Credit Card Payments Steal Money From Doctors

Sometimes, the smaller ways in which payers loot California workers’ comp doctors are the most frustrating.

For example, payments sent to providers in the form of a “credit card;” when the provider “cashes” the credit card payment, the provider incurs a credit card transaction fee.

For group health, it makes sense for doctors to incur credit card fees. Payment by credit card can be the difference between a patient paying their co-pay or deductible at the time of their visit, versus mailing the patient a bill and waiting. In these instances, incurring credit card fees outweighs repeated attempts at collecting revenue later.

Workers’ comp is not group health.

Doctors should refuse to accept credit card payments for treating injured workers, because workers’ comp laws require that the insurer or the employer pay the doctor for the treatment. Since the injured worker does not pay the doctor, there is no financial incentive for a doctor to incur the credit card transaction fee.

At a glance, credit card fees don’t seem like much; fees range anywhere from 2% to 5% of the total bill payment. But those fees can add up, quickly and to significant effect. Which is why it’s important to push back against payers like Gallagher Bassett, which recently issued a credit card payment to a doctor — even after the electronic Explanation of Review (EOR) promised a check, and after the doctor requested that Gallagher Bassett pay by check.

Further, California law should require a workers’ comp claims administrator to reveal if they are receiving a monetary “reward” (read: kickback) for making payments with credit cards. If Gallagher Bassett is profiting by sending a credit card, instead of a good old-fashioned free check, providers (and employers) should be made aware of such profit-making schemes.

Gallagher Bassett’s Credit Card Fake-Out

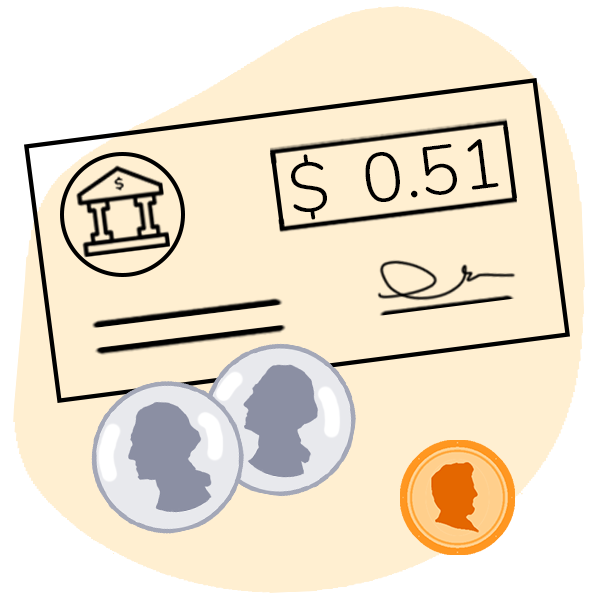

Recently, a daisyCollect provider received an EOR from Gallagher Bassett, a third-party claims administrator (TPA) acting on behalf of insurer Safety National Casualty Corporation.

The EOR delivered electronically by Gallagher Bassett clearly states that payment is forthcoming in the form of a check, as should be the standard in workers’ comp.

But when the provider received the actual payment, the payment came in the form of a virtual credit card image (below).

Gallagher Bassett saddled this doctor with a pointless extra charge, simply for the privilege of being paid. Even if we assume the normal 3% fee on the $1,447.88 bill, the doctor is out $43.44.

If we extrapolate credit card fees to every payment this doctor receives from workers’ comp payers, it could mean thousands of dollars each month in lost revenue.

Why does Gallagher Bassett insist on forcing this doctor to incur credit card fees for treating an injured worker? To make payment more convenient for Gallagher Bassett? Or maybe so Gallagher Bassett can skim another point or two from the doctor’s payment? Or …?

Do Not Accept Credit Card Payments

There are no good reasons for any workers’ comp provider to accept credit card payments, and three very good reasons not to accept credit cards:

-

Credit card payments do not come any more quickly than checks or EFT, when the provider bills electronically. By law, payers must pay e-bills within 15 working days, regardless of the method.

-

There is no return on investment for providers accepting credit card payments. Accepting credit cards from patients for things like copays saves time and eases friction considerably, making the small fees on those small transactions worthwhile. But for workers’ comp treatment bills? Nope, it is not financially savvy to cash those credit cards.

- No federal or California law, regulation, or rule requires providers to accept credit card payments. Despite certain payers arguably implying otherwise, accepting credit card payments is a choice, unless the terms of a separate reimbursement contract state otherwise.

Make it harder for claims admins to improperly deny payment. Your office deserves full reimbursement, on time. daisyBill has the tools — reach out to learn more.

CONTACT DAISYBILL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.