DWC's Failed WCIS Taints CHSWC Reports

With 49 cents spent on administrative expenses for every dollar spent on actual benefits (over absurdly stretched 7-year claim durations) California workers’ comp is in a four-alarm state of bedlam.

To protect employers and injured workers, California needs sober, cogent analysis of the system. Instead, we get reports from the Commission on Health and Safety and Workers’ Compensation (CHSWC).

Many in the California government consider CHSWC reports authoritative. Yet the underlying data are questionable at best—thanks in significant part to the deficiencies of the Workers’ Compensation Information System (WCIS).

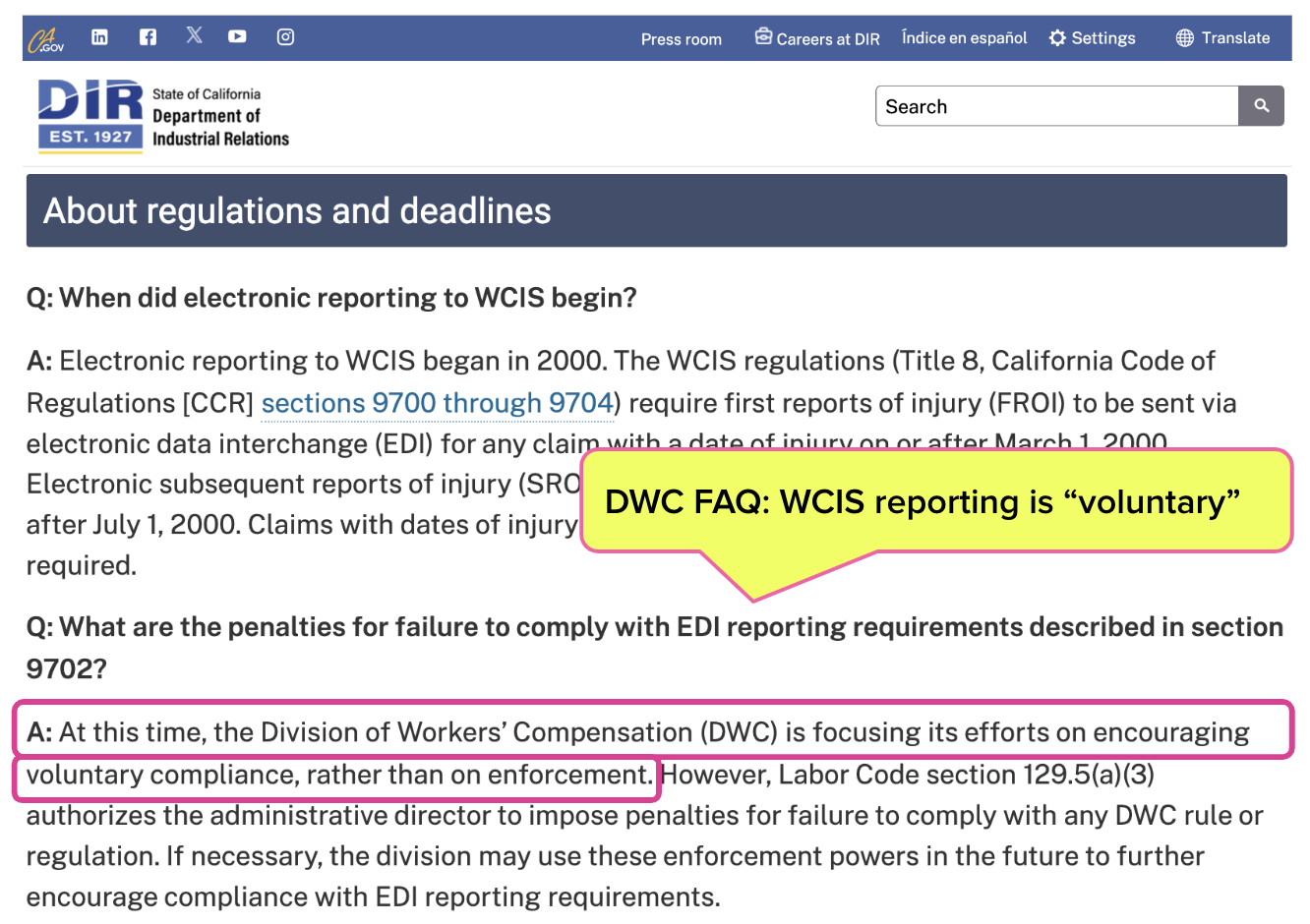

We recently unpacked the Division of Workers’ Compensation (DWC) 's failure regarding WCIS; though legally required to enforce mandatory reporting to WCIS, with penalties for non-compliant claims administrators, the DWC openly states that WCIS reporting is “voluntary.”

This means that WCIS data are self-reported and unverified. Moreover, WCIS data are not available to stakeholders or the public for review. Essentially, data from WCIS comprises whatever claims administrators feel like reporting.

Below, we explore how CHSWC relies on these unverified, self-reported, publicly unavailable WCIS data to create its annual reports. As the DWC ignores the law, the system remains inscrutable and unaccountable—while claims administrators, their sidekick vendors, and private equity firms rake in profit.

