US Dept of Labor (DOL): Avoid the 5 Most Common Billing Mistakes (2025)

.gif)

In daisyBill’s experience, the United States Department of Labor (DOL) is a model workers’ comp claims administrator (aka payer or carrier), consistently paying providers accurately and rapidly for injured worker treatment.

When sending the DOL a paper bill for non-facility treatment, providers treating injured DOL workers must send the DOL a compliant OWCP-1500 form that conforms to the Office of Workers’ Compensation Programs (OWCP) OWCP-1500 rules.

Providers must complete the OWCP-1500 form with information different from the billing information required by Medicare or private insurance.

While the OWCP-1500 closely mirrors the CMS-1500, below are five essential billing instructions that providers must follow to compliantly submit workers’ comp bills non-electronically to the DOL using the OWCP-1500.

daisyBill clients: You do not need to read this article because daisyBill electronically submits all bills to the DOL.

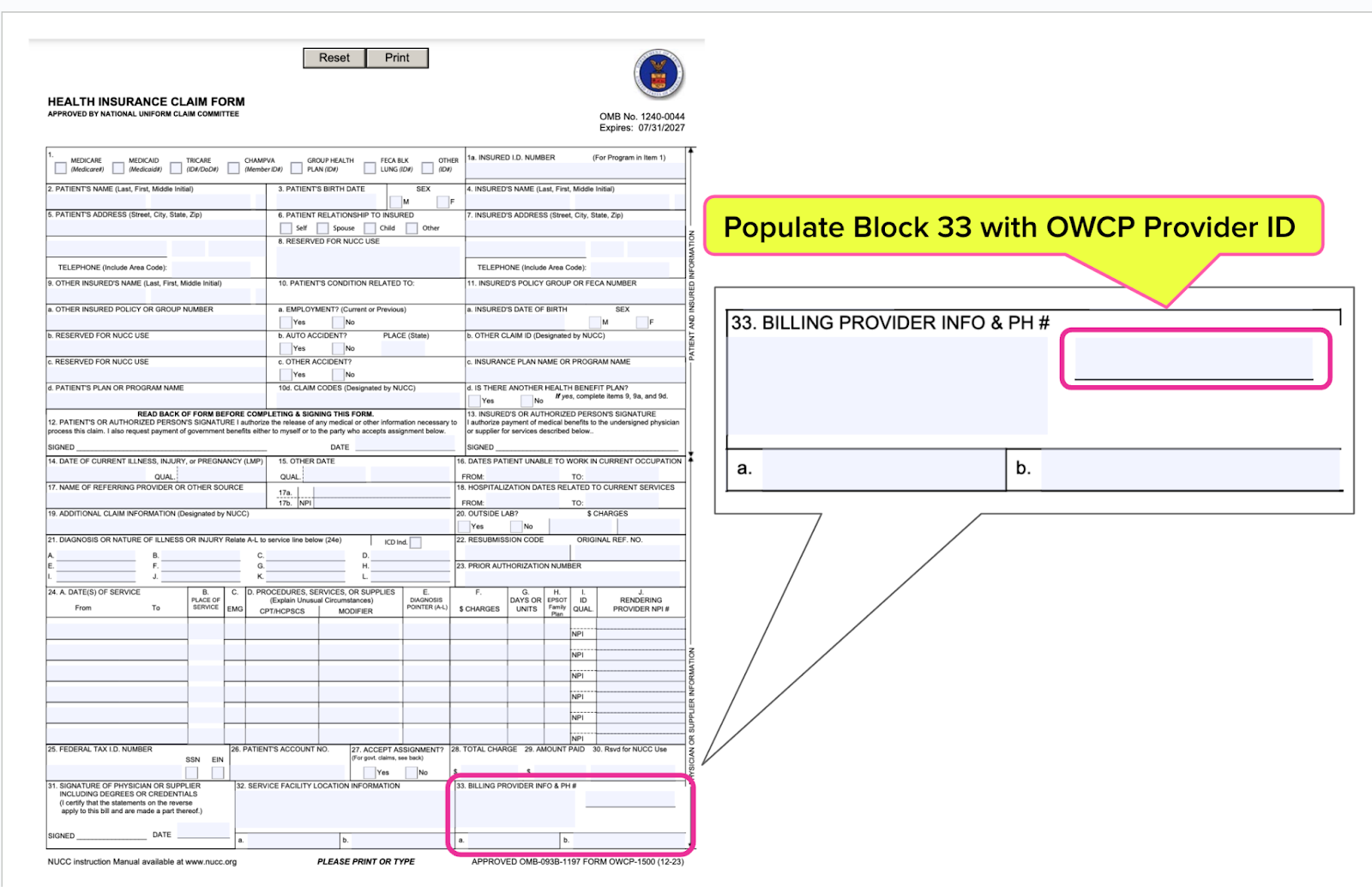

OWCP-1500 Instruction #1: Block 33

In the specified area on the upper right side of Block 33, enter the 9-digit individual or group OWCP Provider ID of the provider billing for the service.

The 9-digit OWCP Provider ID is issued upon successful enrollment in the OWCP Program and is located on the Provider Welcome Letter under the Correspondences on the WCMBP Portal.

If the 9-digit OWCP Provider ID is missing or invalid, the bill will be Returned to Provider (RTP) and must be resubmitted, resulting in delays in payment processing.

