Sedgwick: IBR Filing Fee Hall of Shame (Again!)

Another day, another IBR fee run-around. California law is clear: when Independent Bill Review (IBR) overturns a claims administrator’s incorrect adjudication of a provider’s bill, the claims administrator must reimburse the provider the $180 filing fee the provider paid to initiate IBR.

Sadly, this straightforward reimbursement requirement is unenforced and routinely violated. In fact, it occurs so often that daisyCollect has a Standard Operating Procedure (SOP) for systematically pestering claims administrators until they restore the filing fee to the provider.

In the example below, Sedgwick Claims Management, Inc. shorted a provider the $180 (again). Fortunately, our agents executed the SOP and successfully collected the money owed.

As we continue to point out, laws, regulations, and rules without enforcement are just words on paper — a fact that isn’t lost on claims administrators.

IBR Filing Fee SOP

daisyCollect has instituted an IBR Filing Fee SOP in the likely event a claims administrator fails to reimburse the fee to the provider:

- Call the claims administrator's main number to obtain the adjuster’s contact information (or, if available, use the claims administrator’s live chat).

- Call the adjuster and (more than likely) leave a message asking when the $180 IBR Filing Fee will be reimbursed.

- If there is no response from the adjuster, repeat step 2 twice.

- If the adjuster does not respond, call the claims administrator's main number to obtain the adjuster’s supervisor’s contact information.

- Call the adjuster’s supervisor and (more than likely) leave a message asking when the $180 IBR Filing Fee will be reimbursed.

- Repeat. Repeat. Repeat.

While providers should not have to compel claims administrators to follow the law, this SOP is an unfortunate reality of California’s consequence-free workers’ comp system.

Sedgwick Overturned at IBR

In August 2022, daisyCollect billed Sedgwick for a Comprehensive Medical-Legal evaluation and diagnostic tests for an Agreed Medical Evaluator (AME) client. Sedgwick denied payment for the diagnostics, incorrectly citing a lack of authorization.

Subsequently, daisyCollect submitted a perfectly compliant Second Review appeal to Sedgwick — which Sedgwick, with its well-established habit of non-compliance and habitual violations of California law, incorrectly denied as a “duplicate” of the original bill.

With no other choice, daisyCollect submitted the 82-page IBR request and $180 IBR filing fee.

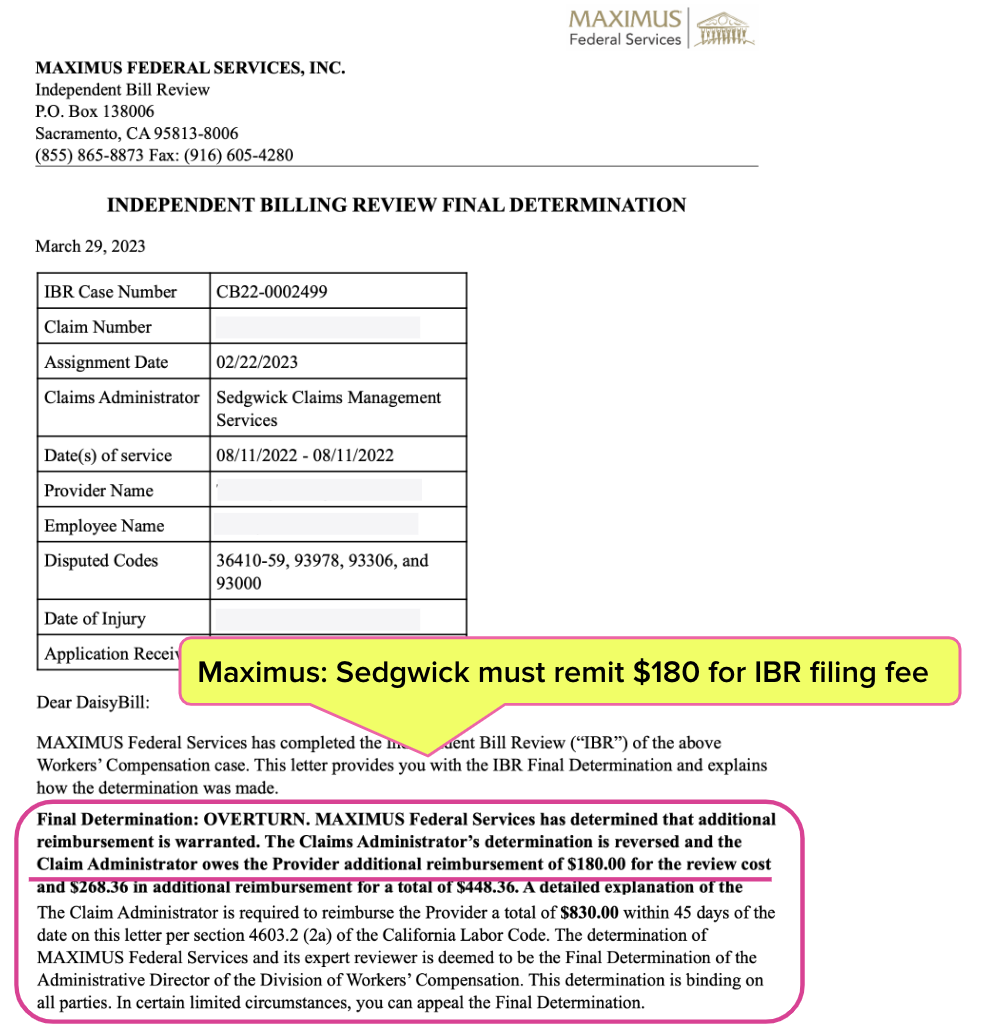

It was an open-and-shut case; Maximus (the entity that conducts IBR in California) overturned Sedgwick’s denial and ordered Sedgwick to pay the bill and the filing fee. Maximus’ March 29, 2023, Final Determination letter is shown below.

CA Law & Regulations re: IBR Filing Fee

California Code of Regulations Section 9792.5.14 mandates (emphasis ours):

“If the independent bill reviewer finds any additional amount of money is owed to the provider, the determination shall also order the claims administrator to reimburse the provider the amount of the filing fee in addition to any additional payments for services found owing.”

Per California Labor Code Section 4603.2, Sedgwick had 45 days from the date of the Final Determination letter to remit every cent owed. Yet on November 14, 2022, Sedgwick remitted only the amount owed for the disputed diagnostic services and not the $180 IBR filing fee as required by law.

daisyCollect then undertook the time-and-resource-consuming IBR Filing Fee SOP to cajole Sedgwick into simply doing what the law requires.

Finally, on February 7, 2024 — 315 days after Maximus’ ruling, 270 days beyond the deadline to comply with Maximus’ ruling, and 534 days after daisyCollect submitted the original bill — Sedgwick reimbursed the provider the $180 IBR fee.

The fact is, no provider should have to beg Sedgwick to adhere to California law.

- How many providers are robbed of the IBR filing fee because they don’t have a daisyCollect agent to hound claims administrators?

- How many providers sacrifice proper reimbursement because they cannot collect the $180 IBR fee if they prevail at IBR?

- Why would a claims administrator follow the law to reimburse the $180 IBR fee if there are no consequences for quietly holding on to the provider’s money?

We pose the above questions to the Division of Workers’ Compensation (DWC), hoping the agency will finally take appropriate action.

Med-Legal billing requires specialized expertise. daisyCollect professionals use our advanced software (and years of experience) to protect your practice. Learn more below:

Learn More About daisyCollect

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)