“Rigorous” Research Based on WCIS

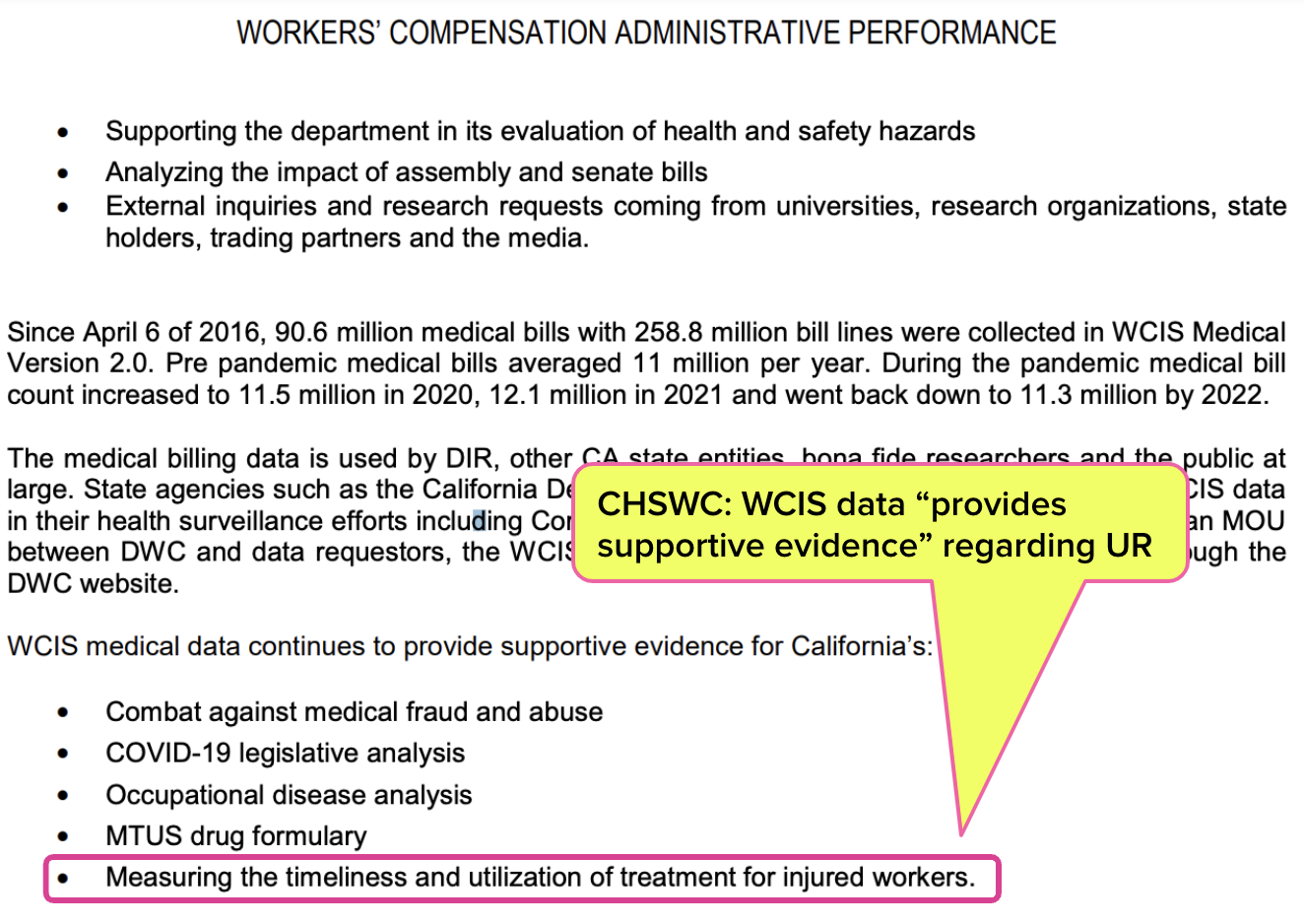

Throughout its annual reports, CHSWC cites data from the DWC, specifically WCIS data. CHSWC sings the praises of WCIS in its 2023 Annual Report, noting (emphases ours):

WCIS data is being used more than ever to help monitor and improve the WC system in California. The quality of the data has enabled rigorous empirical research, providing a real, data-informed foundation for policy.

However, the DWC WCIS FAQ page, under “About regulations and deadlines,” (screenshot below) confirms that WCIS data are hardly comprehensive.

The DWC has declared, in full view of legislators, stakeholders, and the public, that it does not enforce WCIS reporting requirements. Instead, the DWC “is focusing its efforts on encouraging voluntary compliance.”

This is either laughable, disturbing, or both.

WCIS data comprise whatever claims administrators feel like voluntarily reporting, unverified and unmonitored by any authority in a consequence-free environment. We have no idea of the volume or quality of data submitted by claims administrators, as only the DWC and CHSWC have access to it. “Rigorous” indeed.

WCIS Data: Shedding (Zero) Light on UR

CHSWC claims (on page 155) that WCIS data provide evidence regarding Utilization Review (UR), the process by which claims administrators approve or deny the care recommended by injured workers’ treating physicians.

Fun fact: this may be bunk, since the DWC has been ignoring state law requiring the agency to collect comprehensive UR data since 2016. To our knowledge, the DWC has no useful UR data from WCIS or anywhere else.

