CA DWC Fails Employers and Employees

Without enforcement, no amount of laws or regulations can improve or even maintain a functioning workers’ compensation system. California is a tragic example of this, thanks to the Division of Workers’ Compensation (DWC) and its seeming abandonment of the law.

By failing to both enforce and follow critical requirements of the California Labor Code and Code of Regulations, the DWC has left providers and injured workers vulnerable to abuse—as exemplified by Liberty Mutual’s recent stiffing of an orthopedic surgeon.

While providers expend tremendous time and resources to comply with every legal requirement regulators impose, claims administrators test the boundaries of non-compliance daily. The DWC consistently rewards these claims administrators with zero consequences and continued opportunities to swell their coffers with employers’ premiums and providers’ reimbursements.

All of it is fixable, yet the DWC refuses, inexplicably, to exercise its authority and implement the laws passed by California legislators. This DWC inaction means employers and providers are losing money. And worse, the health and livelihoods of injured workers suffer.

Liberty Mutual Stiffs Ortho With DWC Help

As we reported yesterday, Liberty Mutual refused to pay thousands of dollars owed to a California orthopedic surgeon for surgery Liberty Mutual authorized.

California Labor Code (LAB) Section 4610.3 mandates that authorization is final and (absent fraud) cannot be rescinded for literally any reason (emphases ours):

“...an employer that authorizes medical treatment shall not rescind or modify that authorization after the medical treatment has been provided based on that authorization for any reason…”

California Code of Regulations (CCR) Section 9792.6 states (emphasis ours):

“‘Authorization’ means assurance that appropriate reimbursement will be made for an approved specific course of proposed medical treatment to cure or relieve the effects of the industrial injury pursuant to section 4600 of the Labor Code…”

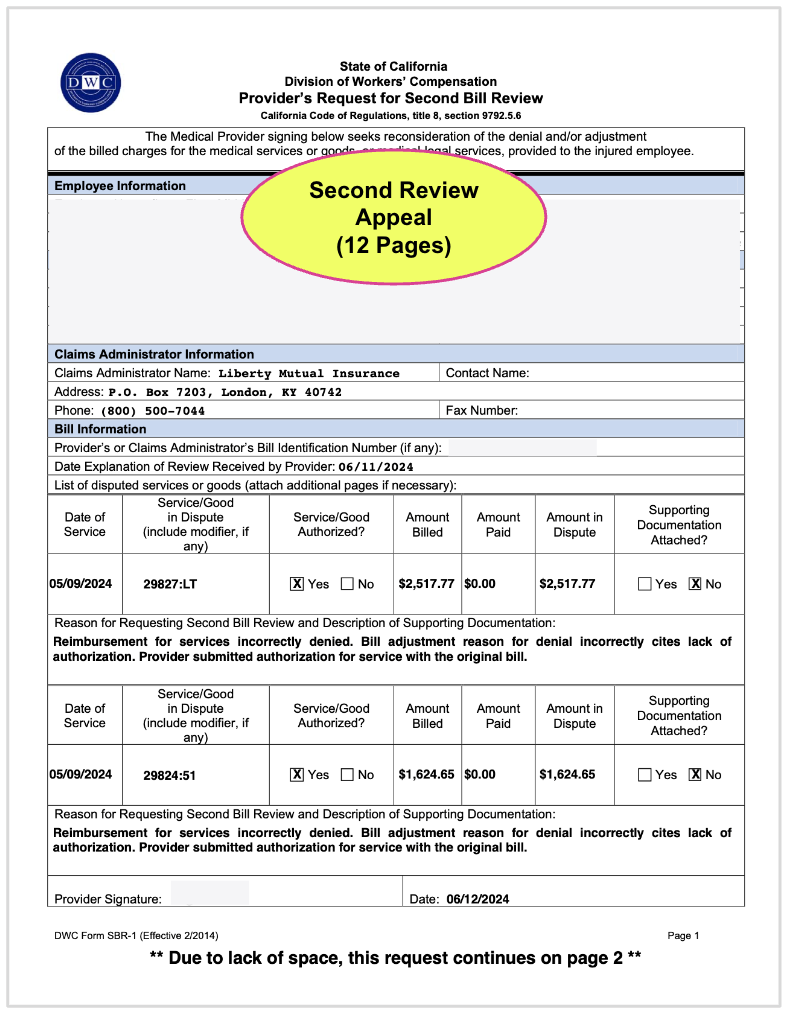

However, despite authorizing the treatment in dispute, Liberty Mutual denied the original bill and subsequent Second Review appeal on the erroneous grounds that the provider never submitted a Request for Authorization (RFA) and that authorization never occurred.

