Tristar: 8,271 Audit Complaints Filed With CA DWC

Using data generated by over 23,000 electronic bills sent by our provider clients in 2022, daisyBill demonstrates consistent non-compliance with California e-billing regulations by Third-Party Administrator (TPA) Tristar Risk Management.

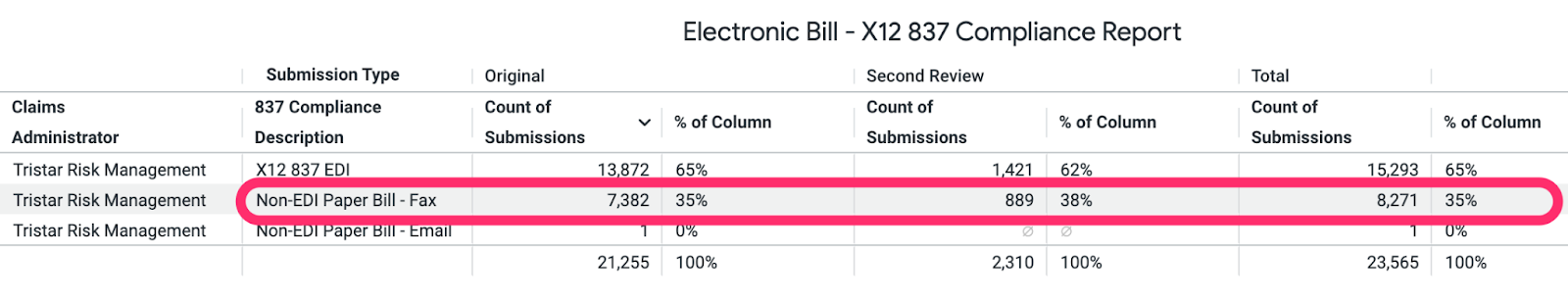

For bills submitted in 2022, below is the message and formal Audit Complaint daisyBill submitted to the Division of Workers’ Compensation (DWC), outlining Tristar’s systemic non-compliance, specifically the TPA’s failure to accept bills electronically in the X12 837 format for 8,271 (35%) bill submissions.

As advocates for providers, we must point out that if a provider fails either to timely or accurately submit a workers’ comp bill (for any reason), the claims administrator simply denies the bill as invalid and is allowed to deny payment for the treatment. The provider is left with little recourse to ‘correct’ the alleged non-compliance, resulting in forfeiture of payment for the treatment rendered.

We urge the DWC to enforce California workers’ comp billing and payment requirements by imposing appropriate consequences on Tristar for its consistent failure to comply with California law. Tristar’s actions impose an unnecessary administrative burden on providers who agree to treat California’s injured workers.

Tristar: Ignoring CA Law

To: XXXXXXXX@dir.ca.gov

Subject: Tristar EDI Non-compliance: X12 837 e-Bill Not Accepted - 8,271

Below is an Audit Complaint reporting credible data that Tristar Risk Management ignores California law by failing to accept bills electronically in the X12 837 format.

Since the acceptance of e-bills was mandated in California, Tristar has restricted its acceptance of e-bills to a selected list of the clients for which it acts as Third-Party Administrator (TPA).

- Tristar uses Jopari as its clearinghouse vendor

- Jopari maintains two separate Tristar Payer IDs: 41556 & J1491

- Payer ID 41556 - Jopari publishes a list 291 Tristar clients that will accept e-bills from providers

- Payer ID J1491 - Jopari publishes a list of 279 Tristar clients that will accept e-bills from providers

- Jopari updates these lists weekly to reflect changes to Tristar clients

- For Tristar clients not listed on either of the two Jopari lists, providers must fax a paper bill to Tristar for payment

- Due to the restricted Tristar e-bill acceptance, YTD 2022, daisyBill clients have faxed 8,271 paper bills to Tristar for payment

- To eliminate the necessity of faxing bills to Tristar, in June 2022, daisyBill contacted Jopari to request that Tristar establish a Payer ID for all Tristar TPA clients. Jopari responded: “Tristar- you submit by employer name. There is no generic payer ID for Tristar.”

Tristar’s refusal to accept e-bills for all of its TPA clients directly violates California law and inflicts a significant burden on California providers. More importantly, e-billing is not viable when a claims administrator can selectively choose to adhere to California law.

Tristar failed to accept e-bills (X12 837) from daisyBill providers as mandated by California law for 8,271 (35%) submissions.

