Travelers Defies IBR, Shorts CA QME

How many ways can an insurer violate workers’ comp payment laws, regulations, and rules on a single bill?

Travelers may have set the benchmark by refusing to correctly pay a Qualified Medical Evaluator (QME) for Medical-Legal services, despite Independent Bill Review (IBR) overturning the insurer’s nonsensical payment denials.

In a “hold my beer” moment of serial non-compliance, Travelers:

- Denied a $4,453.14 Medical-Legal bill by erroneously claiming the services were “non-compensable”

- Denied the QME’s Second Review appeal without providing a denial reason

- Defied an IBR ruling and paid the QME $90.46 less than the amount ordered by improperly applying a Preferred Provider Organization (PPO) discount

- Violated California law by failing to reimburse the QME the $180 IBR filing fee

To receive payment for a single Medical-Legal bill, this QME submitted three different bills (an original bill, a Second Review appeal, and an IBR request) for a combined total of 261 pages and paid to file the IBR request—and Travelers still refuses to pay correctly despite a final and definitive IBR decision.

We can’t be surprised, because this is California.

Laws and regulations are only as effective as the Division of Workers’ Compensation (DWC)’s commitment to enforcing them. As we see daily, enforcement is a low priority for the DWC, whose continued refusal to impose consequences has…well, consequences like the egregious abuse Travelers inflicted on this QME.

Throughout California, providers treating injured workers endure precisely this kind of struggle to be reimbursed (and often for far less than the amount owed for this Medical-Legal bill). Providers can only be pushed so far before injured workers have no one left to treat them.

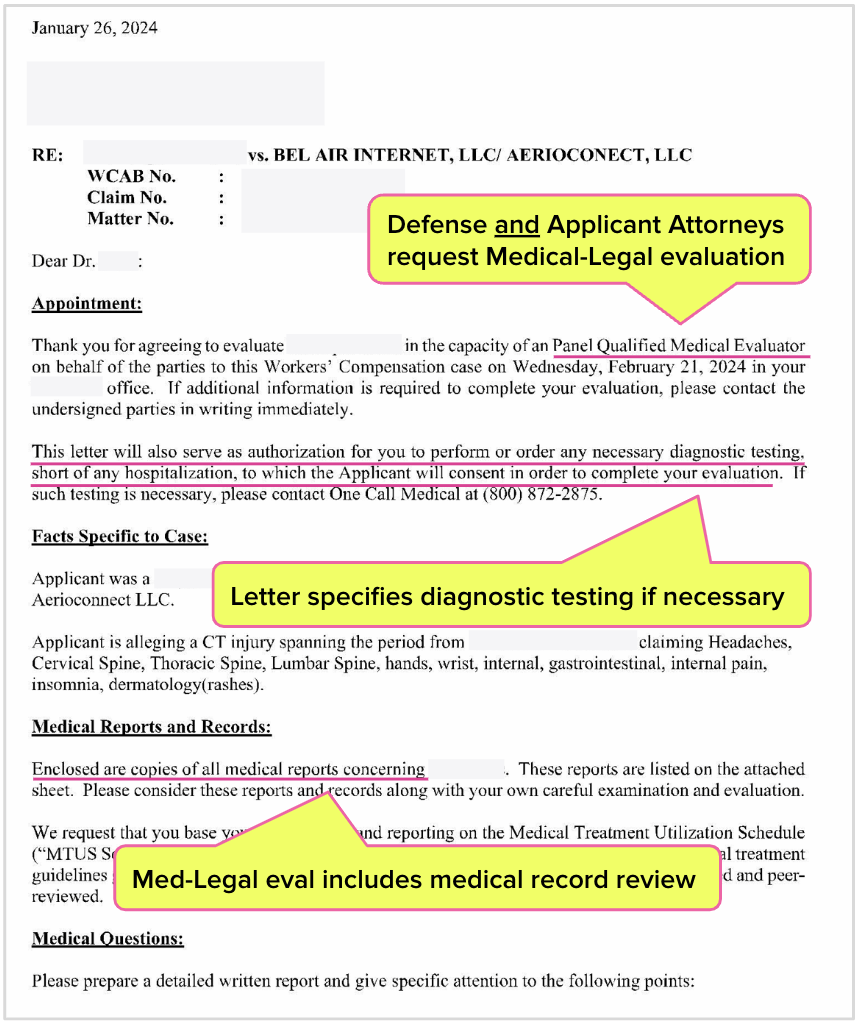

Travelers Requests Med-Legal Exam (Including Diagnostic Tests)

