ProPublica/NPR: Fees & Discounts Gutting Provider Revenue

ProPublica and NPR recently published an exposé on entities that impose fees on doctors who accept electronic funds transfer (EFT) payments. These fees cost providers up to 5% of the reimbursement for each bill, which could be used to improve patient care. The exposé reveals that EFT payments in group health generate significant profits for the entities processing payments at providers’ expense.

Worse, the Centers for Medicare and Medicaid Services (CMS) briefly disallowed these fees— until lobbyists for payment processing companies badgered the CMS into reversing its decision.

The story listed various payment abuses providers face in the group health system, with a particular focus on the powerlessness of government agencies in the face of well-funded interests whose profit models are based on bleeding doctors of revenue (in exchange for no services of any value to the practice or its patients).

Something else must be understood, however; something not included in the scope of ProPublica/NPR’s investigation: providers who treat injured workers are victims of far worse payment schemes.

As outraged as the public should be at the inner workings of the group health middle-person racket, there is an astonishing amount of similar — but more pervasive — payment abuse in workers’ comp.

Below, we offer the following analysis as a companion to the ProPublica/NPR piece.

Practice Revenue-Killers in Group Health & Workers’ Comp

ProPublica’s deep investigation lists several systemic issues in group health currently driving practices into the red (emphases ours):

“Insurers have slashed their reimbursement rates, cost [providers] patients by excluding them from their provider networks, and forced them to spend extra time seeking pre-authorizations for ever more procedures and battling denials of coverage.

Paying fees to get paid is the final blow for some. ‘All these additional fees are the reason why you see small practices folding up on a regular basis, or at least contributing to it,’ said Dr. Terence Gray, an anesthesiologist in Scarborough, Maine.’”

In workers’ comp, the systemic issues are analogous — and even more damaging:

For example, take reimbursement rates and provider networks: OMFS rates for physician services are currently set at roughly 140% of Medicare rates. Yet physicians in our database received 82% OMFS rates collectively since January 2022 for physician services, equal to just 114% of Medicare rates.

This is because discount contracting entities convince doctors to accept often steeply discounted reimbursement rates under threat of exclusion from Medical Provider Networks (MPNs). Doctors are given a choice: either accept lower reimbursements (fee schedules be damned) or lose eligibility to treat injured workers (Pay-To-Treat requirements).

