Injured Workers Are Gold Mines for Insurers

The numbers are in, and they tell a sobering tale. Nationwide, workers’ comp insurers are raking in profits from employers’ premiums—even as workers’ comp in states like California fails to meet the needs of injured workers and remains financially unsustainable for too many providers.

A National Council on Compensation Insurance (NCCI) report shows that insurers saw massive profits for the tenth year in 2023, and 2024 is projected to be just as lucrative.

Insurers aren’t the only entities profiting off the backs of injured workers; private equity is also raking in dollars, as demonstrated by Carlyle’s over $6 billion return on its investment in Third-Party Administrator (TPA) Sedgwick.

Rather than paying for injured workers’ care, employers’ workers’ comp premiums fuel these robust profits (as consumers fund these profits by paying higher prices for goods and services).

Meanwhile, injured workers experience delays and denials of care, and an increasing number of doctors opt out of workers’ comp rather than engaging in daily battles for proper reimbursement.

Insurers and private equity are basking in workers’ comp profit—but it comes at the expense of employers, consumers, providers, and injured workers.

Data: Workers’ Comp Is a Winner for Insurers

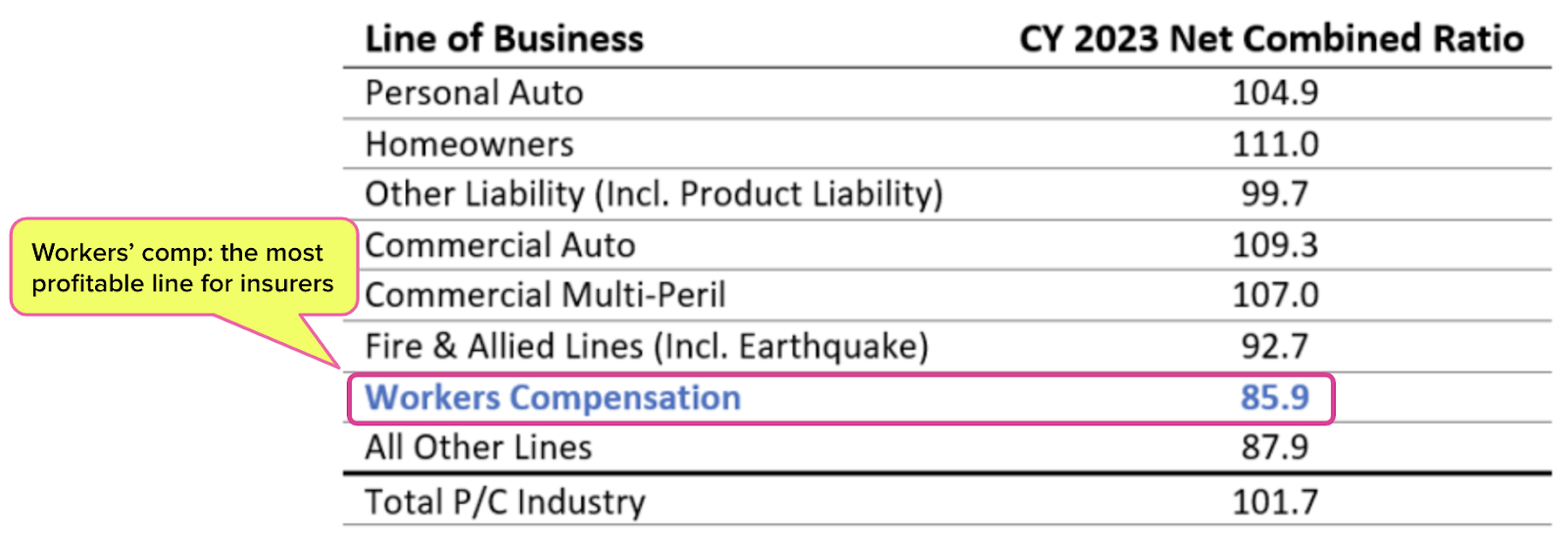

In insurance parlance, a “combined ratio” above 100% means that insurers pay out more (in operating costs and benefits like medical treatment) than they collect in premiums. A combined ratio below 100% means the insurers collect more than they pay—i.e., profit.

In other words, the lower the combined ratio, the more profitable a line of business is for insurers.

According to the NCCI report, workers’ compensation is the most profitable line of business for insurers by a mile, with a combined ratio of 85.9%, as shown below.

Compare this to products like auto and homeowners’ insurance, which according to the NCCI are actually costing insurers, and it’s a no-brainer: workers’ comp is where the money is. Or, as Managed Care Matters put it more starkly (emphasis ours), the money insurers are hauling in from workers’ comp is:

“...a huge transfer of funds from employers and tax payers to insurers, who are also sitting on $14 billion in “excess reserves”.”

CA: Profit at the Expense of Providers, Injured Workers

So what’s the secret? Why is workers’ comp the most reliable ticket to Profitsville in the insurance game?

Could it be because injured workers aren’t consistently getting the care they need? Could it be because providers aren’t sufficiently paid to treat injured workers? We have ample evidence that both are occurring in California.

Meanwhile, insurers continue to pocket employers’ premiums and openly advertise (at least until they’re called out for it) that denying the care recommended by injured workers’ treating physicians produces a “return on investment.”

As care for injured workers is denied and deferred, injuries worsen, delaying returns to work. As workers fail to improve, the result is more doctor visits, which means more claims administration, Utilization Review, bill review, and administrative expenditures—music to the ears of private equity firms invested in all of those services.

As for insurers’ expenses, i.e., actually paying for injured workers’ treatment, there are ways to keep those down—like Preferred Provider Organization (PPO) discounts, which insurers foist on providers as the cost of membership in Medical Provider Networks (MPNs) and which reduce reimbursement rates to below those of Medicare. That, and simply disregarding payment laws without fear of consequence from an anemic Division of Workers’ Compensation.

Who cares if practices aren’t taking in enough revenue to treat injured workers sustainably? Who cares if injured workers aren’t getting better? JUST LOOK AT THAT COMBINED RATIO, BABY.

In California, injured workers have become annuities, pumping profit into the coffers of various entities, not the least of which are insurers. These profits show how well this system works—only not as intended.

Nationwide, daisyBill increases revenue and decreases hassle for providers who treat injured workers. Get a free demonstration below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

This isn't profiting off injured workers - not at all. It is about premiums that are too high due to actuaries pricing risk based on historical costs - not accounting for the huge decrease in claim duration and better RTW now that the industry has done a wonderful job fixing the opioid disaster. Insurers are making big profits simply because rates are too high - this is NOT because injured workers have "become annuities" - that is flat out wrong.