CA DWC Ignores Authorization, Lets Liberty Mutual Stiff Orthopedist

The Division of Workers’ Compensation (DWC), under Administrative Director George Parisotto, has allowed Liberty Mutual to deny thousands in payment owed to a California orthopedic surgeon for care that Liberty Mutual authorized.

Following a 23-month ordeal, an injured worker finally received surgery that Liberty Mutual initially denied, but ultimately authorized after more conservative treatments failed. However, despite granting authorization, Liberty Mutual refused to reimburse the surgeon, inaccurately claiming that the surgeon did not submit a Request for Authorization (RFA) and that Liberty Mutual did not authorize the surgery.

The orthopedist submitted an RFA, and Liberty Mutual authorized the surgery—demonstrably, proveably, and undeniably. The orthopedist included proof of authorization with the original bill, Second Review appeal, and the documents submitted to the DWC to request Independent Bill Review (IBR) to resolve the dispute.

Despite the obvious error by Liberty Mutual, the DWC deemed the dispute ineligible for IBR.

Rather than simply glancing at the extensive documentation the orthopedist included with the IBR request, the DWC chose instead to trust blindly in the inaccurate information Liberty Mutual listed on its Explanation of Review (EOR), which incorrectly claimed the provider neither sent an RFA nor received authorization. Mr. Parisotto and company failed to:

- Review the 38-page IBR request submitted by the surgeon, which included documentation that Liberty Mutual authorized the treatment

- Enforce California law, which mandates reimbursement when a provider furnishes authorized treatment

Despite the immense administrative work expended by the orthopedist to adhere to California Utilization Review (UR) laws, the ineligibility ruling by Mr. Parisotto’s DWC means the surgeon’s only path to reimbursement is to wait for the injury claim to be fully closed and pay a lien representative to bring the dispute to the Workers’ Compensation Appeals Board.

With this decision, Mr. Parisotto has rendered California’s UR laws farcical. The DWC is effectively torching the sanctity of authorization and returning providers to begging for payment through liens, an expensive, lengthy process that providers cannot pursue until the claim is settled (which typically takes seven years in California).

Under George Parisotta’s leadership, the DWC seems little more than a puppet of claims administrators, their side-kick vendors, and the private equity firms that own these entities—injured workers and providers be damned.

