Medical Director: CA Workers' Comp "Subsidizes Corruption"

Recently, the Medical Director of a large medical group sent an email to daisyBill, explaining their decision to "opt out" of treating injured workers in California.

This medical group’s decision to abandon workers’ compensation is a stark reminder that physicians have choices — and they are choosing to stop treating injured workers:

“Your organization has been the stand out in terms of informing every one of the insurance industry corruption and DIR incompetence/collusion that exists. Continued participation as a medical provider in such a system equates to enabling these entities to do what they do; we have decided to opt out [of treating injured workers] for the time being.”

The email explains that financial considerations primarily drove the decision. The medical group conducted an internal analysis which found that they collected only $0.40 for every dollar spent on caring for injured workers — and this medical group is undoubtedly not the only one in similar financial straits.

Below are more damning excerpts from the Medical Director’s email, outlining why this medical group has decided to say NO to the financial blunder of treating California’s injured workers and NO to pleading with regulators to promulgate sensible and protective regulations.

The only remaining question is how many physicians must abandon workers’ comp before California acknowledges that current laws and regulations function as nothing more than a hog trough, feeding gluttonous, profit-driven entities that know exactly how to wring the most slop from a corrupted system.

Unsustainable Reimbursement Reductions

The wake-up call for this Medical Director was an internal audit demonstrating that the practice has reportedly been losing significant revenue by treating injured workers.

“Our internal audit demonstrated we have been collecting 40 cents on the dollar. I knew our collections were poor, but not that poor. This is one of the reasons I was insisting on an audit as well as reaching out to your organization for over 2 years. “

Rather than reimbursing providers the rates mandated by the Official Medical Fee Schedule (OMFS), California allows PPOs and networks to implement “Pay-to-Treat” schemes that siphon reimbursements from physicians while providing zero services to injured workers.

Networks and PPOs can pressure providers into signing discount reimbursement contracts under threat of exclusion from the opaque, barely-regulated MPNs. These contracts reduce reimbursements to below OMFS rates and include terms that allow these entities to sell, lease, or transfer the contractual discounts to other claims administrators and their side-kick vendors.

These contractual MPN/PPO/Network discounts often result in reimbursements at or below Medicare rates, despite OMFS rates established well above Medicare rates (the Physician Fee Schedule reimburses at roughly 139% Medicare rates).

For example, in 2022, the State Compensation Insurance Fund (SCIF) paid doctors only 73% of OMFS rates for new-patient Evaluation and Management services — equivalent to just 97% of Medicare rates.

For this Medical Director, opting out of treating injured workers was as simple as summing the myriad administrative costs required to treat injured workers, summing the meager discounted reimbursements received for that care, and gasping in horror at the difference.

Providers’ Administrative Assembly Line

daisyBill has tirelessly exposed how claims administrators deny and reduce provider reimbursement through legal but insidious means or blatant (and unpunished) disregard of the law. Meanwhile, regulators pile burdensome — and well-enforced — regulations on providers.