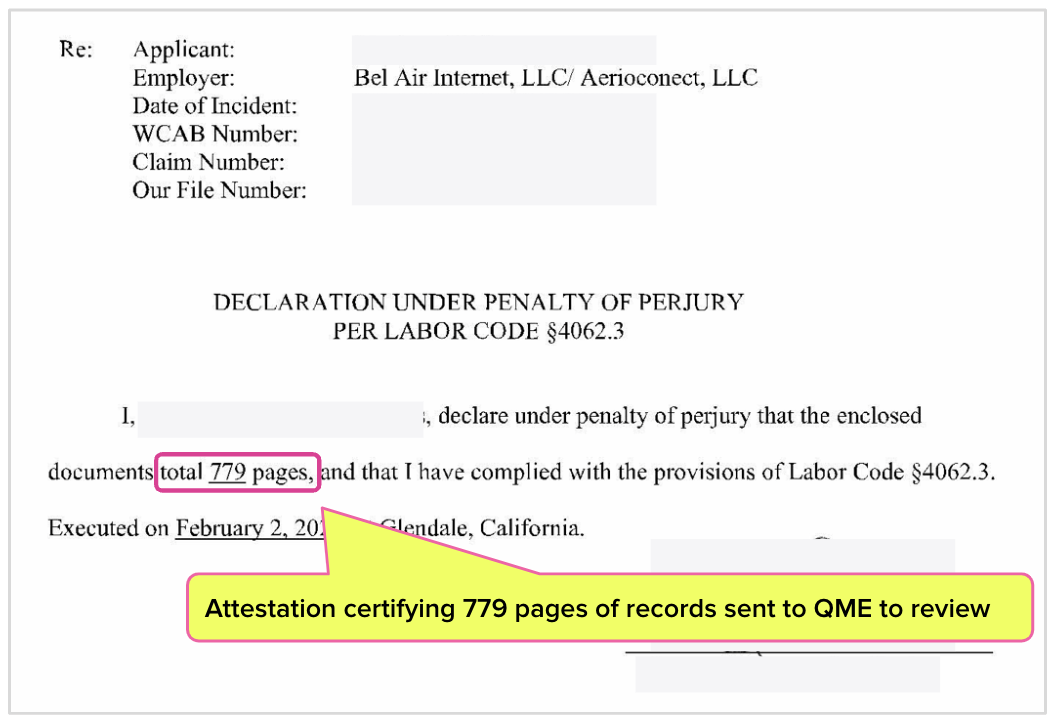

In the letter below, attorneys for both the injured worker and the defense (i.e., the employer and its insurer, Travelers), requested that the QME perform the Medical-Legal evaluation. The letter specifically instructs the QME to review medical records and to perform any necessary diagnostic testing.

The mandatory medical record attestation shows, the QME received 779 pages of documentation as part of the evaluation—which at $3 per page under billing code MLPRR adds up to a hefty sum.

CA Law Incentivizes Travelers to Deny QME Bill

As we’ve explained before, Medical-Legal evaluations are not subject to authorization, liability, or compensability the way regular medical services are. Medical-Legal evaluations are requested by the parties to resolve questions of liability or compensability.

The minute the attorneys formally asked this QME to perform the evaluation, Travelers was obliged to pay for it.

Yet as the Explanation of Review (EOR) below shows, Travelers paid $0 of the $4,453.14 bill, claiming the evaluation was “non-compensable.” Payment for the diagnostic tests was denied, citing a “jurisdictional fee schedule adjustment.”

Even for such a plainly invalid payment denial, Travelers wins by default if the QME doesn’t take action. If any provider fails to submit a Second Review appeal to dispute a payment denial within 90 days, California law dictates that the provider forfeits the entire reimbursement owed.

Why would any claims administrator go out of their way to pay bills properly? In this case, Travelers can deny payment to the QME, kick back in its beach chair (presumably under a Travelers-branded parasol), and wait to see if the QME submits the required appeal on time.

If the QME fails to timely submit the appeal, it’s easy money in the bank for Travelers.