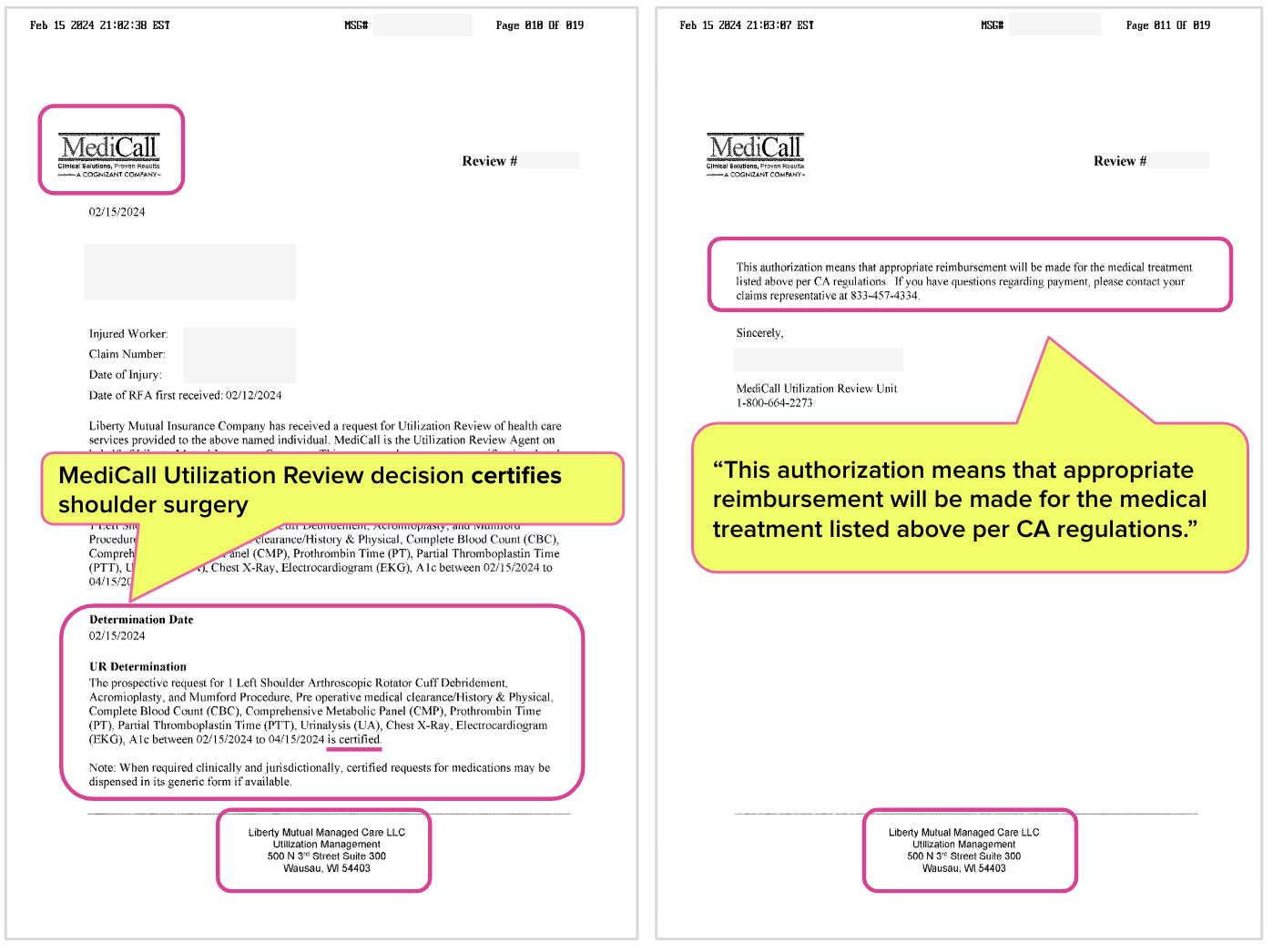

Liberty Mutual (and its UR Vendors) Authorize Surgery

As we explored in recent articles, the injured worker’s maddeningly long process to obtain authorization for surgery included:

