Texas DWC to Audit Payers for Compliance

The Texas Division of Workers’ Compensation (TX DWC)—unlike its counterpart in California—has a plan to address potential non-compliance by claims administrators.

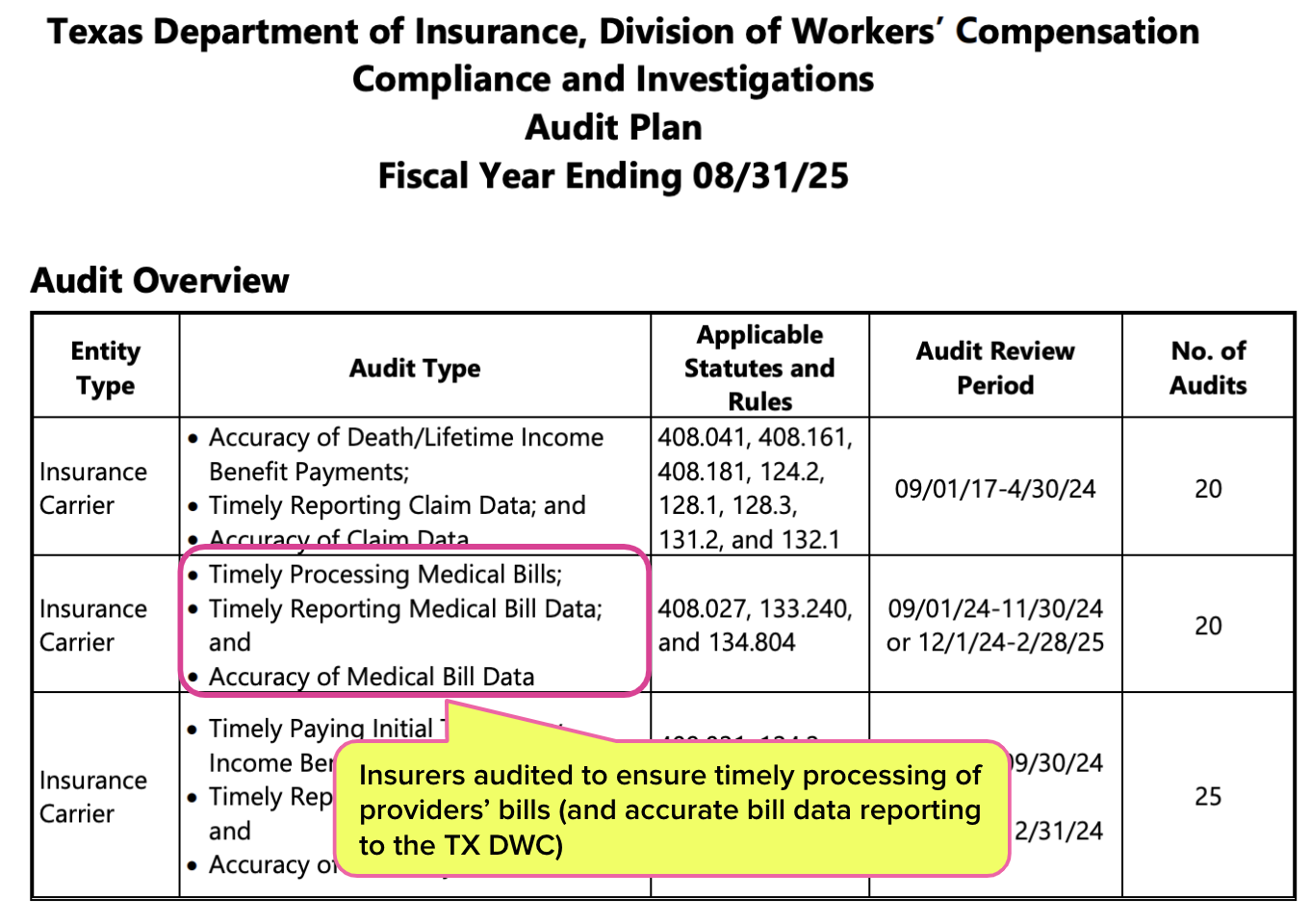

The agency released its 2025 Audit Plan, detailing upcoming efforts to dig through the data and make sure that (in addition to other requirements):

