CA DWC & Maximus Rig IBR to Hand Sedgwick the Win

.gif)

The California Division of Workers’ Compensation (DWC), nominally responsible for enforcing workers’ comp laws, regulations, and rules for all parties involved, continues to contort California law to protect Third-Party Administrator (TPA) Sedgwick.

In perhaps the clearest example yet, an agent of the DWC (Maximus Federal Services) intervened in a payment dispute and allowed Sedgwick to apply a 91% Coventry Preferred Provider Organization (PPO) discount to an orthopedic surgeon’s bill.

However, Sedgwick had signed a legally binding 5307.11 contract, in which Sedgwick agreed not to allow contracted discount entities (like PPOs) to reduce the amount of reimbursement paid.

Despite this signed contract, Maximus determined that Sedgwick owed $0 for the service. In its Independent Bill Review (IBR) ruling, Maximus claimed the orthopedic surgeon provided insufficient documentation and, therefore, no reimbursement was due. This astonishing ruling by the DWC’s proxy disregards two facts:

- The applicable state fee schedule does not require the documentation Maximus claimed as missing.

- Sedgwick paid the orthopedic surgeon for the service, albeit incorrectly, without disputing the documentation.

In other words, Maximus helped Sedgwick by coming up with its own bogus reason to deny an orthopedist payment for treatment Sedgwick authorized. Maximus' twisting of logic (and common sense) to ensure that Sedgwick and Coventry could evade its obligations is yet another example of how the DWC has stacked the system against providers.

California providers cannot expect fairness, equitability, or justice under the DWC, an agency whose actions and inactions clearly signal where its allegiance lies—squarely with claims administrators, PPOs, and their private equity ownership.