CA Law Incentivizes Travelers to Deny Second Review Appeal

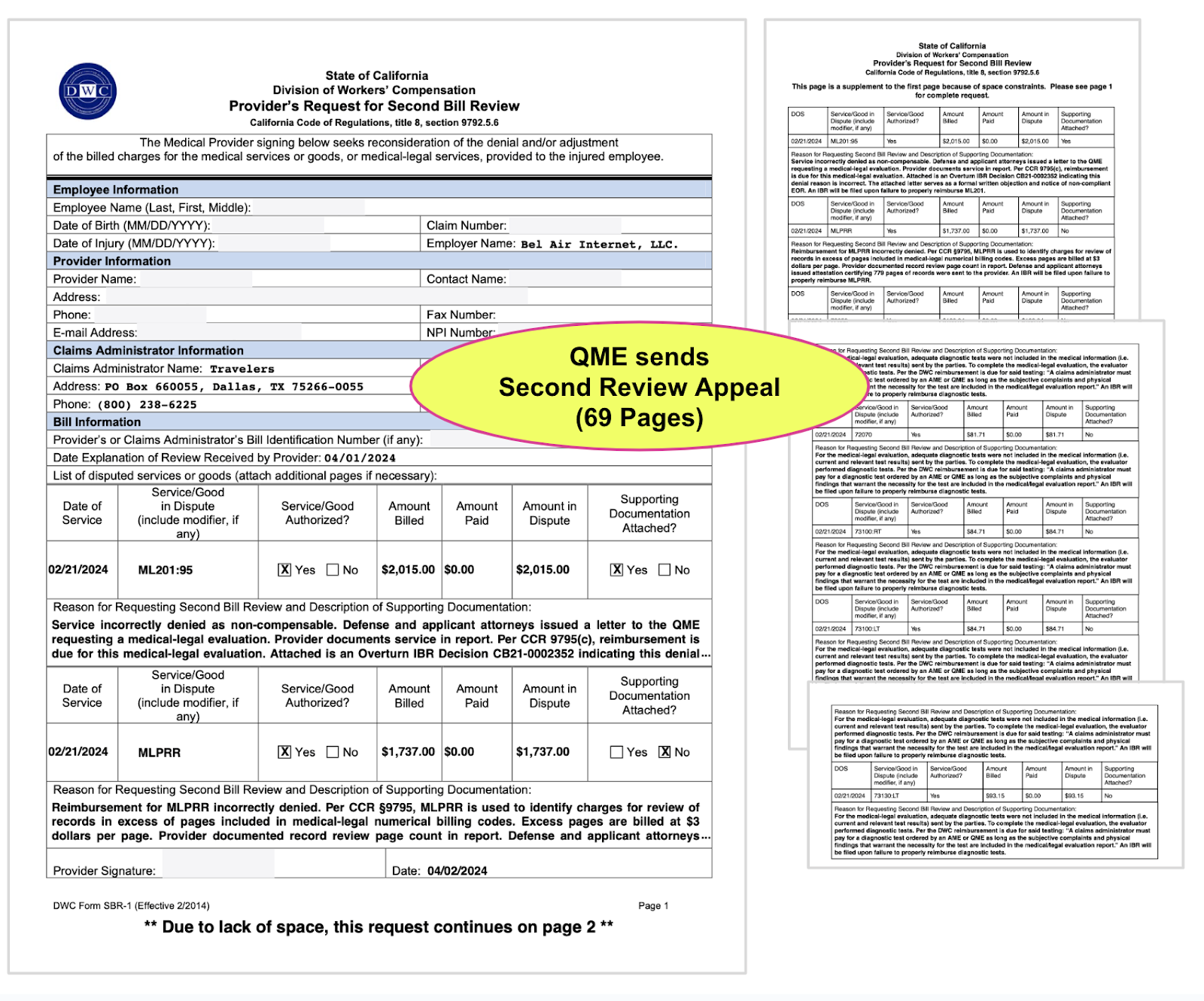

The QME submitted a Second Review appeal on time. In addition to the required Form SBR-1, the appeal included all of the documentation included with the original bill for a total of 69 pages of documentation.

