Sedgwick: IBR Filing Fee Hall of Shame

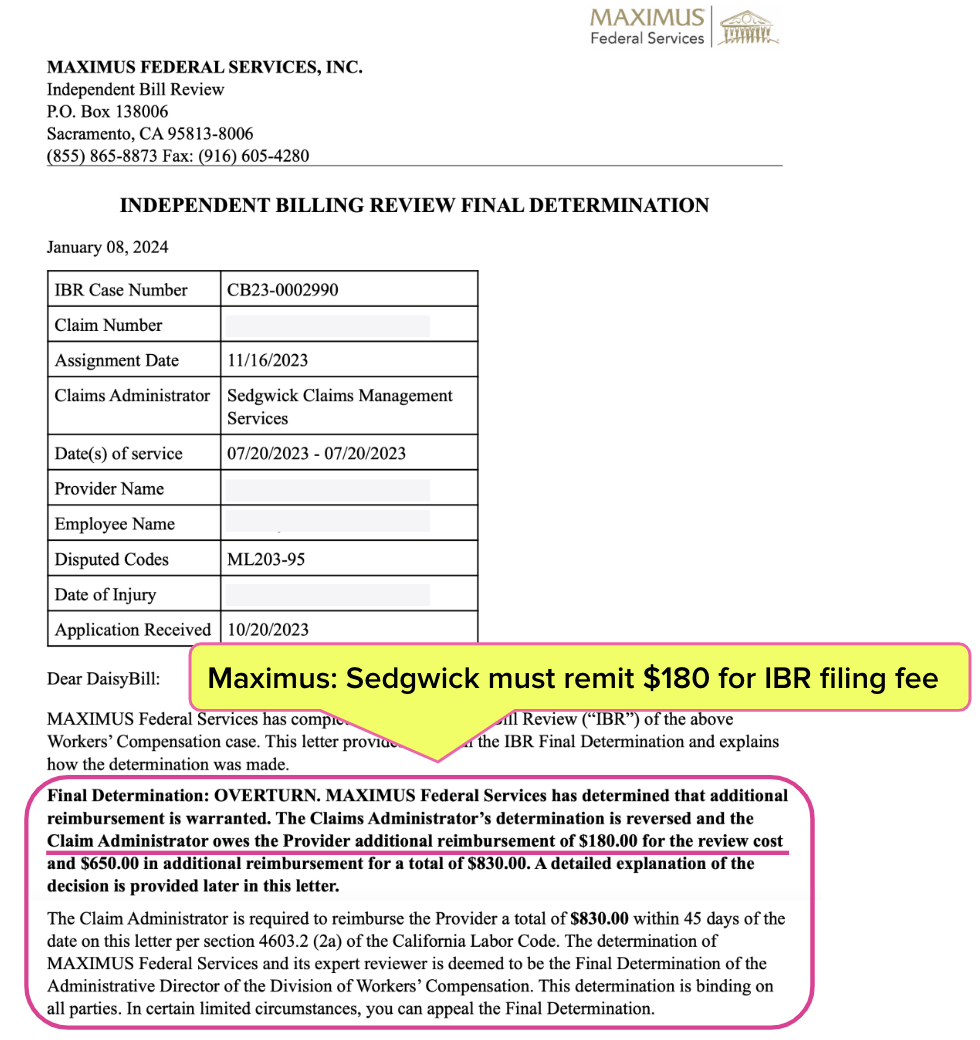

The good news: When Independent Bill Review (IBR) overturns an improper payment denial, Sedgwick Claims Management, Inc. will restore the $180 filing fee the provider paid to request IBR, as required by California law.

The bad news: It may take three months, four emails, one live chat, and an inordinate amount of aggravation to make Sedgwick adhere to California law.

Once again, a claims administrator ignored California’s clear (and clearly communicated) requirement to pay the IBR filing fee and the disputed reimbursement owed. And once again, no consequences are forthcoming from the Division of Workers’ Compensation (DWC) or anyone else.

Sedgwick Overturned at IBR

In August of 2023, daisyCollect billed Sedgwick for a Supplemental Medical-Legal evaluation on behalf of a Qualified Medical Evaluator (QME) client. Sedgwick denied payment, incorrectly citing a lack of sufficient documentation.

Subsequently, daisyCollect submitted a perfectly compliant Second Review appeal to Sedgwick — which Sedgwick, true to its well-established penchant for non-compliance and habitual violations of California law, incorrectly denied as a “duplicate” of the original bill.

With no other choice, daisyColllect submitted the 70-page IBR request and $180 IBR filing fee.

It was an open-and-shut case; Maximus (the entity conducting IBR on the DWC’s behalf) overturned Sedgwick’s ludicrous denial and ordered Sedgwick to pay the bill and the filing fee. Maximus’ January 8, 2024, Final Determination letter is shown below.

Sedgwick Fails to Remit IBR Filing Fee

In case Maximus’ instructions weren’t clear enough, California Code of Regulations Section 9792.5.14 mandates (emphasis ours):

“If the independent bill reviewer finds any additional amount of money is owed to the provider, the determination shall also order the claims administrator to reimburse the provider the amount of the filing fee in addition to any additional payments for services found owing.”

Per California Labor Code Section 4603.2, Sedgwick had 45 days from the date of the Final Determination letter to remit every cent owed. Yet on January 25, Sedgwick remitted only the $650 owed for the evaluation.

daisyCollect then undertook the following time-and-resource-consuming steps to cajole Sedgwick into simply doing what the law requires (and what the DWC just can’t seem to enforce):

Date |

Action |

1/31/2024 |

daisyCollect contacts Sedgwick via Live Chat to obtain adjuster’s email |

1/31/2024 |

daisyCollect sends email to Sedgwick adjuster requesting IBR filing fee |

2/14/2024 |

daisyCollect sends second email to Sedgwick adjuster requesting IBR filing fee |

2/29/2024 |

daisyCollect sends third email to Sedgwick adjuster requesting IBR filing fee |

2/29/2024 |

Sedgwick adjuster replies to third email, asking to whom the IBR filing fee should be delivered |

2/29/2024 |

daisyCollect sends fourth email to Sedgwick adjuster confirming the IBR filing fee should be sent to the QME |

The above steps were taken in addition to:

- Submitting the original bill and required medical documents

- Submitting the Second Review appeal and required documents

- Compiling and submitting the 70-page IBR request with the required documents and $180 fee

Finally, on March 1, 2024 — 53 days after Maximus’ ruling, 8 days beyond the deadline to comply with Maximus’ ruling, and 193 days after daisyCollect submitted the original bill — Sedgwick issued the final $180 owed.

This is the state of workers’ comp billing in California: claims administrators like Sedgwick flout the rules, waste providers’ time and resources, and face no consequences.

It shouldn’t take this level of dogged determination on the part of providers (or their billing agents) to compel the likes of Sedgwick to fulfill their legal obligations. Unfortunately, inadequate enforcement of billing laws and regulations leave no other option.

Med-Legal billing requires specialized expertise. daisyCollect professionals use our advanced software (and years of experience) to protect your practice. Learn more below:

Learn More About daisyCollect

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

Although IBR was implemented by SB863, today I am mourning the 20 year anniversary of the effective date for SB899, which closely followed SB228 and brought us the MPN model in California.