Defense Lien Rep Tries, Fails to Challenge daisyBill Fee Schedule Calculations

At daisyNews, we don’t shy away from offering opinions on controversial aspects of workers’ comp. But some things are not controversies or matters of opinion; they’re simply objective facts of the system.

For example, California workers’ comp fee schedules. The Physician Fee Schedule is not subject to interpretation or bias in favor of providers or payers. It simply establishes the reimbursements for medical services in plain, black-and-white numbers.

However, while fee schedules are objective, they are not simple.

The Division of Workers’ Compensation (DWC) does not simply list procedure codes and the reimbursements owed for each service. Instead, over 200 pages of regulations instruct how to calculate those reimbursements. That’s why providers and payers use daisyWizard’s Fee Schedule Calculator to quickly and accurately determine reimbursements.

But recently, it has come to our attention that a Broadspire lien representative claimed that the daisyWizard Fee Schedule Calculator is unreliable. In the instance below, the defense representative, arguing on behalf of Broadspire, refused to accept the Calculator’s results — reportedly by claiming that daisyBill is biased in the providers’ favor.

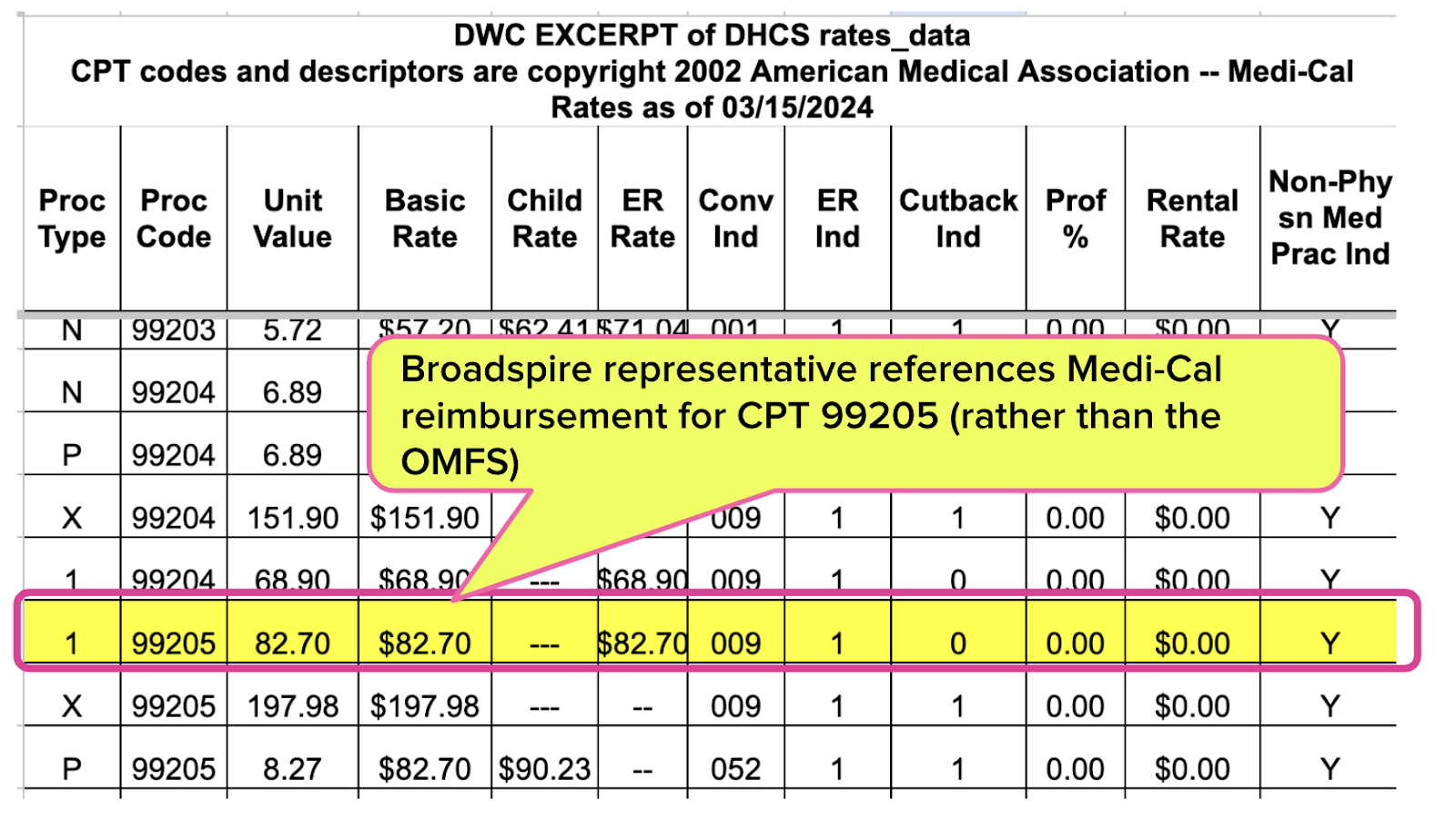

In a conversation with daisyBill, this representative accused daisyBill of “tilting the playing field” in favor of providers. Rather than accepting daisyWizard’s accurate calculations, the representative offered their own amateurish calculations based on inapplicable Medi-Cal reimbursement rates.

We are open to debate on any number of issues in this industry. However, regarding OMFS reimbursement calculations, certain alleged professionals are best advised to stay in their lanes.

Defense Firm Wai Connor Cited Medi-Cal Fee Schedule

The following demonstrates how a defense firm utterly failed to understand how the reimbursement owed to physicians per the OMFS is calculated. The extent of this failure would be comical if not for the real impact of this and other payment hurdles on providers' willingness to treat injured workers.

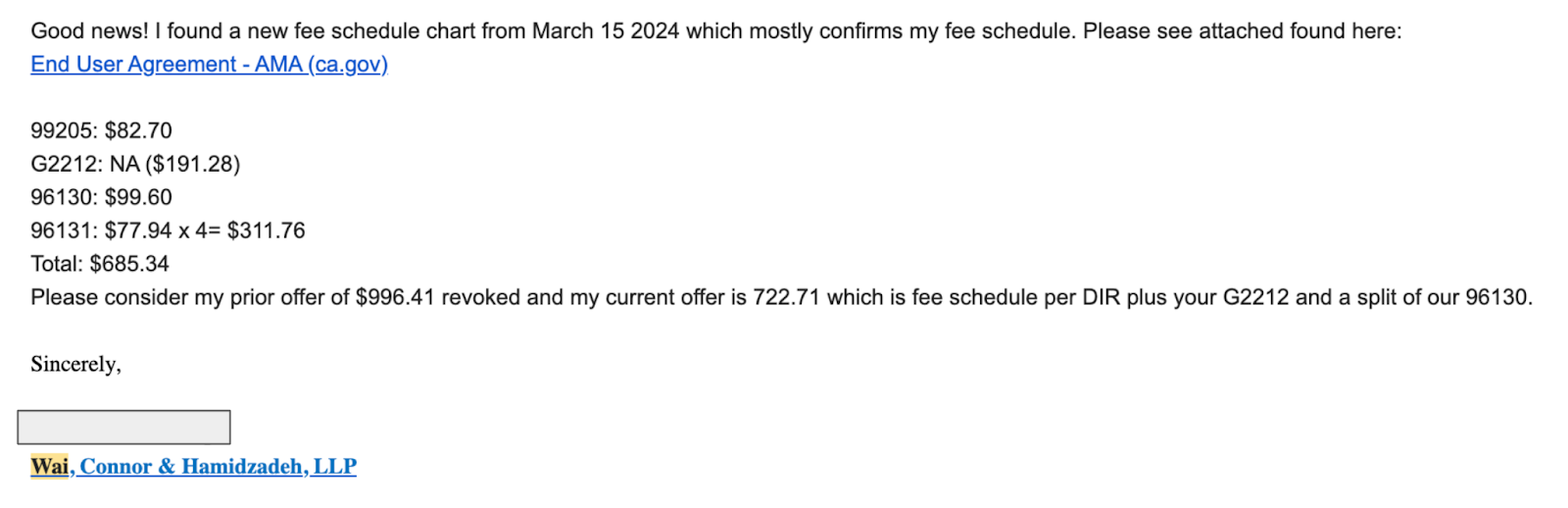

In an email to the provider’s lien representative (screenshot below), the Broadspire representative claimed to have “found” the fee schedule for California workers’ comp physician services, which contradicts the reimbursement amount daisyWizard states is due.