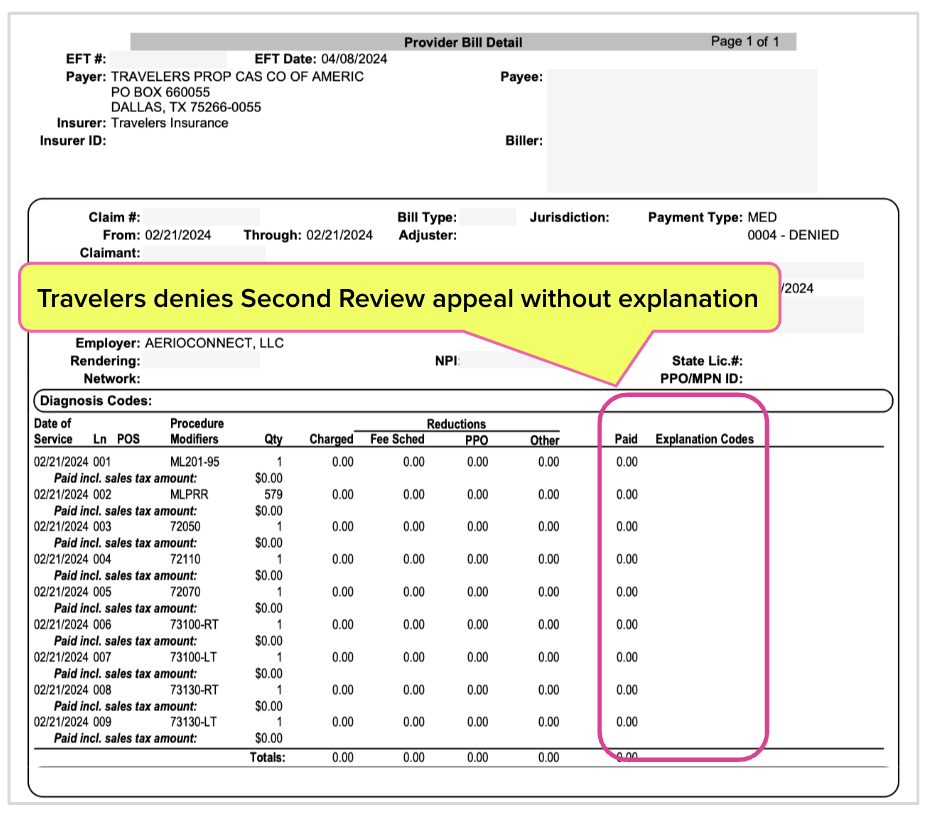

This appeal was Travelers’ opportunity to recognize its error and perhaps educate its bill review staff on how the Medical-Legal system has worked for decades. Instead, Travelers denied the appeal—and the insurer's final EOR included no reasons whatsoever for the denial.

At this point, if the QME failed to pay $180 and submit a request for IBR within 30 days, California law instructs that the QME forfeits the reimbursement owed. Once Travelers denies the Second Review appeal, it can return to its beach chair and wait to see if the QME beats the deadline.

Maximus: Open & Shut IBR Case

Per the state-required appeal procedure, the QME paid the fee and submitted a 140-page request for IBR.

