SCIF Inept UR #4: IMR Rules Favor Insurers

.gif)

In recent articles, we’ve shared the details of State Compensation Insurance Fund (SCIF)’s denial of continued care for an injured worker on false grounds, and how the only recourse open to the injured worker, Independent Medical Review (IMR), is stacked in favor of the insurer.

Today, we dig further into the systemic flaws of the IMR system and probe exactly why injured workers have no realistic path to success — even when the insurer’s reasons for denying the treating physician’s requested treatment are demonstrably untrue or irrelevant.

As you read, SCIF has denied a treating doctor’s request for critical rehabilitative therapy for head trauma for one worker injured while repairing California highways. California cannot act fast enough to fix this flawed, unfair system.

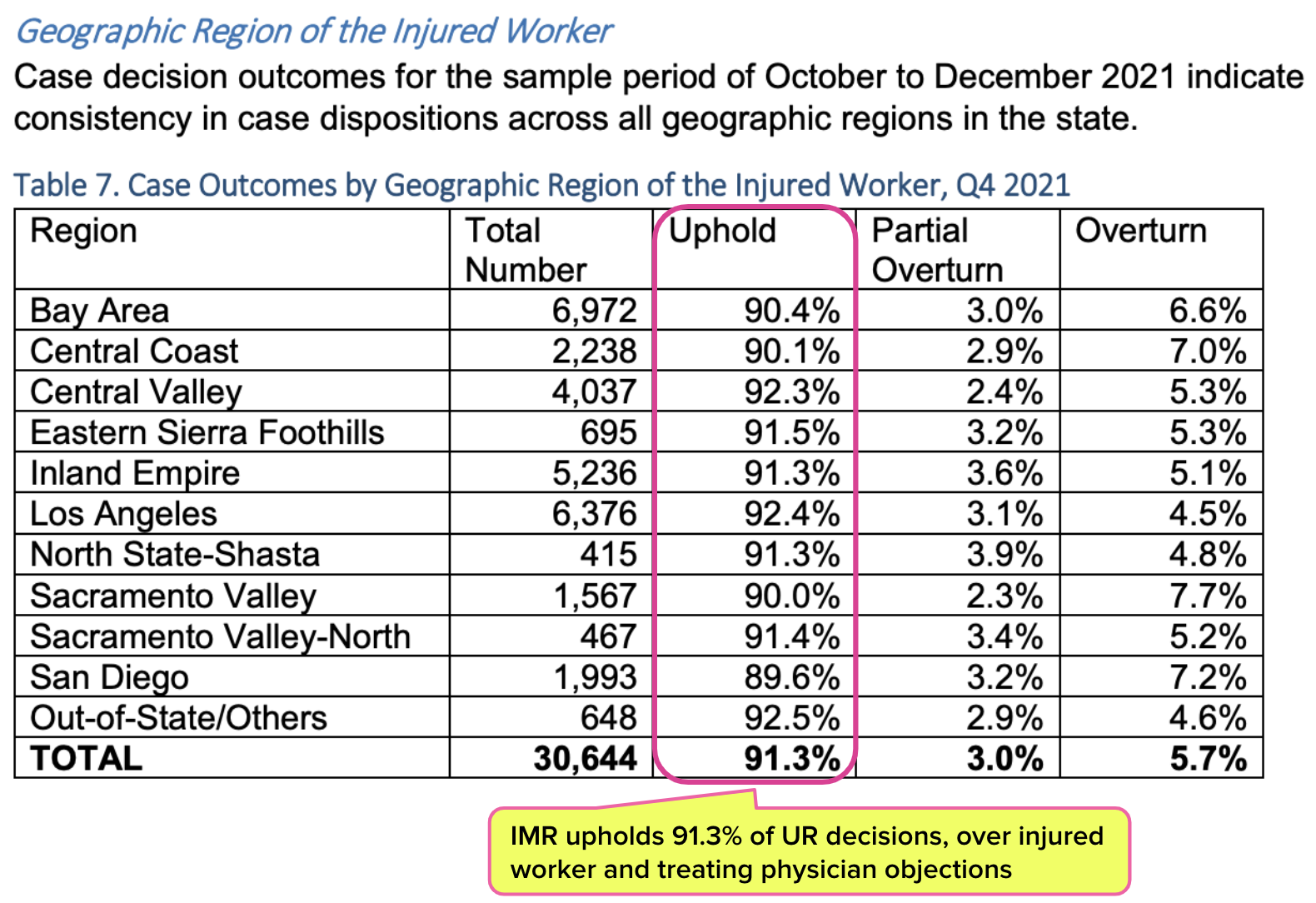

IMR Stats: Injured Workers Have Little Chance

The DWC maintains an Independent Medical Review (IMR) web page, which explains that medical treatment disputes will be resolved through IMR rather than the courts:

“As of July 1, 2013, medical treatment disputes for all dates of injury will be resolved by physicians through an efficient process known as IMR, rather than through the often cumbersome and costly court system.”

