Apricus Applies Massive, Invalid PPO Discount for Sedgwick

Specialty network vendor Apricus, acting on behalf of Third-Party Administrator (TPA) Sedgwick, recently applied an invalid Preferred Provider Organization (PPO) discount to an orthopedic surgeon’s bill, reducing reimbursement to well below Medicare rates.

Apricus/Sedgwick cited a long-canceled MultiPlan PPO agreement and paid the physician a rate equivalent to just 68% of the Medicare allowance for treating a Dollar Tree injured employee.

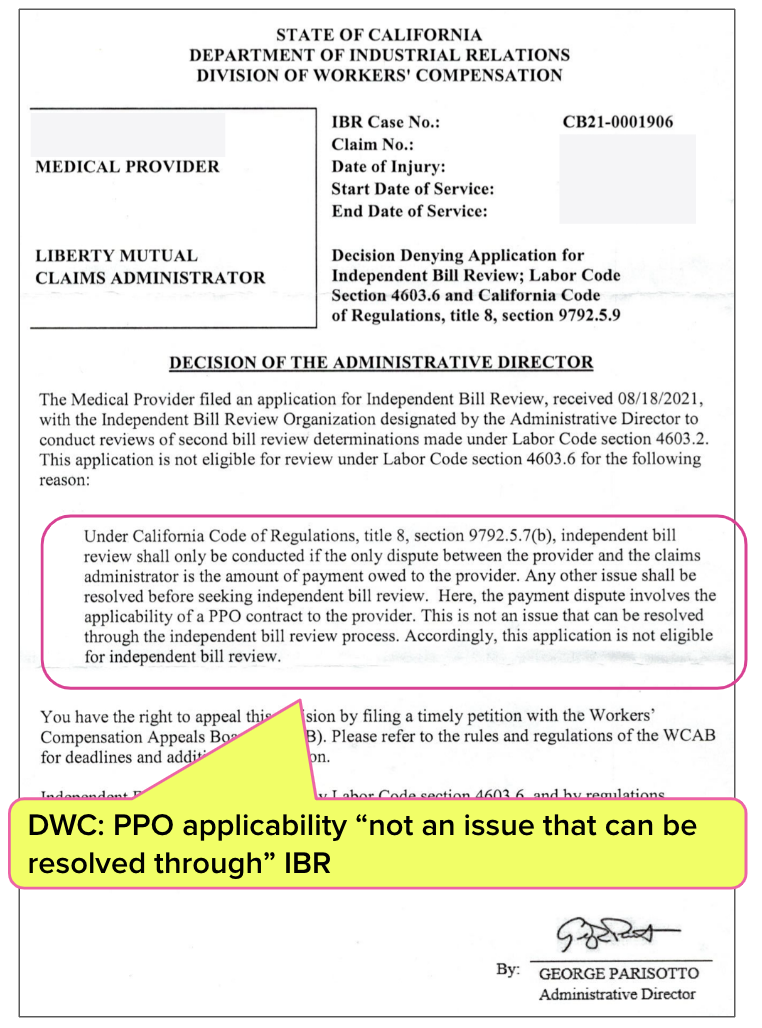

Normally, the appeals process (a Second Review appeal followed by a request for Independent Bill Review (IBR) if necessary) would ensue. But there’s only one problem: the Division of Workers’ Compensation (DWC) has declared that a dispute over a PPO reduction is “not an issue that can be resolved” through IBR.

In other words, Apricus and Sedgwick have granted themselves an inapplicable PPO discount—and the provider has no reasonable way to pursue correct payment because the DWC has effectively eliminated providers’ final recourse for disputing invalid PPO discounts. As we’ve discussed before, the costly, lengthy lien process is not appropriate in these cases, in addition to being significantly more burdensome than IBR.

Claims administrators like Sedgwick (and vendors like Apricus) are free to swipe as much of a provider’s revenue as they please, with the state's tacit permission.

Critically, this May 2024 bill is for an injury sustained in January 2021. For over three and a half years, this injured worker’s extended claim duration has presumably generated profit for the many acronyms involved: a TPA, PPO, BR, UR, VCC, PBM, MPN, and more.

California laws and regulations encourage the transformation of injured workers into annuities that keep money flowing to an unholy triumvirate of insurers, side-kick vendors, and private equity firms—while the DWC strips physicians of even the most basic protections from the deceptive practices of this alphabet army.