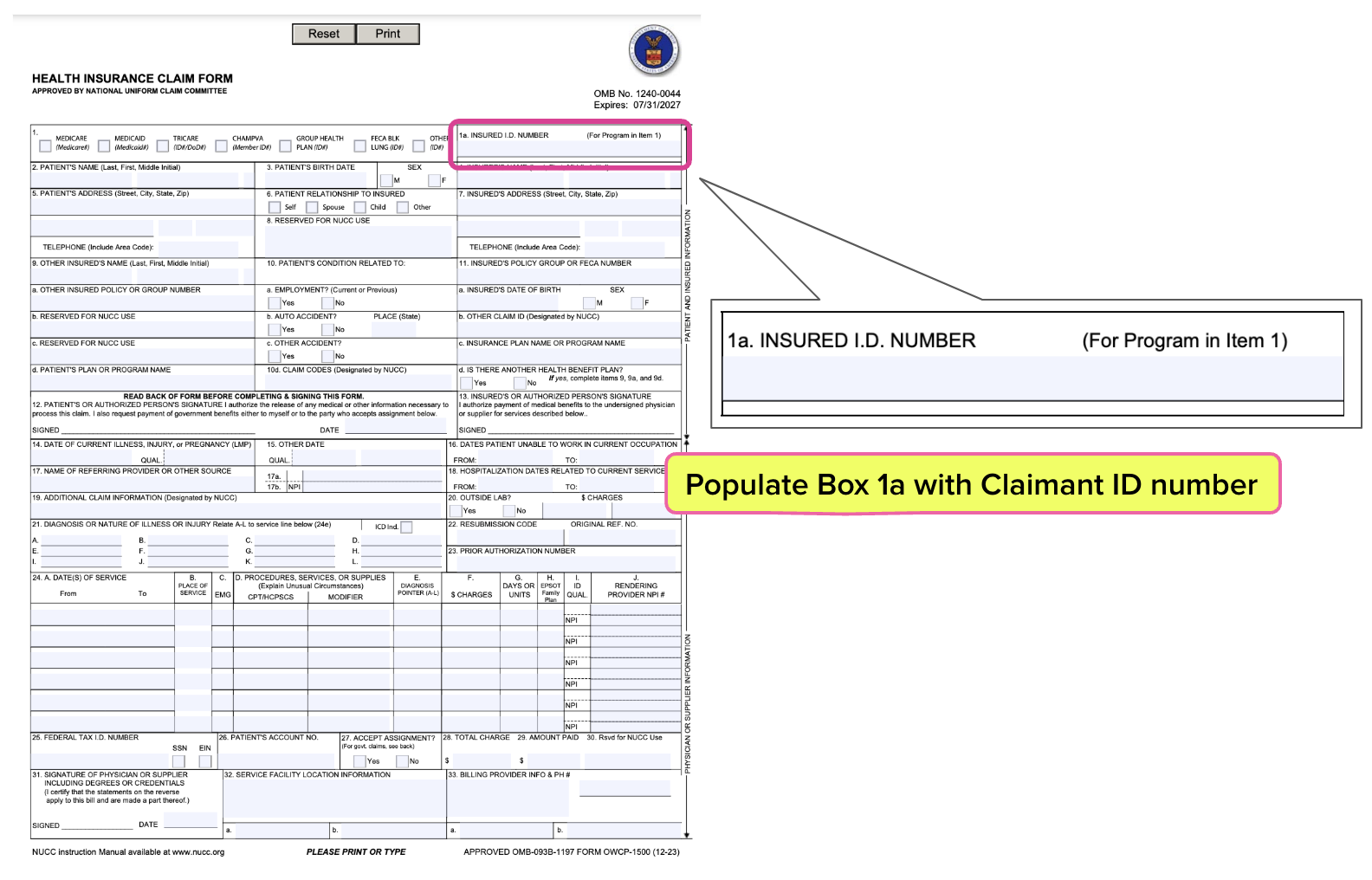

OWCP-1500 Instruction #2: Block 1a

Populate Box 1a with the Claimant ID number assigned to the injured worker by the DOL.

The Claimant ID is the number assigned to an injured worker by the OWCP, and may be obtained from the injured worker. The claimant’s SSN is not their Claimant ID number and should not be used here.

If the Claimant ID number is missing or invalid, the bill will be Returned to the Provider (RTP) and will have to be resubmitted, causing a delay in payment consideration.