IMR, as devised by California regulators, is an ‘appeal’ system arguably set up to grant insurers like SCIF every advantage, a system that leaves injured workers fending for themselves as they attempt to navigate confounding and rigid IMR requirements. California essentially shunts treatment authorization battles from open court to IMR, where the playing field is arguably far less even.

As the DWC’s own statistics show, this “efficient process” is practically nirvana for payers. Below is a table from a 2022 DWC study of IMR results in the last quarter of 2021 by region, demonstrating that insurers win at IMR over 91% of the time.

That’s right: Maximus, the entity to which the DWC outsources IMR, takes the side of UROs in 91.3% of authorization disputes.

In other words, doctors treating patients face-to-face are contradicted by people looking only at paperwork. When the injured worker attempts to appeal, other people look at paperwork and almost always decide the first people looking at paperwork had it right.

IMR: An Uphill Climb for Injured Workers

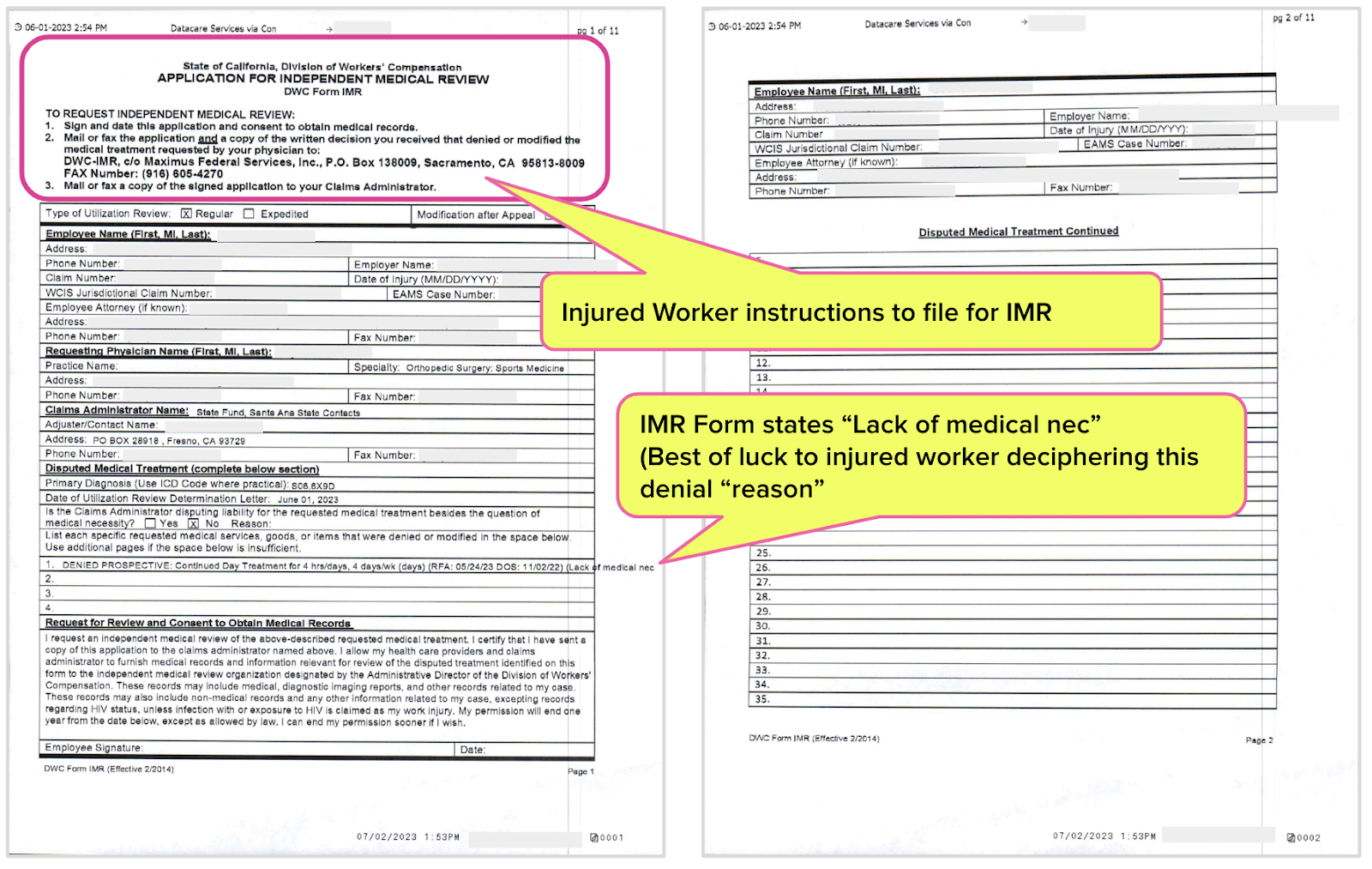

Presumably, the California legislature intended to create a relatively simple process for an injured worker to dispute a UR decision by filing for IMR. Per California Labor Code Section 4610.5, requesting IMR should require only a signature and a stamp:

“As part of its notification to the employee regarding an initial utilization review decision based on medical necessity that denies or modifies a treatment recommendation, the employer shall provide the employee with a one-page form prescribed by the administrative director, and an addressed envelope, which the employee may return to the administrative director or the administrative director’s designee to initiate an independent medical review.”

Yet the process is much more complex, especially for an injured worker unaccustomed to the language of workers’ comp bureaucracy. Remember: the injured worker must file for IMR within 30 days of the UR decision denying treatment; physicians cannot file for IMR to dispute an incorrect UR denial.

To file for IMR, the injured worker must take the following mandatory steps:

- Mail or fax the signed IMR form to the DWC (shown below)

- With the IMR form, include a copy of the written UR decision the injured worker received from the claims administrator

- Mail or fax a copy of the signed IMR form to the claims administrator

This can be even more daunting than it appears at first glance.

First, UROs can issue UR decisions that are dozens of pages long, all of which the injured worker must copy, attach to the UR form, and snail-mail (or fax, if the injured worker has access to either a fax machine or a time machine headed to the mid-’90s) to the DWC. On top of that, the completed IMR form must be copied and sent to the claims administrator.

If the injured worker makes the slightest mistake, the dispute is deemed ineligible for IMR.