Provider Cancels MultiPlan Contract, Sedgwick Takes Discount Anyway

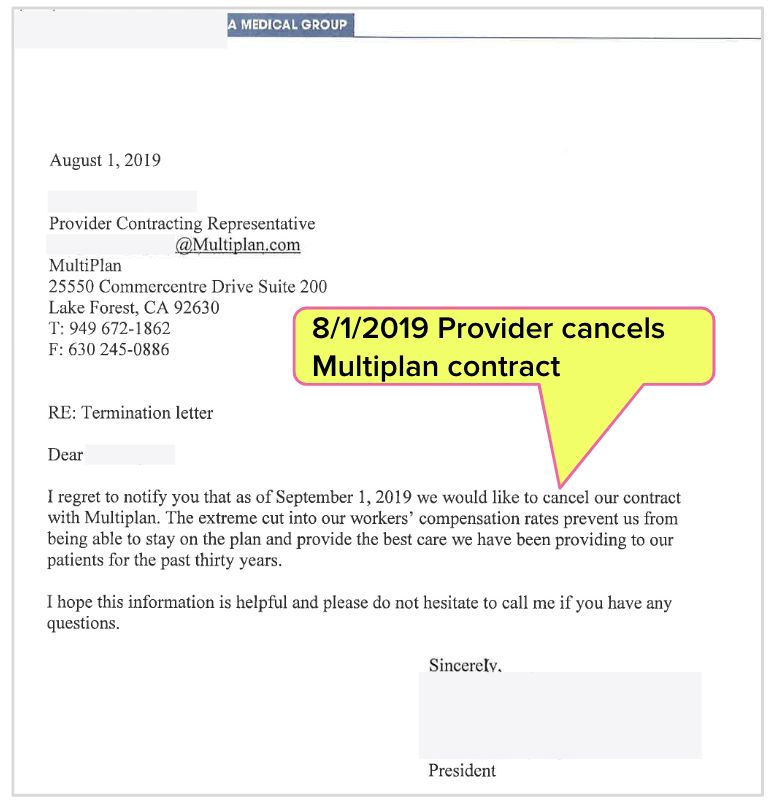

In 2019, a physician terminated their contract with MultiPlan PPO, and for very good reason. As the provider realized, accepting PPO discounts can shrink reimbursement to unsustainably low rates, in exchange for no benefit to the practice.

In the letter below, the provider stated:

“The extreme cut into our workers’ compensation rates prevent us from being able to stay on the plan and provide the best care…”