The surgeon then submitted a request for Independent Bill Review (IBR) that included clear proof of authorization. However, the DWC declared the dispute ineligible for IBR on the grounds that IBR cannot resolve questions of authorization.

Of course in this case and many like it, there was no question of authorization. There was only a spurious, easily-debunked claim of non-authorization on Liberty Mutual’s Explanation of Review (EOR).

The DWC made its IBR ineligibility decision with incontrovertible proof of authorization in its possession, allowing Liberty Mutual to escape its financial and legal obligation by citing a mile-wide loophole in the IBR process.

The “Threshold” Loophole Explained

California established IBR to reduce the number of liens filed by allowing Maximus, a private entity contracted with the DWC, to settle disputes over the amount of reimbursement owed.

But there’s a major, major problem. Under the DWC, claims administrators can game IBR by alleging lack of authorization, however implausibly, even when clear proof of authorization is included with bills, appeals, and IBR requests—as in the Liberty Mutual case.

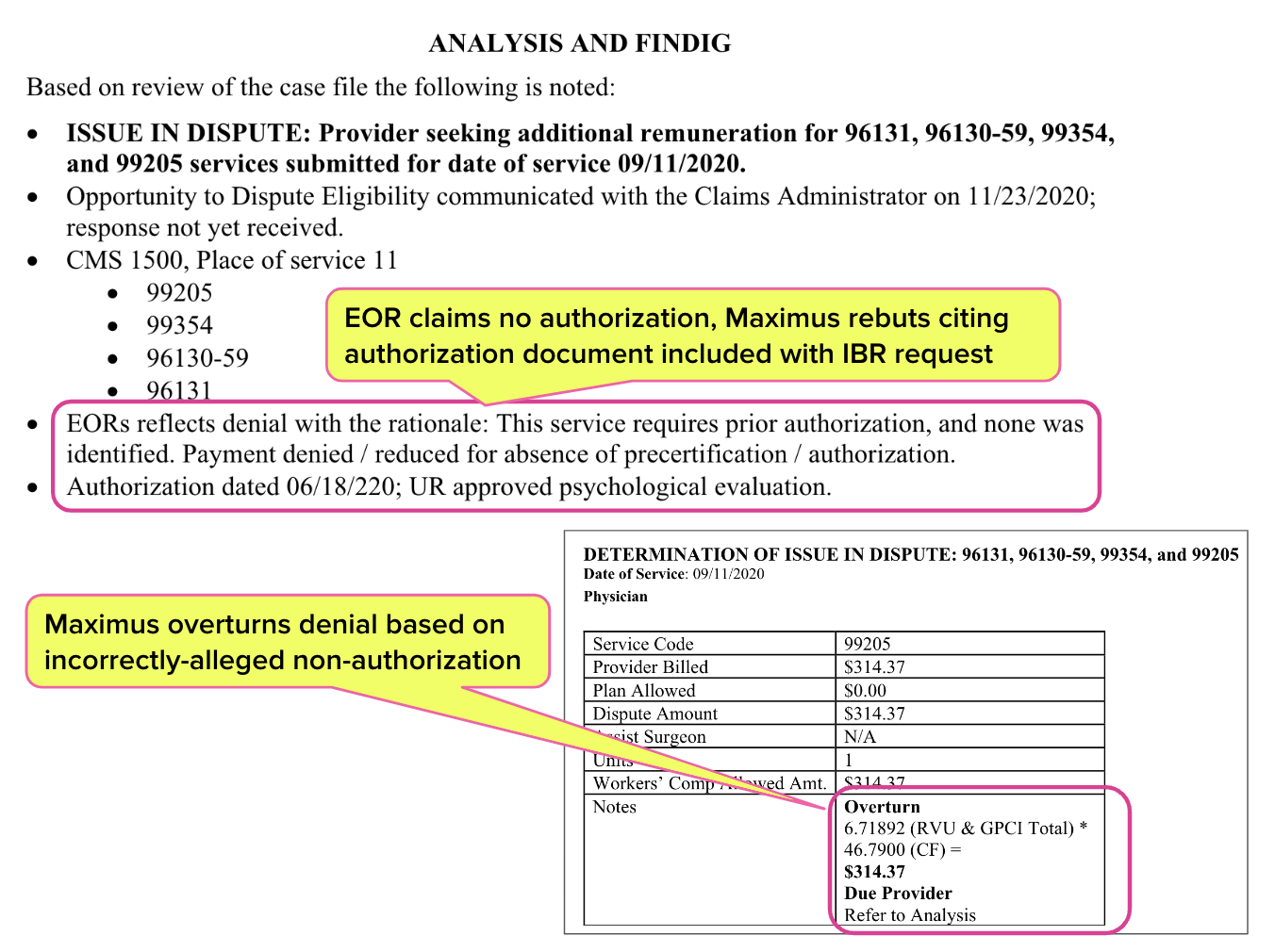

Note that when the DWC has allowed Maximus to conduct IBR in cases where non-authorization was incorrectly alleged and proof of authorization was present, Maximus easily overturned the denial. An example IBR decision from Maximus is below.

DWC: What Laws?

As we’ve chronicled in this space, the DWC has utterly failed (or openly declined) to follow and/or enforce key provisions of California law and regulations. This abdication of a regulatory body’s entire job has done incalculable harm to providers and injured workers across the state.

Examples of the DWC’s failures include:

- Declining to enforce CCR §9792.6 by allowing claims administrators to refuse payment for authorized services

- Declining to enforce LAB §4610.3 by allowing claims administrators to refuse payment for authorized services on the grounds of Medical Provider Network (MPN) non-participation

- Declining to enforce LAB §4609 by allowing various entities to sell, lease, or otherwise transfer contractual reimbursement discounts without providers’ consent or knowledge

- Violating LAB §138.6 by declaring participation in the Workers’ Compensation Information System (WCIS) “voluntary” for claims administrators

- Violating LAB §4610 by declining to collect Utilization Review (UR) data to monitor for abuse

- Violating LAB §4616 through §4616.7 and CCR §9767.5 by failing to enforce MPN access standards that guarantee adequate care to injured workers who are restricted to MPN providers

As a result, injured workers face needless delays and denials of the care they need. The largest Third-Party Administrator, Sedgwick, openly boasts that their Utilization Review services deny 54% of treatments recommended by injured workers’ physicians.

When providers manage to get treatment authorized, they subsequently face needless reimbursement battles and flat-out invalid payment denials for authorized services rendered. Practice revenue plummets thanks to unbridled discount-peddling.

Worst of all, claims administrators are emboldened to disregard state law and regulations (looking at you, Sedgwick), secure in the knowledge that nothing will happen.

Provider Compliance: Exhausting Administrative Resources

As the DWC lets claims administrators run rampant, providers are forced to comply with every requirement. The consequence of provider non-compliance is swift and automatic: non-payment.

