AmeriTrust: IBR Hall of Shame

Can claims administrators defy California law, make up their own proprietary payment rules, and refuse to reimburse providers who treat injured workers correctly? The answer is YES.

In the story below, AmeriTrust demonstrates how the workers’ comp system allows claims administrators to ignore the insufficient protections in place for providers. Worse, it is far from an isolated incident.

When a provider prevails at Independent Bill Review (IBR), California law requires the claims administrator to reimburse the provider the $180 filing fee the provider paid to Maximus, the entity that conducts IBR. Yet claims administrators routinely fail to remit this fee — mainly because the Division of Workers’ Compensation (DWC) does little to enforce its (already payer-friendly) regulations.

With no way to bill for or otherwise pursue reimbursement of IBR filing fees, providers can only beg and hope that claims administrators voluntarily comply with the law.

AmeriTrust - 5 Steps To Avoid Payment

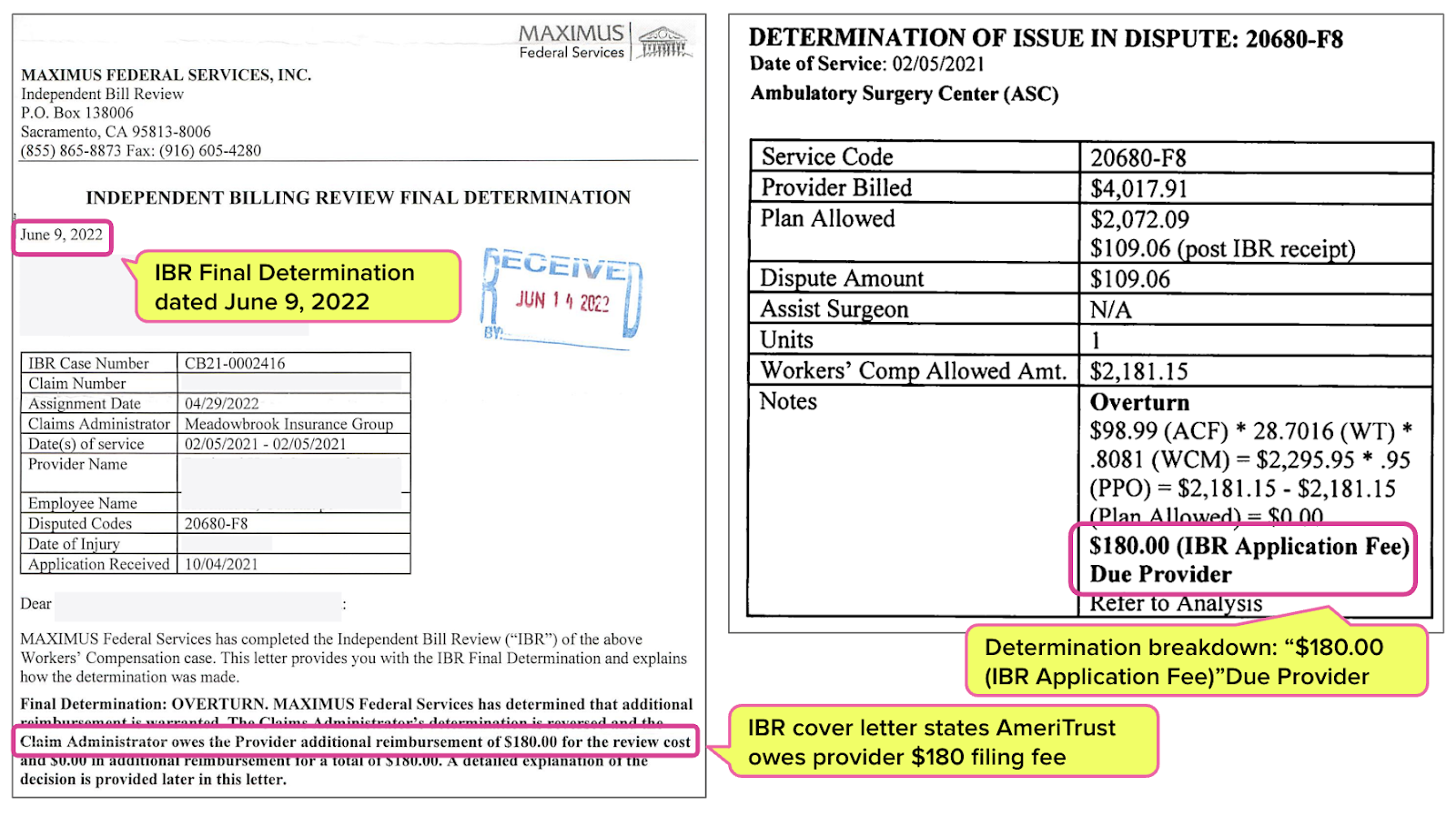

Initially, AmeriTrust shorted the provider $109 in reimbursement for an injured worker’s treatment. Below is the torture that ensued when the provider attempted to collect the payment owed:

- The provider complied with California law and submitted a Second Review appeal requesting the $109 additional payment. AmeriTrust denied the Second Review appeal, refusing to pay the $109.