- A Medical-Legal dispute and evaluation

- Dozens of doctor visits

- Initial denial of surgery

- Nearly two years of pain for the injured worker

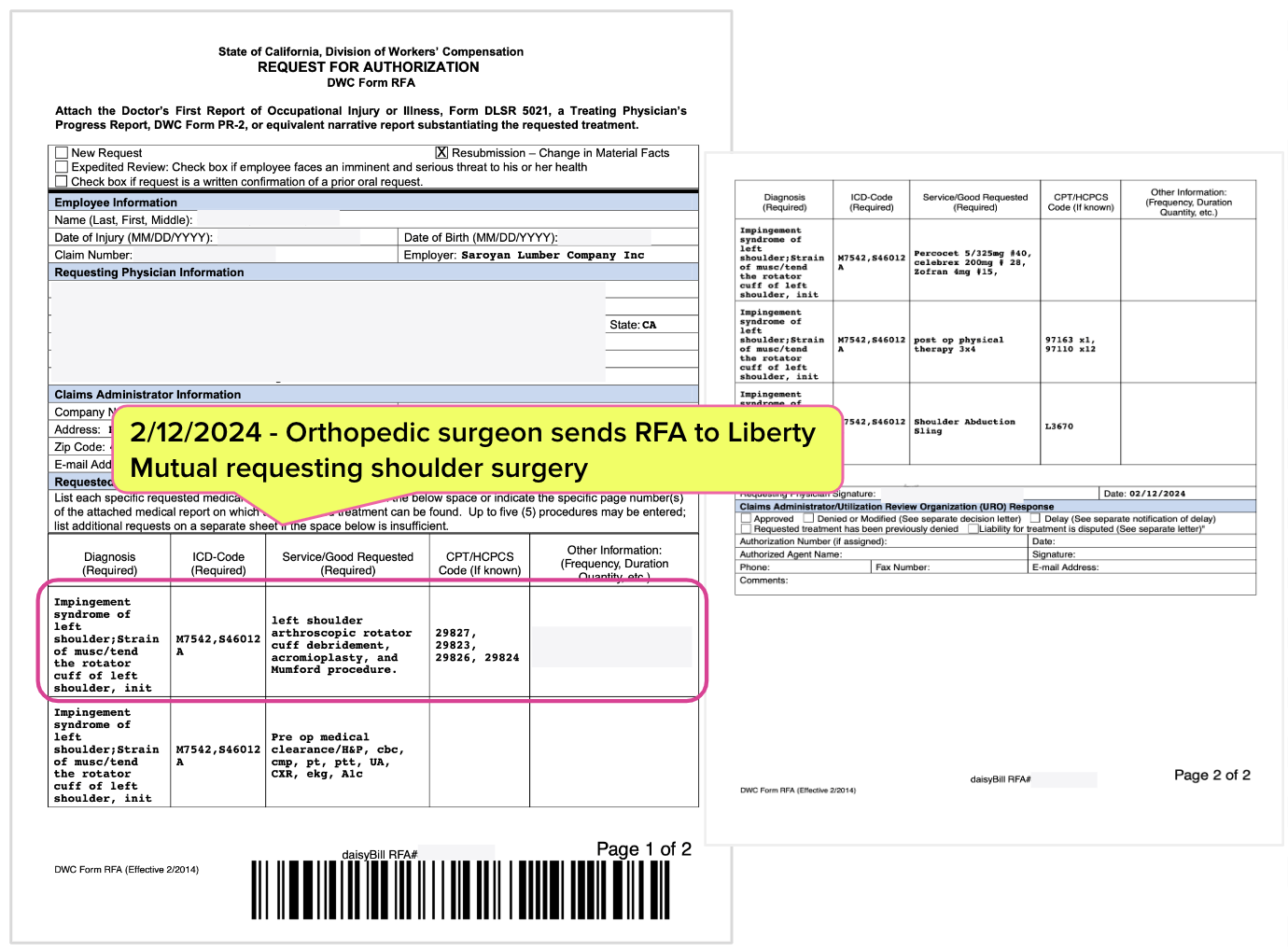

In February of 2024, twenty months after the Date of Injury, Liberty Mutual authorized the requested surgical procedures and pre and post-operative care. The RFA (submitted on the mandatory DWC Form RFA) is below.