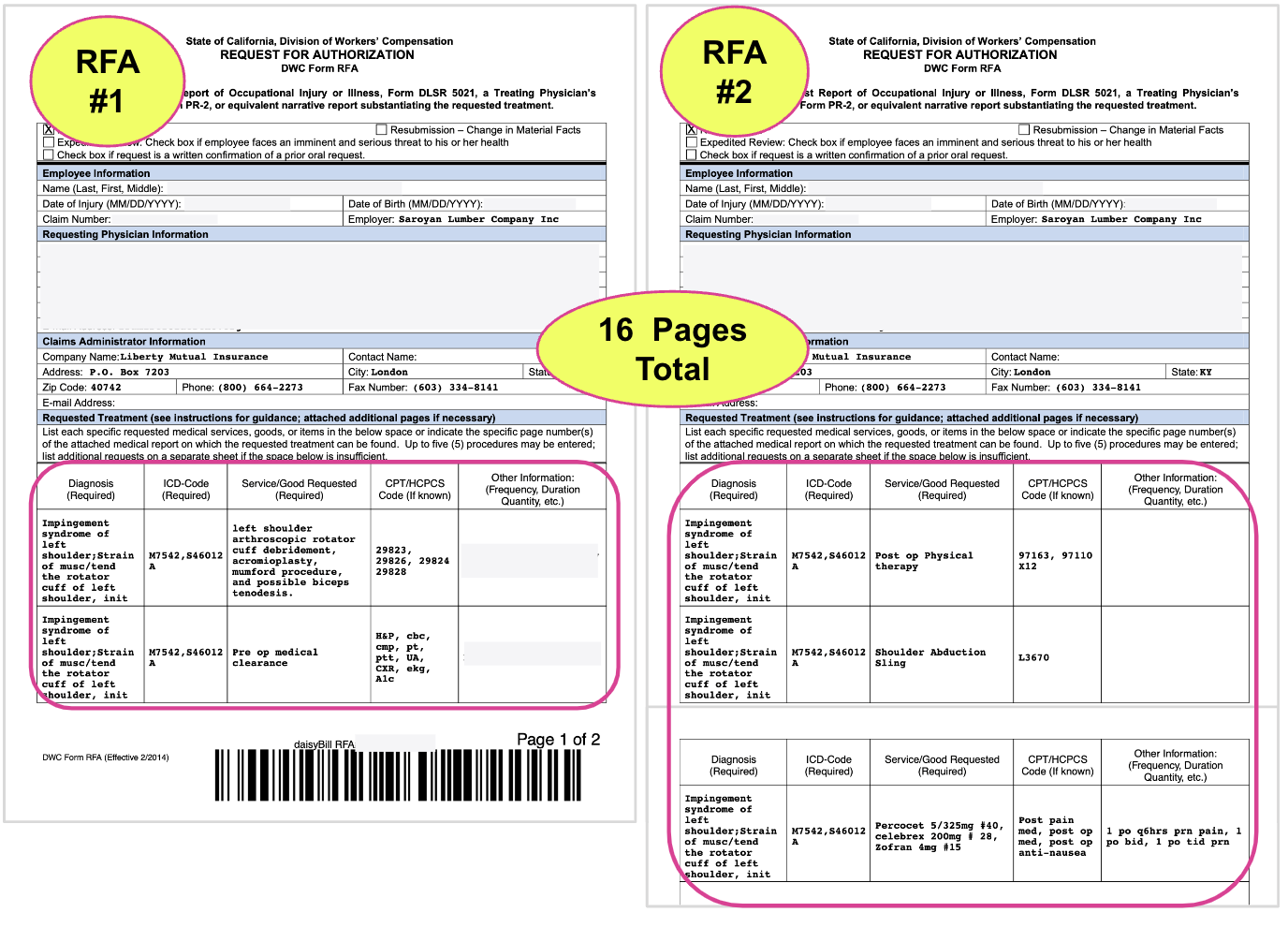

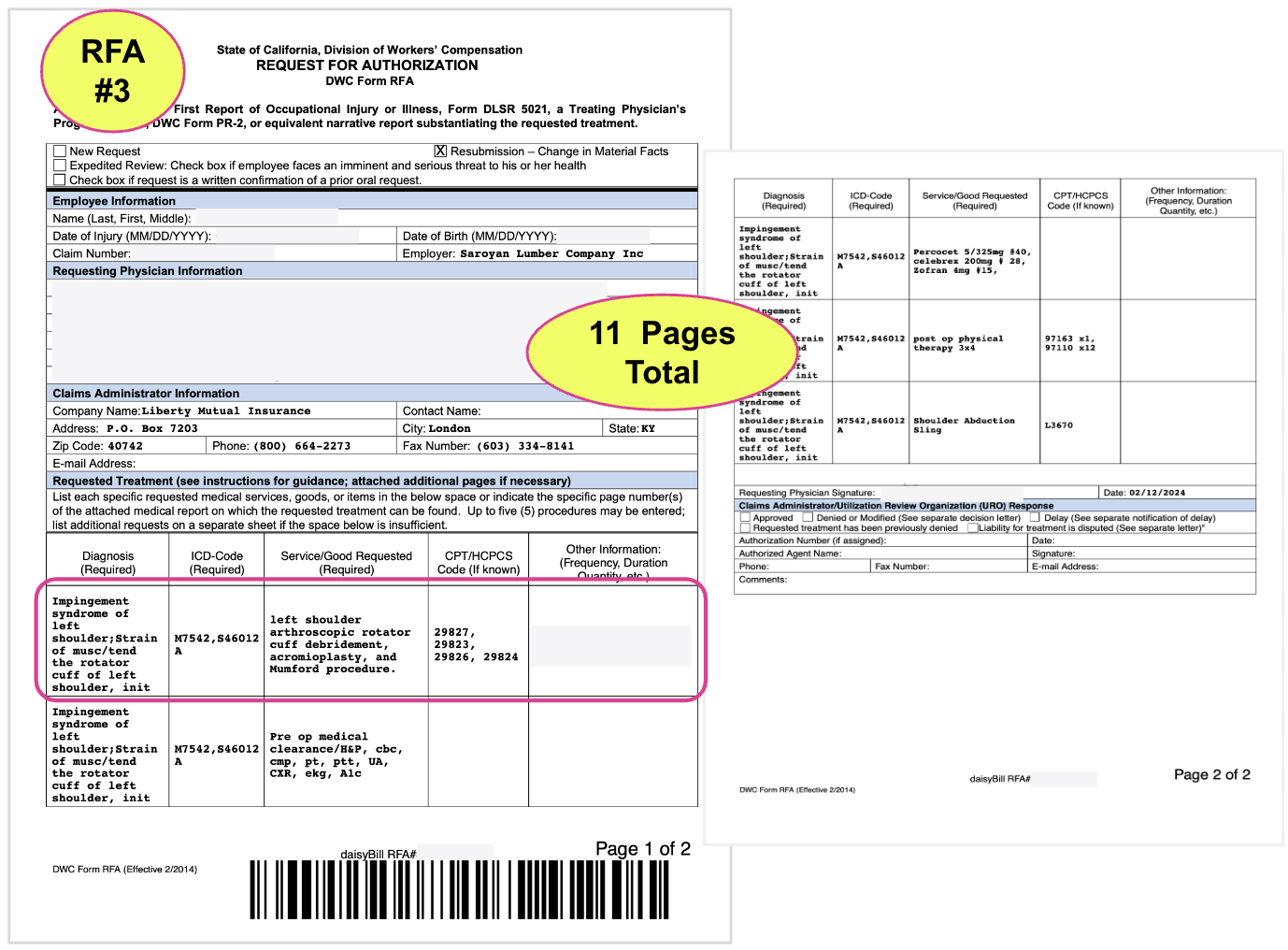

Provider compliance comes at a cost. In the Liberty Mutual case, consider the sheer volume of administrative work required to get this injured worker the care they needed and to subsequently attempt (unsuccessfully) to obtain the reimbursement owed for that care Liberty Mutual authorized:

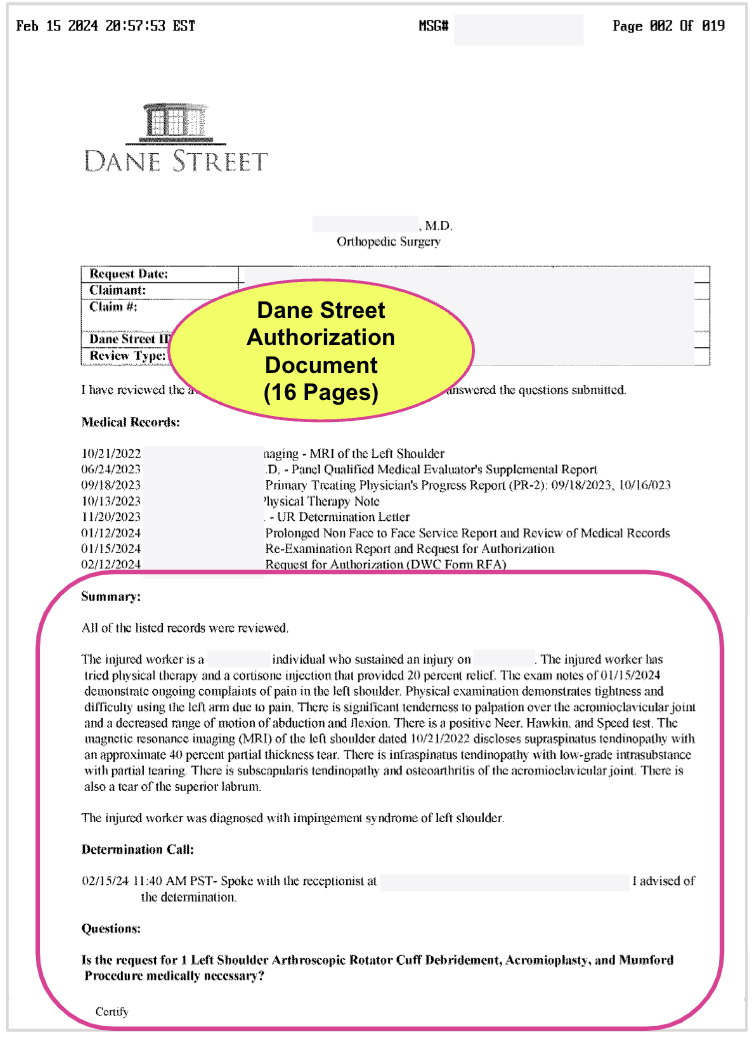

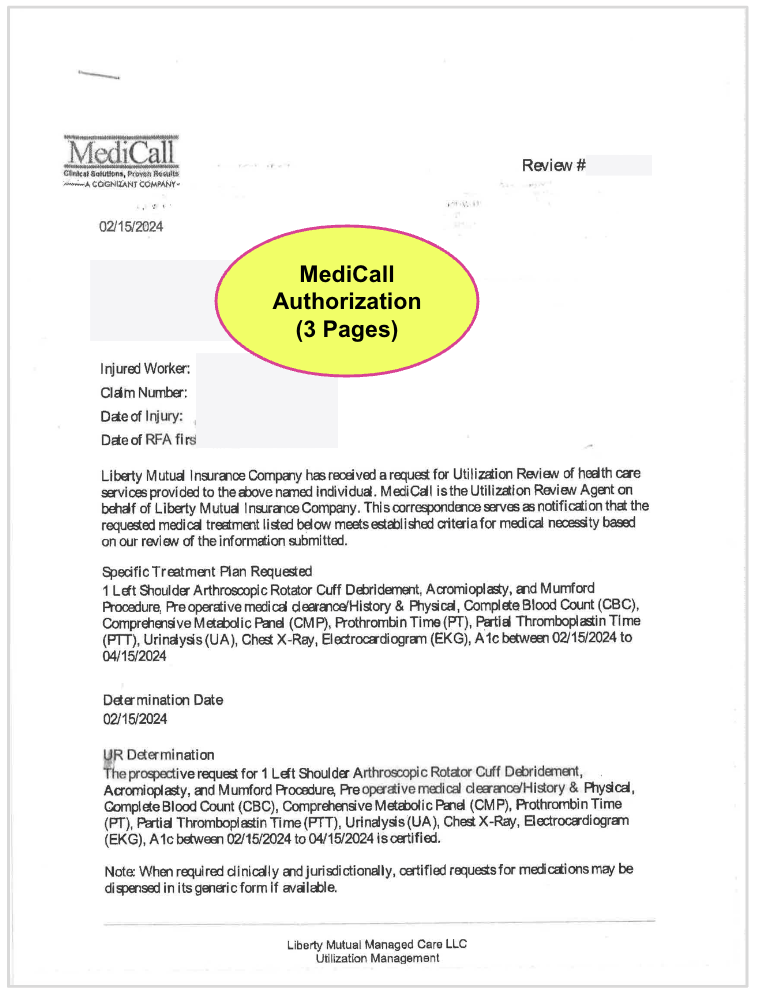

- Compiling and submitting 3 separate Requests for Authorization with supporting documentation totaling 27 pages

- Wading through 2 bloated UR decisions (from 3 different UR vendors) totalling 42 pages, much of it nonsensical