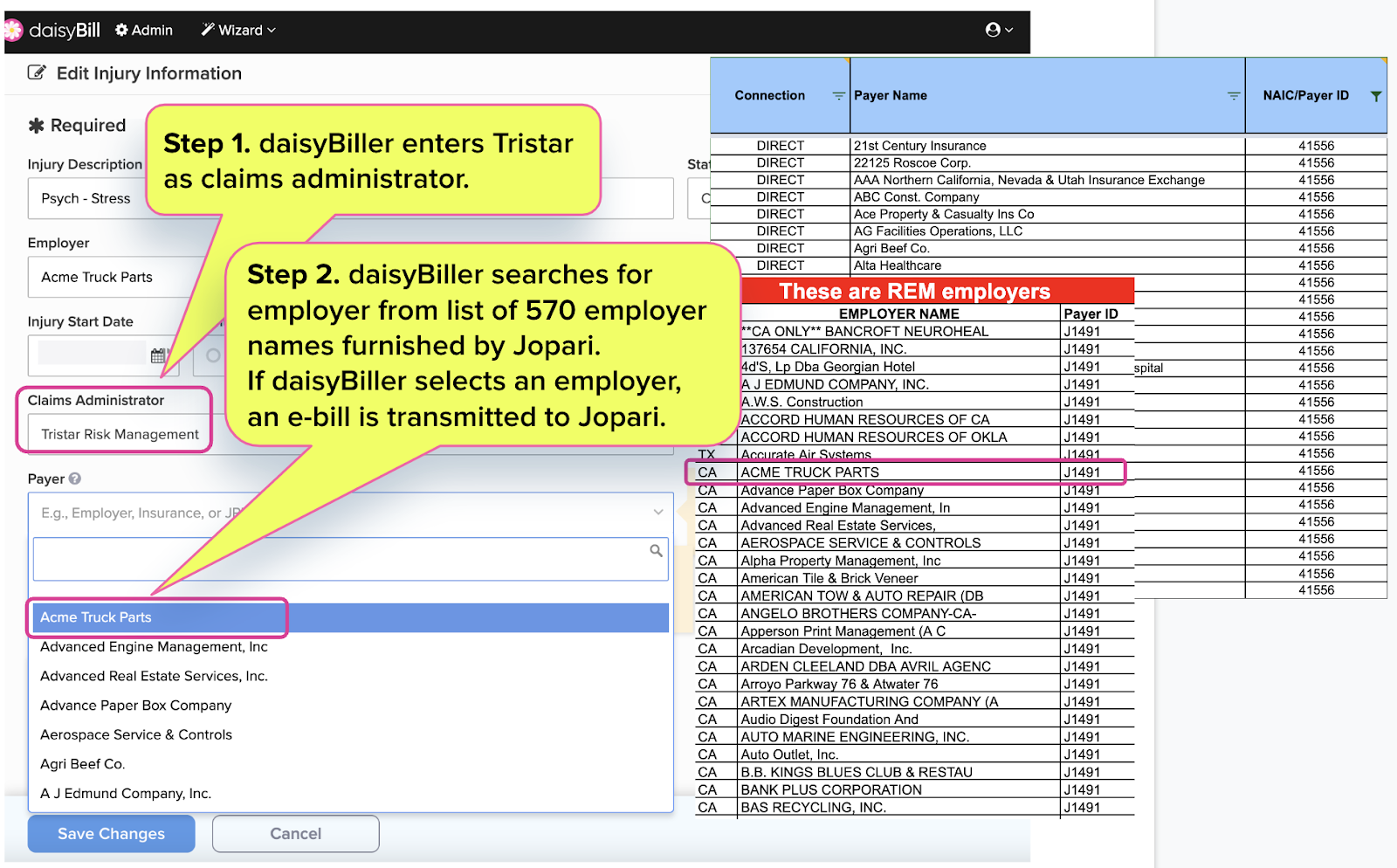

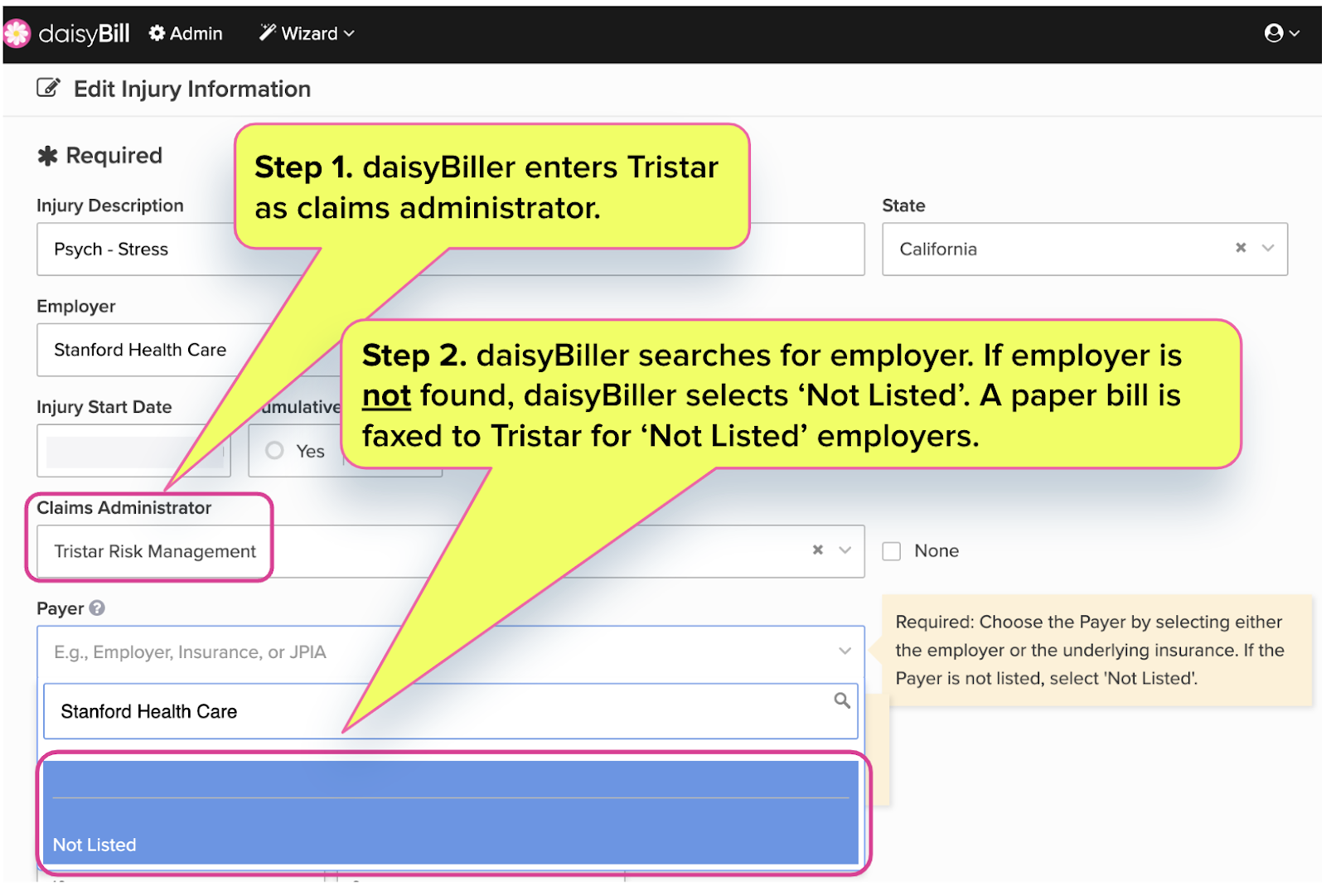

Further, below are screenshots of the complexities a provider must navigate to manage Tristar’s refusal to use a single Payer ID for all of its TPA clients.

Tristar Requires Provider To Choose Underlying Payer

To send an e-bill to Tristar, the provider must select the correct underlying payer name so that daisyBill can route the e-bill to the correct Tristar Payer identification number.

If the provider fails to locate the name of the underlying payer in the Tristar payer list, the provider selects that the payer is ‘Not Listed’ and daisyBill faxes a paper bill directly to Tristar.

This Audit Complaint data represents California workers’ comp bills submitted to Tristar by daisyBill providers from January 1, 2022 through July 1, 2022.

Attached is a CSV list containing 8,271 bills providers submitted to Tristar where Tristar failed to accept the bill electronically in the X12 837 format. The attached CSV list includes the following columns:

- Column L: [Bill] Transmission Date

- Column H: Submission Method - NonEDI - This column is all ‘FAX’ because Tristar failed to accept e-bills.

- Column I: Clearinghouse - This column is BLANK because Tristar failed to accept e-bills.

- Column AN: Patient Name

- Column AO: Claim Number

Audit Complaint Details

This Audit Complaint Data submitted to the DWC represents a credible complaint and credible information of claims handling violations.

Noncompliance: Claims administrator failed to accept an Original Bill or Second Review Appeal in the mandated ASC X12N/005010X222A1 837 format.

Effective October 2012, DWC Rule 7.1 requires the claims administrator to accept workers’ comp e-bills from providers in the X12 837 format.

CCR §10106.1(c)(3) instructs that the Audit Unit “shall review and compile complaints” that indicate a claims administrator is “failing to meet their obligations under Divisions 1 or 4 of the Labor Code or regulations of the Administrative Director.”

Pursuant to LAB §129, CCR §10106.1(c)(3) provides the DWC Audit Unit may target audit subjects based on: “...credible complaints and/or information received by the Division of Workers' Compensation that indicate possible claims handling violations, except that the Audit Unit will not target audit subjects based only on anonymous complaints unless the complaint(s) is supported by credible documentation.

Protect your practice. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Reach out to learn how we can help.

CONTACT US

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.