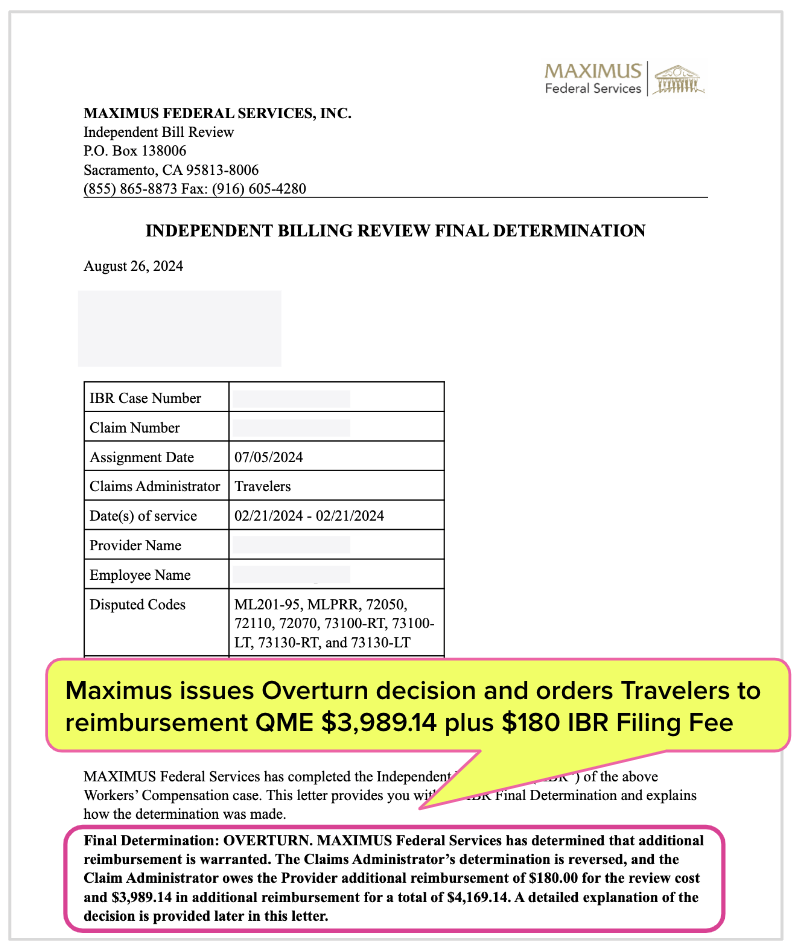

Maximus, which conducts IBR on behalf of the DWC, swatted away Travelers’ unfounded reimbursement illogic and overturned the payment denial. Maximus demanded that Travelers reimburse the QME $3,989.14 plus the $180 IBR filing fee. Maximus’ IBR Final Determination letter is below.

(Fortunately in this case, the DWC didn’t inexplicably intervene and declare the dispute “ineligible” for IBR, even though Travelers’ initial payment denial reason was theoretically a “threshold” issue. At least the DWC is as inconsistent as it is inept.)

