Signature Networks Can't Hide Truth About PPOs

Marketing material from Signature Networks Plus, an organization that peddles access to and membership in Medical Provider Networks (MPNs), crosses the line between awkward corporate blather and accidental self-parody.

On its website, Signature gives the MPN game away by declaring “We are much more than an organization that slaps an MPN label on a PPO [Preferred Provider Organization].”

As daisyNews has repeatedly argued (and Signature seems to affirm), the primary function of California’s MPN is to rope providers into PPOs, which impose steep reimbursement discounts on doctors by threatening to exclude them from the MPNs.

Moreover, the Signature website raises false alarms by warning potential clients to stay compliant with California’s MPN regulations even though California’s Division of Workers’ Compensation (DWC) rarely, if ever, enforces those regulations.

Make no mistake; if an MPN organization announces that MPNs are not just convenient cover to force providers into PPOs, you can be sure of only one thing: MPNs are just convenient cover to force providers into PPOs.

Signature Networks: PPO “Pay to Treat” at Its Finest

The MPN/PPO “Pay to Treat” system works as follows:

- Claims administrators require injured workers to seek care from physicians within MPNs.

- To maintain membership in those MPNs and maintain eligibility to treat injured workers, providers are required to join PPOs.

- PPOs require providers to sign discount reimbursement contracts that reduce the amount paid for treating injured workers to rates well below the fee schedule and often below Medicare rates.

Once an MPN forces a provider into a PPO, that PPO sells, leases, and otherwise transfers the providers’ discount reimbursement contracts to other claims administrators, PPOs, bill review services, and more—essentially creating payment mayhem for providers and decimating practice revenue.

Touting themselves as the “Subject Matter Experts of the Medical Provider Network (MPN) world,” Signature assures potential clients that far from simply “slapping” MPN “labels” onto PPOs, Signature “pulls together Networks with Intelligence” and builds MPNs “by nomination and invitation only.”

In other words, Signature wants to create the impression that its MPNs are all about high-quality providers offering the best care, with “savings on the total claim” as an afterthought.

Robotic corporate-speak and random capitalization aside, Signature almost immediately undercuts its claims of being innocent, benign network organizers by advertising “Preferred Provider Organization (PPO) offered Nationwide.”

Why Stay Compliant? CA Has No MPN Enforcement

Most laughably, the Signature home page warns potential clients that they had better stay compliant with California MPN regulations, specifically California Code of Regulations Section 9767.19, which mandates monetary penalties for various MPN violations, including:

- Failure to comply with MPN access standards requiring a certain number of providers in the applicable geographic area

- Failure to perform quarterly updates of provider rosters

- Failure to report inaccuracies in provider rosters

- Failure of Medical Access Assistants (MAAs) to respond to injured workers’ calls

Signature reminds its potential clients that “2017 brings penalties in California” for non-compliance. Putting aside the fact that no one has updated this dire warning in seven years, Signature neglects to mention one critical thing: the DWC does not enforce MPN compliance.

The DWC has absolutely no idea which MPNs even apply to any given injured worker or employer, let alone which providers are members of each MPN, let alone whether MPNs meet legal access standards. The tangled morass of thousands of (mostly terminated, suspended, or otherwise defunct) MPNs on the DWC’s official list is an effectively ungoverned mess—as countless incidents of unpunished MPN abuse demonstrate.

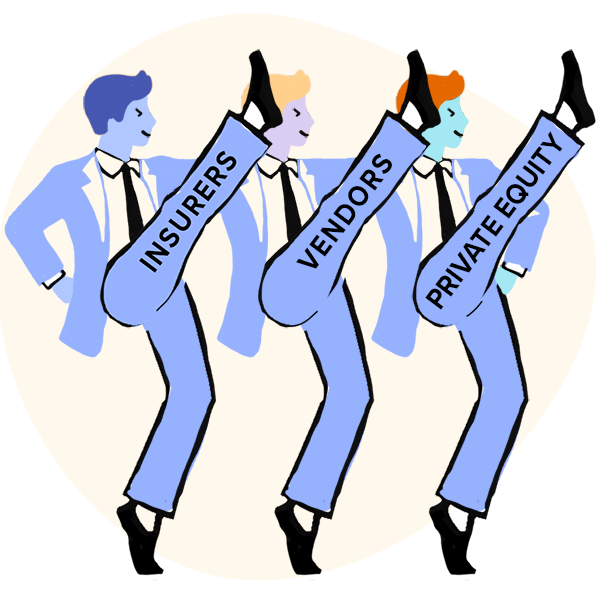

California’s MPN system is defined by its lack of governance, a fact that claims administrators, various types of sidekick vendors, and private equity firms with ownership stakes in these companies take full advantage of. “Administrative Penalties” for MPN violations are essentially unheard of.

Signature Networks wants providers to believe that MPNs serve some function other than cost-cutting at the expense of medical practices, and wants insurers and employers to believe that the MPN system has rules that are enforced. But the self-contradictory marketing fluff on Signature’s website can’t hide the ugly reality of this hopelessly corrupted system.

Nationwide, daisyBill increases revenue and decreases hassle for providers who treat injured workers. Get a free demonstration below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

.png)

.gif)