PPO Annuity Arithmetic Examined

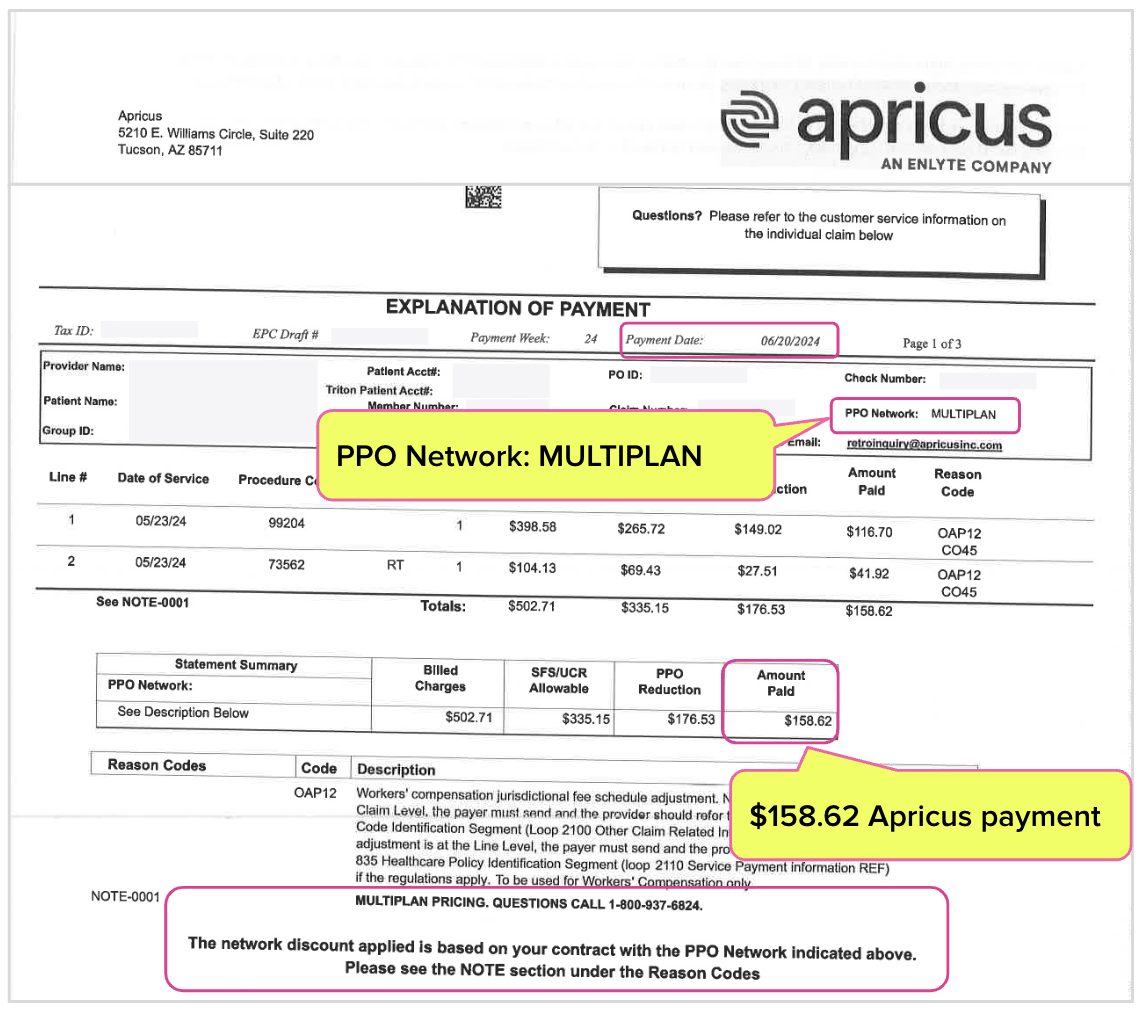

Five years later, the orthopedist treated a Dollar Tree employee and sent the bill to Sedgwick—only to discover that Sedgwick kicked the bill over to Apricus, which promptly took a massive discount on Sedgwick’s behalf, citing the canceled MultiPlan PPO agreement.

