Gallagher Bassett Denies Bill, Spews Nonsense, Ignores Appeal

.png)

Welcome to California workers’ comp, where a claims administrator’s legal obligation to timely pay providers’ bills is more a matter of theory than practice.

Safe from any real threat of enforcement action by the Division of Workers’ Compensation (DWC), Gallagher Bassett denied payment for a perfectly compliant, valid, nearly $19,000 bill for Medical-Legal services.

Gallagher Bassett’s stated reason for the payment denial, detailed below, is self-evidently nonsensical. Sadly, it’s par for the course for this claims administrator who, as daisyData shows, has denied 29% of providers’ bills this year.

In a climate where reflexive, inappropriate bill denial has become standard practice, it’s no surprise that Gallagher Bassett would throw any denial “reason,” however dubious, at the wall to see if it sticks. Even worse, Gallagher Bassett ignored the physician’s timely, compliant Second Review appeal disputing the illegitimate denial.

When daisyBill reached out for an explanation, Gallagher Bassett’s response was a word salad so self-contradictory that we can’t help but wonder whether human beings work there or if AI support bots have learned how to consume tequila.

Gallagher Bassett still has a chance to pay what it owes, and we suggest they do so quickly; the penalty and interest payments on a bill this big can buy a lot of reposado.

Gallagher Bassett Denies QME Bill, Citing Gibberish

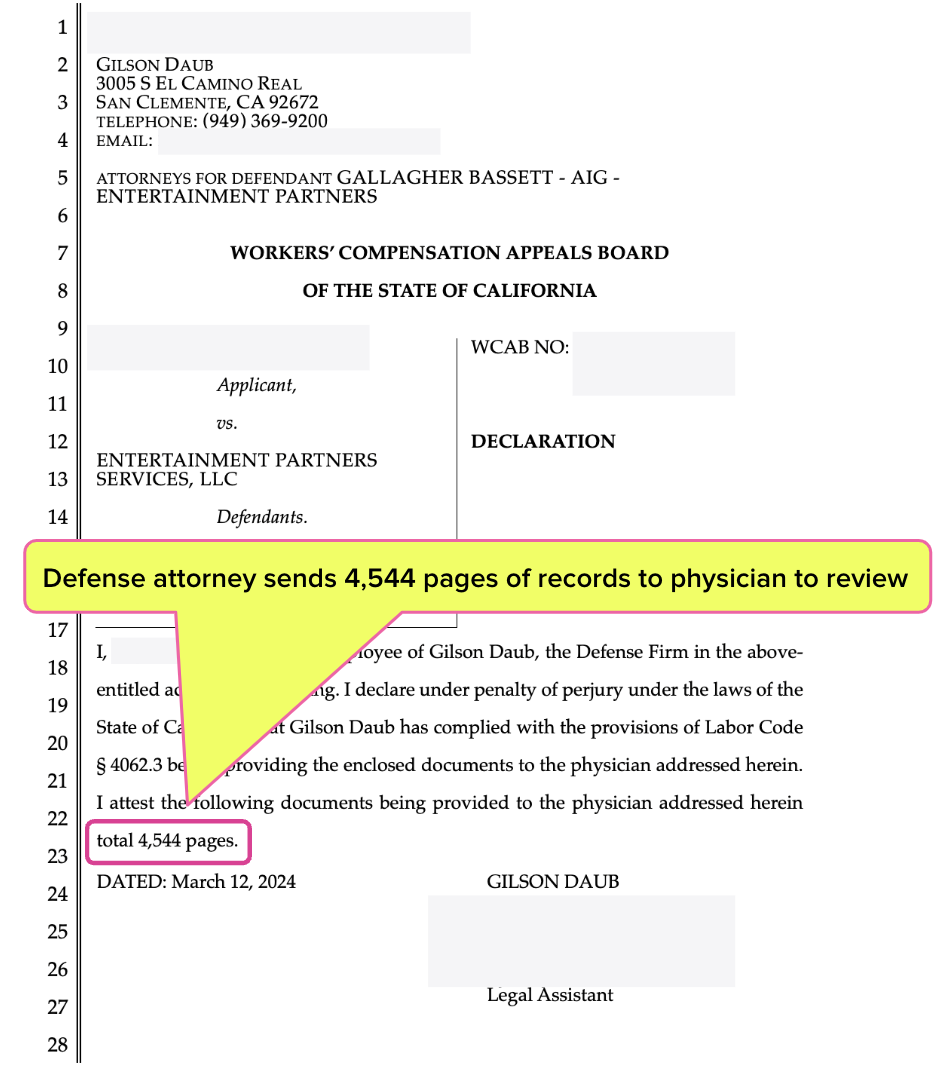

In the letter below, Gallagher Bassett’s defense attorneys requested a Comprehensive Medical-Legal evaluation from a Qualified Medical Evaluator (QME), including a review of over 4,500 pages of medical documents.

Per California Code of Regulations (CCR) Section 9793, Gallagher Bassett’s attorneys formally attested to the exact number of pages of medical records. The QME is a psychiatrist, and the evaluation’s focus was psychiatry. Several diagnostic tests were required to complete the evaluation, as is allowed under CCR Section 9794.

In other words, this was an arduous, time-consuming evaluation by a panel-selected specialist who deserves full compensation under the Medical-Legal Fee Schedule (MLFS), including record review fees under procedure code MLPRR.