- The provider complied with California law and paid $180 to request Independent Bill Review (IBR). After the provider filed for IBR, AmeriTrust paid the provider the $109 owed.

- Maximus agreed that AmeriTrust initially incorrectly reimbursed the provider. Maximus instructed AmeriTrust, per California law, to reimburse the provider the $180 IBR filing fee.

- AmeriTrust failed to reimburse the provider the $180 IBR filing fee.

- The provider contacted AmeriTrust, which claimed they owed no further payment because the provider missed the “timely filing” deadline.

So we’re clear: “timely filing” does not apply to paying the IBR filing fees. Providers do not send bills for IBR filing fees. California Labor Code mandates that claims administrators whose errors are overturned at IBR reimburse the $180 to the provider within 45 days.

With no way to enforce the IBR filing fee repayment, this provider paid $180 (in addition to the enormous administrative resources expended) to collect $109. Heads, the claims administrator (always) wins; tails, the provider (always) loses.

AmeriTrust Overturned at IBR

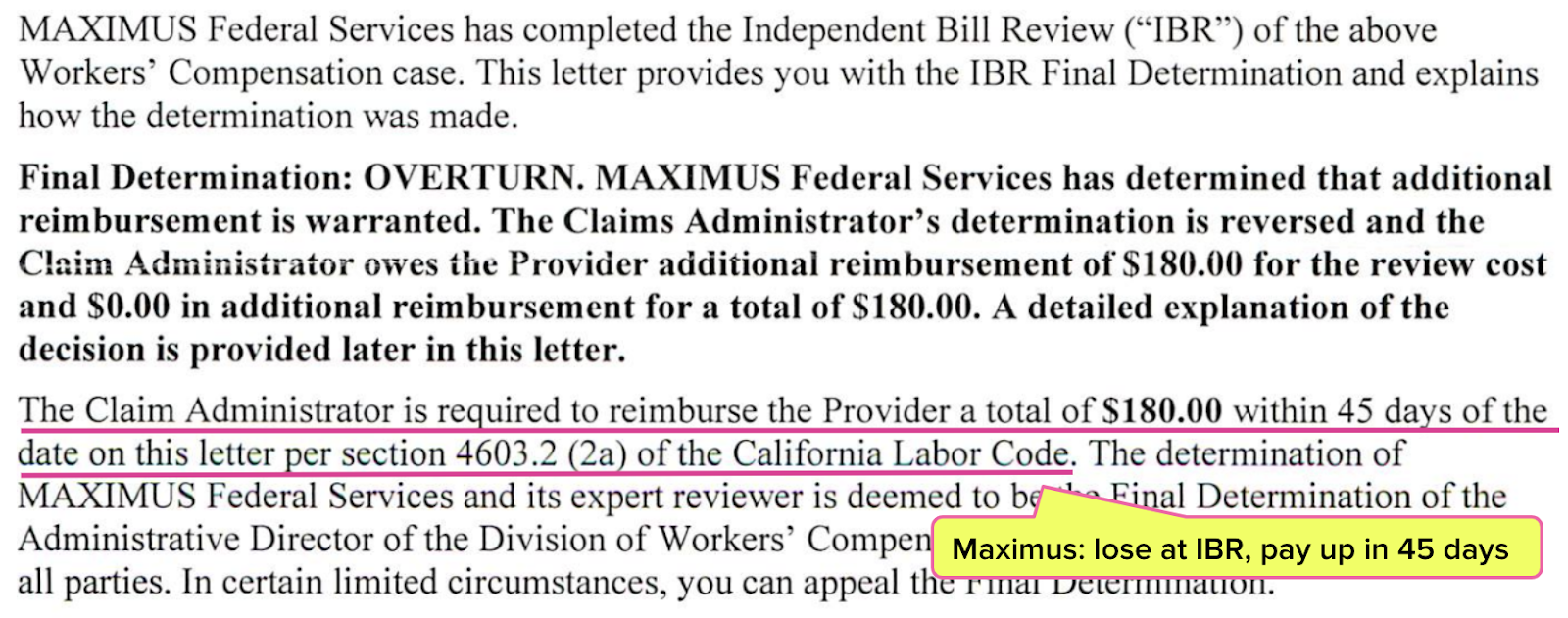

In June of 2022, Maximus overturned AmeriTrust’s improper adjustment. In its Final Determination letter, Maximus clearly instructed AmeriTrust to reimburse the provider the IBR application fee:

“Provider submitted EOR reflecting reimbursement of $109.06, received post IBR receipt, for a total reimbursement of $2,181.15. No additional reimbursement is due. $180.00 IBR application fee is the only amount due.” (emphases added)

Moreover, the Final Determination letter and the determination breakdown reiterated exactly what AmeriTrust owed (the letter lists the claims administrator as “Meadowbrook Insurance Group,” a previous iteration of AmeriTrust).