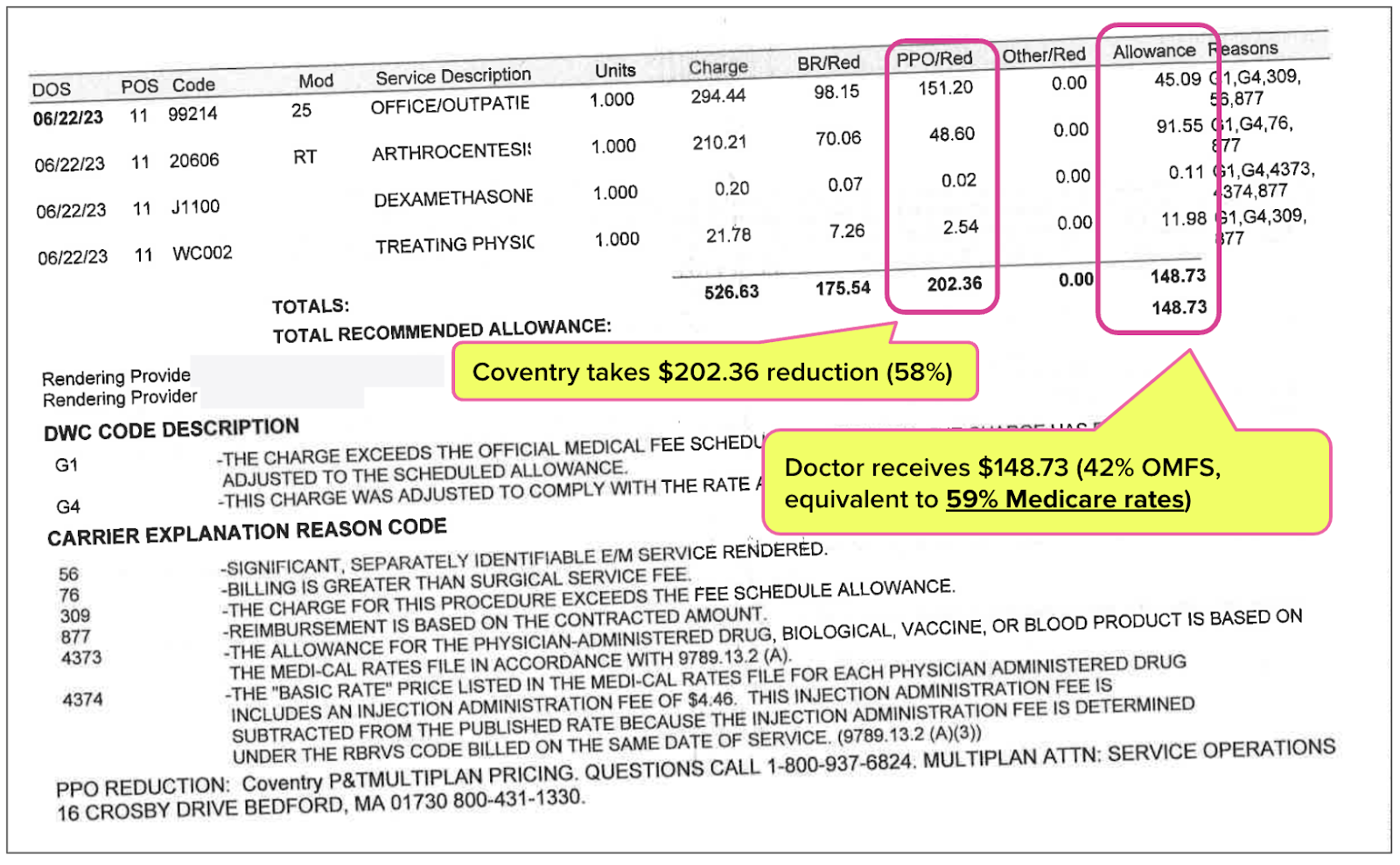

The resulting revenue losses can be staggering. In the example below, Coventry took a discount of $202.36, or 58% of the amount owed under the OMFS, leaving the provider with just $148.37 or 42% of the OMFS reimbursement — equal to 59% of the Medicare rates.

While providing zero services to the injured worker, Coventry took more money from the provider than the provider received for treating the injured worker!

Once a doctor signs and agrees to a contractual discount in hopes of being eligible for an MPN, the discount entity often leases or sells the discount to numerous other payers and middle-person entities. These payers and entities reduce the provider’s reimbursement without offering any benefit in exchange for sacrificed revenue.

As with payment processing fees in group health, the permissibility of certain discount practices has been questioned. And just as the CMS caved to the interest of payment processors, California state legislators do nothing to protect providers who treat injured workers. Existing bans on improper sharing of contractual discounts are all but ignored, as is the requirement that payers specify the contractual discount applied to any given bill.

In other words, the “middle-person” discount entities get their way, even over the nominal objections of the government. Doctors, patients, and injured workers suffer as a result.

Workers’ comp providers in California and nationwide, as with group health, also face burdensome authorization requirements and “battles” over denials of coverage and payment. And just as payment processing fees are the “final blow” in group health, workers’ comp providers “pay to get paid” when claims administrators use virtual credit cards (VCCs) to issue reimbursements.

There is far too much money to be made by siphoning money from doctors in group healthcare in ways that are detrimental to patients. ProPublica and NPR are correct to point this out. Workers’ comp is in similar, but arguably even more dire straits.

Make workers’ comp easy. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Request a demo below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

We recently opted out of all the work comp MPN's. Although Amtrust was able to still get the PPO discount because of Conduent. They did provide a signed contract with another entity that allowed them to still take the money. We are doing our best to make these ridiculous payment reductions go away once and for all. We have also been telling the insurance carriers we want paper checks. I feel like the should be zero cost to get an ACH transaction directly deposited to our bank account but that doesn't happen. EFT's should not cost a provider. The virtual cards and a processing fee nightmare. They should be the ones paying the fees to process not us!