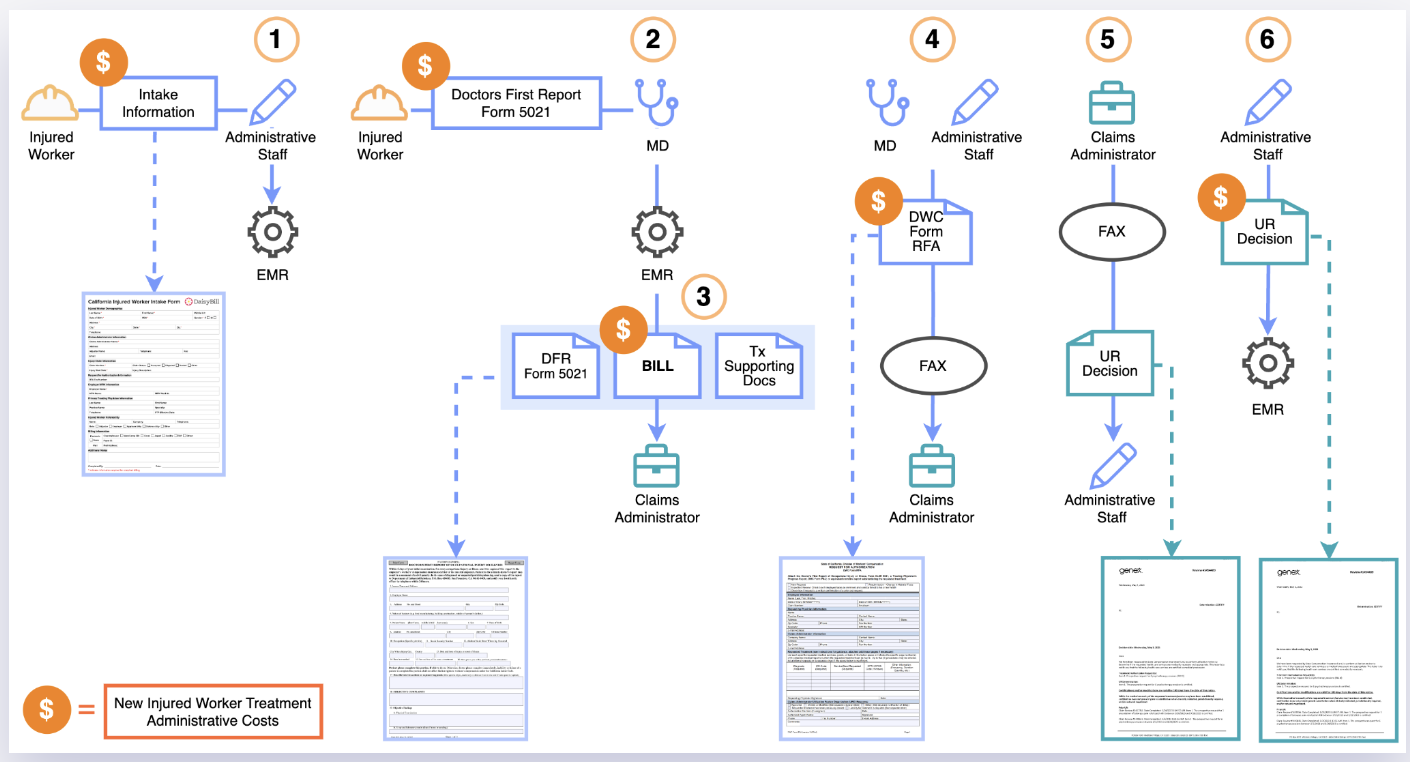

Treating an injured worker requires a provider to assemble an administrative assembly line, with staff trained to call claims administrators, complete (antiquated) forms, transmit those forms by fax machine, receive faxed responses, and transmit all of this documentation with their bills (including documents originally received from the claims administrator, in a pointless circular exchange).

California workers’ comp regulators mandate endless administrative tasks providers must undertake to receive payment, including:

- Calls to the claims administrator to ascertain a) if the provider is eligible to treat the injured worker and b) the details necessary to send a bill for the treatment

- The Doctor’s First Report of Occupational Injury, which the provider must complete and mail (two copies) to the employer

- Undertaking the absurd 10-step process necessary to determine MPN applicability and provider membership

- Bills for services that must include written documentation of the treatment rendered, a PDF of the Utilization Review decision authorizing the treatment, and proof treatment was furnished by an MPN-eligible provider

- Completing and faxing the Request for Authorization (RFA) form to the claims administrator to request additional treatment.

- Managing Utilization Review (UR) decisions faxed to the provider by the claims administrator, indicating whether the claims administrator considers the requested treatments medically necessary

Providers also expend additional administrative time and effort on managing nurse case managers, peer-to-peer requests, endless correspondence from attorneys, and employers’ demands for work status reports for every injured worker.

As this medical group’s financial audit revealed, once the MPN/PPO/Networks siphon off their share, the administrative costs of treating injured workers far exceed the paltry reimbursement rates.

Double-Sided Regulatory Environment - An Unholy Alliance

Enabled and empowered by inadequate, payer-skewed regulations and lax enforcement, claims administrators consistently find ways to deny or reduce payment improperly. In the email, the Medical Director expressed their disgust at what they see as an alliance between state regulators and insurers:

“We have no ongoing interest in subsidizing the corrupt insurance industries and the DIR [Department of Industrial Relations, under which the DWC operates]. As your organization has worked tirelessly to demonstrate, there is zero accountability in the WC system.”

When a claims administrator asserts that a provider failed to adhere to administrative requirements, the consequence is a swift and automatic denial of payment. Yet when a claims administrator denies payment on false grounds, the provider must undertake a long and arduous appeal process to disprove the improper denial.

How many reams of data showing implausible rates of payment denial and adjustment will it take before regulators take action to protect providers?

How many hundreds of millions of dollars in revenue recovered via Second Review appeals and Independent Bill Review (IBR) is enough to make the state regulators see how bill review has become a game of chicken?

Most importantly, how many good doctors have to walk away from serving injured workers at a financial loss because California prioritizes the profits of claims administrators and their sidekick vendors over the care provided to injured workers?

An Unsustainable System?

“I can only hope for a total collapse/implosion and eventual restructuring (in which MPNs, biased, profit-generating UR, corrupt bill review and downcoding, and hidden PPO reductions do not exist).

If we re-engage at some point in the future, we plan to proactively avoid any agreed upon fee schedule reductions, etc. “

In a glimmer of hope for the future of workers’ comp, California recently shelved a potentially disastrous bill designed to give network entities increased control over the Medical Provider Network (MPN) system. But AB 1278’s failure will not be the last battle for the soul of workers’ comp.

The usual flaunting of payment regulations by claims administrators who fear no consequences will continue. Providers’ administrative staff will continue to struggle with outdated and useless forms. The system’s profiteers will continue to find ways around the all-but-meaningless state fee schedules through discount reimbursement models, paying whatever the lowest bidder is willing to accept.

This Medical Director’s sizable practice will not be the last California healthcare provider to do the math and conclude that treating injured workers under the status quo is a financial blunder.

This medical group’s decision is a dire warning for employers. While providers can choose to stop treating injured workers (and more providers surely will make that choice), injured workers cannot “opt out” of this broken system.

Workers’ comp can work for providers. daisyBill software, data, and expertise make billing easier, faster, and less costly. Sign up for a free demonstration below.

FREE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.