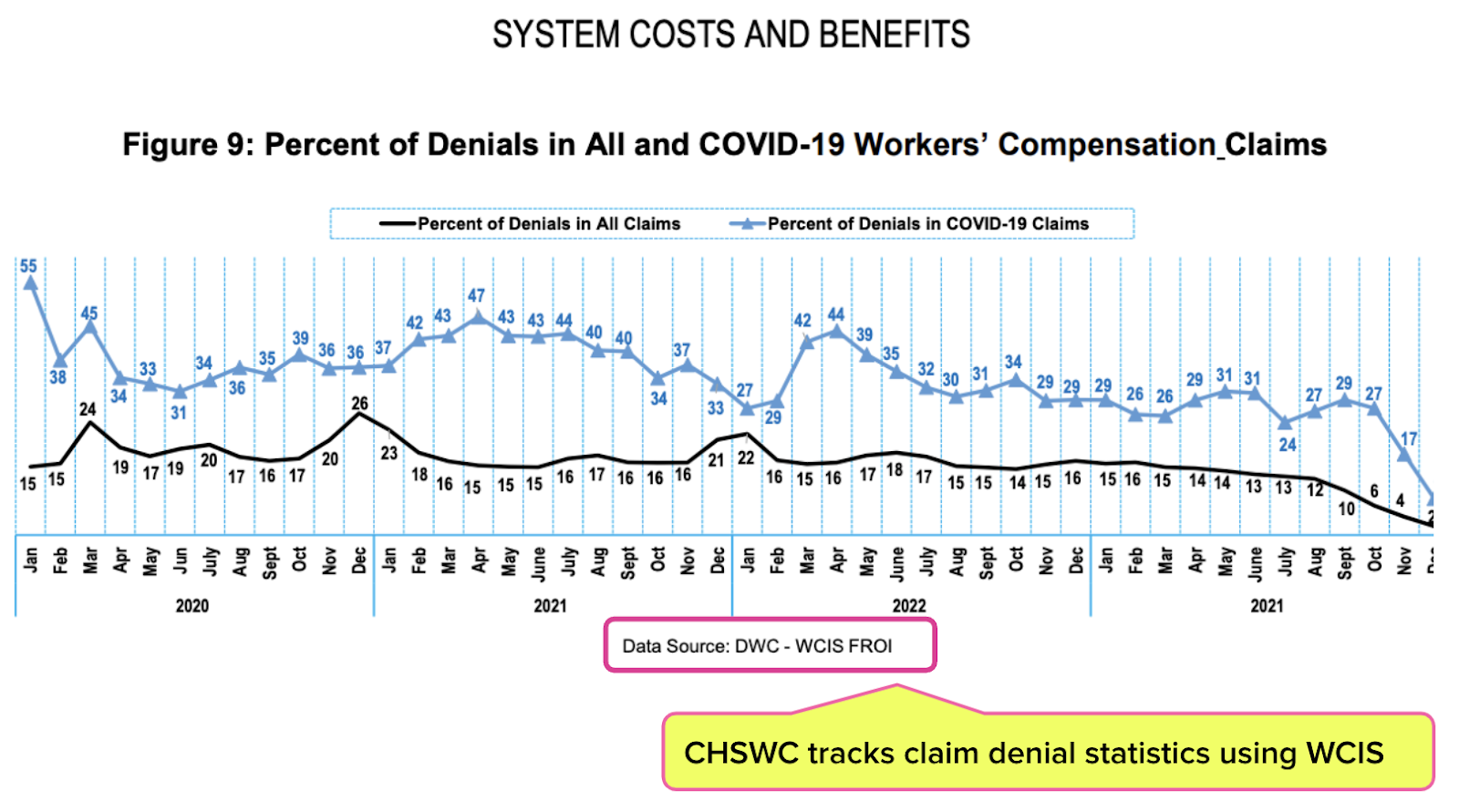

However, CHSWC reports on denial rates for workers’ comp claims (both system-wide and specifically for COVID-19 claims) using WCIS data (page 43).

Again, bear in mind that the DWC ignores California law requiring the DWC to gather solid UR data. Apparently, CHSWC is confident that WCIS somehow has all the UR data necessary to draw useful conclusions—despite the data being self-reported, not verified by any third party, and almost certainly incomplete.

WCIS Data: Key to CHSWC Fraud Analyses

In its report, CHSWC also makes recommendations for tackling fraud. One tool CHSWC recommends for identifying fraud is WCIS data (page 14).

This raises a troubling question: if data are submitted to WCIS voluntarily by claims administrators, with no verification of said data, how can it be considered hard evidence of fraud?

WCIS Data: Preventing Target Audits?