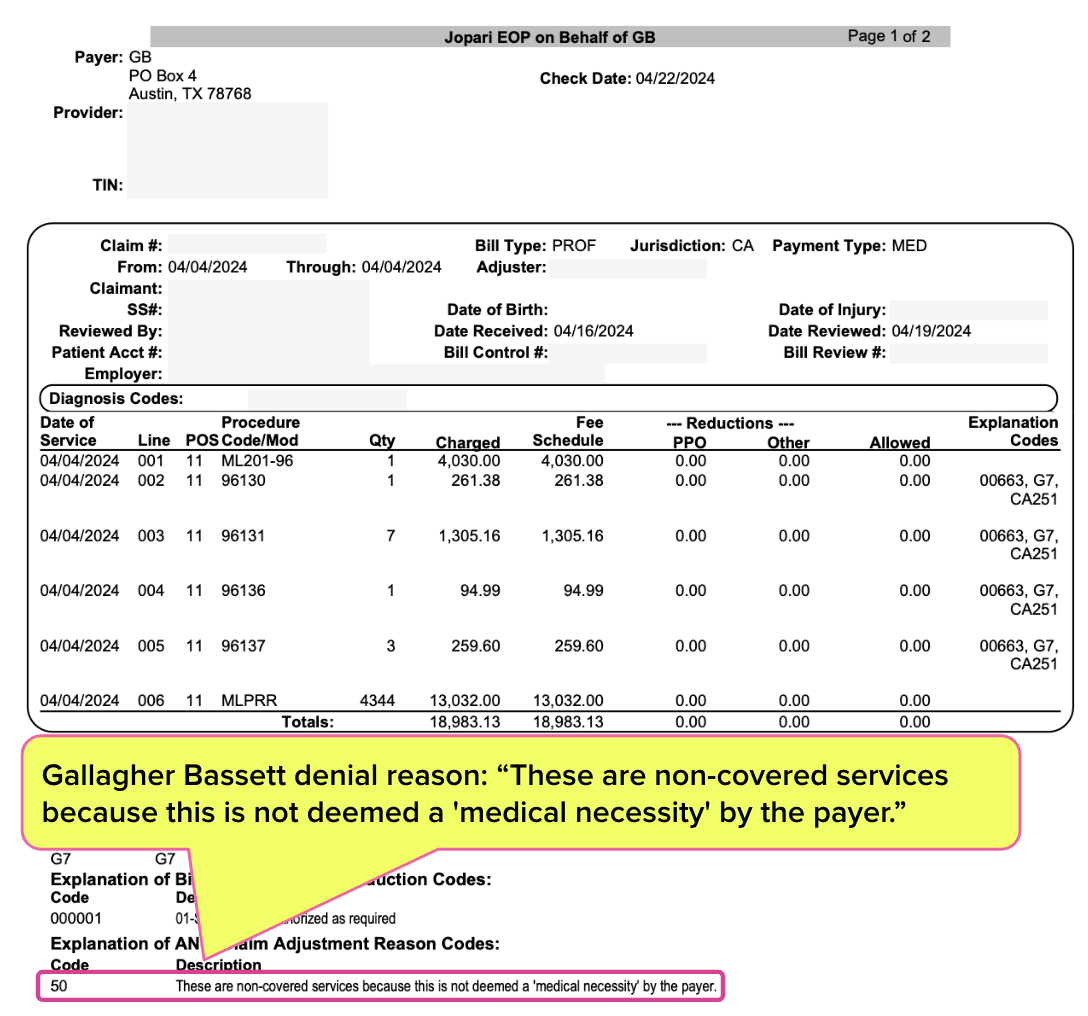

The total billable amount came to $18,983. However, Gallagher Bassett determined it would pay $0. The bill payment denial reason? As the Explanation of Review (EOR) below states, “These are non-covered services because this is not deemed a ‘medical necessity’ by the payer.”

As anyone with even a passing familiarity with workers’ comp understands, a Medical-Legal evaluation is never a “medical necessity,” as the sole purpose is to determine eligibility for workers’ comp benefits.

Gallagher Bassett Ignores Second Review Appeal, Cites Gibberish

Faced with this utterly ridiculous payment denial, the QME took the correct next step: timely filing a Second Review appeal to dispute the denial—which daisyData indicates providers were forced to do for 29% of all bills submitted to Gallagher Bassett in 2024.

According to CCR Section 9792.5.5, Gallagher Bassett had 14 calendar days to respond to the appeal with a final EOR. Yet 28 days after receiving the appeal, Gallagher Bassett responded with the sound of crickets.

A daisyBill agent reached out to Gallagher Bassett via phone for an explanation. When asked about the long-overdue response to the Second Review appeal, the representative explained that…well, “explained” might not be the right word. The representative stated:

“I only have one bill on file. It was received on April 16, 2024. And upon checking here, this one is denied by the adjuster for the reason that this is a duplicate claim or service but upon checking also here it has a recommended allowance. What I'm going to do, I'm going to send an outreach to the resolution manager. Someone from our team or the adjuster will call you back within five to ten business days.”

Where to begin?