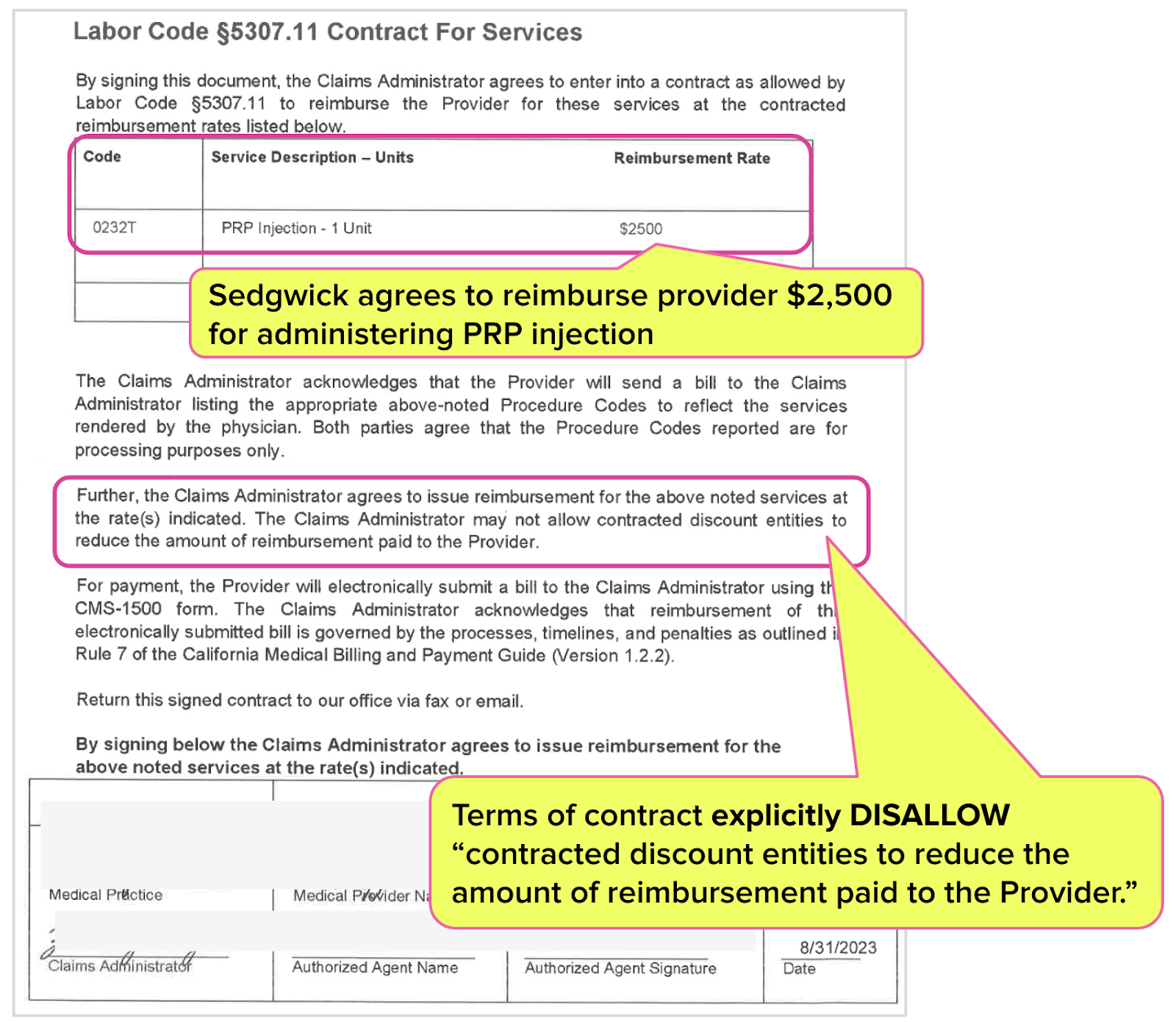

Sedgwick Signs 5307.11 Contract for PRP Injection

According to Labor Code Section 5307.11, California law allows providers and claims administrators to establish separate reimbursement contracts outside the Official Medical Fee Schedule (OMFS).

As shown in the 5307.11 contract below, Sedgwick, acting on behalf of AIU Insurance Company, authorized and agreed to pay the orthopedic surgeon $2,500 for a PRP injection.

California’s Official Medical Fee Schedule (OMFS) does not set a reimbursement rate for a PRP injection billed with code CPT 0232T. Instead, the DWC designates CPT 0232T as payable “By Report (BR).” Accordingly, all providers who receive authorization for this treatment must enter into a 5307.11 contract to establish a reasonable reimbursement rate.

Critically, the 5307.11 contract Sedgwick signed specifically forbids Sedgwick from applying Pilfering Provider Organization discounts:

“The Claims Administrator may not allow contracted discount entities [like PPOs] to reduce the amount of reimbursement paid to the Provider.”

After receiving the signed contract, the orthopedist provided the PRP injection and sent Sedgwick a bill for $2,500 along with all the required documentation, including:

- The mandated PR-2 which reported the following details about the procedure: "PRP injection was administered to the right knee under sterile conditions without complications. A bandage was placed over the injection site after the procedure. The patient tolerated the injection well.”

- The signed 5307.11 contract confirming the agreed-upon payment terms.

