WCIRB's Shocking Admission About Workers' Comp Data

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is the leading data source for California legislators, regulators, and others. But in its 2024 “State of the System” report, the WCIRB makes an astonishing disclosure, for anyone willing to read and analyze the report’s finer print.

While bemoaning rising fee schedule rates as a driver of insurer expenses, the WCIRB admits that its data fail to account for Preferred Provider Organization (PPO) and other network discounts, which reduce the actual reimbursement amounts insurers pay to providers to far below fee schedule rates.

This enormous oversight deserves more than a passing acknowledgment in the WCIRB report’s footnotes.

WCIRB data form the core of reports to the state legislature and reports by the Commission on Health and Safety in Workers’ Compensation (CHSWC). These reports are presented by the DWC at their conferences. In a word, the WCIRB is trusted—but this footnote should raise high-alert alarms about the massive gap in its unverified, insurer-derived payment “data.”

If the footnote is true, these data are so appallingly incomplete that they cannot serve legislators, regulators or employers. But presumably, they work just fine for insurers, sidekick vendors, and private equity firms—because a workers’ comp system shrouded in confusion is easier to mine for profit.

Quietly Excluding PPO and Network Discounts

The 2024 WCIRB report bemoans the impact of increased fee schedule reimbursement rates on the rising costs to insure employers. However, a crucial mitigating factor quietly left out of the WCIRB’s calculations is the actual reimbursements paid once PPO and other network reimbursement discounts are deducted.

The WCIRB report acknowledges (albeit discreetly) that their analyses do not account for the fact that insurers sidestep paying Official Medical Fee Schedule (OMFS) rates by applying PPO and other network discounts. In its 2024 “State of the System,” a footnote on page 73 discloses that the WCIRB’s analysis of recent fee schedule updates (emphasis added):

“Does not reflect the impact of negotiated discounts from the fee schedule level that impact the actual medical payments.”

Full stop. Ring the fire alarms.

While the WCIRB whines that fee schedule increases are decreasing insurer profits, it neglects to factor in the massive PPO and other network reductions that reduce the actual payments made to providers, which are significantly below fee schedule rates (and often below Medicare rates).

How does the WCIRB account for these PPO and network reductions? Who is profiting from these payments that are below fee schedule rates? No one knows.

As our OMFS Reimbursement Reduction page reveals, the hundreds of claims administrators in our system use PPOs to collectively pay daisyBill providers just 83% of the amounts owed under the OMFS. Note that the data on this page do not reflect the vast network reductions (such as Medrisk, etc) inflicted on ancillary service providers.

For example, see the Explanation of Review (EOR) below, in which Sedgwick owed the provider $796.59 per the fee schedule, but (with an assist from specialty network vendor Apricus) only paid the provider $416.56, which represents 52% of the amount owed per the fee schedule. Sedgwick/Apricus took $380.03 from the provider using a canceled MultiPlan PPO.

Going by the footnote in the WCIRB’s 2024 State of the System report, this substantial $380.03 PPO deduction is not being disclosed by insurers in the self-reported, unverified data they submit to the WCIRB.