The only problem: Broadspire’s cracker-jack defense team found the Medi-Cal fee schedule, not the workers’ compensation Physician Fee Schedule.

The link provided in the defense attorney’s email is to the reimbursements owed to providers treating in California’s Medicaid program, as explained by the California Department of Health Care Services:

Medi-Cal is California's Medicaid program. This is a public health insurance program which provides needed health care services for low-income individuals including families with children, seniors, persons with disabilities, foster care, pregnant women, and low income people with specific diseases such as tuberculosis, breast cancer, or HIV/AIDS. Medi-Cal is financed equally by the state and federal government.

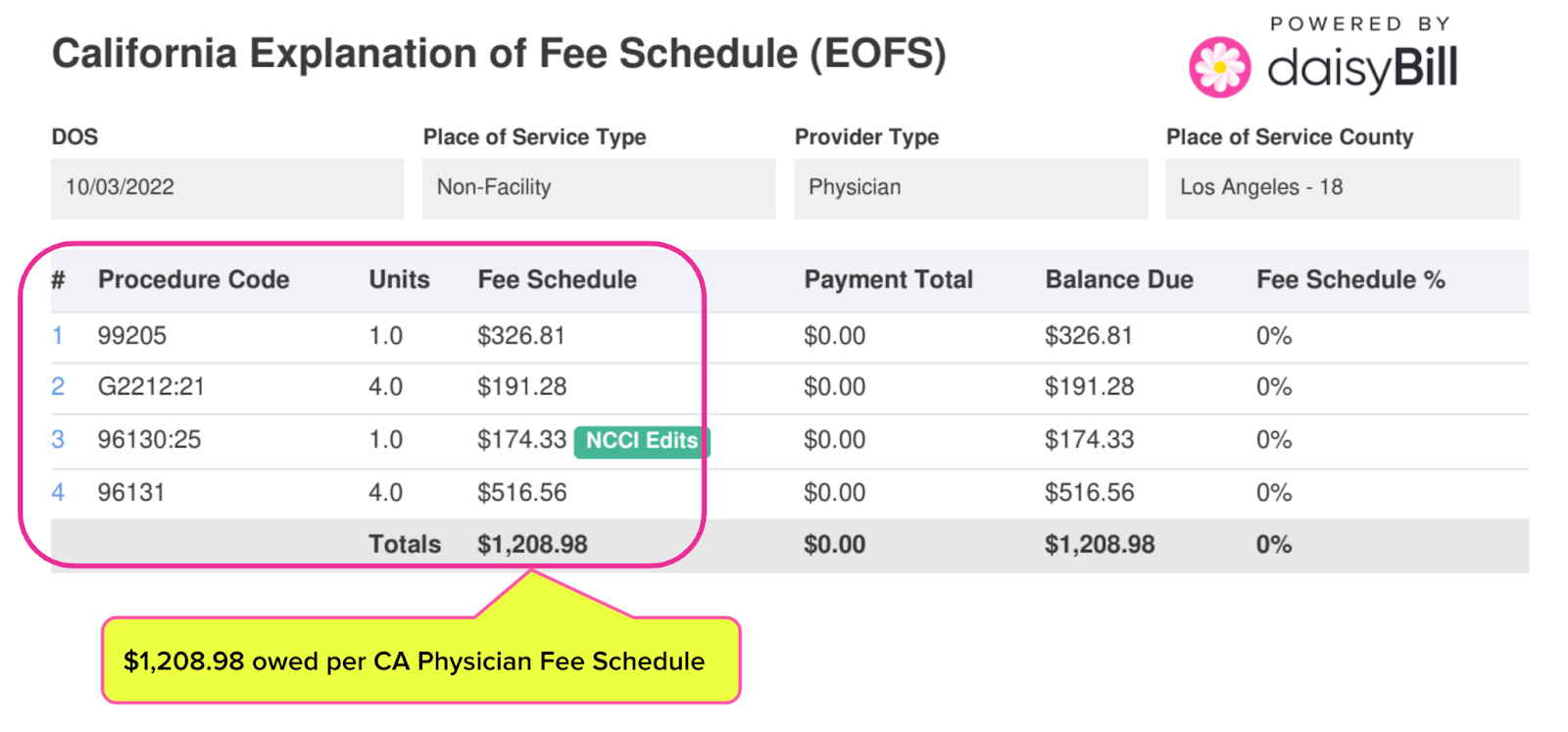

This find is only “good news” for a claims administrator trying to calculate reimbursements for a Medi-Cal patient, not an injured worker. Per the OMFS, Broadspire owed this provider $1,208.98 rather than the $685.34 that would be owed for treating a Medi-Cal patient.

daisyWizard Reimbursements Explained

To repeat, the Physician Fee Schedule does not simply list procedure codes and the reimbursements owed for each service. The DWC’s hundreds of pages of calculation instructions are complex, to say the least, and require specialized expertise to execute.

To calculate the reimbursement owed for a given procedure code, the following information must be obtained from the provider:

- Date of Service

- Place of Service Type (Facility or Non-Facility)

- Provider Type (Physician, Non-Physician, Social Worker)

- Place of Service County or Zip Code

- Procedure Code (and Modifiers, if applicable)