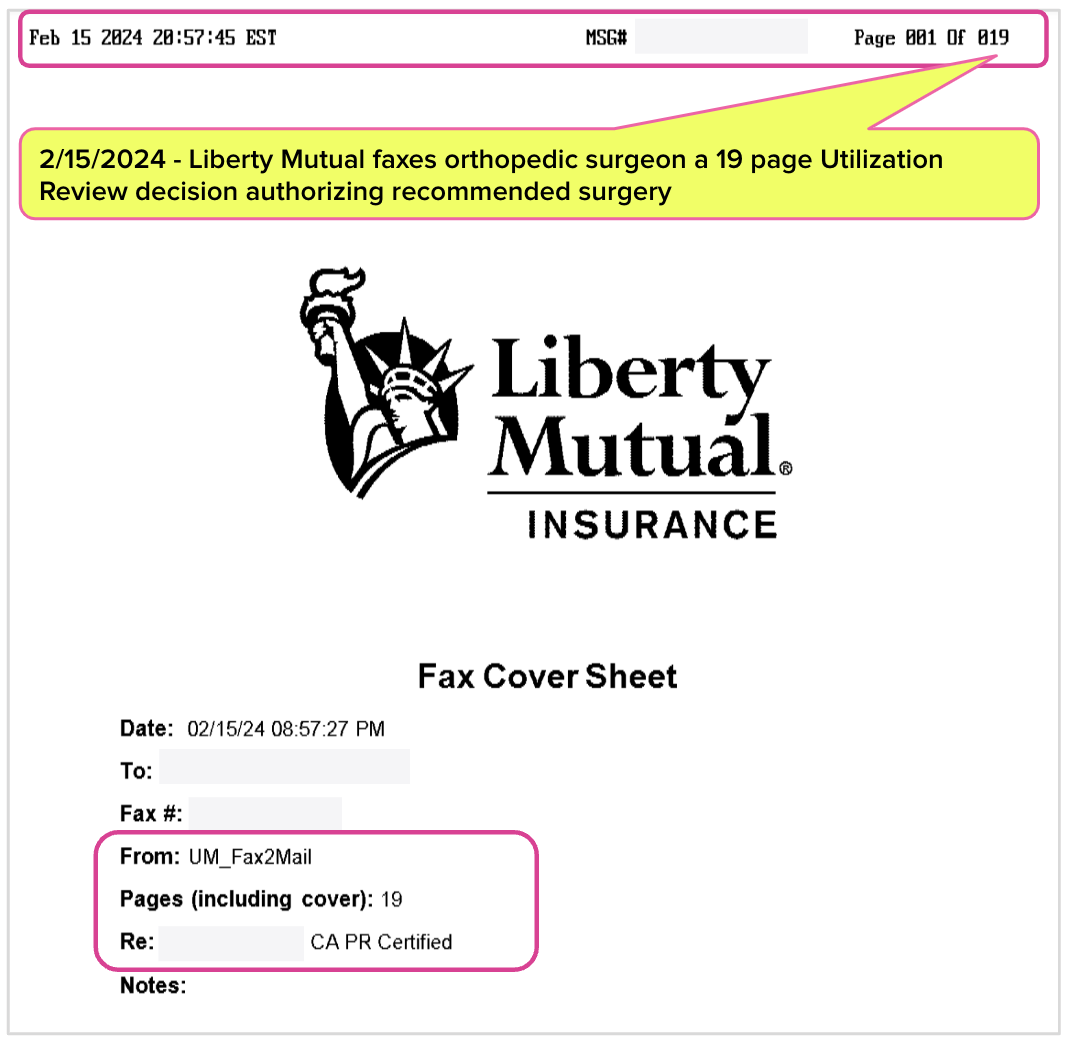

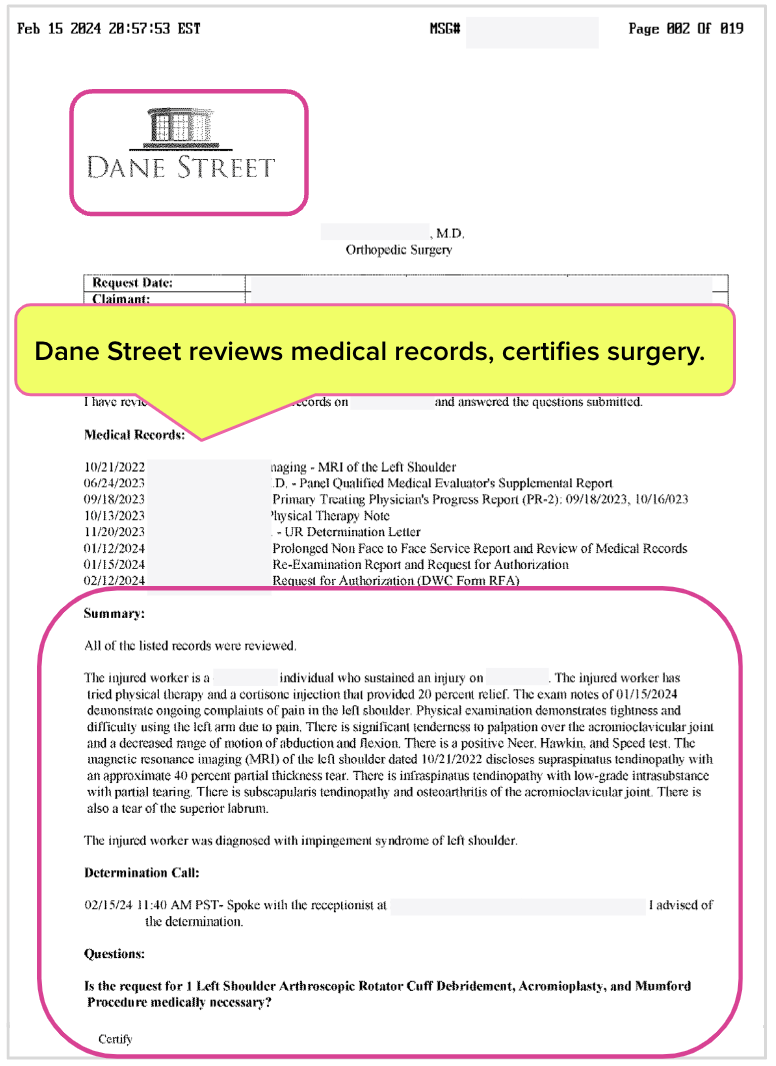

Two vendors conducted UR for the surgery on behalf of Liberty Mutual, Dane Street and MediCall. Both certified the recommended surgery, as shown in the letters below.

Further, the Liberty Mutual MediCall UR decision states: “This authorization means that appropriate reimbursement will be made for the medical treatment listed above per CA regulations.”