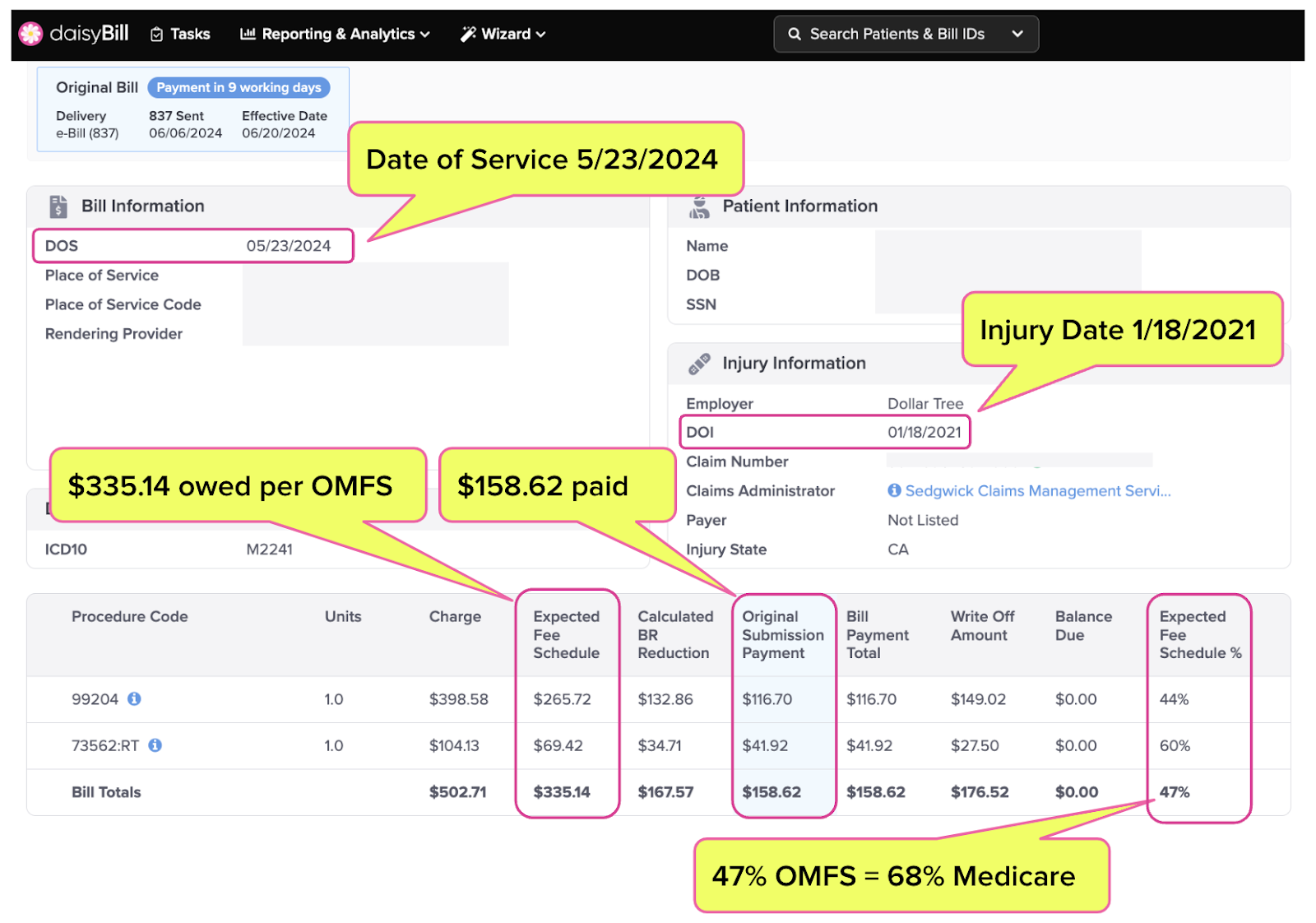

As shown in the screenshot from daisyBill below, Sedgwick/Apricus paid less than half the reimbursement owed under the Official Medical Fee Schedule (OMFS):

- Per the OMFS, Sedgwick owed the provider $335.14

- Sedgwick/Apricus paid the provider only $158.62 or 47% of the amount owed per the OMFS

- The payment amount was equivalent to 68% of the Medicare rate for the same services

Unlike the orthopedic surgeon, Sedgwick/Apricus provided no treatment or services to Dollar Tree’s injured employee—yet with the click of a button, this duo took $176.52 of the surgeon’s reimbursement.

This example demonstrates how profitable injured workers are when a TPA and PPO can use technology to simply siphon off 53% of the fee schedule amount owed to a physician. Extrapolate $176.52 across 3.5 years of an injured worker’s medical bills, and the (unearned) PPO profits increase month by month

According to the Explanation of Review (EOR) Apricus sent to the orthopedist, this extreme discount was based on the long-canceled MultiPlan PPO agreement, as shown below.

DWC Blocks IBR for PPO Disputes

The provider canceled their MultiPlan contract in 2019, yet Sedgwick/Apricus cited this canceled contract to take $176.52. Normally, the next step for the provider would be to submit a Second Review appeal and, if necessary, request IBR.

But thanks to the DWC’s abdication of its regulatory duties, appeals are not an option.

In a 2021 decision (shown below), the DWC declared that whether or not a PPO discount is valid is “not an issue that can be resolved through the independent bill review process.”

Further, the DWC Audit Unit has also reported that it “does not audit for bill reductions.”

The DWC’s position raises an important and obvious question: how can a physician resolve a dispute over an improper PPO discount?

The DWC has no problem intervening in PPO disputes for Medical-Legal services. Since California law does not permit separate 5307.11 reimbursement contracts established outside the Medical Legal Fee Schedule (like PPO discount contracts), the DWC consistently overturns claims administrators' attempts to apply PPO discounts to Medical-Legal bills.