Travelers Defies Maximus IBR Ruling

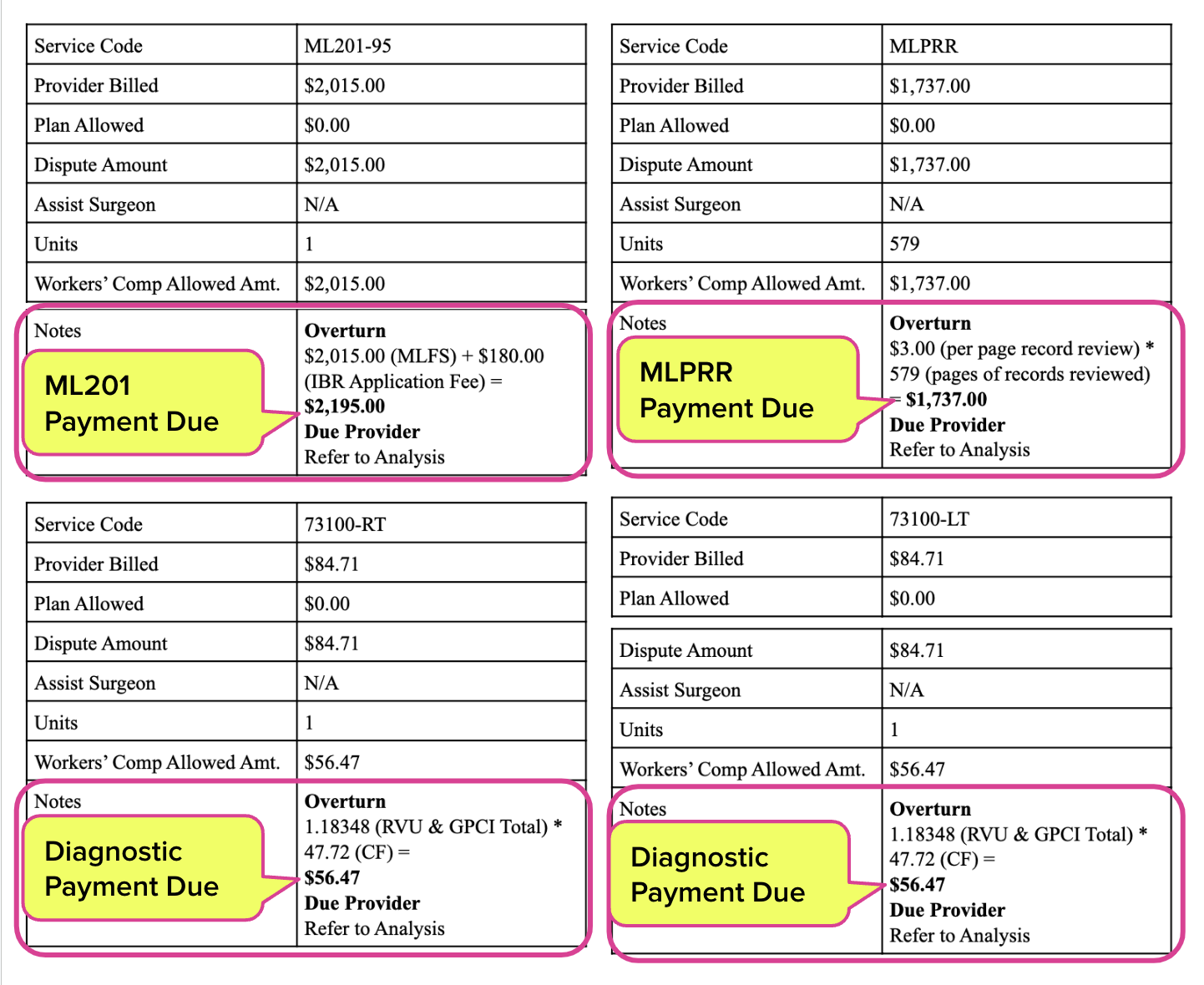

The sole, stated function of IBR is to determine the exact reimbursement amount owed. For that reason, Maximus always includes a breakdown of its reimbursement calculations with every Final Determination letter.

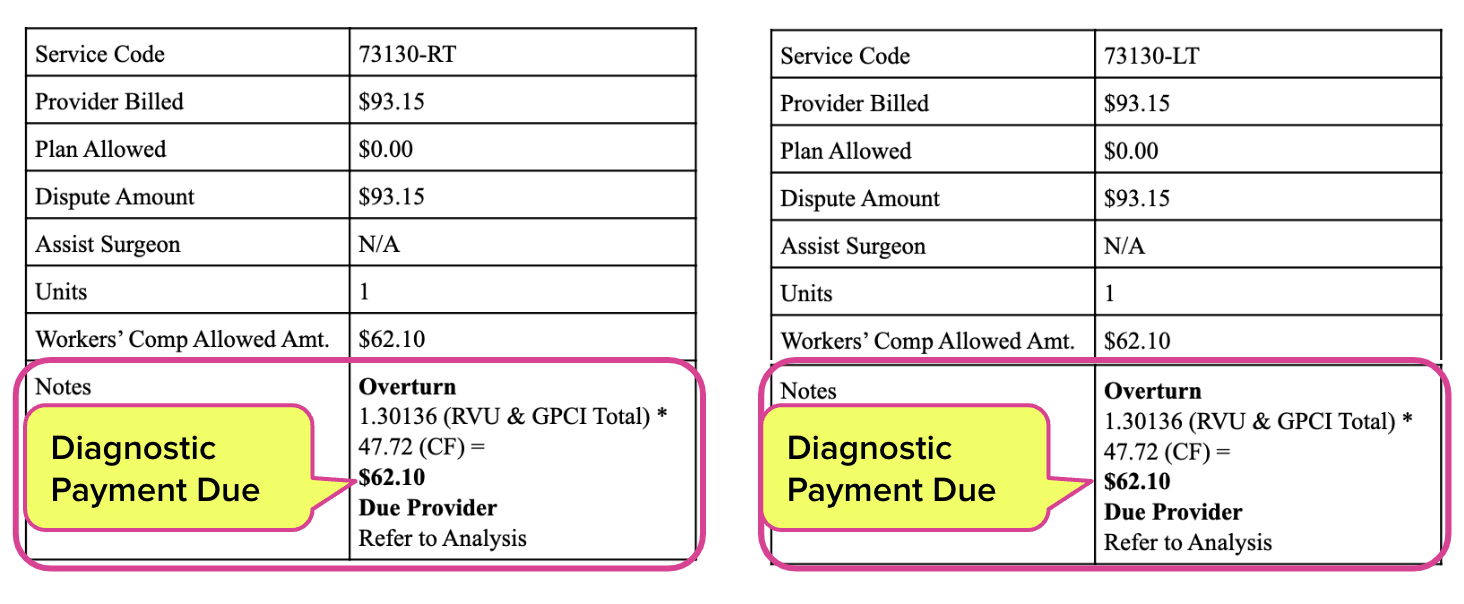

As shown below, Maximus was abundantly clear in telling Travelers precisely how much to pay the QME for each service billed, including the diagnostic tests.