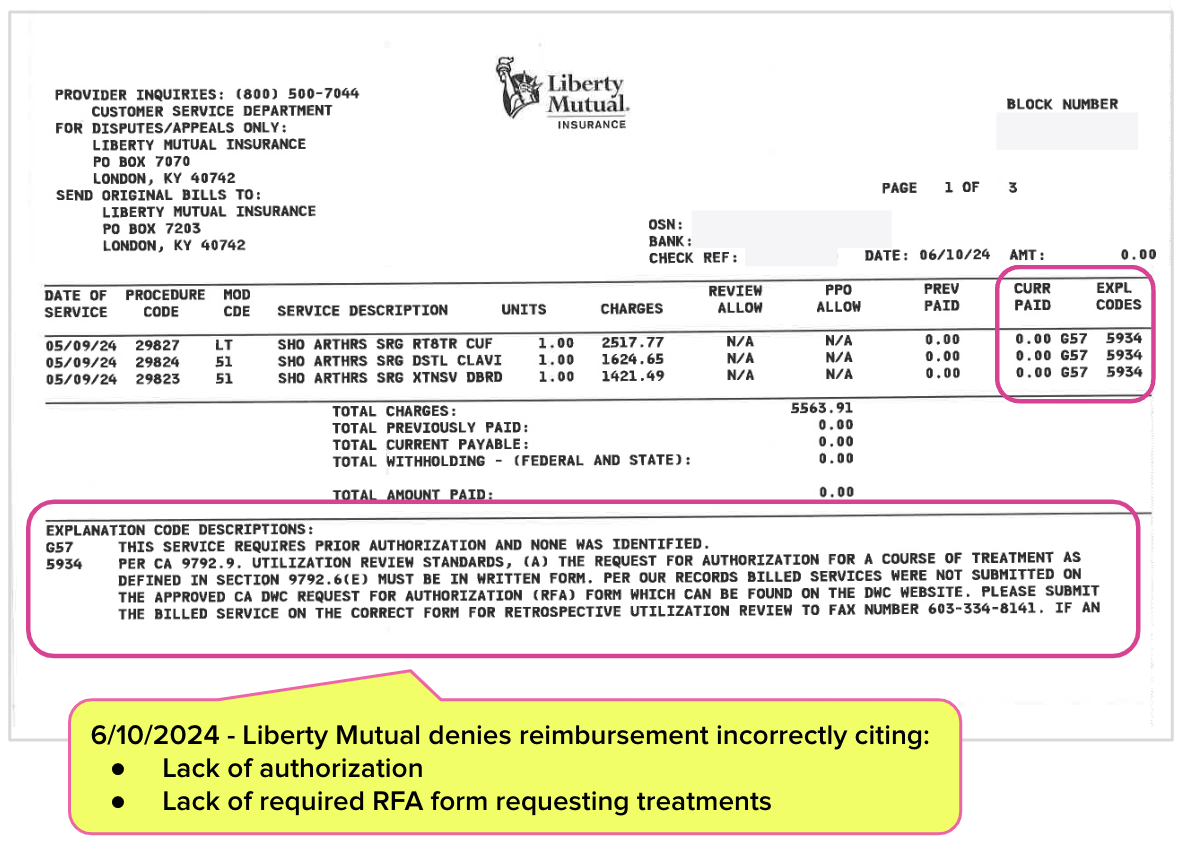

Liberty Mutual Refuses Payment, Cites Non-Authorization

The surgeon billed Liberty Mutual $5,563.91 for the authorized surgical procedures and included the MediCall authorization sent by Liberty Mutual with the bill. Liberty Mutual owed the orthopedic surgeon $2,203.99 per the Official Medical Fee Schedule.

Liberty Mutual responded with an EOR allowing $0 in reimbursement, claiming:

“THIS SERVICE REQUIRES PRIOR AUTHORIZATION AND NONE WAS IDENTIFIED.

…PER OUR RECORDS BILLED SERVICES WERE NOT SUBMITTED ON THE APPROVED CA DWC REQUEST FOR AUTHORIZATION (RFA) FORM…”