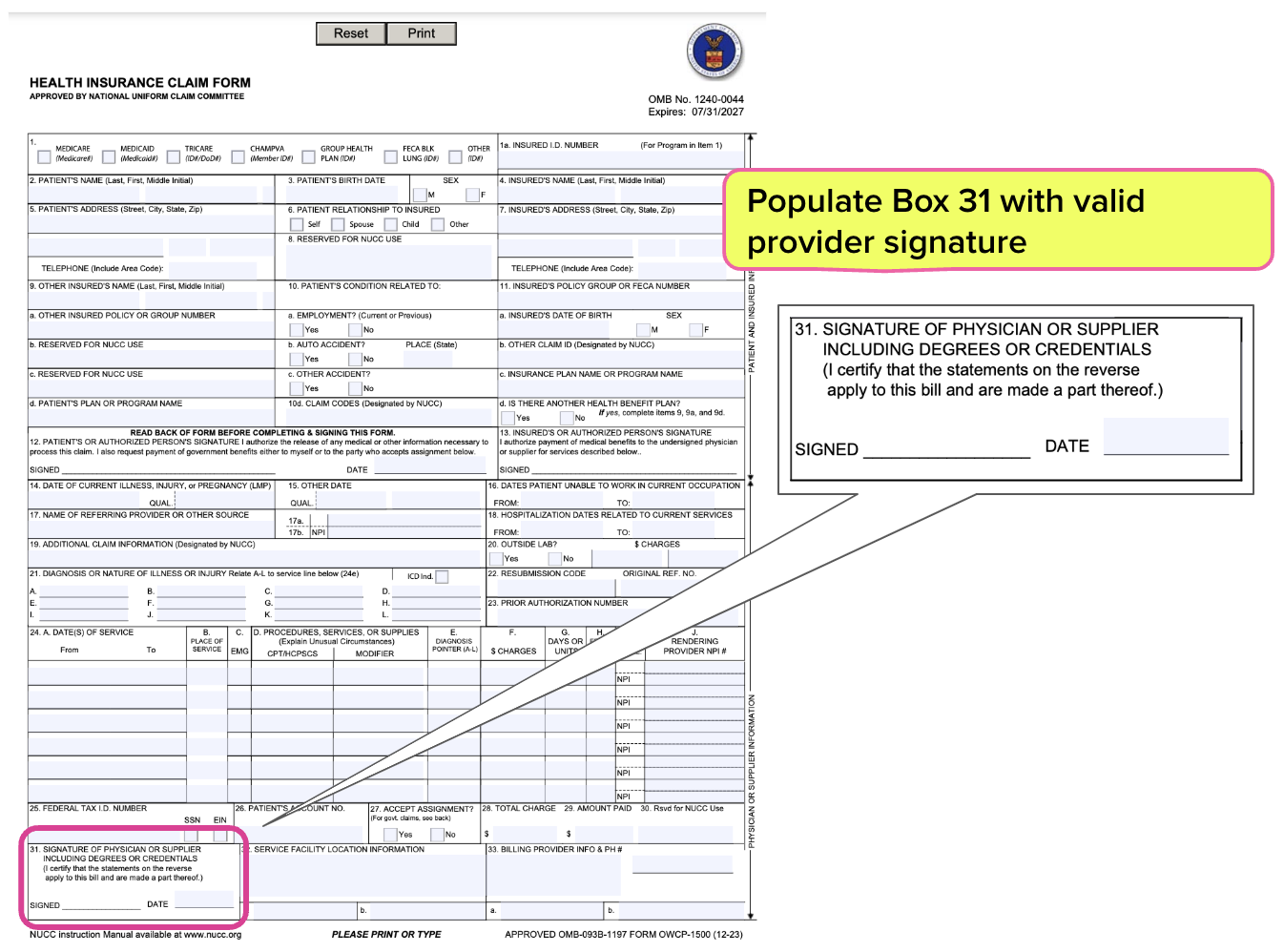

OWCP-1500 Instruction #3: Block 31

Populate Block 31 with the Physician or Supplier signature.

The Provider signature certifies that the statements on the reverse side of the OWCP-1500 form are applicable to the submitted bill. The signature can be:

- Printed, stamped, typed, or hand-signed, and

- Must be the name of a person, not a facility.

The following are considered acceptable signatures for Federal Employees’ Compensation Program (FECA) only:

- Signature stamp, or

- Signature on file

For DCMWC and DEEOIC, providers must sign and date the form.

If the signature in Block 31 is missing or invalid, the bill will be Returned to Provider (RTP) and will have to be resubmitted, causing a delay in payment consideration.