Yet instead of complying with Maximus’ IBR decision, Travelers added yet another depressing twist to this QME payment torture.

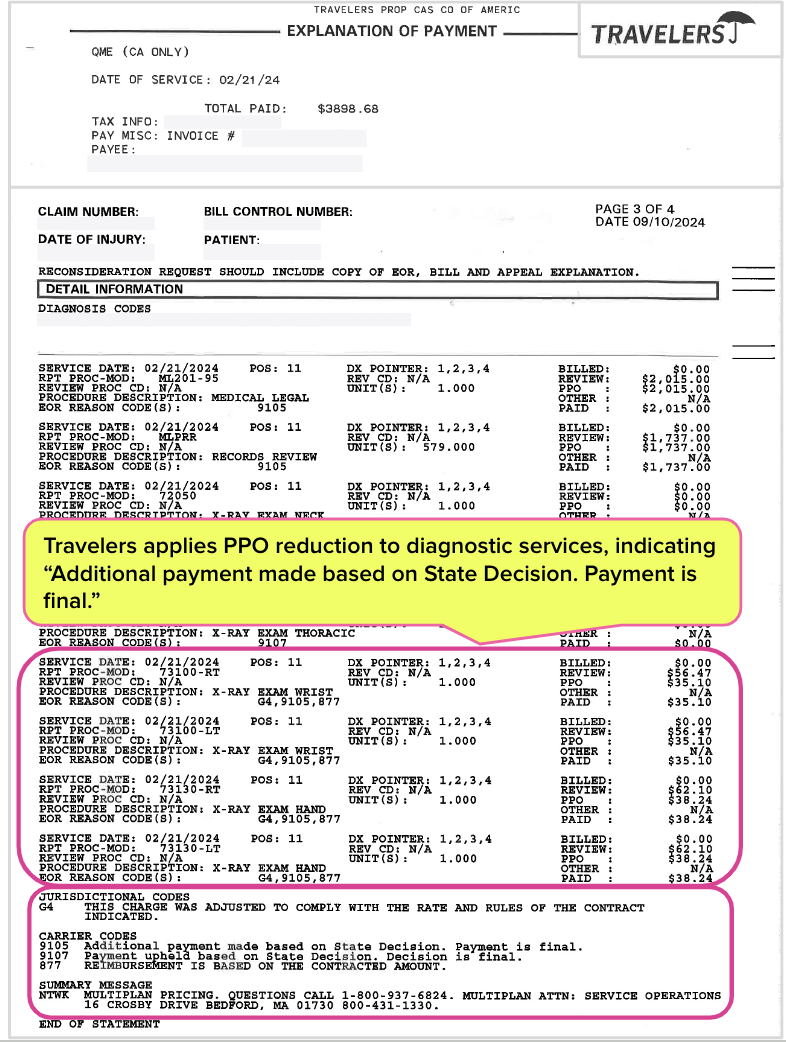

The insurer paid the QME in full for the evaluation (billing code ML201-95) and the record review (code MLPRR). However, the EOR below shows that Travelers granted itself a generous PPO discount for the diagnostic tests, paying the QME only 62% of the amount specified in the IBR Final Determination.

Travelers kept $90.46 of the amount Maximus stated was due by erroneously (or “erroneously,” as the case may be), citing a Multiplan PPO discount.

Travelers’ payment to the QME also failed to include the $180 owed for the IBR filing fee, because why bother? Claims administrators routinely withhold the fee despite Maximus’ orders, without consequence.