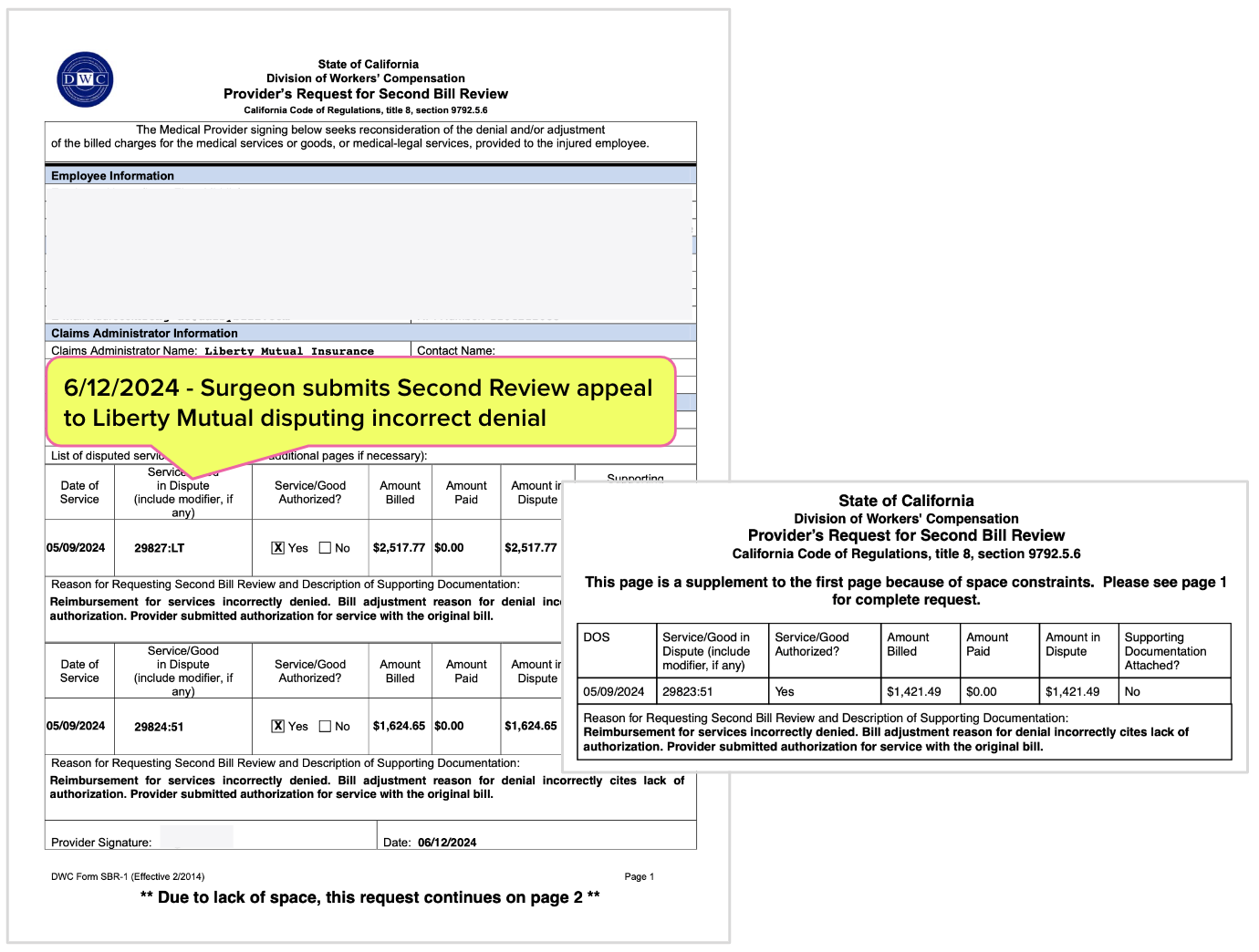

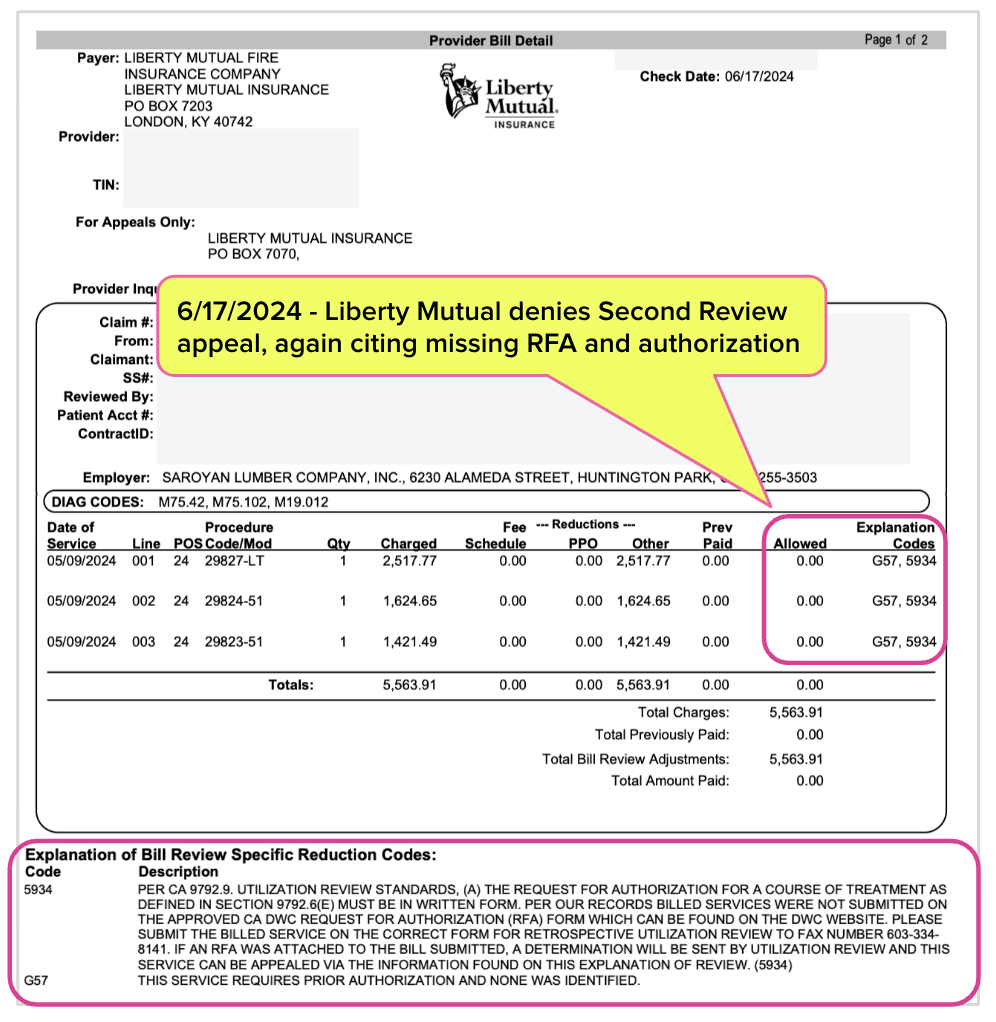

Liberty Mutual Doubles Down on Denial

To dispute the payment denial, the surgeon submitted a timely, compliant Second Review appeal to Liberty Mutual—again, complete with the MediCall authorization Liberty Mutual sent the provider. The orthopedic surgeon's “Reason for Requesting Second Bill Review and Description of Supporting Documentation” was as follows:

“Reimbursement for services incorrectly denied. Bill Adjustment reason for denial incorrectly cites lack of authorization. Provider submitted authorization for service with original bill.”

Unbelievable (or totally believably, if you study workers’ comp), Liberty Mutual stood by its initial decision and denied the Second Review appeal, citing the same entirely bogus reasoning: that no RFA was submitted, and that authorization was not granted.