Did Gallagher Bassett deny the original bill (which was sent on April 16) as an alleged “duplicate,” or did they deny the appeal as a “duplicate” (if so, it would not be the first time)? Either way, why would Gallagher Bassett determine a “recommended allowance” to pay for a supposedly “duplicate” bill?

When pressed for details, the representative would only repeat that a “resolution manager” would call back in five to ten business days, potentially making the appeal response over a month tardy. That’s assuming Gallagher Bassett will pay the correct amount; the representative claimed they were “not allowed” to disclose the exact amount of the recommended allowance “just to avoid confusion.”

CA Disputes Default to the Payer

This would all be too comical if not for the significant potential impact on this QME’s revenue—and the impact of the broader pattern on all California providers.

Consistently, claims administrators force providers to battle through similar nonsense simply to get paid. Along the way, the providers must adhere to strict timelines and compliance requirements. If a provider makes a single mistake in filing for Second Review or, if necessary, Independent Bill Review (IBR), the default outcome is that the claims administrator owes nothing.

Even when a provider does everything right and prevails at IBR, it’s even money that the claims administrator will conveniently forget to refund the $180 IBR filing fee or any of the “self-executing” penalty and interest charges for late payment.

This dynamic is primarily a result of one thing: the system-crippling passivity of the DWC, which by all available evidence has (so far) refused to take its enforcement mandate seriously.

Is it any wonder Gallagher Bassett and others deny providers’ bills at such implausible rates? Once more for the cheap seats: California has ensured that claims administrators can reap substantial profits by creating—intentionally or not—senseless, unwarranted roadblocks to proper payment.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)