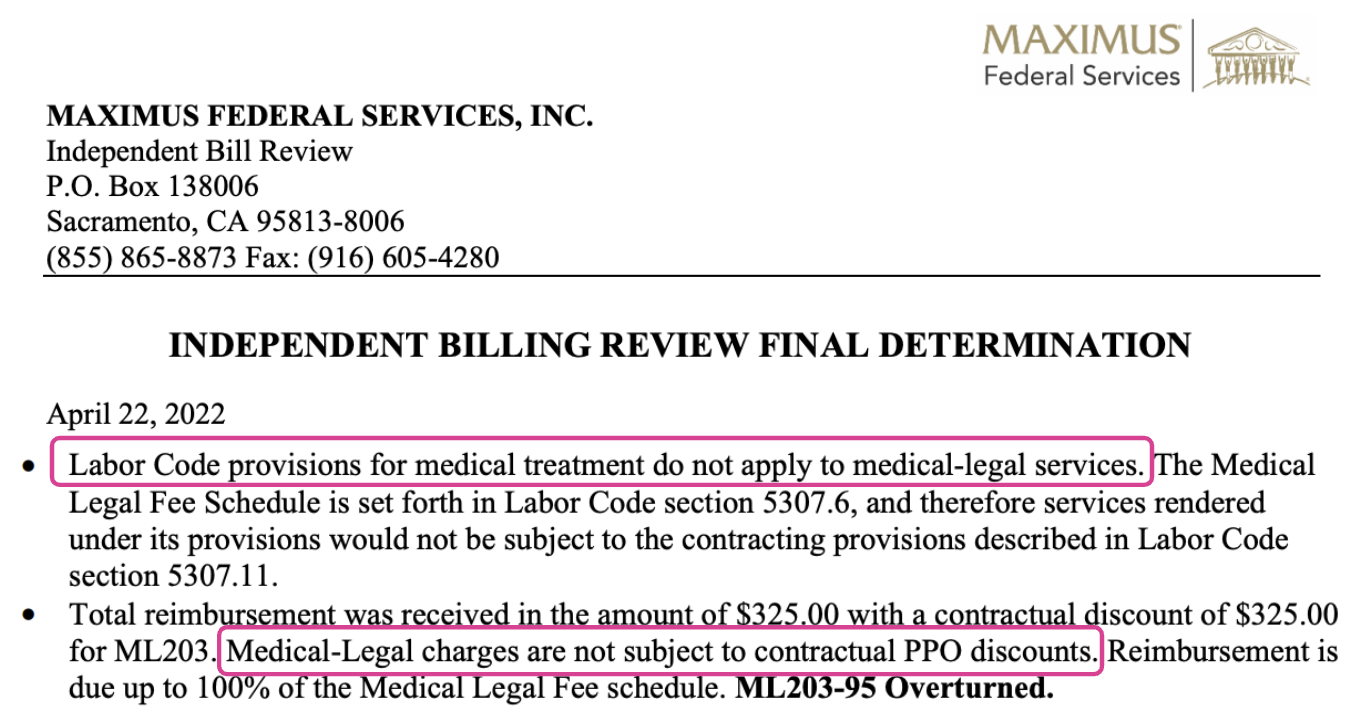

Per Maximus, Medical-Legal PPO Discounts Disallowed

PPO discounts are never applicable to bills for Medical-Legal services. Ever. PPO discounts are only allowable under the Official Medical Fee Schedule (OMFS), not the Medical-Legal Fee Schedule (MLFS).

California Code of Regulations Section 9794 instructs that diagnostic testing in a Medical-Legal context is reimbursed according to OMFS rates. However, just because the medical-legal regulations reimburse at the rates established by the OMFS does not mean that Travelers may treat medical-legal services as if they were medical services.

This is not some obscure quirk of Medical-Legal billing and payment.

The inapplicability of PPO discounts is well-established. For example, in the 2022 Final Determination shown below, Maximus explains that the provisions of the Labor Code that allow PPO discounting “do not apply to medical-legal services” and that “Medical-Legal charges are not subject to contractual PPO discounts.”

CA Providers Tortured, Injured Workers Suffer

Knowing what was owed for these Medical-Legal services should not have been a challenge, at least not for alleged professionals whose entire job is to pay providers’ bills accurately. In this case, Travelers had even less of an excuse since Maximus did the arithmetic.

The amount of paperwork that went into this bill and subsequent dispute exemplifies the administrative torture endured by California providers who serve injured workers. For providers medically treating injured workers, the amounts owed are a fraction of this Medical-Legal bill—yet those providers must also endure the same brutal payment gauntlet.

This is what happens when the regulatory agency responsible for enforcing compliance simply isn’t minding the store. Claims administrators have zero incentive to reimburse correctly or to abide by state laws, regulations, or IBR decisions. With the DWC AWOL, flouting the rules is only logical.

This is the reason providers increasingly refuse to treat injured workers in California.

Note: the featured graphic accompanying this article depicts a stylized BEACH PARASOL and not an umbrella, per the adamant requests of Travelers’ attorneys.

Med-Legal billing requires specialized expertise. daisyCollect professionals use our advanced software (and years of experience) to protect your practice. Learn more and request a demo below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)

Great, well stated case. Shame on DWC

go get em, Sarah