Orthopedist Requests IBR

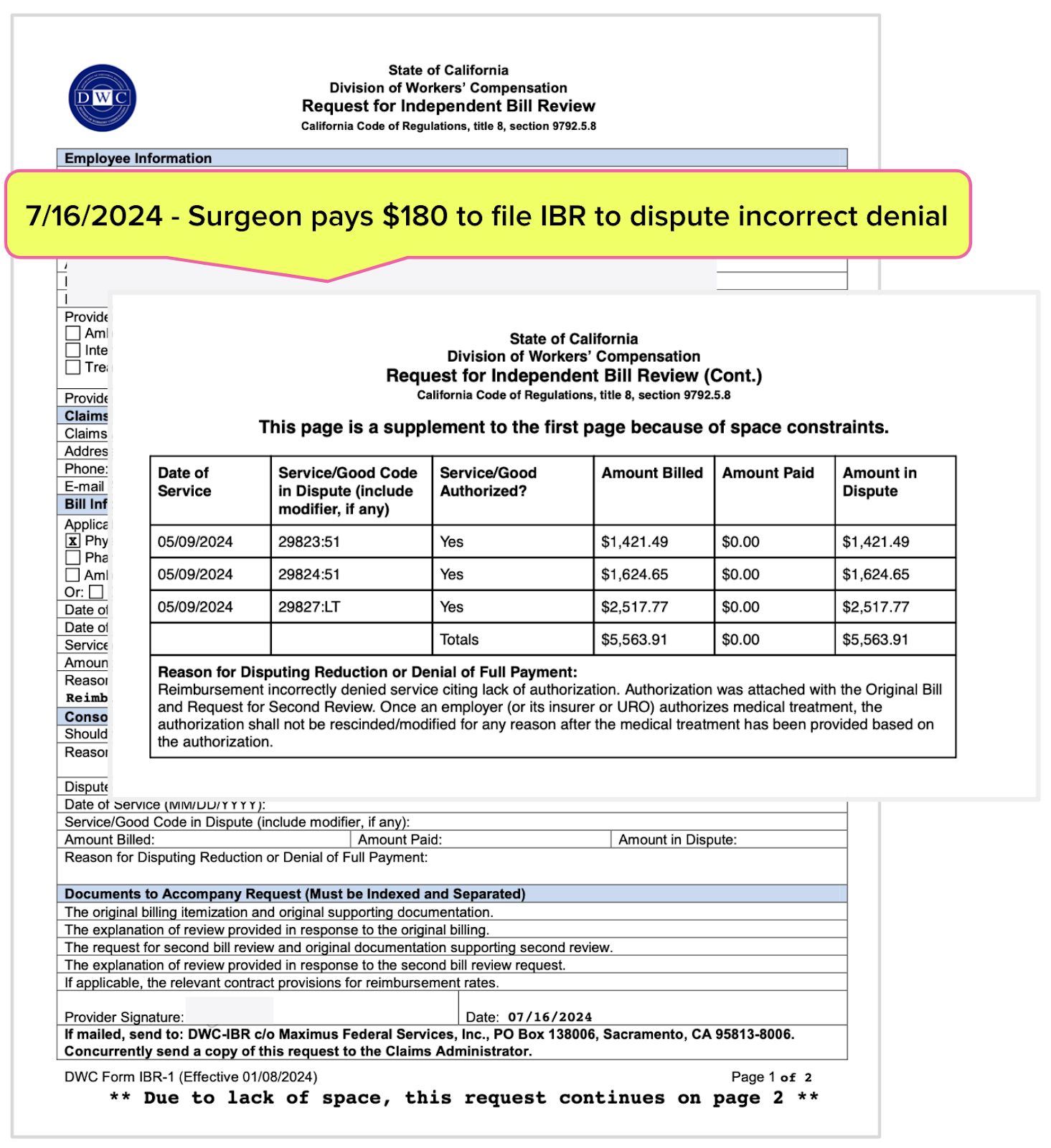

With no other option to pursue the payment owed, the surgeon assembled a 38-page request for IBR and paid the $180 IBR fee (only $132.50 of which is refundable following an “ineligible” decision) to Maximus Federal Services, the private entity that conducts IBR on the DWC's behalf.

The IBR packet sent to Maximus included two copies of the MediCall authorization sent by Liberty Mutual shown above.

Surely Maximus, which statistically overturns the majority of payment denials and adjustments disputed by California doctors, would set things right. Right? Unfortunately, Maximus would never get the chance.