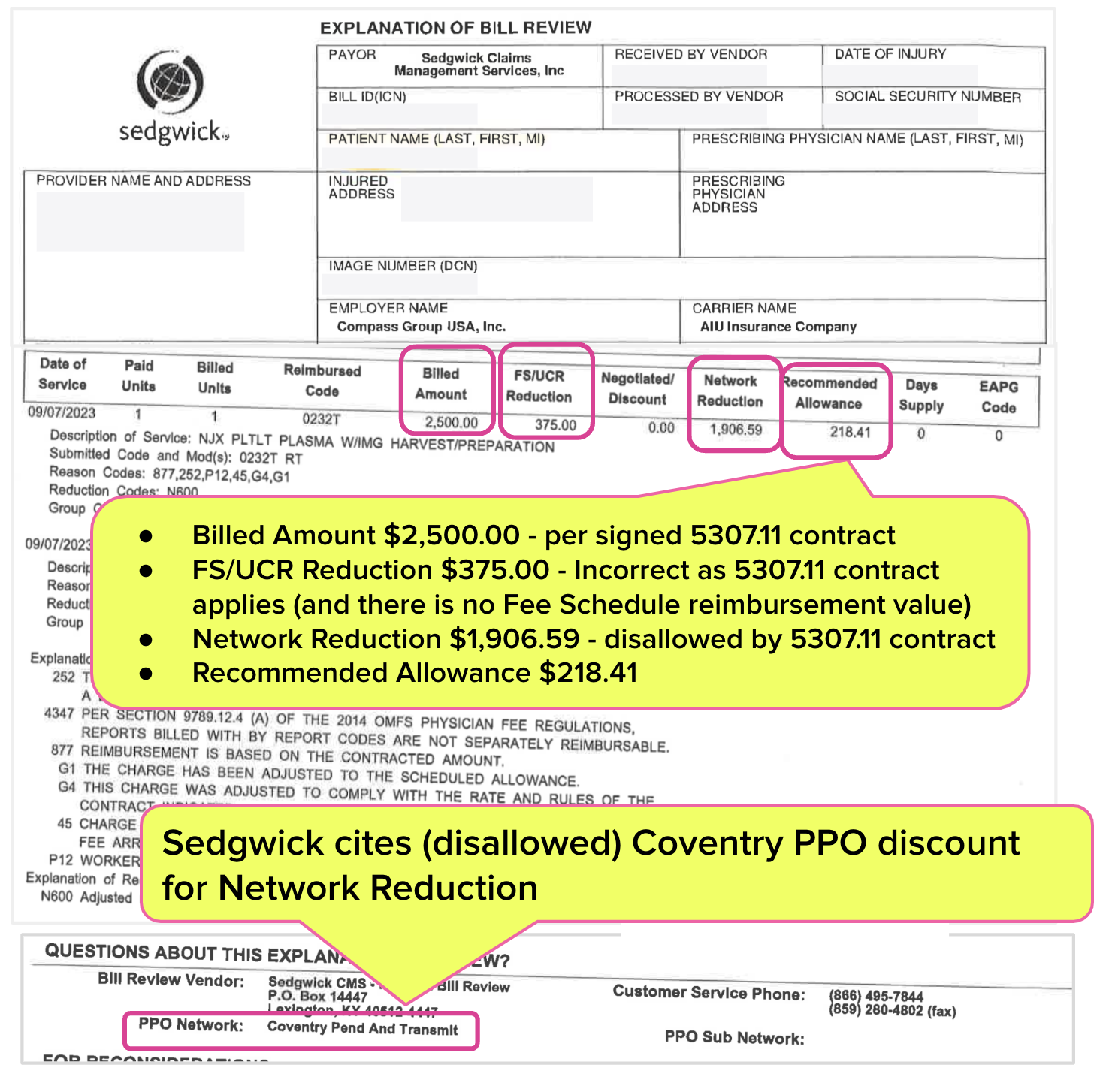

Sedgwick Stiffs Orthopedic Surgeon $2,281.59

As shown in the Explanation of Review (EOR) below, rather than reimbursing the provider $2,500 as contracted, Sedgwick paid the provider just $218.41 for the injection. Inexplicably, the EOR indicates that Sedgwick:

- Incorrectly reduced the reimbursement by $375.00, citing a nonexistent Fee Schedule/Usual and Customary Reimbursement reduction (FS/UCR) and

- Reduced the reimbursement by $1,906.59, citing a Coventry PPO Network, which the 5307.11 contract explicitly bars.

Sedgwick and Coventry, acting on behalf of AIU Insurance, took $1,906.59 from the orthopedic surgeon. This TPA/PPO pilfering should raise alarms for the insurer and the employer.

- Does AIU Insurance know about this $1,906.59 PPO reimbursement arithmetic?

- How is this $1,906.59 PPO reduction reflected in the employer’s Compass Group USA, Inc. workers’ comp premium calculations?

Most importantly, are AIU Insurance and Compass Group aware that Sedgwick and Coventry are stiffing the providers who treat their injured workers?

