WCIRB Smoke & Mirrors Misinform CA Employers, Stakeholders

As daisyNews has long argued (and Workers’ Comp Executive recently pointed out), California has a major problem with how it assesses the challenges of workers' compensation: the state’s over-reliance on “data” collected by the Workers’ Compensation Insurance Rating Bureau (WCIRB).

All stakeholders should be wary of California’s dependency on unverifiable WCIRB data collected from its insurer members.

WCIRB data are presented to the State Legislature in annual reports and parroted in reports issued by the Commission on Health and Safety and Workers’ Compensation (CHSWC). The Division of Workers’ Compensation (DWC) allows the WCIRB to present these data at its annual conferences. Finally, California Labor Code grants the WCIRB a “consultation” role in maintaining the Workers’ Compensation Information System (WCIS), the DWC’s primary data source.

Most recently, the WCIRB’s 2024 “State of the System” report takes an unsurprising tack: inflating insurers’ expenses and minimizing their profits, arguably giving a false impression that insurers are not raking in as much money as they probably are.

Make no mistake: despite the WCIRB’s unverifiable “data,” workers’ comp is a lucrative game. In California, injured workers are transformed into annuities that keep money flowing to an unholy triumvirate of insurers, side-kick vendors, and private equity firms. These entities profit handsomely from what the WCIRB describes as “Medical Cost Containment Programs” (MCCP)—programs that restrict injured workers’ access to care, keeping them sicker longer and ultimately generating more revenue.

The WCIRB insurer data presented to legislators and regurgitated by CHSWC and the DWC are nothing more than a smokescreen for this profitable, yet deeply dysfunctional system where injured workers’ care is not the priority.

CA: Devastating Facts

Even the WCIRB cannot hide the fatal fact that injured workers fare poorly in California compared to the rest of the country. In a 2022 report about claim duration, the WCIRB states “It takes 7 years to close 90% of claims in California compared to 3 years for the median state” (emphasis added).

In the 2024 “State of the System” report, the WCIRB’s self-reported, unverifiable insurer data reveal:

- “California still has longer duration of medical payments compared to the rest of the country”

- “The percent of California indemnity claims open at 60 months is more than three times the comparison state median, despite a post-SB 863 increase in claim closure rates in California”

Conveniently, the report fails to acknowledge that insurers control injured workers' access to care.

Throughout California, injured workers are restricted to the providers chosen through insurers' Medical Provider Networks (MPNs). Further, California law allows insurers’ claims administrators to deny any and all treatment recommended by MPN physicians.

Despite the WCIRB’s insurer members choosing the providers and choosing whether to approve or deny the recommended treatments, the WCIRB report ignores these essential facts when attempting to explain the huge discrepancy between California’s and other states’ ability to close injured workers’ claims.

With apparently no sense of irony, the WCIRB also claims that a “driver” of the extraordinary amount of time it takes to close California claims is “A higher frequency of ML [Medical-Legal] reports…” In other words, the WCIRB blames supposedly litigious injured workers for longer claims, while ignoring insurers’ efforts to restrict care, which forces workers to pay for attorney representation and resort to the Medical-Legal system.

Triumvirate Profits: Follow The Money

In diagnosing the dysfunction of California workers’ comp, the essential question is: who benefits from longer claims duration? Certainly, not the injured worker or employers.

The cynical calculus is that the triumvirate of insurers, side-kick vendors, and private equity earn more profits the longer an injured worker remains unhealed. The logic is brutally straightforward for those willing to exploit it; an injured worker is an ongoing revenue stream, generating more profit the longer their treatment is drawn out.

Private equity firms often control the adjacent vendors connected to workers' comp, finding innovative ways to redirect employer funds—which are meant to pay health care providers—into their own pockets. This diversion of funds typically flows through a gauntlet of benign-sounding acronyms:

- Third-Party Administrators (TPAs)

- Bill review (BRs) companies

- Preferred Provider Organizations (PPOs) and similar network discount intermediaries

- Medical Provider Networks (MPNs) and entities offering physician network services

- Utilization Review Organizations (UROs)

- Credit card companies profiting from fees on payments made with Virtual Credit Cards (VCCs)

- Pharmacy benefit managers (PBMs)

In this harsh reality, it is in the financial interests of these powerful entities to encourage and maintain the dysfunction in California's workers' comp system. WCIRB reports fail to present the data showing how insurers, sidekick vendors, and private equity feast off of injured workers, filling their pockets via this alphabet soup of acronyms.