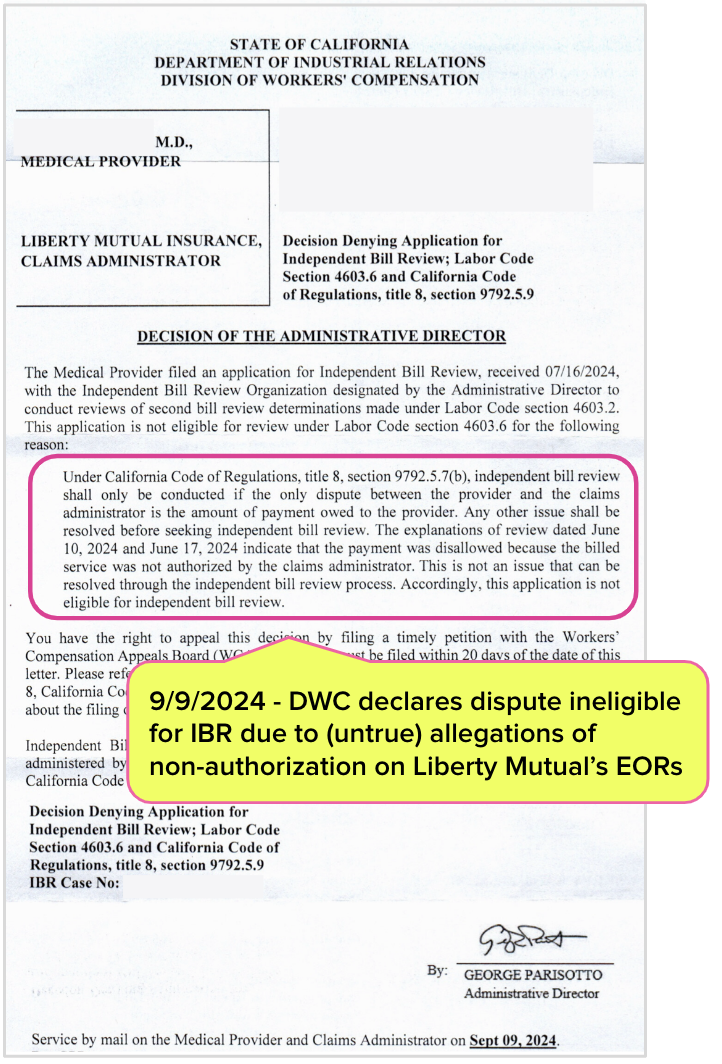

Instead of allowing IBR to go forward, Mr. Parisotto declared the dispute is ineligible for IBR because Liberty Mutual’s EOR alleged—inaccurately—that the services in question were not authorized. In the ineligibility decision below, Mr. Parisotto claimed that:

“The explanations of review dated June 10, 2024 and June 17, 2024 indicate that the payment was disallowed because the billed service was not authorized by the claims administrator. This is not an issue that can be resolved through the independent bill review process.”

After slogging through a bureaucratic hellscape to obtain approval to perform medically necessary surgery and then slogging through further billing obstacles to pursue the reimbursement owed, this orthopedic surgeon's quest for reimbursement just became much more difficult—because the DWC and its Administrative Director gave Liberty Mutual a way out of its legal obligation to pay.

Meanwhile, Liberty Mutual walks away with the employer’s premiums (to say nothing of the reimbursement owed), and multiple redundant UR vendors walk away with their cut of the spoils. As ensured by Mr. Parisotto, the UR machine continues to profit the entities positioned to feed from it, even as doctors are given the proverbial shaft.

California regulations and Labor Code are clear in mandating that authorization guarantees payment once the authorized services are rendered. But Mr. Parisotto has rendered authorization meaningless, declaring with decisions like this that any claims administrator can avoid paying by simply alleging lack of authorization, however implausibly.

It’s heads I win, tails you lose; fail to obtain authorization, and payment is forfeit. Obtain authorization, and payment is also forfeit—even when it requires a little assist from the DWC and its Administrative Director.

Submit RFAs in 30 seconds and automatically track UR decisions with daisyAuth. Request a demo below!

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

Why don't you file a writ challenging the AD's decision?

Dan, of course. However, you miss the point. Very recently, SB 636 (Cortese) was vetoed by Gov Newsom because he alleged it was unnecessary and would drive up costs. Of course he was wrong and this case study is a prime example and certainly not the only one. SB 636 required a UR physician denying or modifying care to be licensed in California and thus the UR physician's actions would be subject to scrutiny by the Calif Medical Board. However, because that would have taken a big bite out of the closed system that is California's workers comp, insurers and likely the DWC (Parisotto) made this bogus point to the Governor and he wasn't willing to do the homework necessary to understand the problems caused by the opaque UR system as it is now applied. Sure, continued litigation will right the wrong (maybe) but even the California Supreme Court recognized the potential for wrong decisions in its opinion in King v Compartners back in 2018 when the Justices pointed out to the legislature that the UR system was not working as it intended. When Sedgewick can boast in an advertisement that it denies 54% of UR requests and as a result UR (as practiced by Sedgewick) provides a financial return of 5:1, there is no denying that California's injured workers - privately employed or employed by public entities - are getting shafted as are their medical providers.

It really pi$$es me off that as providers and billers, we have to do this on a regular basis. The cost is astronomical.