California MPNs: Camouflage for Discounts and Denials

Medical Provider Networks (MPNs) are under fire — as they should be.

Far too often, Calforina claims administrators (aka ‘payers’) use MPNs — and providers’ unfamiliarity with how they work — to avoid properly paying providers for authorized services. Commonly, claims administrators cite MPNs to reduce provider reimbursement in two ways:

- Tying the provider’s inclusion in the employer’s MPN to the reasoning behind reduced or denied payments

- Rescinding authorization based on the provider’s non-inclusion in the employer’s MPN

Both practices are cynical attempts to take advantage of how impenetrable the MPN system can be for providers. These manipulative tactics don’t even rise to the level of loopholes — they are simply ploys to cloak incorrectly paid reimbursements or improperly denied services.

MPNs and Denied Reimbursements

Some claims administrators use the provider’s inclusion in an MPN to justify reducing or denying provider reimbursements below the amount allowed by the Official Medical Fee Schedule (OMFS).

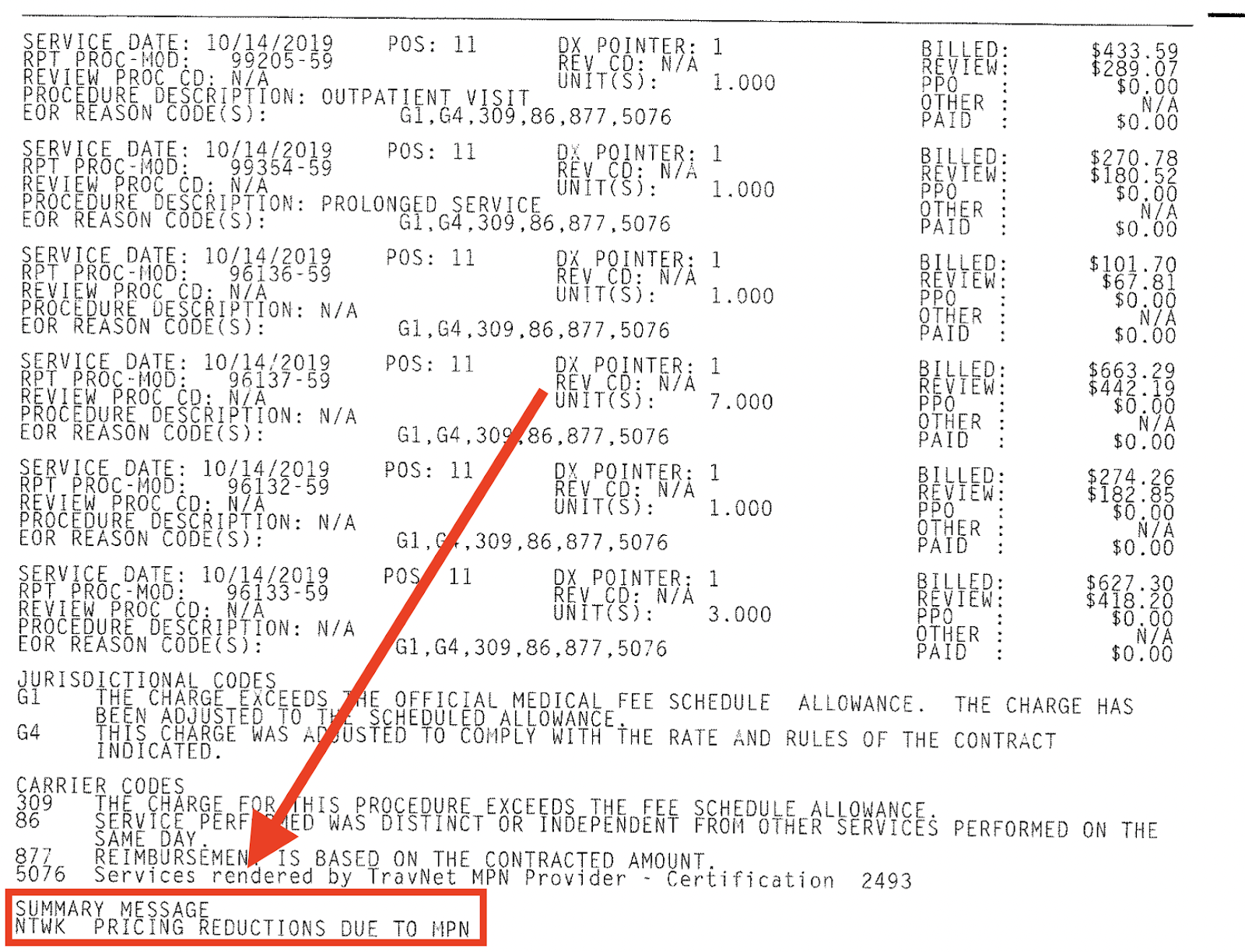

For example, Travelers Insurance inexplicably denied payment for authorized services, returning a nonsensical Explanation of Review (EOR) that offered no explanation at all. When DaisyBill reached out to Travelers, a supervisor there pointed to the EOR’s summary message: “NTWK PRICING REDUCTIONS DUE TO MPN.”

When a provider agrees to participate in an MPN, they agree to participate in an MPN, and nothing more. No discounts should be included or implied. Unfortunately, many entities pressure providers to join non-MPN discount networks as a condition of inclusion in MPNs (we’ll explore that in a future post).

MPN inclusion should not entitle the payer to any sort of reimbursement discount.

Because of their entanglement with various reimbursement discount schemes, MPNs in their current form are as dangerous to practice revenue as PPOs.

MPNs and Authorization

To be absolutely clear: The provider’s inclusion, or lack thereof, in an MPN has no legal bearing whatsoever on reimbursement for authorized treatment. This is an unambiguous fact of California workers’ comp. Labor Code Section 4610.3 states:

...an employer that authorizes medical treatment shall not rescind or modify that authorization after the medical treatment has been provided based on that authorization for any reason, including, but not limited to, the employer’s subsequent determination that the physician who treated the employee was not eligible to treat that injured employee [emphasis added]...

The claims administrator may compliantly refuse to process the Request for Authorization that the provider submitted, based on a provider’s non-inclusion in the employer’s MPN. However, authorization granted cannot be rescinded, even if the claims administrator later discovers the provider is not in the employer’s MPN.

On their website, the DWC hammers this point home:

...authorization shall not be rescinded or modified for any reason after the medical treatment has been provided based on the authorization, even if the employer later determines the physician was not eligible to treat (e.g. was not an MPN provider) [emphasis added]...

And yet, on many occasions we’ve seen claims administrators deny reimbursement for authorized services on the basis of MPN non-inclusion. Insurance company Employers Holdings even went as far as offering “conditional” authorization, claiming the right to rescind authorization if the provider is not a member of the MPN — in bald-faced contravention of the rules.

Far removed from anything to do with ensuring quality care or even controlling employer costs, MPNs have devolved into just another way to hustle providers out of full reimbursement.

Make RFAs, billing, and appeals easier than ever — and get paid faster. DaisyBill empowers providers to collect what’s owed in record time. Contact us to learn how we can help your practice.

LET’S CHAT!

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)