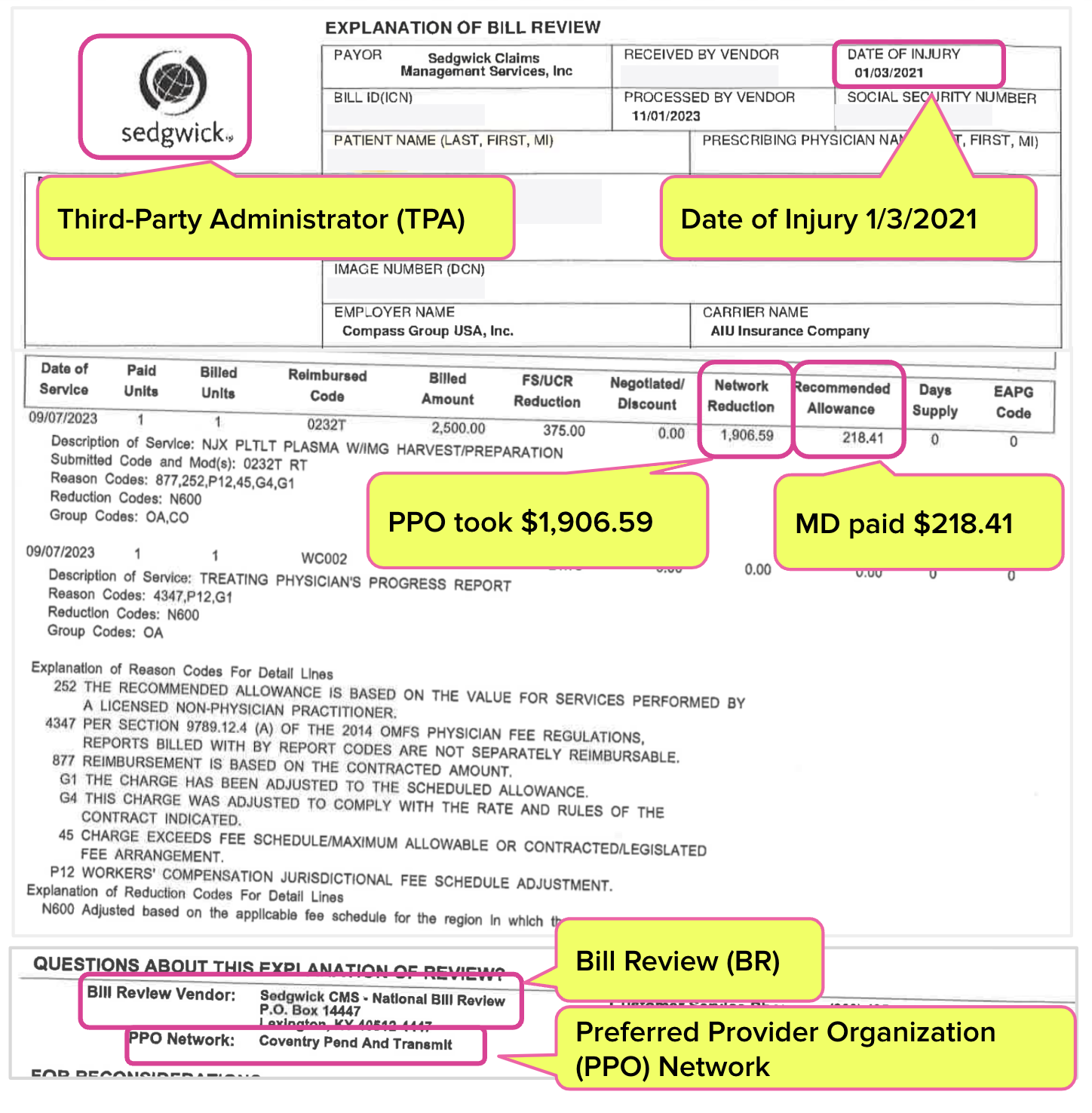

For an example, take the recent case of a doctor who was stripped of over $1,900 when Third-Party Administrator (TPA) Sedgwick applied a random Coventry PPO discount to the doctor’s bill—even though Sedgwick had signed a contract under Labor Code Section 5307.11 explicitly barring the application of PPO discounts.

The doctor received $218.41 for the treatment, but the Coventry PPO Network Reduction took $1,906.59.

This bill is from September 2023, for an injury sustained on January 3, 2021. For almost three years, this extended claim duration has generated profit for the multitude of acronyms involved: a TPA, BR, PPO, and more.

Until California can get workers’ comp data that are complete and verifiable, from sources that have no vested interest in how the data are interpreted and utilized, nothing will improve.

The “state of the system” is that it’s working great for insurers, vendors, and private equity—but abysmally for injured workers, employers and the providers who treat them. California cannot accurately diagnose and address this reality without data that can be trusted.

Protect your practice. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Reach out to learn how we can help.

CONTACT US

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)