However, AmeriTrust ignored Maximus and California law.

AmeriTrust Claims “Timely Filing” Issue With IBR Filing Fee

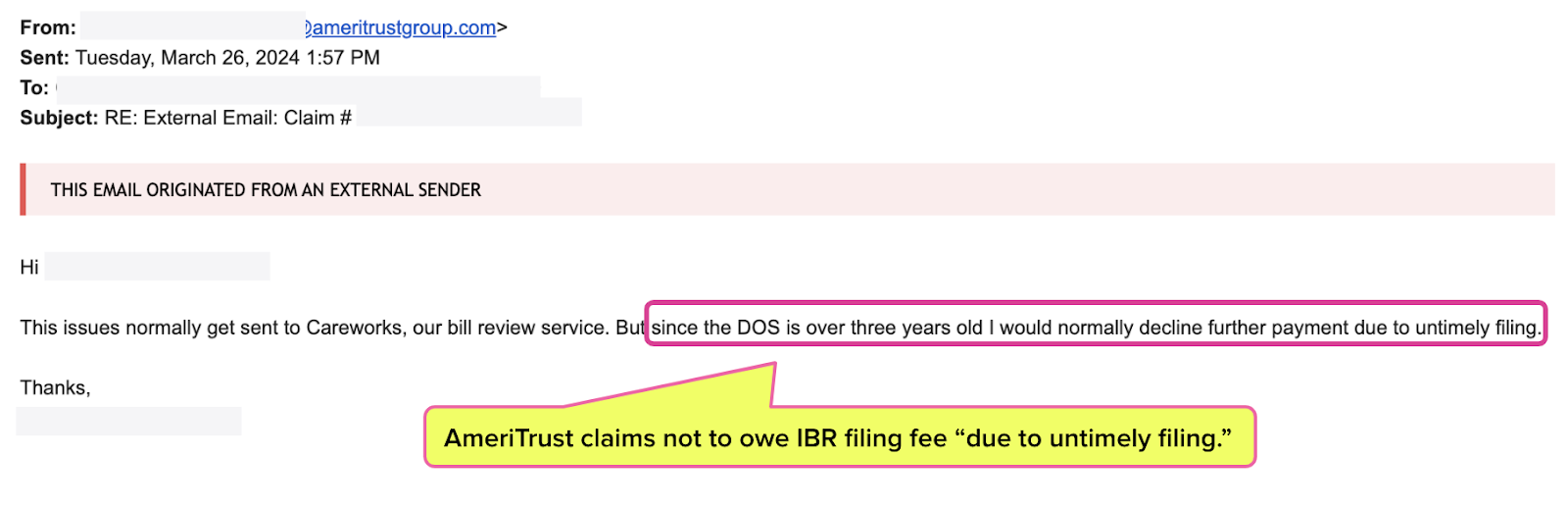

In March of 2024, the provider’s staff sent an email (below) to AmeriTrust, helpfully reiterating what AmeriTrust owed.

AmeriTrust, an insurer operating in California that should have a basic grasp of workers’ comp reimbursement and dispute resolution, questioned whether it was still obligated to pay.

An AmeriTrust representative claimed that the provider failed to send a bill for the IBR filing fee in a timely manner, despite the fact that there is no way for a provider to bill for a missing IBR filing fee. We here at daisyNews wouldn’t believe it ourselves if we hadn’t seen the email below.

With that, we offer readers (and hopefully, the folks at AmeriTrust) two basic facts about IBR:

Fact #1: California Code of Regulations Section 9792.5.14 states (emphasis ours):

“If the independent bill reviewer finds any additional amount of money is owed to the provider, the determination shall also order the claims administrator to reimburse the provider the amount of the filing fee in addition to any additional payments for services found owing.”

Fact #2: Following an IBR Final Determination, the claims administrator must pay up within 45 days per California Labor Code Section 4603.2, as cited in the Final Determination letter (below).

In both the Final Determination letter and LAB §4603.2, we missed the part about the provider having to “timely file” a bill for money owed due to IBR — because it doesn’t exist. Again, there is no way to bill for an IBR filing fee or any other money owed per IBR. Nor should there have to be, as the claims administrator’s responsibilities are well-established.

However, failure to include the filing fee is a notoriously common offense among claims administrators, who have little to fear regarding regulatory repercussions. All too often, claims administrators pay the additional reimbursement due but fail to send the $180 IBR fee.

Disputing an incorrectly denied or underpaid bill can be challenging enough. But when a claims administrator can make up their own rules and disregard California law with impunity, it’s hard not to understand why providers give up on treating injured workers altogether.

With tools for quicker, easier appeals, daisyBill helps your practice demand full reimbursement — with just a few clicks. Learn more or request a demo below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

Why not file Non-IBR petition?