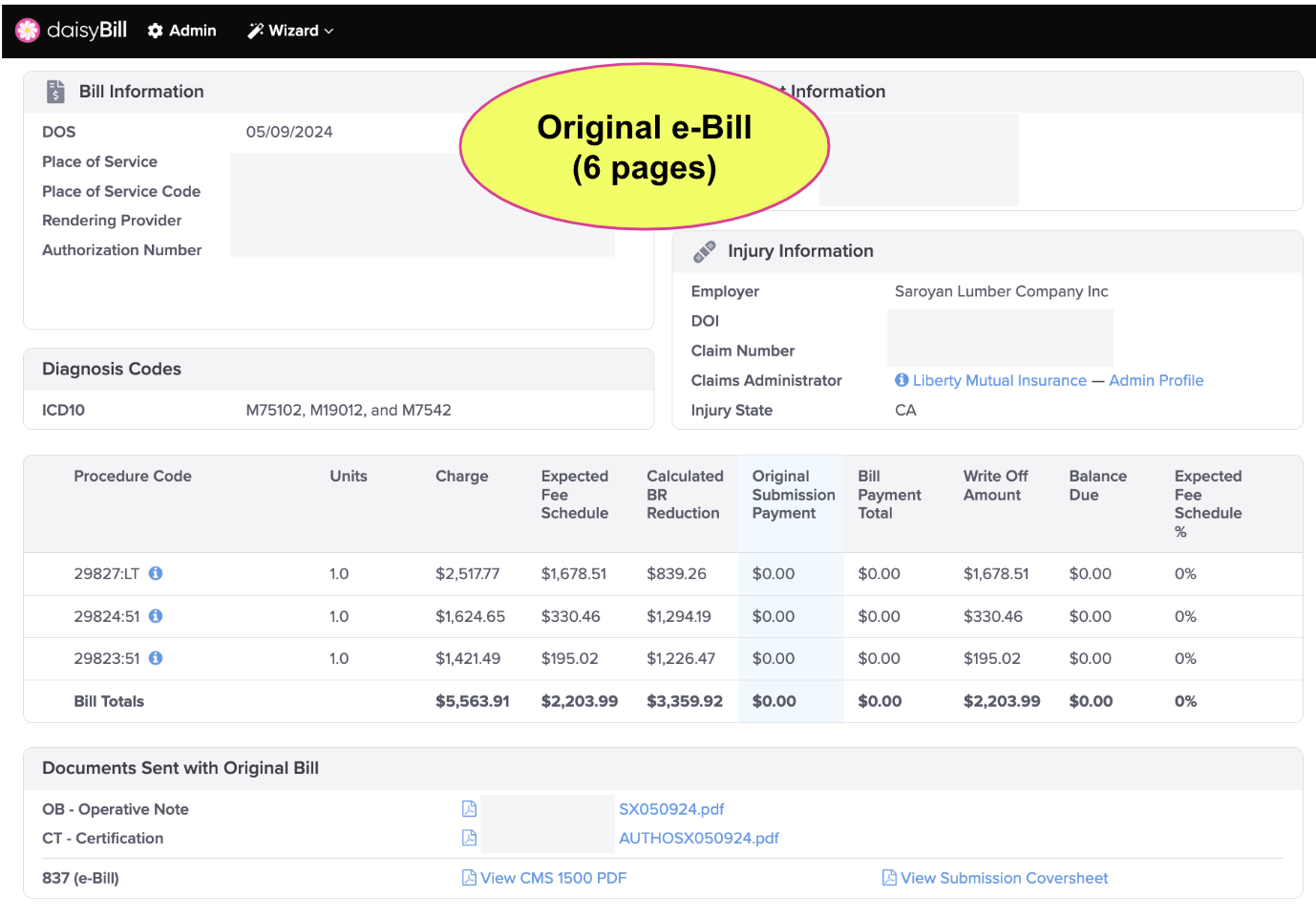

- Submitting an original bill with 5 pages of supporting documentation, including the documentation Liberty Mutual later inaccurately claimed was missing

- Submitting a Second Review appeal with 5 pages of supporting documentation

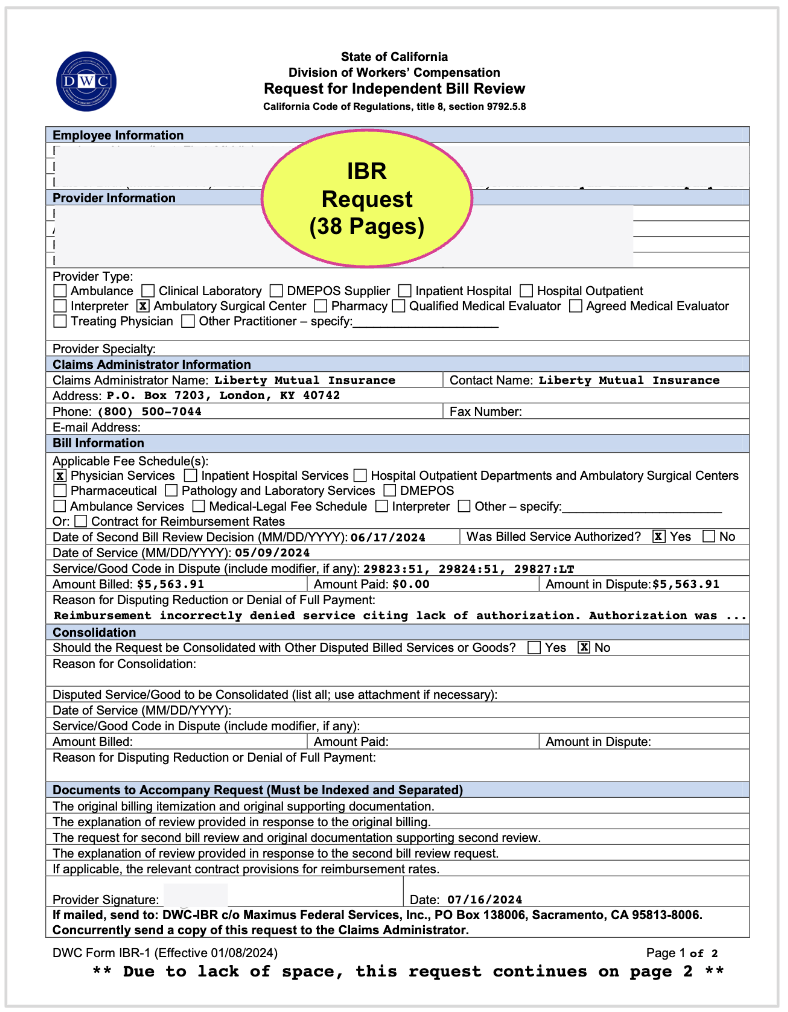

- Submitting a 38-page request for IBR

The reams of paperwork involved in this appalling saga are reproduced below, to illustrate the scale of what providers contend with in simply attempting to do their jobs (and heaven forbid, get paid for it).

If this provider has any hope of payment, it will require even more time and resources, including paying a lien representative a hefty percentage of the reimbursement owed and potentially waiting years for justice.

This is why providers refuse to treat injured workers. This is why injured workers in California struggle to find the care they need. Under the DWC and its Administrative Director George Parisotto, California workers’ comp providers lack even the most basic legal protections.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.