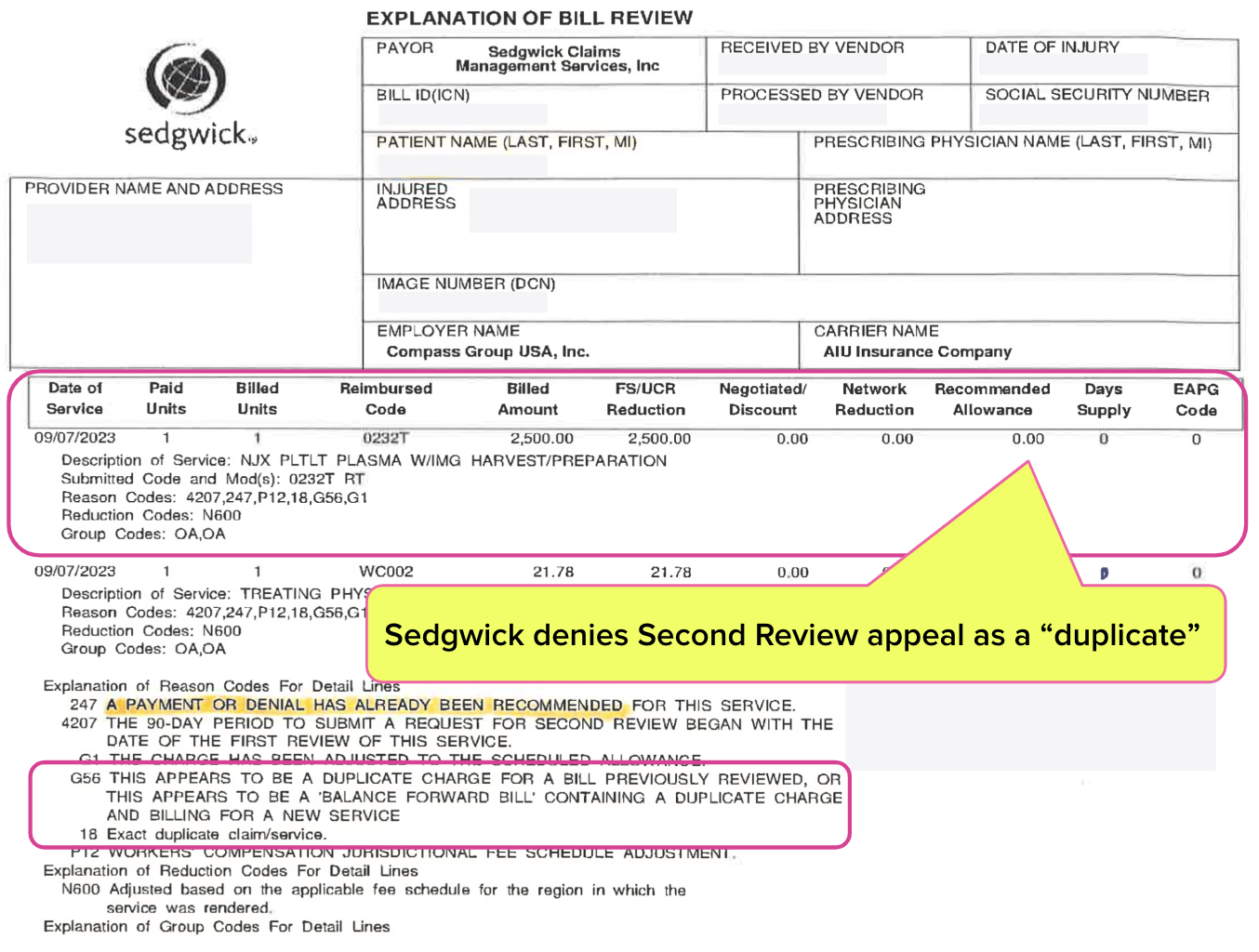

Sedgwick Denies Second Review Appeal

The provider submitted a timely and compliant Second Review appeal to dispute the inappropriate payment reductions. In response, Sedgwick sent the provider a final EOR (below), in which the TPA denied the Second Review by noncompliantly and erroneously claiming it “duplicates” the original bill.

Note that Sedgwick has a long-standing—and profitable (in this case, $2,281.59 in profits)—problem with denying Second Review appeals as duplicate bills. Sedgwick makes this “mistake” a lot, a fact of which the DWC is well aware (but simply ignores).