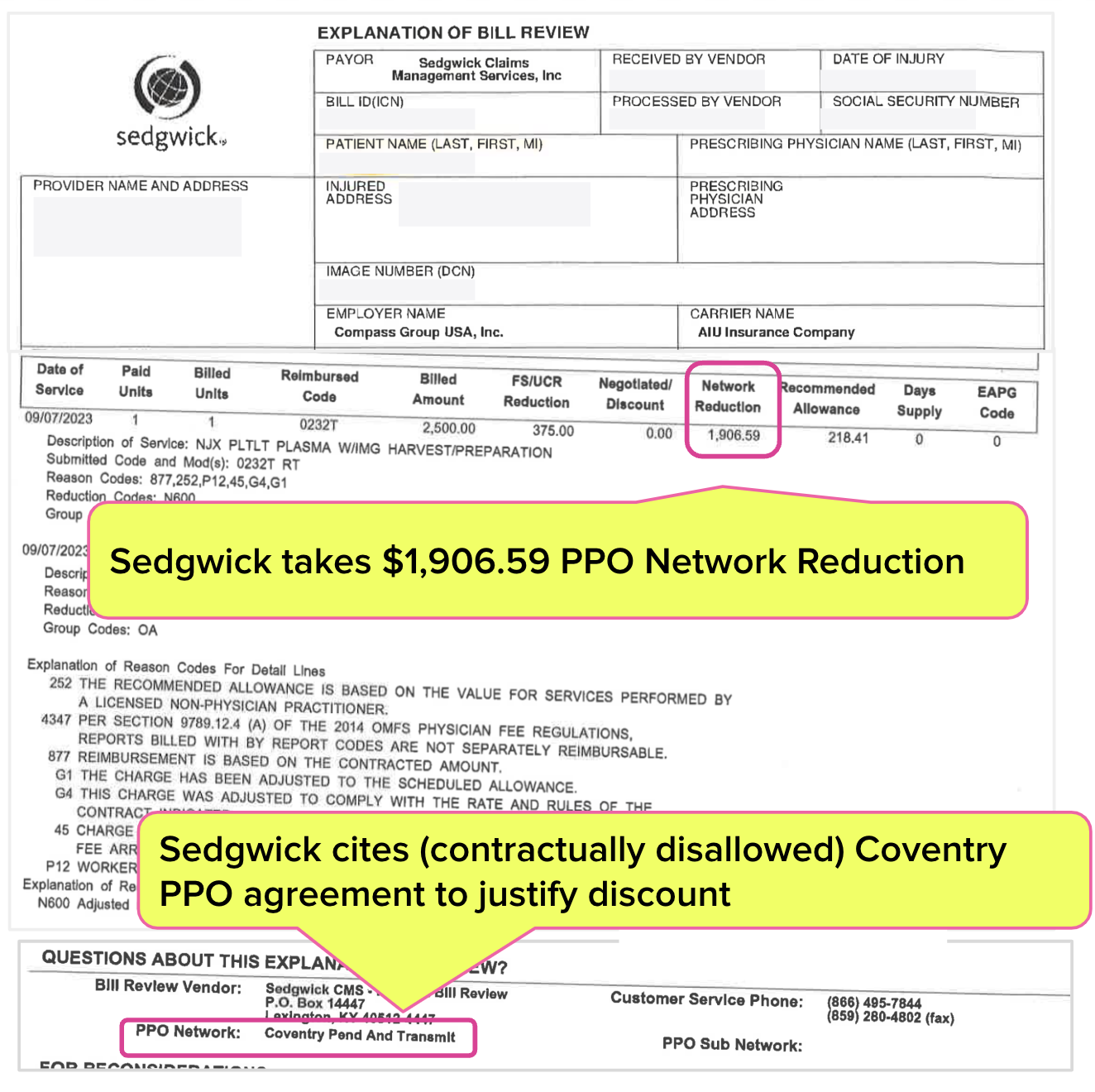

In another egregious example, Sedgwick/Coventry helped themselves to over $1,906.59 in PPO discounts and paid the physician only $218.41—despite Sedgwick’s having signed a binding contract that specifically forbids PPO discounting for the service rendered.

Again, the WCIRB footnote would seem to indicate that AIU Insurance Company may not have self-reported data that reflect this $1,906 Sedgwick/Coventry reduction.

When the WCIRB blindly accepts unverified data from insurers, do those data reflect the amounts actually paid to providers? Or does the WCIRB simply report what providers would be paid if not for rampant, (sometimes erroneous or invalid) PPO and network discounting?

The WCIRB has a stated job of helping California legislators and regulators understand how the workers’ comp system functions. But WCIRB data only help to advance the interests of its insurer members. By what bizarro-world version of basic logic does it make sense for this organization to be the state’s go-to data source?

In a deeply depressing irony, the WCIRB’s role in data collection and analysis produces far more questions than answers—chief among them: Why does California allow this cabal of insurers to keep us all in the dark???

With tools for quicker, easier appeals, daisyBill helps your practice demand full reimbursement—with just a few clicks. Learn more or request a demo below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)