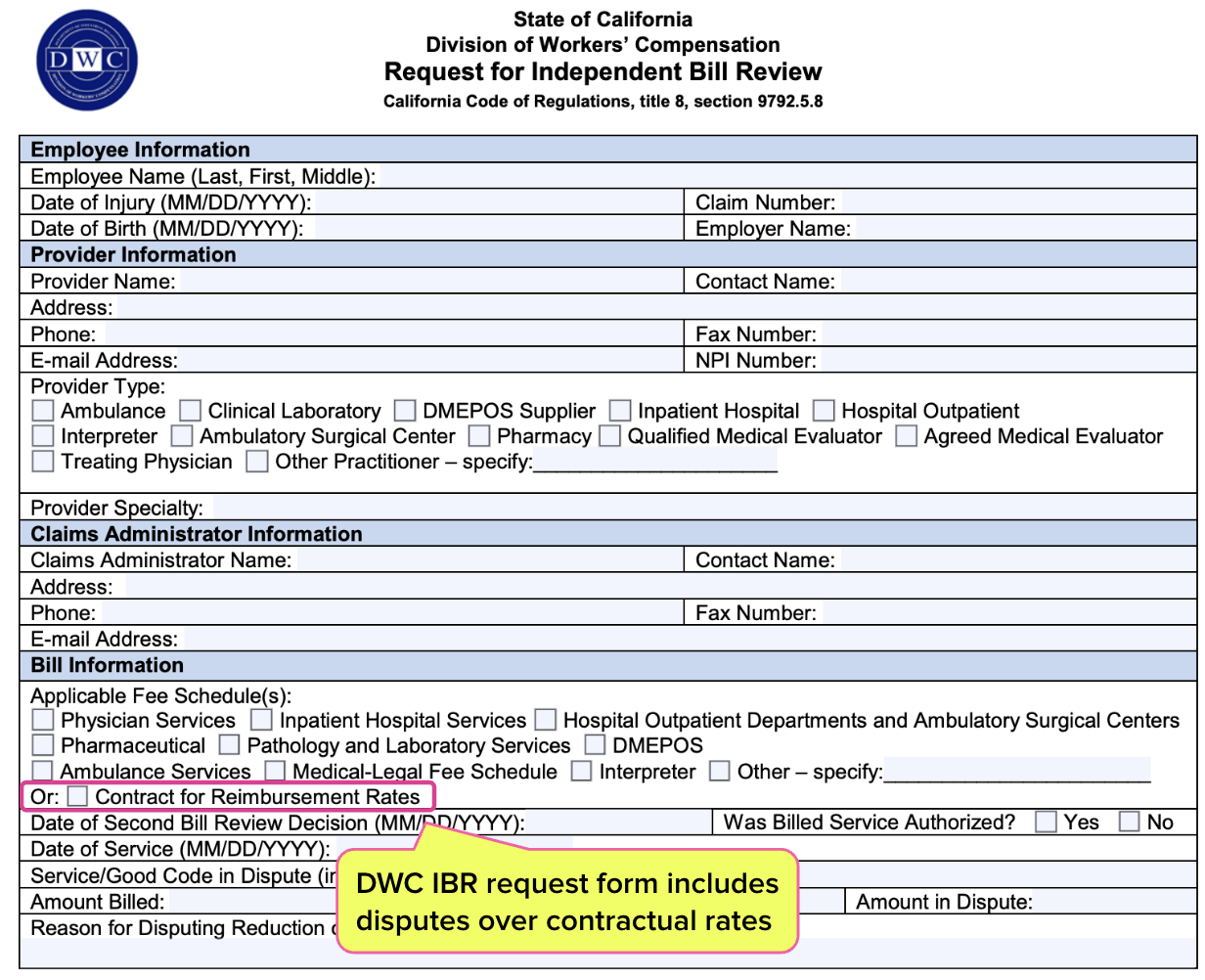

Note also that the DWC’s required form for requesting IBR actually includes a checkbox to indicate a reimbursement contract dispute, and explicitly instructs that IBR can resolve disputes over payments owed under separate 5307.11 reimbursement contracts (like PPO discount contracts).

Yet when a claims administrator like Sedgwick uses a demonstrably invalid PPO discount to decimate a provider’s reimbursement for medical treatment, the DWC washes its hands—and the provider is left with no recourse to justice.

Based on the DWC’s absurd position, any claims administrator can apply any PPO discount—real or imagined, applicable or not—to any bill for treating an injured worker. All the claims administrator has to do is deny the Second Review appeal, confident that if the provider requests IBR, the DWC will offer nothing but a shrug.

If there were any lingering doubts about the DWC’s unspoken role as guardian of payers’ profits, lay those doubts to rest. Sedgwick and Apricus are free to act with impunity, as demonstrated by this indefensible reduction.

Once again, insurers, sidekick vendors, and private equity are incentivized to view California’s injured workers as living, breathing annuities that keep revenue flowing into their coffers over extended claim durations. As the revenue flows in, entities like Apricus and Sedgwick—with an assist from the DWC—make sure as little revenue as possible flows out to providers.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

This is infuriating. This happened to one of my providers as well. It took me a little over a year AFTER terminating the Multiplan contract to stop their PPO reductions. These PPO companies are like peeling an onion.