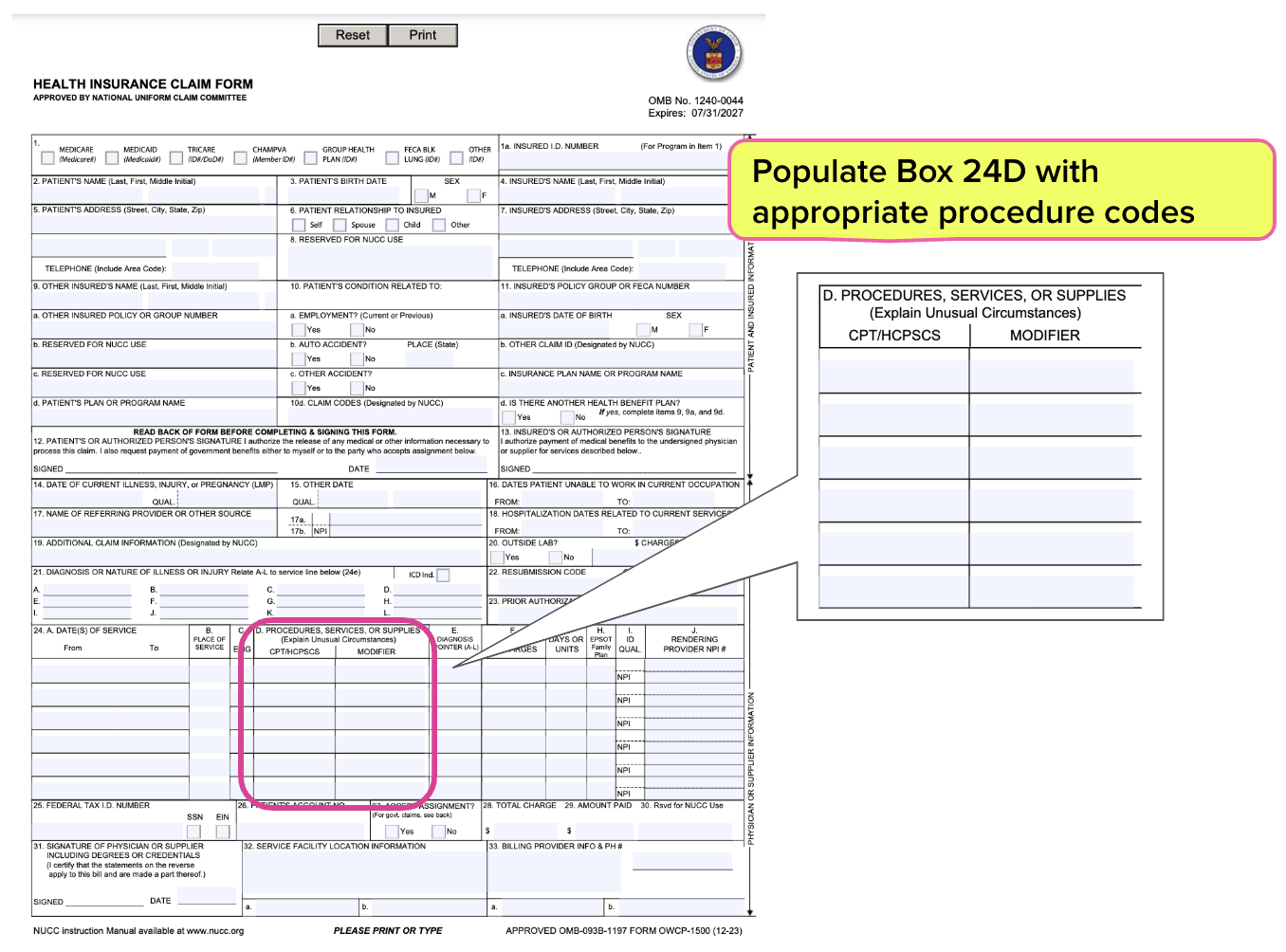

OWCP-1500 Instruction #4: Block 24D

Populate Block 24D with the appropriate procedure, HCPCS, or OWCP generic procedure codes, which must be five alpha-numeric characters.

