Diabolical Discounts: Long Beach Pays Doctor $32 to Treat Injured Employee

Across the nation, providers struggle to treat injured workers without financially damaging their practices. The problem is especially ugly in California, where extreme reimbursement discounting is rampant.

Our NEW weekly “Diabolical Discounts” feature brings you the most atrocious examples.

This week’s diabolical discounter is the City of Long Beach, which paid a doctor just $32.08 to treat an injured worker—a mere 22% of the Official Medical Fee Schedule (OMFS) rate and only 33% of the Medicare rate.

This self-insured, self-administering public employer gutted a physician’s reimbursement using a toxic combination of two discount contracts from Coventry and MultiPlan.

A public entity used taxpayer dollars to bankroll private equity-backed PPO networks, siphoning off most of a physician’s lawful payment for treating an injured public employee.

This isn’t accidental. In fact, it smacks of institutionalized theft.

daisyNews details discount-stacking schemes like these time and again. Whether it’s Coventry, MultiPlan, Anthem, or some combination of discount “agreements” strung together, the playbook never changes:

- Stack discount on top of discount.

- Provide network jargon in the Explanation of Review (EOR) by way of explanation for the discounts.

- Pay as little as possible—and dare the doctor to fight back.

California has allowed its workers’ compensation system to become a conduit for private equity profiteers, where even public agencies have joined in the plunder. Every dollar shaved off a doctor’s reimbursement becomes profit for Coventry, MultiPlan, Third-Party Administrators (TPAs), and their private equity owners.

City of Long Beach Pays 22% OMFS—Thanks to Coventry and MultiPlan

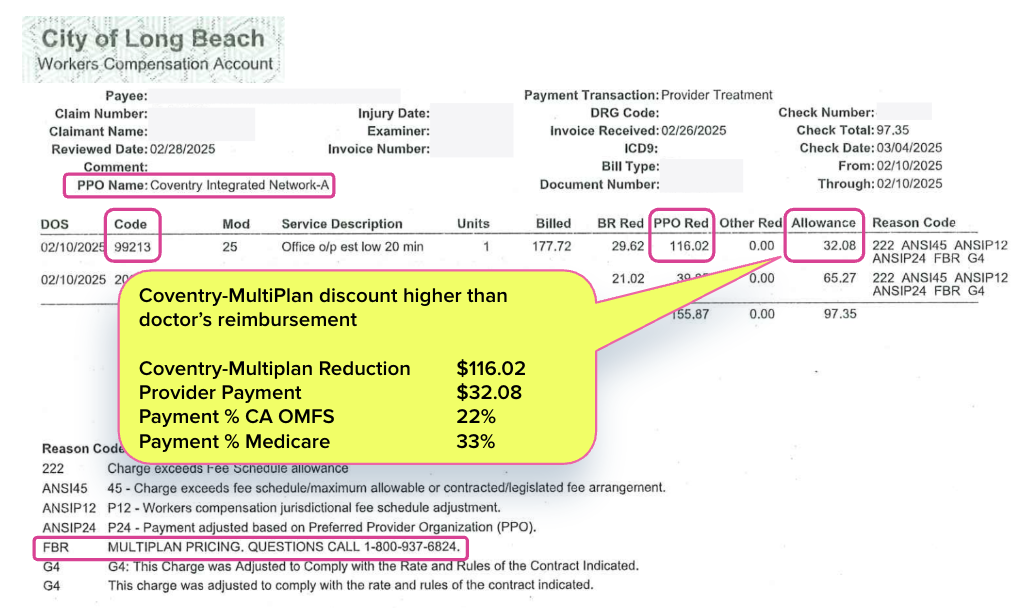

The EOR (below) shows that the doctor billed for Evaluation and Management (E/M) code CPT 99213. The fee schedule reimbursement rate for this locality and date of service is $148.10.

Long Beach applied a Preferred Provider Organization (PPO) “Network Reduction” to reduce reimbursement by over 78% to just $32.08. That’s right—the discount ($116.02) is nearly quadruple what Long Beach paid the doctor ($32.08).

The EOR lists the “PPO Name” as “Coventry Integrated Network-A.” However, the reduction “Reason Code” on the EOR specifically cites “MULTIPLAN PRICING.”

It’s no surprise that a claims administrator lists two separate discount contracting entities on the same EOR. These entities often lease, sell, or otherwise transfer discounts, sometimes without the doctor’s knowledge or consent. They also “stack” discount contracts to maximize the plunder.

The result: the provider walks away with a fraction of the amount the state deemed appropriate for treating an injured worker.

California Workers’ Comp: Profiting Private Equity at Providers’ Expense

Private equity firm Stone Point Capital funds Enlyte, the parent company of Coventry. Private equity is also deeply invested in MultiPlan. When doctors become entangled in these complex webs of discount contracting entities and their private equity backers, practice revenue inevitably suffers.

Doctors are trapped in a rigged game, constantly losing revenue due to:

- PPO contracts that they never signed or that they canceled

- Networks they can’t escape

- Discounts they can’t dispute

- And a state agency—the California Division of Workers’ Compensation—that refuses to intervene

When physicians fight back, they face insurmountable odds—even when they succeed in proving what they’re rightfully owed.

As we detailed in this article, Sedgwick admitted to improperly reducing payments for injured workers’ treatment. With penalties and interest per Labor Code Section 4603.2, Sedgwick owed the practice $574,350. Yet, as of the latest update, Sedgwick has paid the practice only $12,896, or about 2% of the total amount owed with penalties.

There is no enforcement.

No consequences.

No accountability.

There is only a silent system that lets private equity loot providers.

Why Doctors Are Tapping Out of Workers’ Comp

When payers reimburse doctors $32, they send a clear message: treating injured workers isn’t worth it.

Physicians can’t sustain their practices on payments that barely cover lunch, so they stop treating injured workers, leading to longer delays, higher employer costs, and a system in collapse.

Doctors often sign PPO contracts to join an MPN. However, those contracts can unleash a flood of revenue-draining discounts, especially when Anthem, Coventry, or MultiPlan pass them around like trading cards.

We’re deeply grateful to every provider still standing.

But we can’t blame providers for tapping out.

daisyBill keeps track of every bill and reimbursement—and reveals patterns of underpayment. Click below to take a closer look:

CHECK OUT DAISYBILL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

Even plumber charges 400/-$ for only evaluation in 15 minutes in Bay Area. We should start plumbing company and not to pay malpractice insurance.

I find it appalling that a doctor is paid only $32.08 for a medical visit. Yet if an interpreter was present the interpreter would be paid $180.00. Maybe we should tell our children to grow up to be an interpreter rather than a doctor.