can afford) to put up with it.

The UR Problem

While we understand the need to prevent fraudulent or otherwise inappropriate treatment, the state of California UR is fundamentally broken.

Insurers pay UR doctors to control costs. And despite regulations barring any official incentivizing of denials, the inherent conflict remains — and often puts UR doctors in direct opposition to the treating doctors who examine injured workers and render care. As for appealing bad UR decisions…good luck with that.

The result? We spent a few weeks scrutinizing the denials of just one insurer. We found enough evidence to reasonably conclude that something is deeply wrong with California UR — and that injured workers are paying the price with their bodies.

The Enforcement Problem

California has laws and regulations designed to protect providers and injured workers. The problem is that too often, they’re simply not followed. And they’re not followed because they’re not enforced.

On behalf of clients, daisyBill has submitted formal Audit Complaints for hundreds of thousands of violations by various claims administrators. The mountains of data we’ve submitted to the Division of Workers’ Compensation (DWC) is enough to substantiate the Target Audits that are well within the DWC’s power to conduct.

And yet…most of what we hear in response to cold, hard, incontrovertible evidence of consistent illegal behavior is the sound of crickets. Meanwhile, providers go un-and-underpaid, and injured workers go un-and-under-treated. It’s no wonder why practices are closing.

RehabOne is not the first, and will certainly not be the last, domino to fall. As usual, the state’s injured workers will bear the consequences of California’s failure to manage this growing crisis.

daisyBill makes workers’ comp billing easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)