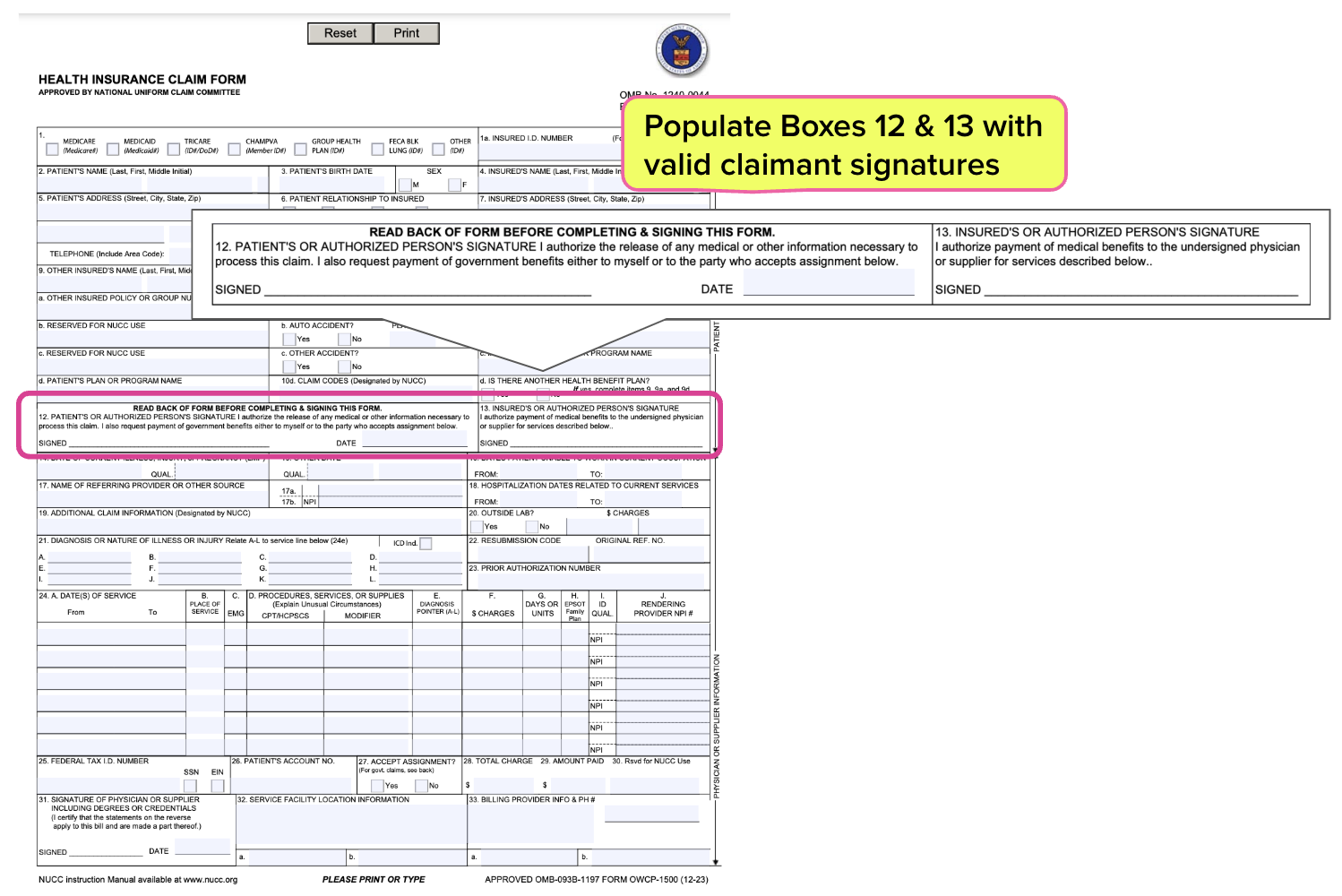

OWCP-1500 Instruction #5: Blocks 12 and 13

Blocks 12 and 13 must include the Claimant (injured worker) signature or one of the acceptable signatures.

Block 12 Claimant signature authorizes the release of medical information. Block 13 Claimant signature authorizes payment for billed services to go to the provider.

The following are considered acceptable signatures for Blocks 12 and 13:

- “Assignment of File”

- “Authorization on File”

- “Signature on File”

If the signature in Blocks are missing or invalid, the bill will be Returned to Provider (RTP) and will have to be resubmitted, causing a delay in payment consideration.

Avoiding the errors above will help ensure timely payment (at least according to paper billing standards) for DOL paper billing. We recommend using daisyWizard's Fee Schedule Calculator to get instant, accurate reimbursement calculations.

Of course, we strongly encourage providers to send DOL workers’ comp bills electronically (e-billing) which results in rapid (even same-day) payment from the DOL. Moreover, reliable e-billing software like daisyBill’s automatically flags missing billing information as part of the e-bill “scrubbing” process.

If you have any questions about billing the DOL for injured worker treatment, don’t hesitate to contact our experts (whether you’re a client or not).

Bill with 100% confidence in the accuracy of your reimbursement amounts: use our Fee Schedule Calculator—available for CA, NY and the DOL. Try it free for 3 days!

TRY THE CALCULATOR

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)