- Providers’ medical bills are timely processed, and

- Insurance carriers timely report accurate medical bill data

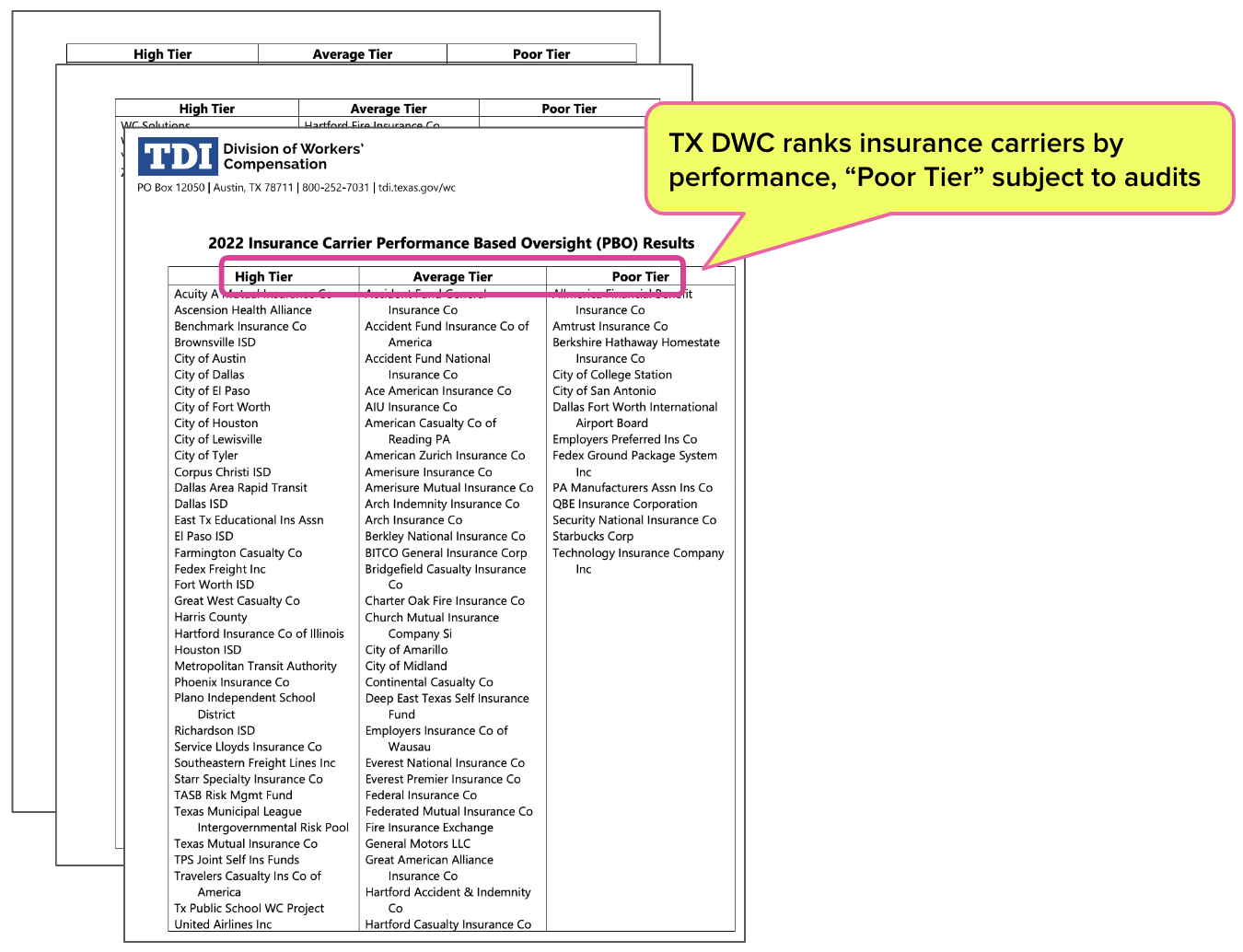

The TX DWC plans to conduct 65 audits of “poor performers” identified in its Performance-Based Oversight (PBO) program, which ranks workers’ comp insurance carriers according to their compliance with workers’ comp payment laws and regulations.

In other words, the TX DWC does something every state workers’ comp agency should do: demand data from payers, consistently collect and review that data, and impose consequences for patterns of bad behavior.

Consequences for Non-Compliance in TX: PBO and Audits

In Texas, state regulators don’t wait for consistent non-compliance to become an intractable problem before addressing it. Instead, Texas Labor Code Section 402.075(c) mandates that selected providers and insurance carriers are assessed every two years:

“At least biennially, the division shall assess the performance of insurance carriers and health care providers in meeting the key regulatory goals. The division shall examine overall compliance records and dispute resolution and complaint resolution practices to identify insurance carriers and health care providers who adversely impact the workers' compensation system and who may require enhanced regulatory oversight.”

The assessments, conducted under the PBO program, evaluate insurance carriers based on five categories:

- Timely payment of Temporary Income Benefits (TIBs)

- Timely reporting of initial payment of TIBs to the TX DWC

- Timeliness of processing initial medical bills

- Timeliness of processing requests for reconsideration of medical bills

- Timeliness of submission of the EDI medical data to the TX DWC

Based on those assessments, insurance carriers are placed into “High,” “Average,” or “Poor” performance categories—with the names of the carriers in each category made public on the Texas Department of Industrial Relations (TDI) website, as shown below.

From there, §402.75 directs the TX DWC to “...focus its regulatory oversight” on carriers “identified as poor performers.”

The TX DWC publicizes its planned schedule of audits, including what violations are being investigated, which specific statutes and rules are being violated, and how many insurance carriers will be audited. Further details about the audit process are laid out on the TDI website.

Data + Enforcement = Compliance

Of particular note is that the TX DWC specifically investigates the timeliness and accuracy of the medical bill data submitted by insurance carriers. Although the TX DWC relies in part on self-reported data, the agency does not blindly trust payers to share the data necessary to evaluate compliance.

Contrast this with the California DWC, which has declared that submitting data to the state’s Workers’ Compensation Information System (WCIS) is “voluntary,” in violation of state law. The California DWC has also refused since 2016 to even establish a way for claims administrators to report Utilization Review (UR) data, in violation of state law.

As a result, California legislators and other stakeholders rely almost entirely on voluntarily self-reported, wholly unverified data provided by payers.

California should look to Texas as an example of how to instill accountability. Until then, rampant and unpunished non-compliance will remain a problem, as will extended claim durations, ballooning administrative costs, and fed-up providers fleeing the system.

Nationwide, daisyBill increases revenue and decreases hassle for providers who treat injured workers. Get a free demonstration below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)