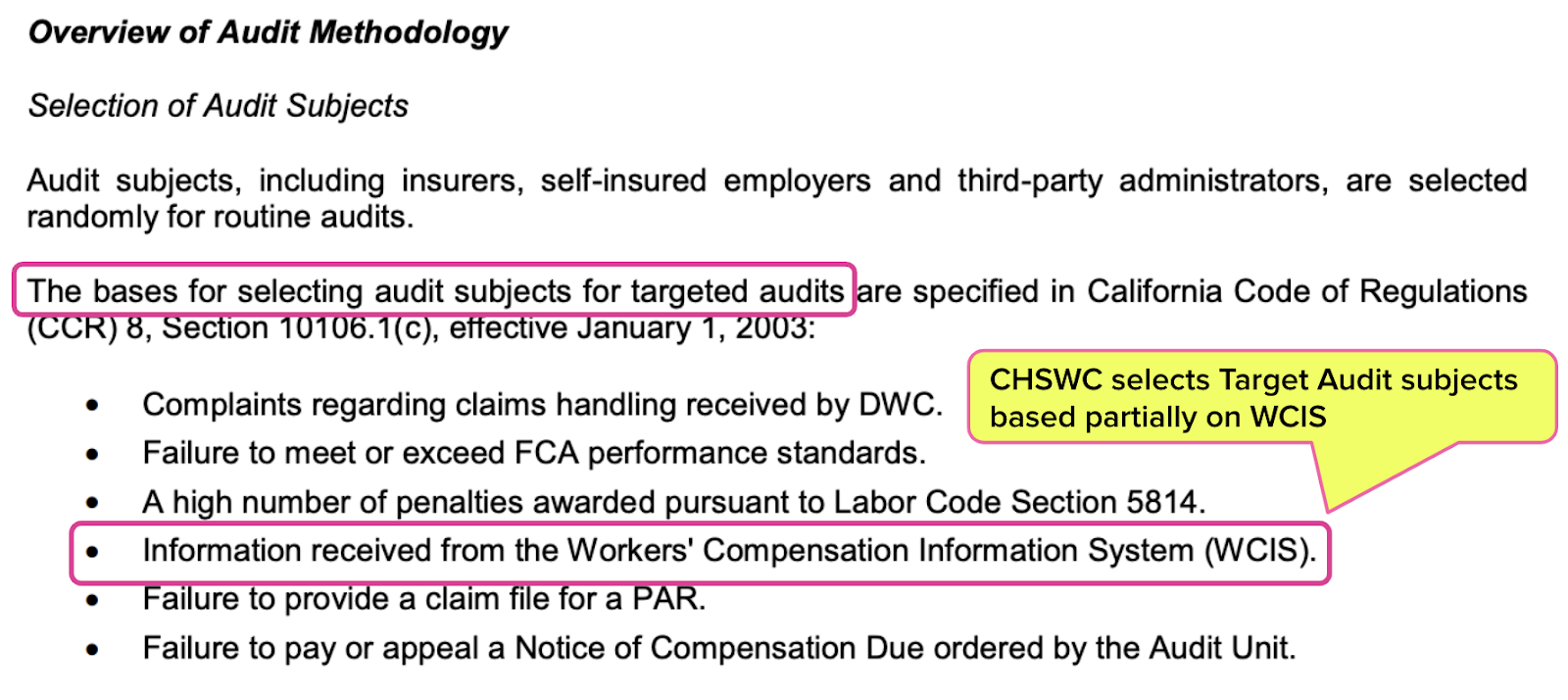

Finally, CHSWC’s report sheds light on an issue that has frustrated daisyBill for some time—the DWC’s apparent refusal to conduct Target Audits against claims administrators that may be guilty of patterns of non-compliance with payment laws and regulations.

According to the report, the DWC selects target audit subjects based on several factors. One of those factors is—you guessed it—“Information received from” WCIS (page 108).

WCIS Data: Key to CHSWC Study on Impact of Legislation

CHSWC’s Special Report (included in the 2023 annual report) on the effects of California Senate Bill 863 on UR also cite WCIS as the “primary data source” (page 260).

Voluntary Data, Predictable Results

For all CHSWC’s reliance on WCIS data, reporting to WCIS is effectively optional—leaving serious doubts as to whether WCIS data truly reflect the realities of the workers’ comp system.

By its inexplicable refusal to fulfill its regulatory obligations, the DWC has created an “Honor System” for claims administrators. As a result, California stakeholders are fed a data diet that comes almost exclusively from either questionable, voluntary WCIS data, or from insurer-reported, unverified Workers’ Compensation Insurance Rating Bureau (WCIRB) data.

The CHSWC report is the best example of this troubling pattern.

Without trustworthy data, legislators, regulators, and other stakeholders have no way to improve this rickety system. Unable to conclusively identify systemic problems, determine where the money goes, and see who benefits from dysfunction, we are rudderless.

Know (and get) exactly what you’re owed for treating injured workers. Get instant, accurate fee schedule calculations with daisyWizard’s OMFS Calculator.

TRY THE CALCULATOR

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.