Tristar: 2,315 Audit Complaints Filed With CA DWC

Third-Party Administrator (TPA) Tristar Risk Management continues to ignore California workers’ comp billing regulations with impunity, burdening providers with administrative work and making it more challenging to treat injured workers.

Specifically, Tristar failed to send electronic Explanations of Review (e-EORs) for 95% of the e-bills submitted by providers from June 15, 2023, through July 31, 2023.

Critical to e-billing, e-EORs automatically post payment in the provider’s system, saving countless hours of administrative work — which is why California regulations require claims administrators to return an e-EOR within 15 working days of receiving an e-bill.

Tristar’s self-insured employer and insurer clients should take notice of the verifiable data below, which demonstrates the TPA’s blatant lack of compliance with California regulations. Additionally, the Insurance Commissioner or the Director of Industrial Relations should carefully review Tristar’s certificate of consent to administer claims of self-insured employers.

California Labor Code Section 129.5 empowers the DWC to impose administrative penalties of $100 for each instance of a TPA failing to “comply with any rule or regulation of the administrative director.”

Previously, on 7/12/2023, daisyBill filed 3,678 Audit Complaints with the Division of Workers’ Compensation (DWC) reporting Tristar’s failure to send e-EORs in response to e-bills submitted by providers from March 30, 2023, through June 14, 2023.

On 8/29/2023, daisyBill filed an additional 2,315 Audit Complaints with the DWC, reporting Tristar’s continued non-compliance.

According to our arithmetic, Tristar should be penalized as follows:

e-Bill Submission Timeframe |

Count of Tristar e-Bills Missing e-EOR |

Audit Penalty Calculation |

3/30/2023 - 6/14/2023 |

3,678 |

$367,800 |

6/15/2023 - 7/31/2023 |

2,315 |

$231,500 |

Total |

5,993 |

$599,300 |

Will the DWC impose monetary penalties? A 2023 non-compliance rate of 92% missing e-EORs, unresolved over months despite repeated outreach, goes beyond an isolated technical glitch or momentary failure. The data forces us to wonder whether Tristar’s repeated violations constitute a business practice in violation of California regulations.

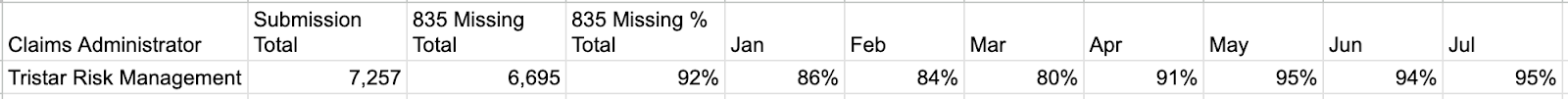

In our Audit Complaint, daisyBill provided the DWC with the following statistics regarding Tristar’s 2023 regulatory violations:

Revocation: Certificate of Consent to Administer Claims

When a claims administrator engages in a general business practice of failing to adhere to its obligations in a manner that causes injury to those dealing with it, Labor Code Section 129.5 directs that the DWC administrative director refer the violation to the Insurance Commissioner or the Director of Industrial Relations and request a hearing to determine further actions (emphases added).

Upon a second or subsequent finding, the administrative director shall refer the matter to the Insurance Commissioner or the Director of Industrial Relations and request that a hearing be conducted to determine whether the certificate of authority, certificate of consent to self-insure, or certificate of consent to administer claims of self-insured employers, as the case may be, shall be revoked.

As we know, there is no law without enforcement. Sadly, historical precedent suggests that no thinking person should hold their breath waiting for an announcement of penalties by the DWC, or of hearings investigating Tristar’s certificate to administer claims of self-insured employers.

Audit Complaint: Tristar e-EOR

Below is the formal Audit Complaint submitted by daisyBill to the DWC:

To: XXXXXXXX@dir.ca.gov

Subject: Tristar EDI Non-compliance: X12 835 Missing - Count 2,315

Below is an Audit Complaint reporting credible data that Tristar Risk Management failed to send 2,315 electronic EORs (X12 835) to daisyBill providers as mandated by California law.

A provider's receipt of an electronic EOR (X12 835) is a critical component of electronic billing for the following three reasons:

- The electronic EOR closes the payment loop for a workers’ comp e-bill, and

- Automatically posts to the respective e-bill, thereby significantly reducing a provider's administrative burden of manually recording payment information to the respective e-bill, and

- Allows the gathering of essential payment data about the claims administrator hidden in the paper EORs mailed to individual providers.

This Audit Complaint data represents California workers’ comp e-bills submitted to Tristar Risk Management by daisyBill providers from June 15, 2023 through July 31, 2023.

On 8/4/2023, Tristar’s Quality Assurance Manager emailed the DWC Audit Unit and daisyBill responding to the 3,678 Audit Complaints the DWC forwarded Tristar on 7/12/2023. This Tristar correspondence did not address Tristar’s failure to send Explanations of Review electronically as reported in the 7/12/2023 Audit Complaints.

Subsequently, as the data below indicates, Tristar continues to fail to respond to 95% of e-bills sent by daisyBill providers with the required electronic Explanations of Review.

Attached is a CSV list containing 2,315 e-bills providers submitted where Tristar failed to return a mandated electronic EOR to the provider. The attached CSV list includes the following columns:

- Column L: [Bill] Transmission Date

- Column W: EOR (835) Compliance Due Date

- Column X: 835 EOR: Receipt Date - This column is BLANK because Tristar failed to send the provider an electronic EOR (835).

- Column AO: Patient Name

- Column AP: Claim Number

Audit Complaint Details

This Audit Complaint Data submitted to the DWC represents a credible complaint and credible information of claims handling violations. Per Title 8, California Code of Regulations section 10111.2(b)(10),(11), Tristar should be subject to audit penalties.

EDI Non-compliance: Claims administrator failed to send an electronic Explanation of Review (EOR) in the mandated ASC X12N/005010X221A1 (835) format, despite the claims administrator sending a 277 Acknowledgement accepting the Original Bill / Second Review Appeal.

DWC Rule 7.1 requires the claims administrator to electronically send an EOR to the provider using the X12 835 EDI standard within 15 working days of receipt of an e-bill.

Per California DWC Medical Billing and Payment Guide 7.2, any electronically submitted bill determined to be completed, not paid, or objected to within the 15 working day period shall be subject to audit penalties per Title 8, California Code of Regulations section 10111.2(b)(10),(11).

daisyBill tracks responses to your bills, appeals, and RFAs — so your practice knows when payers break the rules. Click below to learn more, or request a demonstration.

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.