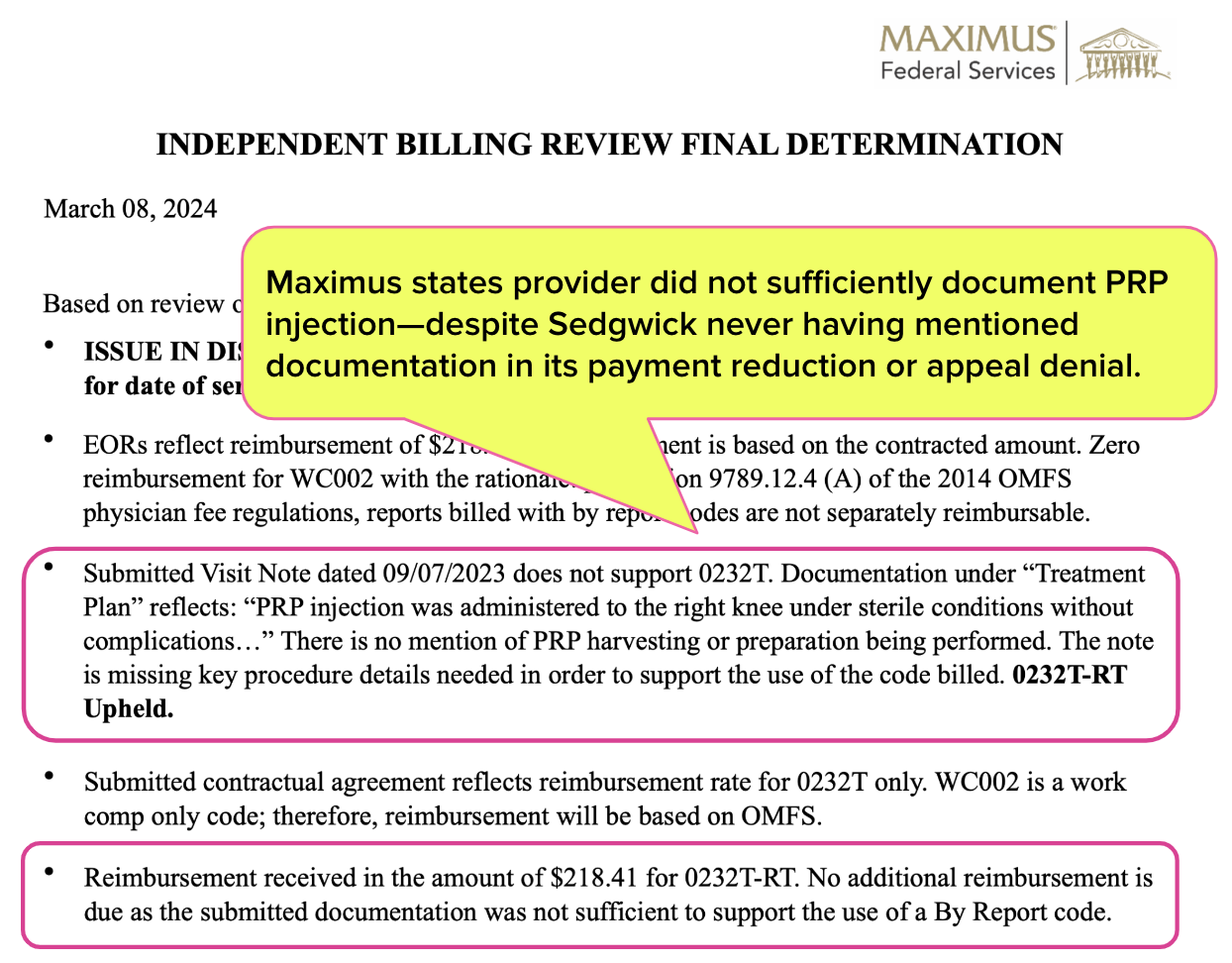

DWC & Maximus Feed Provider to Sharks

Maximus is the private entity designated by the DWC to conduct IBR on the agency’s behalf. To escalate a payment dispute to DWC review, a provider must pay $180 and submit a lengthy IBR application to Maximus, which acts as the DWC’s IBR proxy.

With a signed contract that flatly disallows the Coventry PPO discount cited and a flatly untrue reason for denying the Second Review appeal, the orthopedic surgeon rationally assumed that Maximus would rule in their favor.

Yet astoundingly, Maximus determined that Sedgwick owed the orthopedic surgeon $0 for the PRP injection. Maximus claimed that the provider’s documentation submitted in the PR-2 did not sufficiently substantiate the injection. The IBR decision stated that the provider failed to mention “PRP harvesting or preparation being performed.”

To be clear, Sedgwick did not object to (or even mention) the provider’s documentation. Moreover, neither the CPT guidebook nor any state fee schedule regulations specify any particular documentation requirements for a PRP injection.

In other words, Maximus not only permitted Sedgwick to disregard the contract Sedgwick signed, but Maximus also invented a wholly new pretext to defend the TPA’s misdeeds. By Maximus’ logic, the provider should be grateful to receive 9% of the contractually agreed-upon reimbursement amount.

With this absurd IBR decision, once again, the actions of the DWC and Maximus reveal their partisanship and their roles in protecting Sedgwick’s profits. This duo has repeatedly demonstrated a willingness to step in and shield claims administrators—and a galling, consistent, well-documented unwillingness to guard providers from abuse by claims administrators.

Orthopedic Surgeon Tries Again

Since this baseless IBR decision, the provider has amended the PR-2 report to include the PRP “harvesting and preparation” details Maximus demanded and resubmitted the bill to Sedgwick for payment.

Predictably, Sedgwick denied this resubmission as a “duplicate bill.” The provider then submitted a Second Review appeal requesting the remaining balance owed.

We have no expectations that Sedgwick will honor its legal obligations. Likewise, we do not expect Maximus or the DWC to reconsider their apparent advocacy for this routinely non-compliant TPA.

The workers’ comp billing and payment game often pits providers and payers against each other. This game has a designated referee, the DWC (and an assistant referee, Maximus). But unfortunately for providers, there are many incidents demonstrating that these referees are playing defense for claims administrators rather than caring for injured workers.

Nationwide, daisyBill increases revenue and decreases hassle for providers who treat injured workers. Get a free demonstration below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

wow- scary