- Number of Units

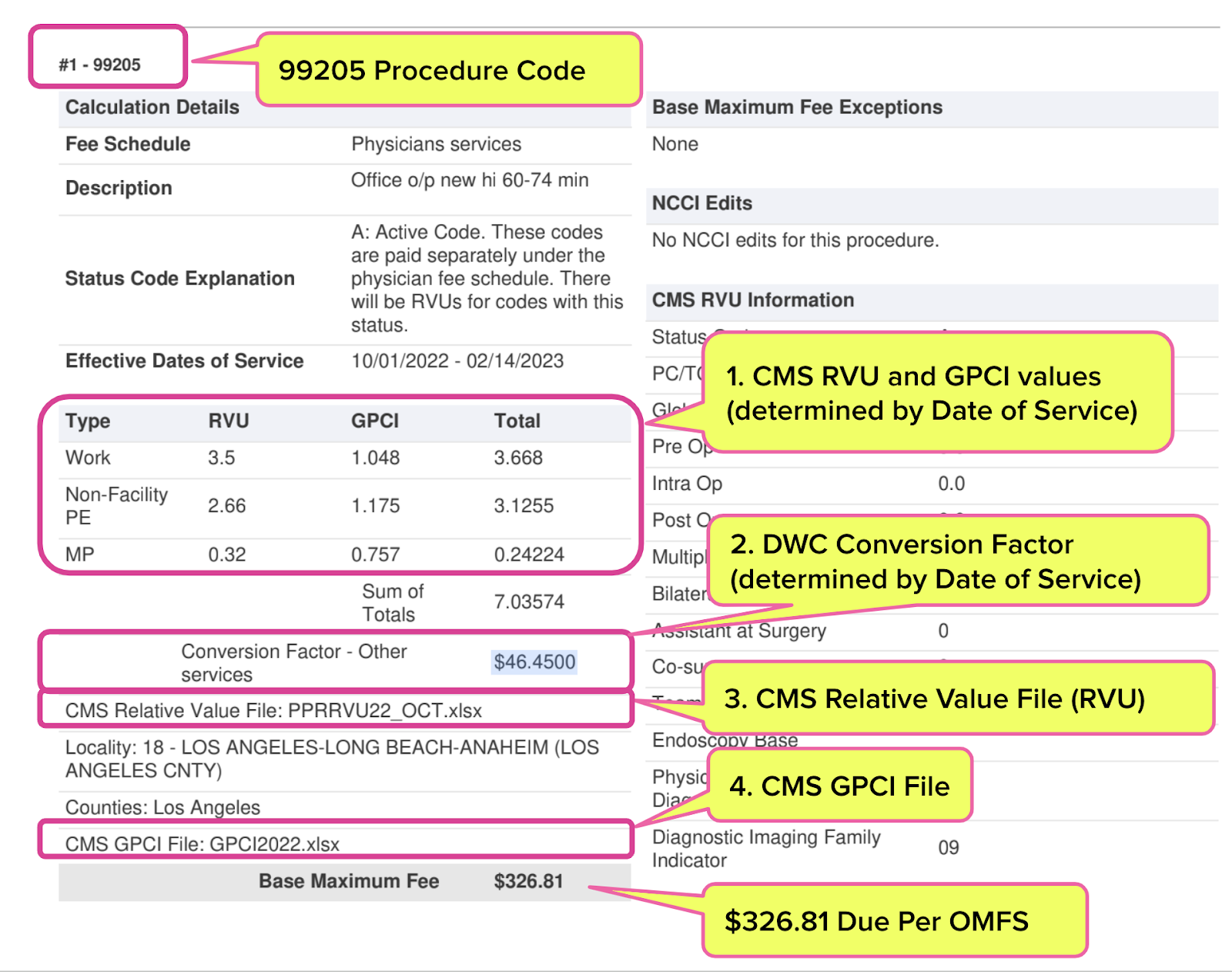

As shown below, correctly calculating the $326.81 reimbursement for CPT 99205 requires data dependent on several factors, including the date the medical service was rendered. Those factors include:

- RVU and GPCI values

- The DWC Conversion Factor

- The CMS Relative Value File used to obtain RVU values

- The CMS GPCI File used to obtain GPCI values

The daisyWizard Fee Schedule Calculator did not randomly arrive at the $326.81 reimbursement amount by checking the OMFS website. As the calculation breakdown above demonstrates, the equation requires data from Medicare (RVUs and GPCIs) and the DWC (the Conversion Factor).

Both Medicare and the DWC change these values at least annually. In fact, the DWC has changed the Conversion Factor twice in 2024 so far.

Broadspire’s representative, out of some vague distrust of a company that seems to defend providers too vehemently for his taste, decided he could do better — by downloading the Medi-Cal PDF from the Department of Industrial Relations (DIR) website.

While maligning daisyBill, the representative referenced these inapplicable Medi-Cal rates in his miscalculations, including the Medi-Cal rate for CPT 99205 of $82.70.

Reimbursement Rates: Not Subject to Opinion

Providers, bill reviewers, and lien representatives on both sides of payment disputes turn to dedicated workers’ comp reimbursement technology to ensure the accuracy of their calculations. It’s simply the only realistic, sustainable way to pay for the treatment of injured workers correctly.

daisyBill is proud to be a resource for all system stakeholders, and unrelenting in ensuring that our math checks out. It is (literally) our full-time job.

While we will never stop insisting on payer compliance, criticizing the DWC for insufficient enforcement, or championing providers' rights, it’s all in pursuit of our one goal: helping this system work properly.

Our software does not ask anyone to take our word for the accuracy of its calculations. It shows the work to the smallest detail — which any attorney, Workers’ Compensation Appeals Board (WCAB) judge, or other authority can verify independently. In calculating reimbursement rates, there is no room for opinion, bias, or other subjective factors (or Medi-Cal).

To learn more about the daisyWizard Fee Schedule Calculator, see the short video below — or start your free trial here.

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

I see a problem quite often when I use DaisyBill for my calculations (I am on the defense side) and the provider claims to use DaisyBill and their calcuations differ! Why??? How does that happen? Also, many providers refuse to accept the NCCI edits when it reduces their reimbursement value.