Second, given the consequences of failing to timely file for IMR, the injured worker must have proof of mailing or a fax receipt proving the successful, timely delivery of the IMR form and UR decision to the DWC.

For example, the DWC will automatically rule the dispute IBR-ineligible if the injured worker fails to send a copy of the UR decision with the IMR form, or fails to make it to the post office within 30 days of receiving the UR decision. Once deemed ineligible for IMR, the denial stands for 365 days.

IMR: Circular Documentation Hell

In the case of the injured worker denied therapy by SCIF/EK Health, even if:

- The injured worker made the necessary copies, and

- The injured worker bought stamps and envelopes (the insurer is required to provide only one addressed envelope, despite the injured worker having to submit copies of the IMR forms to both the DWC and the insurer), and

- The DWC did not rule the dispute IMR-ineligible

…there would still be only a 9% chance of success by DWC statistics.

Since the medical report was somehow lost between SCIF and EK Health after SCIF (verifiably) received it with the RFA, what rational adult is willing to bet that SCIF will make sure Maximus gets the report for IMR purposes?

So we’re absolutely clear, the SCIF sends Maximus the medical records and documents. This is how IMR works in a case like this:

- The doctor submits the necessary medical documentation to the insurer, with the RFA

- The documentation somehow fails to make it to the insurer’s URO

- The URO denies treatment based on missing documentation

- The injured worker requests IMR

- The insurer that lost the documentation determines the documentation sent to Maximus

It’s a classic failure of circular logic. It would be funny if it weren’t for the tragic consequences for the injured worker.

Perhaps that’s why we get comments like the one below from doctors. We cannot independently verify anything alleged in this comment, but if this is the experience reported by doctors, it’s time to consider reform.

This is exactly what is happening to me with Genex. They do this on every single claim. They say they don’t have records which have in fact been faxed.

They also call three times for a peer-to-peer review, and when I call them back, they are unavailable. Then they issue a denial and say in the letter that the doctor was not available prior to the end of the review (which is a lie, as each time I try to reach the clinician the same day).

This pattern is happening over and over and over. One time I shockingly was able to speak to one of their UR clinicians, and he said he didn’t even ever see the letter they sent out on his behalf. So the UR clinicians are allowing their names and licenses to be put on letters they do not even read, apparently.

Authorization is the first hurdle in the workers’ comp obstacle course. Enjoy 30-second RFA submission and automatically tracked UR decisions with daisyAuth — request a demo below!

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)